Silver North’s drill results set the table for bigger 2026 drill program – Richard Mills

2026.01.09

Silver North (TSXV:SNAG, OTCQB:TARSF) completed its 2025 drill program in mid-November at its flagship Haldane Project, located within the historical Keno Hill Silver District in the Yukon territory.

The road-accessible, 8,579-hectare Haldane property is 25 km west of Keno City, YT, adjacent to Hecla Mining’s producing Keno Hill silver mine. Haldane hosts several occurrences of silver-lead-zinc-bearing quartz siderite veins resembling the veins being mined at Keno Hill.

Silver North offers investors exposure to one of the most prolific silver districts in Canada and the world — Keno Hill — which is seeing major investment from Hecla Mining, the largest silver producer in the United States, following Hecla’s 2022 takeover of Alexco Resources.

Under the Spotlight – Jason Weber CEO, Silver North

Silver North just over a year ago announced the Main Fault discovery — the third Silver North has made since acquiring the Haldane property.

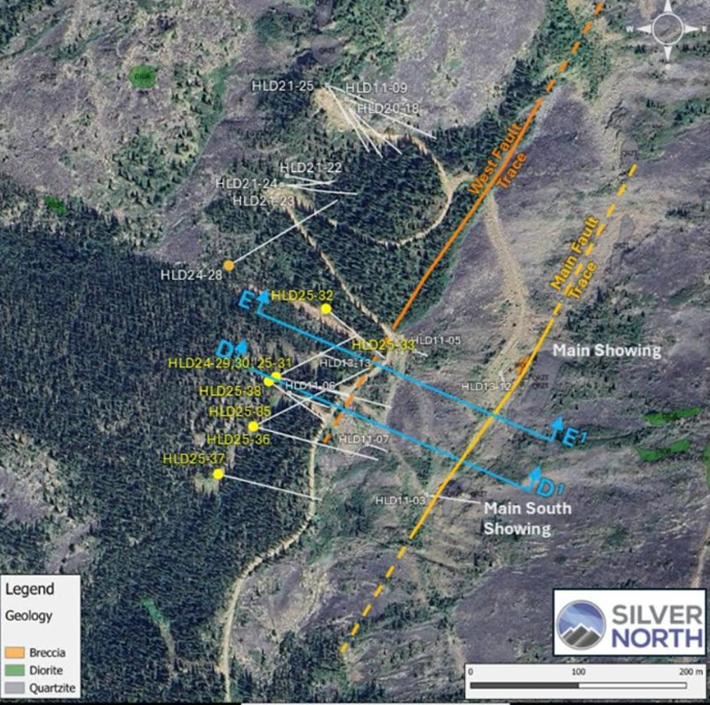

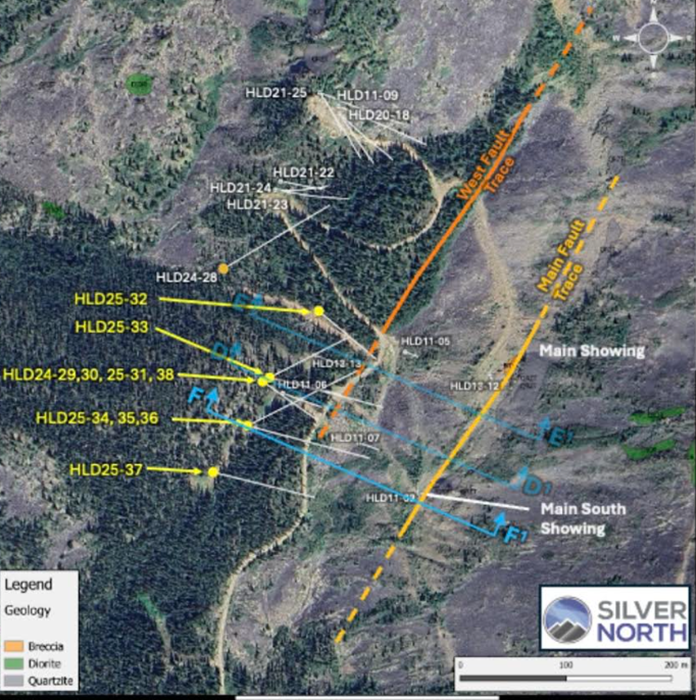

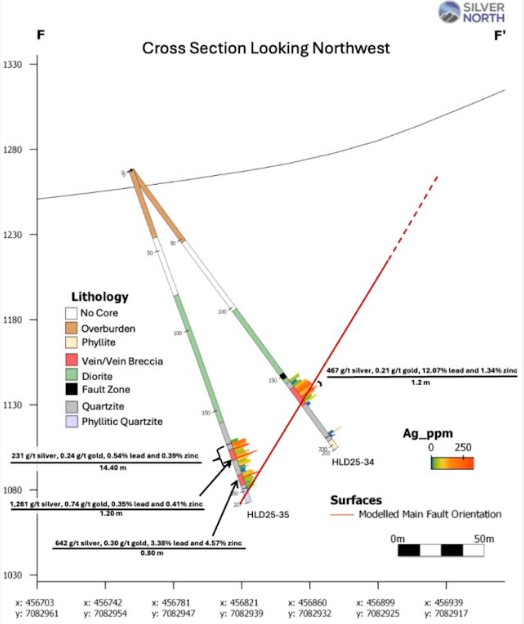

Eight holes were completed last summer at the Main Fault target. A total of 1,759.8 meters were drilled.

Silver North’s primary goal was to test the strike and depth continuity of the Main Fault. The program successfully tested the Main Fault structure 150 meters along strike and up to 150m down dip.

Main Fault is unique in that it is one of the few targets that has mineralization expressed on surface. But nobody has been able to test if adequately below surface, until Silver North came along.

CEO Jason Weber told me that the Main Fault is a large, complex structure that has high-grade silver with significant gold. That made it a high-priority target for drilling in 2025. Main Fault has similar silver grades to the West Fault discovery but has higher-grade gold. It also has high continuity potential, with potentially 300 meters of strike on surface.

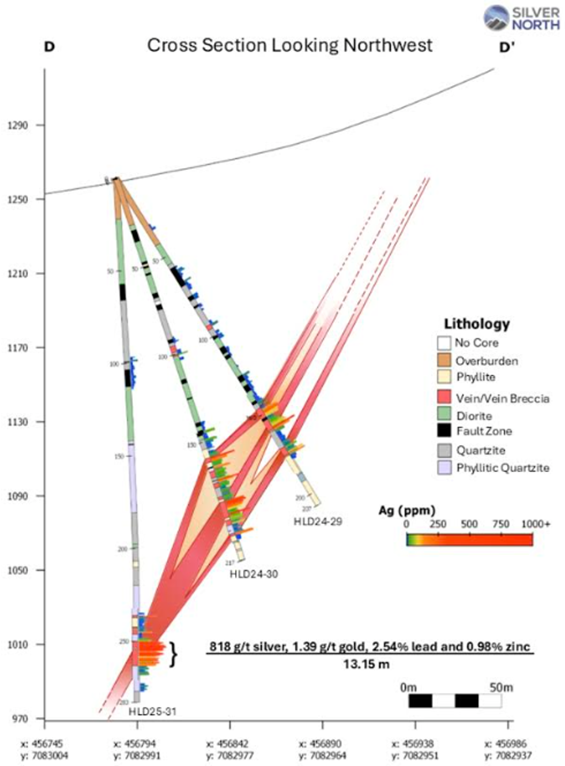

On Nov. 17 SNAG released the first three holes at the Main Zone. One of the holes, HLD25-31, was the best drilled on the property to date.

Highlighted results include 3.2 meters averaging 2,014 g/t silver, 1.72 g/t gold, 4.73% lead and 1.1% zinc within a larger 13.15-meter intersection of 818 g/t silver, 1.39 g/t gold, 2.54% lead and 0.98% zinc from 249.9 meters down hole.

Another sub-interval starting at 256.1m averaged 1,112 g/t silver, 4.61 g/t gold, 7.11% lead and 1.51% zinc over 1.25m.

HLD25-31 extended last year’s discovery down dip by 90 meters.

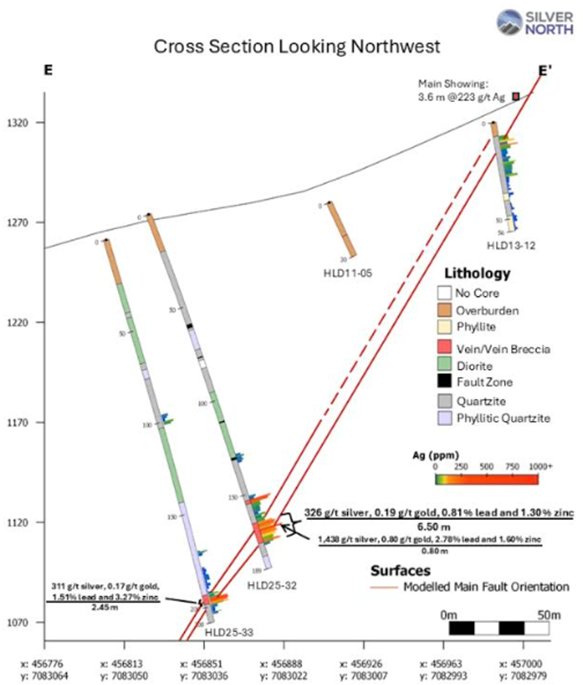

On Dec. 10 an additional two holes were released. With five holes reported, the Main Fault has been extended to 100 meters on strike and 150m down dip in drilling and 300m down dip from surface.

Results include 1.25 meters averaging 1,261 g/t silver, 0.74 g/t gold, 0.35% lead and 0.41% zinc starting at 179.5m, within a larger 14.4-meter intersection of 231 g/t silver, 0.24 g/t gold, 0.54% lead and 0.39% zinc starting at 170.6m in hole HLD25-35.

Three thoughts spring to mind. One, Silver North’s geological theory was literally proven on its first hole, with consistent high-grade silver combined with significantly higher gold concentrations than seen anywhere else on the property.

Two, the high silver grades indicate that Haldane is a pure silver play — a rarity in silver exploration, with most silver found as a byproduct of lead-zinc or gold. For example, hole HLD25-31 contained 81% silver, 12% gold, 5% lead and 2% zinc (by value).

Weber said the mineralogy can be quite complex, sometimes with intensely oxidized siderite vein and breccia, other times siderite vein and stockwork, and at times a mix of both. What’s important is that the mineralogy is similar to that found at Keno Hill.

And three, we know that 2026 is going to be a transformative year for SNAG. Its success at Haldane behooves the company to go raise a bunch more money to chase down the mineralization.

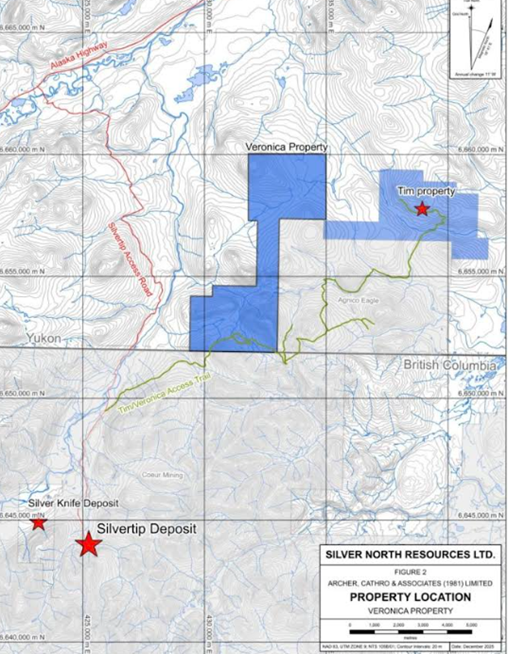

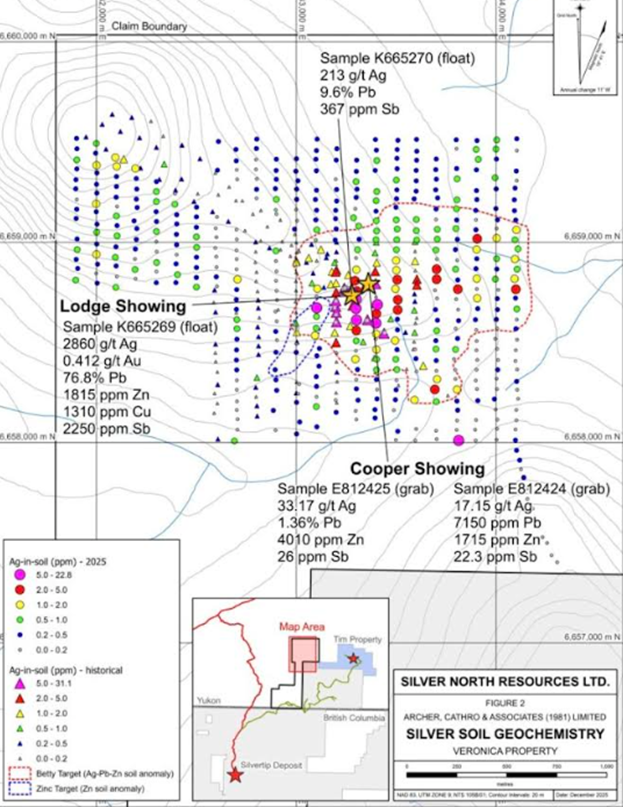

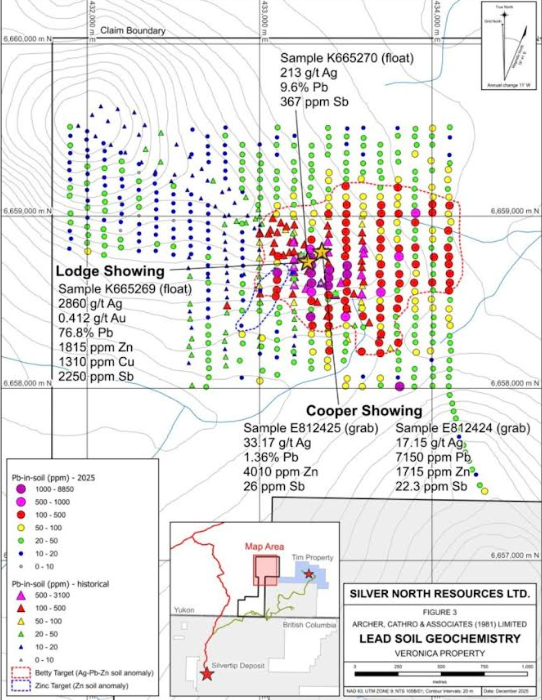

At the Veronica property — one of three properties comprising the GDR Project — adjacent to the Tim property (under separate option to Coeur Mining) in the Silvertip area of the southern Yukon, final results from the 2025 field exploration program were released on Dec. 11.

Lead assay results from two silver-bearing samples of massive galena in cobble-size float (2,860 and 213 g/t silver) at the Lodge showing, which initially exceeded upper detection limits of the sampling procedure, returned 76.8% lead and 9.6% lead, respectively. At the Cooper showing, lead analysis from one silver-bearing sample from outcrop (33.17 g/t silver) returned 1.36% lead.

What’s important is the lead mineralization, in the form of the mineral galena, is at a horizon that would be productive for Carbonate Replacement Deposit (CRD)-style systems. While not much in the way of outcrop, it appears it could be at the same horizon as Coeur Mining’s nearby Silvertip mine.

With $2.25 million just raised, Silver North is already reaching out to drill companies in preparation for 2026 exploration at Haldane. An airborne survey is planned for March-April, and Weber is budgeting about $5 million for this year’s field program.

Most of budget will be spent at the Main Fault. Weber said he’d like to see 5,000 meters drilled there, a significant increase to the nearly 1,800m drilled in 2025.

A half-million-dollar program is also planned for Veronica, concentrating on geophysics to work up drill targets.

Conclusion:

Silver North has done three drill programs and each of the programs has made discoveries, but Main Fault is special, it’s a large chunk of mineralization with current potential consisting of 300 meters of strike length and down-dip potential up to 300 meters.

A note is required here, not only did Silver North do three drill programs, but they achieved a 100% success rate by hitting mineralization on every hole, except one that was lost in a fault and did not reach target depth.

In 2025 SNAG had the goal of achieving better visibility towards possibly attaining a 30-million-oz regular Keno Hill deposit.

(The average silver mine in the Keno Hill District is 30Moz, and the historical production grade sits around 1,100 g/t silver.)

In my opinion the company seems to be on its way to achieving that, with 2025 drilling showing continuity, veining and high-grade silver mineralization. Haldane’s scale has yet to be determined, but 2026 drilling should provide more intelligence on just how big the system could be.

Pure silver plays are difficult to find; many companies try to convince investors into believing their silver content is more than it is. If Ag Eq is used, look at the posted silver equivalent grade. Too many times, it is an economic co-byproduct, not the main value. Silver North is a true silver play, with silver currently comprising over 80% of listed metal value.

I say currently because the most recent drill holes at the Main Fault are showing higher gold values and increasing continuity of gold mineralization, who knows where that goes in the future. Potentially being revalued because of gold content is a good problem to have.

Silver North Resources

TSXV:SNAG, OTCQB:TARSF

Cdn$0.38 2026.01.07

Shares Outstanding 61.2m

Market Cap Cdn$27m

SNAG website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Silver North Resource (TSX.V:SNAG). SNAG is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of SNAG

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.