Silver North focused on Keno Hill silver-mining district – Richard Mills

2024.04.11

At Ahead of the Herd, one of our most important contributions to the junior resource investment community is identifying companies that we think present an opportunity for significant value creation.

We want our due diligence to be on undervalued companies with what we consider top shelf management and good projects working in safe, mining-friendly jurisdictions, preferably where previous mining has taken place. Finding gold and silver in the shadow of headframes remains a solid strategy for precious metals investors.

We also want to be in the right commodity at the right time. We’ve been hammering the point about silver breaking to the upside for several months now. Gold just reached a new record high on April 8 of $2,353/oz. Having been range-bound for months, silver has finally begun following gold higher. The monetary/ industrial metal, with new uses in solar power and electric vehicles, has breached $28 and is up 17% year to date.

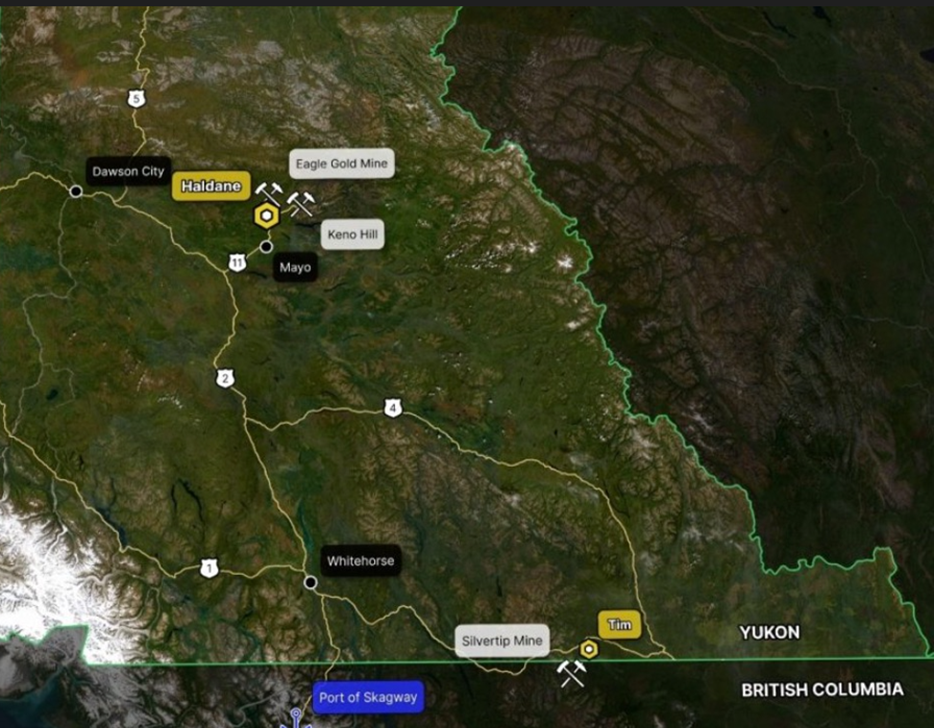

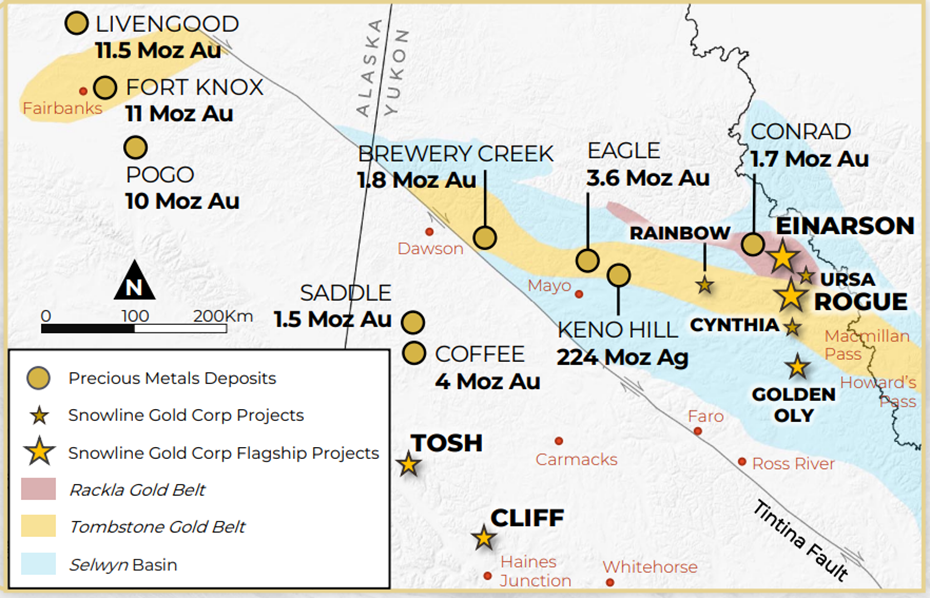

Silver North Resources (TSX.V:SNAG) offers exposure to one of the most prolific silver districts in Canada — Keno Hill in the Yukon Territory. A recent discovery by Snowline Gold has rekindled interest in the Yukon, and Keno Hill is seeing major investment from Hecla Mining, the largest silver producer in the United States, following Hecla’s 2022 takeover of Alexco Resources.

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at Keno Hill.

Between Haldane and its Tim carbonate replacement deposit (CRD), on the BC-Yukon border, Silver North offers strong discovery/ development potential against an increasingly bullish backdrop for silver.

Keno Hill Silver District

The Keno Hill Silver District has been described by Bob Cathro, one of Western Canada’s pioneer exploration geologists, as “one of the great mining camps of Canada.”

Keno was not only Canada’s second largest primary silver producer and one of the richest silver-lead-zinc deposits ever mined, it was also a mainstay of the Yukon economy, keeping the territory flush from the 1920s to the early ‘60s following the decline of the Klondike Goldfield.

At its peak, Keno Hill supported about 15% of the territory’s population and produced more wealth than the Klondike, one of the richest placer gold districts in the world.

According to the Yukon government, from 1913 to 1989, 4.87 million tonnes were mined at an average grade of 1,389 grams per tonne silver, 5.62% lead and 3.14% zinc. Over 65 deposits and prospects have been identified in the district. Most occur within the Keno Hill quartzite as structurally controlled veins close to the Robert Service Thrust Fault.

The district is located about 450 km north of the Yukon capital, Whitehorse.

Following a small amount of hand mining between 1913 and 1917, larger scale production was almost continuous from 1919 to 1989, except during

World War. Two companies produced most of the ore, Treadwell Yukon Corp. from 1925 to 1941, and United Keno Hill Mines between 1947 and 1989.

Silver production is recorded from 35 mines with seven producing over 10 million ounces each, with the largest being Hector‐ Calumet (96 Moz) and Elsa (30 Moz). Mineralogical Association of Canada, ‘The Keno Hill silver mining district’ (2016)

The winds of change blew through the district in 2022, with Hecla Mining’s acquisition of Alexco Resources.

In 2020 Alexco resumed production at its Bellekeno mine, having shuttered it in 2013 due to low metals prices. According to the company, via CBC News, Bellekeno produced about 2 million ounces of silver and 20 million pounds of lead and zinc concentrate each year while in operation.

There were also plans to ramp up production at other Alexco operations — Bermingham and Flame and Moth.

However, in July, 2022, Alexco received an offer from Hecla Mining to purchase all of its shares, a takeover bid valued at ~$72 million.

At the time, Hecla’s CEO Phillips Baker said integrating Alexco’s Keno Hill project in the Yukon could make Hecla the largest silver producer in Canada, as well as the United States.

The following year, Hecla invested further in the Yukon, purchasing ATAC Resources and their Rackla and Connaught properties — discoveries made during the 2010 White Gold area play.

Critically, the Hecla-Alexco deal occurred at the same time as Hecla agreed to pay Wheaton Precious Metals $135 million in shares for the company to terminate its silver stream at Keno Hill. Eliminating the stream lifted a major impediment to Alexco’s takeover.

(Alexco was likely founded on the idea that they would probably be a zinc producer, so they sold the silver stream to Wheaton Precious Metals.)

Hecla Mining is now the biggest player in the district, and ramping up production at its 400 tonne-per-day mill. Hecla commenced production at Keno Hill in mid-2023. The mine is expected to produce 2.7 to 3 million ounces in 2024. Five deposits are present at Keno Hill: Bellekeno, Flame and Moth, Lucky Queen, Bermingham and Onek.

Hecla’s Yukon mine hosts enough high-grade reserves for 11 years of mining; drilling shows promise for near-future growth

Hecla Mining Company March 28 filed a technical report outlining 55 million ounces of silver reserves for its Keno Hill mine in Canada’s Yukon. This marks a 45% increase in reserves since gaining ownership of the historic silver property through the acquisition of Alexco Resource Corp. toward the end of 2022.

Calculated at a price of $17 per ounce of silver, Keno Hill hosts 2.07 million metric tons of proven and probable reserves averaging 26.6 ounces per ton (55.1 million oz) silver, 0.01 oz/t (13,000 oz) gold, 2.5% (52,380 tons) zinc, and 2.8% (58,170 tons) lead.

This is enough reserves to support a mining operation at Keno Hill capable of producing 52.9 million ounces of silver over 11 years. At an average silver price of $22/oz, Hecla estimates that this operation would generate $420 million of free cash flow and an after-tax net present value (5% discount) of $305 million.

Hecla, however, expects to quickly expand upon the reserves at Keno Hill.

One of the reasons for this expectation is the substantial resources that have not yet been upgraded to the reserves category.

According to the latest Resource calculation, Keno Hill hosts 4.5 million tons of measured and indicated resources averaging 7.5 oz/ton (33.9 million oz) silver, 0.006 oz/ton (26,000 oz) gold, 3.5% (157,350 tons) zinc, and 0.9% (41,120 tons) lead.

In addition, the Yukon mine project hosts 2.8 million metric tons of inferred resource averaging 11.2 oz/ton (31.8 million oz) silver, 0.003 oz/ton (9,000 oz) gold, 1.8% (51,870 tons) zinc, and 1.1% (32,040 tons) lead.

Another reason for Hecla’s confidence in the growth of both reserves and resources is recent high-grade silver drill intercepts that are not included in the reserve calculations.

Highlights from 3,900 meters of underground resource definition and geophysical drilling completed during the fourth quarter of 2023 at Keno Hill include:

• 12 meters averaging 54 oz/ton silver, 4.8% lead, and 2.5% zinc.

• Three meters averaging 58.6 oz/ton silver, 3.6% lead, and 4.3% zinc.

• 4.6 meters averaging 32.7 oz/ton silver, 1.7% lead, and 1.7% zinc.

• 2.8 meters averaging 32.4 oz/ton silver, 8.3% lead, and 4.1% zinc.

“Drilling has intersected wider zones and higher grades – such as 54 ounces per ton silver over 39 feet – than are currently in the reserve model and has encountered high-grade mineralization more than 1,000 feet deeper than any previous drilling; both are changing the potential size of the deposit,” Hecla Mining President and CEO Phillips Baker, Jr. said in February.

In addition, Hecla reported that its surface exploration drilling during the fourth quarter of last year encountered high-grade silver and intriguing quantities of the critical mineral indium.

As exploration expands upon the current reserves and resources, Hecla continues to ramp up the Keno Hill silver mine to commercial production.

This ramp-up began during the second quarter of 2023, with the Yukon mine contributing 184,264 oz of silver during the period. This continued into the second half of the year, with the operation producing 608,301 oz of silver during the third quarter and 710,012 oz during the final three months of the year.

Baker said earlier this year that “the roughly half year of production at Keno Hill shows its potential to be a meaningful producer.” North of 60 Mining News

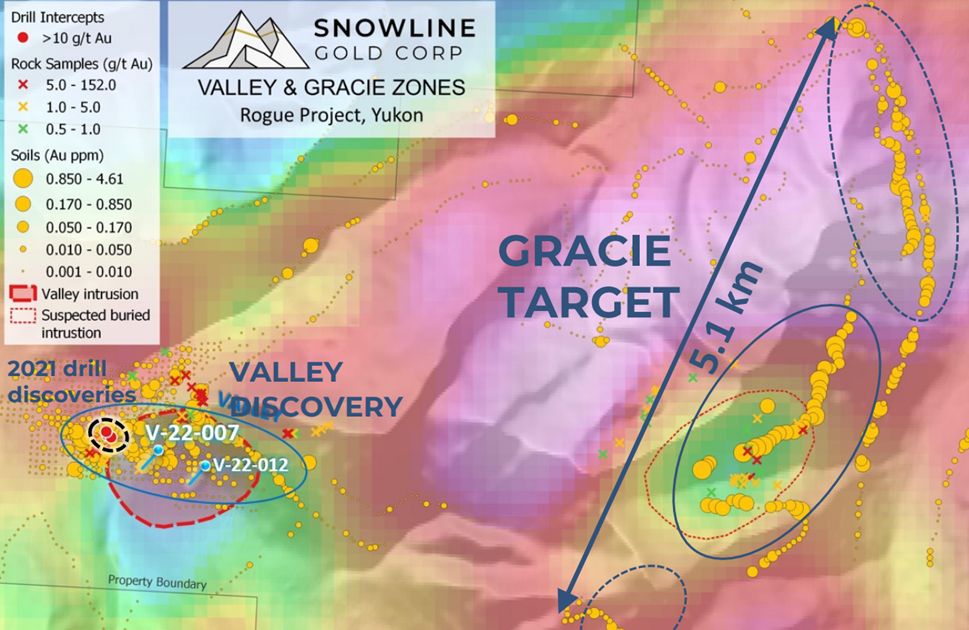

Last year, as Hecla was quietly restarting the Keno Hill mine, a much noisier development occurred. Holes drilled by Snowline Gold (TSX.V:SGD), whose Rogue deposit is east of Keno Hill, returned 2.5 grams per tonne gold over 553 meters, marking the Valley discovery.

From just under a dollar a share in June, 2022, Snowline Gold is now at $5.59 and the company boasts a market capitalization of $809 million.

The Rogue Plutonic Complex hosts a 60- by 30-kilometer area of small and large intrusions that are like Valley in their geology, geochemistry and gold anomalism. A new target Aurelius, announced on Feb. 20, is a 2,000- by 500-meter zone located 12 km northwest of Valley. Two outcrop chip samples averaged 2.01 g/t Au over 17m and 2.31 g/t Au over 14m respectively.

Canada’s Yukon Territory is becoming a hotbed of mineral exploration and development success stories. Below is a company that is currently unknown but with, imo, an important discovery and significant development upside.

Silver North Resources

In a recent talk with AOTH, Silver North’s CEO Jason Weber said the management team has known people at Hecla for years, including Rob Brown, Hecla’s vice president, corporate development and sustainability. When Hecla moved into the district last year, Weber said it was an opportunity to “say hey, welcome to the neighborhood.”

He noted that when Hecla took over Alexco, they kept the Alexco geologists, who had done good work by “not only making new discoveries but importantly, starting to unravel the Keno vein systems and some of their key characteristics.”

“They started to put together what some of these preferential orientations are so it’s really fascinating,” Weber continued. “We can use what Hecla’s gained in knowledge and apply it. And to their credit, Hecla’s been really open with their crews, they’re super accessible. We can call them up and talk geology with them and they’ll throw out advice for us and it’s been fantastic to be their neighbor.”

Weber is a seasoned geologist with over 25 years’ experience in the industry. He is the former president and CEO of Kiska Metals, acquired in 2016 by Aurico Metals and its advanced-stage Kemess copper-gold project (now owned by Centerra Gold). Weber has also served as director and advisor to several junior resource companies.

VP Exploration Rob Duncan runs the day-to-day field operations. Duncan has over three decades of experience, including stints with producers such as Rio Tinto and Inmet Mining. He has held senior management positions at several juniors exploring throughout the North American Cordillera, Canadian Shield and Eastern Europe, on a variety of deposit types including orogenic gold, porphyry copper-gold, VMS, intrusion-related gold, and epithermal gold-silver systems.

Executive Chairman Mark Brown is a chartered accountant who has handled the financial dealings of Alianza Minerals and Silver North Resources since 2007. Brown was previously the controller of two gold companies with operations in northern Canada and South America and was the founder of Rare Element Resources, taking it from inception to listing on the NYSE-AMEX.

Rounding out the management team are directors Marc Blythe and Craig Lindsay. Blythe is another “finance guy” with deep mining industry experience; Lindsay founded Magnum Uranium before it merged with Energy Fuels in 2009 and recently, sold Otis Gold to Excellon Resources in 2020.

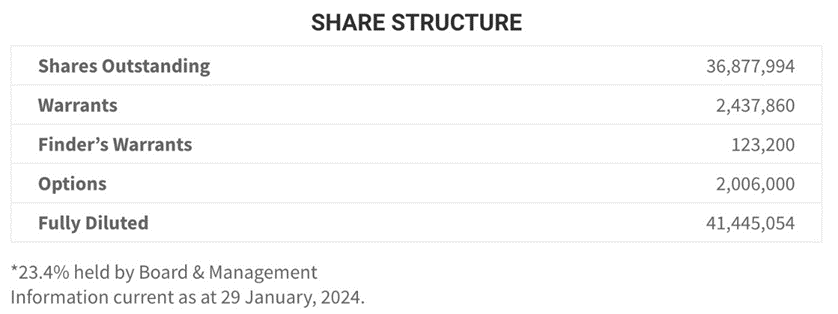

Silver North has a relatively small float, just 41.9 million shares outstanding, with nearly a quarter of the shares (23.4%) held by the board of directors and management.

Haldane silver property

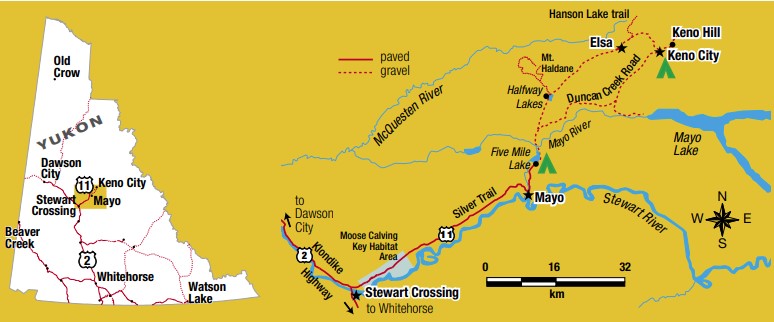

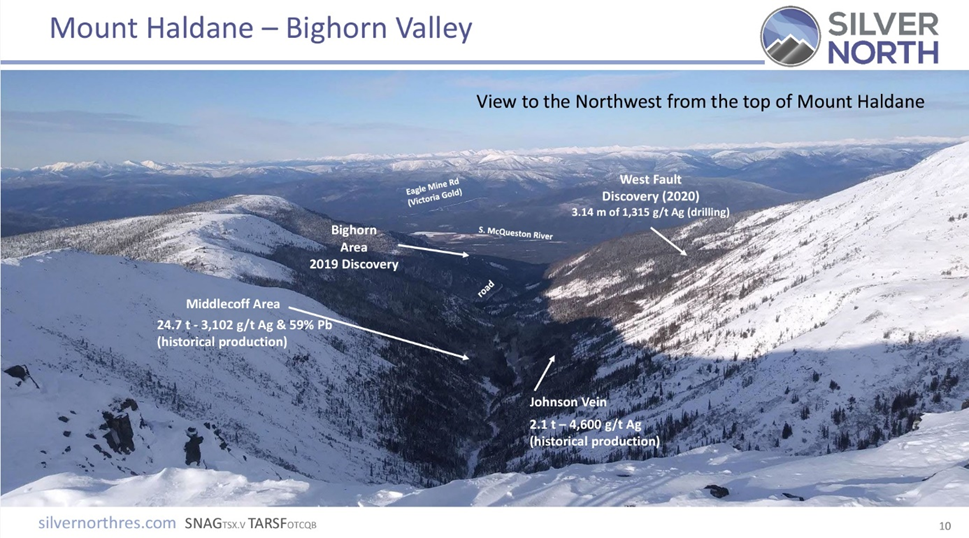

Silver North’s Haldane property is 25 kilometers west of the main Keno Hill deposits, and south of Victoria Gold’s Eagle mine, which poured it’s first gold in 2019. The 8,164-hectare land package hosts structurally controlled silver veins containing galena, sphalerite, and tetrahedrite-tennantite in quartz-siderite gangue.

The corporate presentation on Silver’s North’s site shows historic small-scale mining — underground workings developed at the Middlecoff and Johnson veins — produced 24.7 tons of 3,102 g/t Ag and 59% lead, and 2.1 tons of 4,600 g/t Ag.

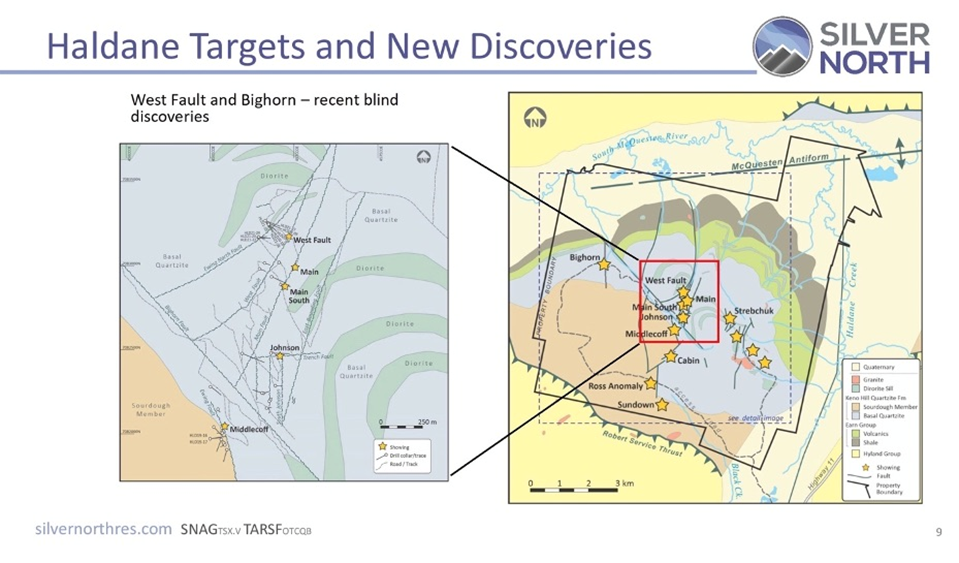

The property showed the potential to double the strike length of 12 km, with new discoveries in 2019 and 2020 at West Fault and Bighorn.

In 2021, a hint of what might be hidden below surface manifested in a drill hole of 1.2m @ 3,267 Ag.

The re-branded company says the project is located adjacent to, and has the same rocks as Hecla’s high-grade Keno Hill silver mine.

“In terms of geology, we have the exact same geological environment [as Keno Hill]…the same structural regime, the same mineral assemblages, everything. It’s a dead ringer, but it’s vastly underexplored. Even today, with all of our work on it, there’s only a total of 27 drill holes that’s ever been completed on the project,” Weber told Crux Investor in a recent report.

Approximately 12 kilometers of cumulative vein exploration potential exists at the Haldane project, with the 27 drill holes completed from surface to date testing less than 600 meters. The best mineralization occurs where the mineralized structures cut the Keno Hill quartzite unit — a similar geological setting for mineralization as at the main Keno Hill deposits mined for over 100 years.

According to a project history,

The Haldane property is named after Mt. Haldane, on the mountain on which the property is centred. Earliest documented work dates to 1918, but prospector Andy Johnson is credited with the first lead-silver discovery here in 1896 and staked the first claims on the mountain in 1905. This early work focused on the Mt. Haldane Vein System (MHVS) an area encompassing two areas of mining on either side of Bighorn Creek. At the Middlecoff Zone on the south side of Bighorn Creek, mineralized veins were traced over 600 m on surface and the underground development produced 24.7 tonnes of hand-sorted ore that graded at 3,102 g/t Ag and 59% Pb. At the same time, work was taking place on the Johnson Vein on the north side of Bighorn Creek, including a short adit. Eventually, in 1926 and 1927 these workings produced a total of 2.1 tonnes at 4,602 g/t Ag and 57.9% Pb, also of hand-sorted ore. This mineralization is hosted in north-trending veins within the Keno Hill quartzite. Glaciation during the last glacial period was confined to the valleys, meaning that much of the Mt Haldane area has not been glaciated at higher elevations and because of this, ground is heavily weathered and broken, with oxidation extending as deep as 150 metres and little fresh sulphide mineralization exposed on surface.

Silver North has evaluated the property and come up with three targets:

West Fault, Middlecoff and Bighorn.

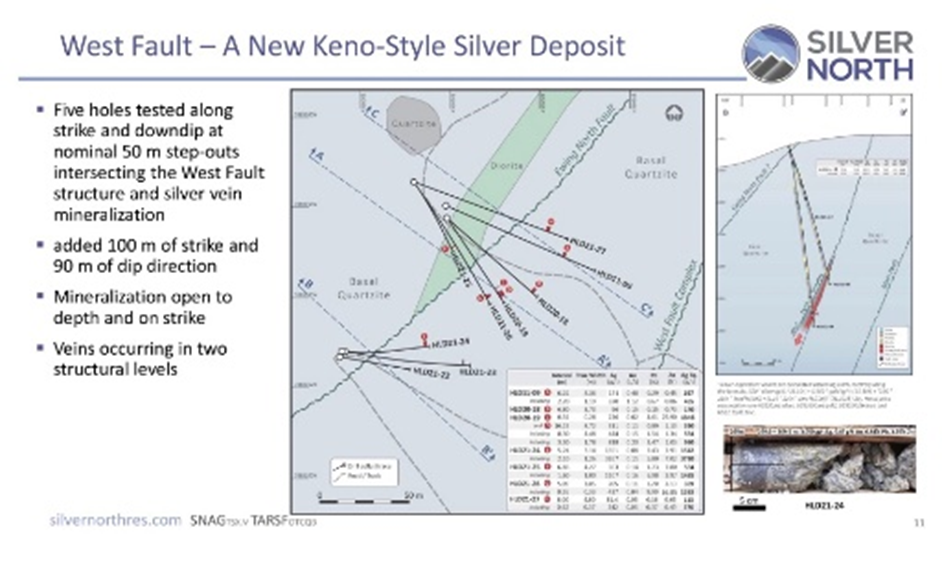

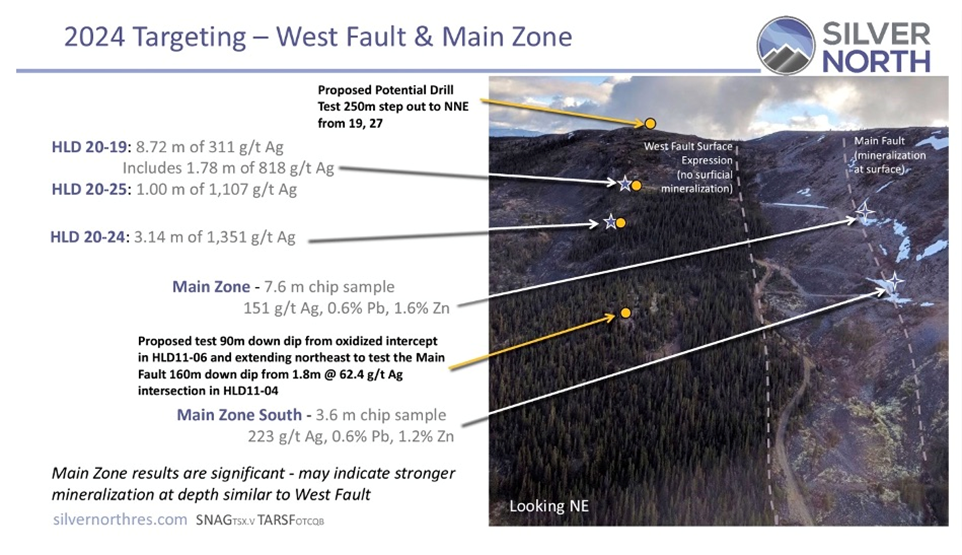

The West Fault discovery in 2020 consisted of the intersection of a wide zone of silver mineralization averaging 311 g/t silver over 8.72 meters in hole HLD20-19.

The Bighorn target was explored in 2019, with a mapping and soil geochemical sampling program expanding the Bighorn soil geochemical anomaly at least 900m in length and almost 150m in width. Multiple structures anomalous in lead and silver were identified in mapping and trenching, and high lead and silver values were returned from soil sampling (including a high of 63 g/t silver and >1% lead).

This work was confirmed by drilling which consisted of one hole that tested the width of the anomaly, intersecting at least four structures including a 9-meter-wide (core length) fault that hosted a 2.35-meter section averaging 125.7 g/t Ag and 4.4% Pb. This hole confirms the Bighorn Zone as a second target area 2.8 km from the Mt. Haldane Vein System.

The Middlecoff target sits on the southwest side of Bighorn Creek and was the focus of early work at Haldane. Underground development started at Middlecoff in 1919-20 produced 24.7t at 3,102 g/t Ag. Historic work includes 207m drifting and a 56m shaft in 1919, plus an additional 91m of underground development and 518m of horizontal underground drilling in 1966.

The Johnson Vein and Main Zone are also high-priority targets within the MHVS area. Approximately 340m of underground development was completed in the Johnson adits with 2.1 tonnes of 4,600 g/t silver extracted in 1926.

The Main Zone appears to be a parallel structure to the West Fault, perhaps offset 100-150 meters to the southeast. Unlike the West Fault, which does not have mineralized silver showings on surface, the Main Zone has two areas of silver mineralization exposed on surface. The Main Zone showing consists of a 7.6m chip sample which averages 151 g/t Ag, 0.6% Pb, and 1.6% Zn, while the Main Zone South yielded a 3.6m chip sample returning 223 g/t Ag, 0.6%Pb, and 1.17% Zn. Both results are considered to be extremely significant, indicating the potential for high-grade silver mineralization at depth.

New Discovery

In 2021 Silver North announced a new discovery at the West Fault Zone, where drilling intersected 311 g/t silver over 8.7 meters (true width), This was followed by 3.14m of 1,315 g/t silver.

According to Silver North, this new zone has been traced over a 100- by 90-meter area with room to expand along strike and at depth.

But to us at AOTH, it’s more a discovery. This discovery, in an incredibly mineral rich area, ripe with mining history, and high grade mines, went un-noticed by investors who were ignoring gold and silver stocks.

“We announced it just a few days after the whole silver Reddit craze peaked and so we were putting out results in an ever-declining silver market,” Weber recalled, adding, “this is a legitimate discovery”.

We agree.

Silver North’s goal was to find Keno-type mineralization and at least 300 grams-per-tonne rock over a comfortable mining width of 4 meters. They achieved that with the West Fault discovery of 311 g/t Ag over 8.7m.

He said Silver North’s thesis is to find new mineralization at Haldane not discovered by “old-time prospectors”. Again, results are encouraging. Apart from the discovery at West Fault, the company has found almost 2 ounces (1 troy oz = 31.2 grams) of silver in soils at Bighorn with high lead concentrations.

“We drilled one hole into that target and found new Keno-style veins and so that was kind of the proof in the pudding for us, that this was a potentially viable target,” Weber said.

Silver North is seeking to raise $2 million for a six-hole diamond drill program for the Haldane project in 2024. This program will target the extensions of high-grade silver mineralization at the West Fault Zone. It is believed that the 100- by 90-meter area continues along strike and to depth along a southwest plunge direction. The 2024 program will test this southwest plunge with four holes on 50-meter step outs.

Drilling will also further investigate the Main Zone.

Tim CRD property

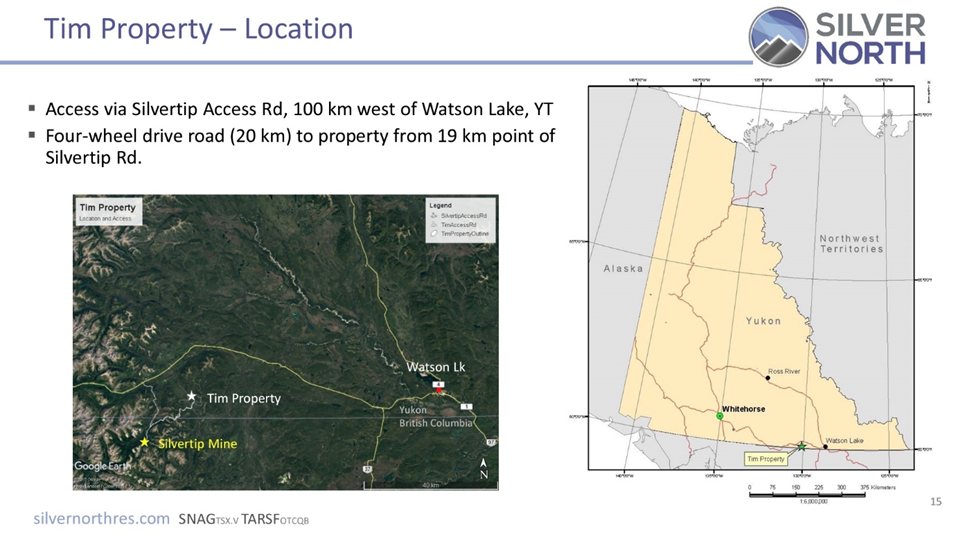

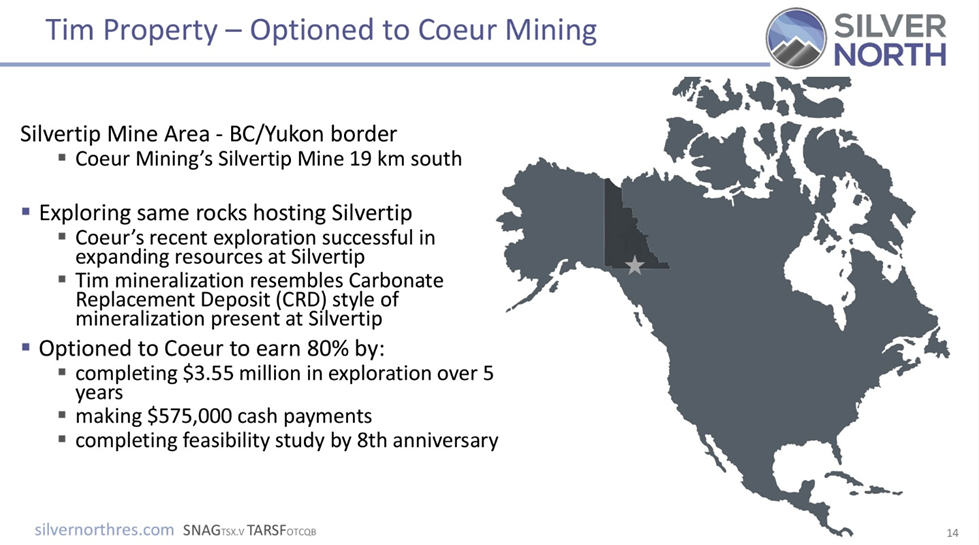

South of Haldane, Silver North Resources is working with partner Coeur Mining to develop the Tim property, located on the Yukon side of the Yukon-British Columbia border.

Silver North has an option agreement with Coeur Mining, which can earn 80% ownership in the project by spending $3.5 million on exploration over five years, making $575,000 cash payments and completing a feasibility study within eight years.

Coeur’s Silvertip silver-lead-zinc project, situated 19 kilometers south in BC, is also a CRD deposit; in fact it is one of the highest-grade silver-lead-zinc operations in the world.

Besides Silvertip, Coeur has operations in Alaska (Kensington), South Dakota (Wharf), Rochester in Nevada and Palmarejo, Mexico.

Carbonate Replacement Deposits (CRD) are, according to many geologists your author have spoken to over the years, their favorite type of deposit because they contain some of the most interesting assemblages of mineralization.

These deposits are also known as high temperature carbonate-hosted gold-lead-zinc deposits because their formation requires high temperatures over 250 degrees C. The orebody is formed by the replacement of sedimentary, usually carbonate rock, by minerals-laden solutions found near porphyry intrusion.

This replacement process results in the formation of deposits that are remarkably similar in terms of their mineralogy (how the minerals are spread throughout the deposit) as well as in the formation of crystals.

Examples of CRD discoveries based on this model include:

- Bingham Canyon in Utah, a long-running open-pit mine that extracts a huge porphyry copper deposit containing 17 million tonnes of copper, 23 million ounces of gold, 190Moz of silver and 850 million pounds of molybdenum.

- MAG Silver’s Cinco de Mayo property in Chihuahua state, Mexico.

- Arizona Mining’s Taylor deposit which South 32 bought for $1.8 billion.

- RC Consortium’s Resolution Copper deposit estimated to contain enough copper to produce 40 billion pounds over 40 years.

- Newmont Goldcorp’s Penasquito mine in Mexico, which is the fifth largest silver mine in the world @ 17.8 million ounces of gold and 1.08 billion ounces of silver.

Besides their common formation, all CRD deposits are polymetallic, meaning they have various metals in them including precious (gold, silver) and base metals (copper, lead, zinc). The mineralization may extend up to seven or eight kilometers from the intrusive stock, the porphyry, and the mineralogy changes as you move out from the core.

They are especially important for mining because of their large scale and high grades, containing between 10 and 150 million tons of economically mineable minerals. Moreover, they can be closely related and close to large porphyry systems.

Unlike deposit types found at surface, which are typically mined in open pits, CRDs’ environmental footprints are much smaller because it’s high-grade underground mining.

According to Silver North, high-grade silver in trenching at the Tim property returned 3.7 meters of 365 grams per tonne silver and 7.15% lead. The company believes the host rock is the same as Silvertip, where Coeur is having success expanding known mineralization.

Historic trench samples returned 352 g/t Ag and 9.12% Pb over 4m, and two grab samples taken from another trench returned assays of 1,248.1 g/t Ag and 49.5% Pb, and 978.7 g/t Pb and 32% Pb, respectively.

Re-opening of the historic trenches in 2021 exposed oxidized material thought to be related to carbonate replacement mineralization, similar to silver-bearing mineralization seen elsewhere in the region.

An analog is Western Alaska Minerals (TSX.V:WAM), which has a CRD system encompassing the past-producing Illinois Creek gold-silver mine, the Waterpump Creek deposit and the Honker gold prospect.

Twenty-five kilometers northeast of the Illinois Creek CRD are the Round Top copper and the TG North CRD prospects. All prospects were originally discovered by Anaconda Minerals in the 1980’s. Since 2010, Western Alaska reassembled the Anaconda land package and has been actively exploring the district. Its claims cover 73,120 acres or 295 square km.

A resource estimated published in February 2024 shows in-situ mineral resources of 234,000 gold ounces and 7.7 million silver ounces in the indicated category, and 102,000 oz gold and 3.6Moz inferred for the Illinois Creek deposit. At their newly discovered Waterpump Creek area, 21.4 Moz of silver has been estimated in the inferred category (at 279 g/t Ag) for the sulphide zone. An additional 3.5 Moz is estimated for an oxide resource, also in the inferred category.

Combined with material on the leach pad, the total resource is 253,000 ounces of gold and 9.6Moz of silver (indicated) and 104,000 oz gold and 3.8Moz silver (inferred).

Western Alaska Minerals (TSXV:WAM) has a current market capitalization of $56.4 million and trades at $0.78/sh.

Back to the Tim property, Coeur is funding a minimum $700,000 drill program of about 2,000 meters, expected to start in June. Crews would operate out of Coeur’s Silvertip mine camp. Up to six drill pads will test the potential for CRD-style mineralization along almost 2 km of strike length.

As mentioned, previous work has identified silver mineralization in trenches dating back to the 1980s. A 2022 program conducted by Coeur to verify previous trench sampling returned 468.1 g/t silver, 21.1% lead, and 0.3% zinc over 4 meters from one re-opened trench. Another, located approximately 200 meters along strike, returned 265.0 g/t silver, 6.7% lead and 0.9% zinc over 8.8m.

Conclusion

At AOTH, our favorite companies are those in the post-discovery resource definition stage (also known as brownfield-stage companies). These companies have already found something, the share price has settled back after the initial discovery. and the company is going in to see what they have and hopefully produce an NI 43-101-compliant resource estimate and build on it. The risk has been greatly reduced, the waiting time for a discovery non-existent and the reward very nice, considering the much lower amount of risk.

Silver North Resources has already made a discovery at its Haldane project; the market just didn’t notice it. At the West Fault Zone, 2021 drilling intersected 311 g/t silver over 8.7 meters (true width), followed by 3.14m of 1,315 g/t silver. This was a key development, arguably an important chapter in the company’s story.

Silver North has identified four targets — West Fault, Middlecoff, Bighorn and the Main Zone.

Management has outlined a six-hole diamond drill program for the Haldane project starting in fall, 2024. The drills will investigate the Bighorn target and West Fault, where it is believed that the 100- by 90-meter area continues along strike and to depth. The program will test this southwest plunge with four holes on 50-meter step outs.

Silver North has an experienced management team and is getting technical help from Hecla, new to the area with its 2022 acquisition of Alexco Resources and the Keno Hill mine. Hecla restarted the mine last year and is ramping up production at its 400 tonne-per-day mill.

Hecla is not only a good miner, but is known as a competent explorer. The company kept the knowledgeable Alexco geologists and added more geos with experience at other Hecla properties. Through exploration, Hecla increased its proven and probable reserves at Keno Hill by 45%.

Junior exploration companies are rarely successful when the CEO is tasked with money-raising, developing the project and telling its story to investors. Silver North has wisely split these functions off to three individuals, each with expertise in their given areas.

Silver North’s two projects, Haldane and Tim, are both located next to high-grade projects run by experienced miners — Hecla and Coeur.

At Tim, Silver North has an option agreement with Coeur, meaning Coeur incurs the exploration expenses and the risk, leaving Silver North to deploy its cash, and geological expertise, on the more advanced Haldane project.

This summer, Coeur is planning to drill about 2,000 meters from six drill pads, testing the potential for CRD-style mineralization along almost 2 km of strike length.

CRDs are especially important for mining because of their large scale and high grades, containing between 10 and 150 million tons of economically mineable minerals. Moreover, they can be closely related and proximal to large porphyry systems.

Silver North is also drilling six holes into the Haldane project. Bottom line for us at AOTH? SNAG is an exciting story that has, lucky for us, so far gone un-noticed by the market.

Silver North Resources

TSXV:SNAG

Cdn$0.15 2024.04.10

Shared Outstanding 36.8m

Market cap Cdn$5.5m

SNAG website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does does not own shares of Silver North Resources (TSX.V:SNAG). SNAG is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of SNAG.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.