Silver North adds fourth target at Haldane, as 2024 drilling concludes – Richard Mills

2024.10.18

Silver North Resources (TSXV:SNAG, OTCQB:TARSF) has successfully completed 2024 drilling at its Haldane silver project within the historical Keno Hill Silver District in the Canadian Yukon Territory.

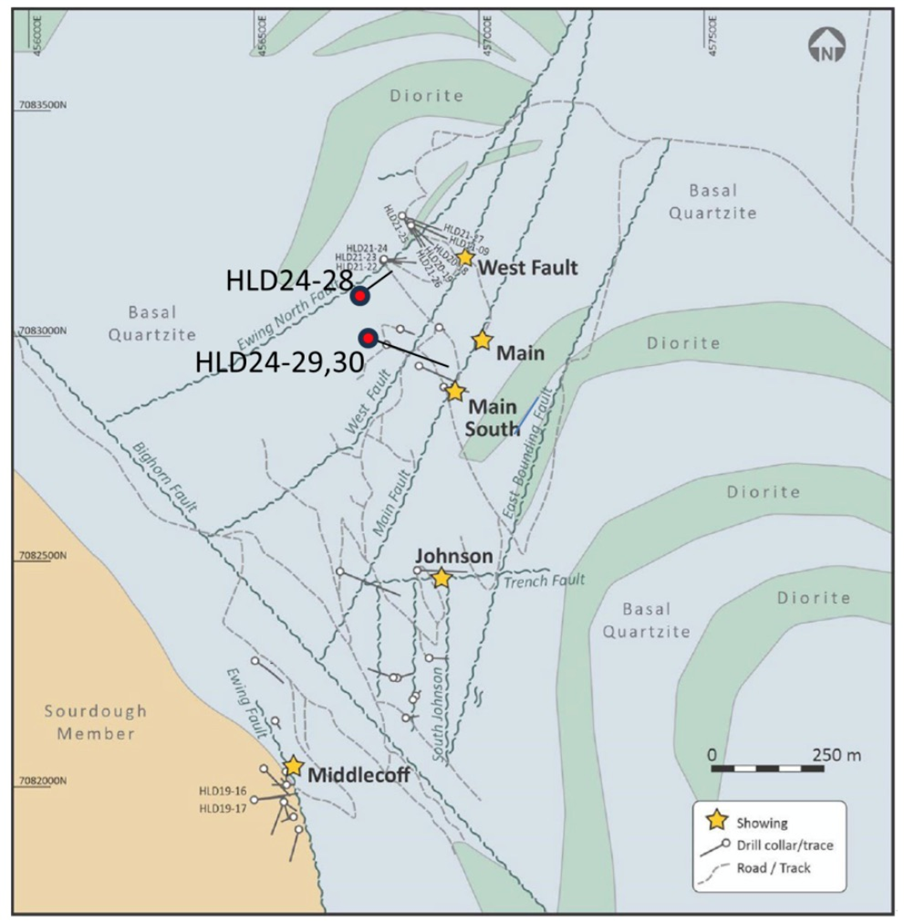

The Vancouver-based company said this week that 732 meters of drilling was completed in three holes testing the West Fault and Main Fault targets. It’s the first time SNAG has tested the Main Fault, with two holes successfully intersecting the target in moderately to un-oxidized rocks, allowing for strong recovery of the vein targets.

The Main Fault is expressed as a wide structural zone with the presence of classic Keno-style quartz-siderite sulfide veins and breccias.

Haldane project

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at the Keno Hill Silver District in Canada’s Yukon Territory.

The property is 25 kilometers west of the main Keno Hill deposits, and next door to Banyan Gold’s ~7 Moz gold inferred resources at its AurMac project.

The 8,579-hectare land package hosts structurally controlled silver veins containing galena, sphalerite, and tetrahedrite-tennantite in quartz-siderite gangue.

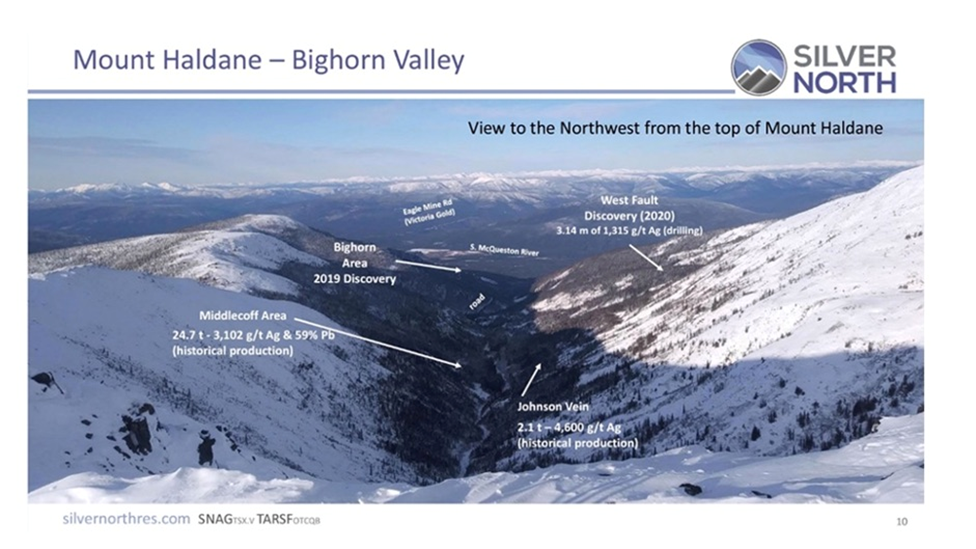

The corporate presentation on Silver’s North’s site shows historical small-scale mining — underground workings developed at the Middlecoff and Johnson veins — produced 24.7 tons of 3,102 g/t Ag and 59% lead, and 2.1 tons of 4,600 g/t Ag.

The property showed the potential to double the combined strike length of known veins currently totalling 12 km, with new discoveries in 2019 and 2020 at West Fault and Bighorn.

In 2021, a hint of what might be hidden below surface manifested in a drill hole of 1.2m @ 3,267 g/t Ag.

The re-branded company says the project is located adjacent to, and has the same rocks as Hecla’s high-grade Keno Hill silver mine.

Approximately 12 kilometers of cumulative vein exploration potential exists at the Haldane project, with the 31 drill holes completed from surface to date testing less than 800 meters. The best mineralization occurs where the mineralized structures cut the Keno Hill quartzite unit — a similar geological setting for mineralization as at the main Keno Hill deposits mined for over 100 years.

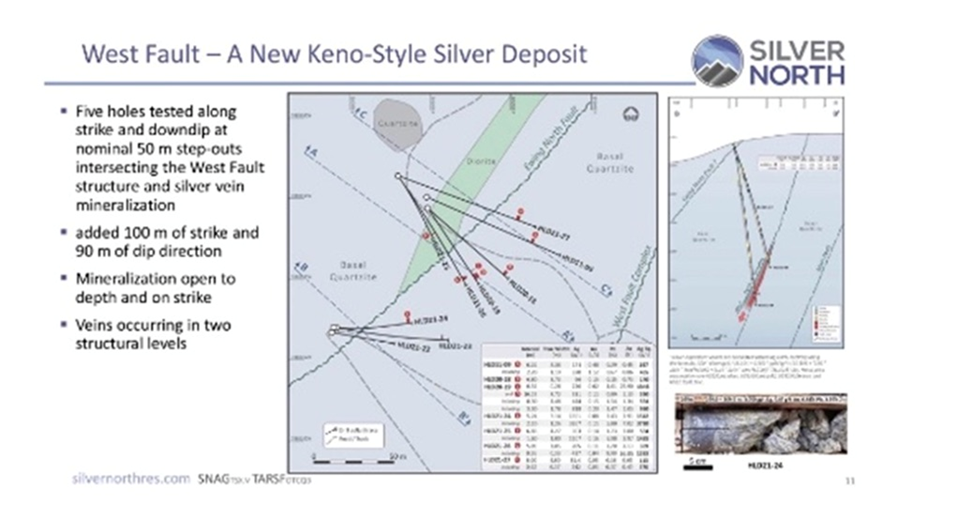

In 2021 Silver North announced a new discovery at the West Fault Zone, where drilling intersected 311 g/t silver over 8.7 meters (true width), This was followed by 3.14m of 1,351 g/t silver.

According to Silver North, this new zone has been traced over a 100- by 90-meter area with room to expand along strike and at depth.

Silver North’s goal was to find Keno-type mineralization and at least 300 grams-per-tonne rock over a comfortable mining width of 4 meters. They achieved that with the West Fault discovery of 311 g/t Ag over 8.7m.

President and CEO Jason Weber said Silver North’s thesis is to find new mineralization at Haldane not discovered by “old-time prospectors”. Again, results are encouraging. Apart from the discovery at West Fault, the company has found almost 2 ounces (1 troy oz = 31.2 grams) of silver in soils at Bighorn with high lead concentrations.

“We drilled one hole into that target and found new Keno-style veins and so that was kind of the proof in the pudding for us, that this was a potentially viable target,” he said.

2024 drilling

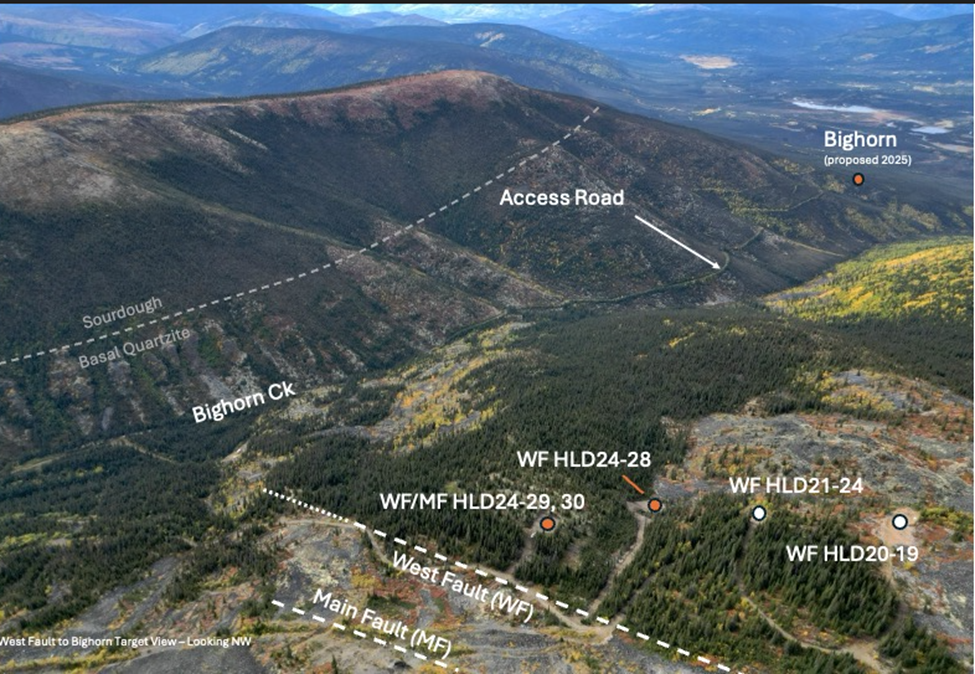

“We are very pleased with the progress we made at Haldane in this program,” Weber stated in the Oct. 16 news release. “We have shown that the Main Fault is another viable target with wide intersections of the structure 150 and 190 metres below surface, hosting classic Keno-style veins and breccias with siderite gangue and sulphide mineralization. Regardless of the silver grades returned from these two Main Fault intersections, we can confidently say we have added a fourth viable silver target at Haldane.”

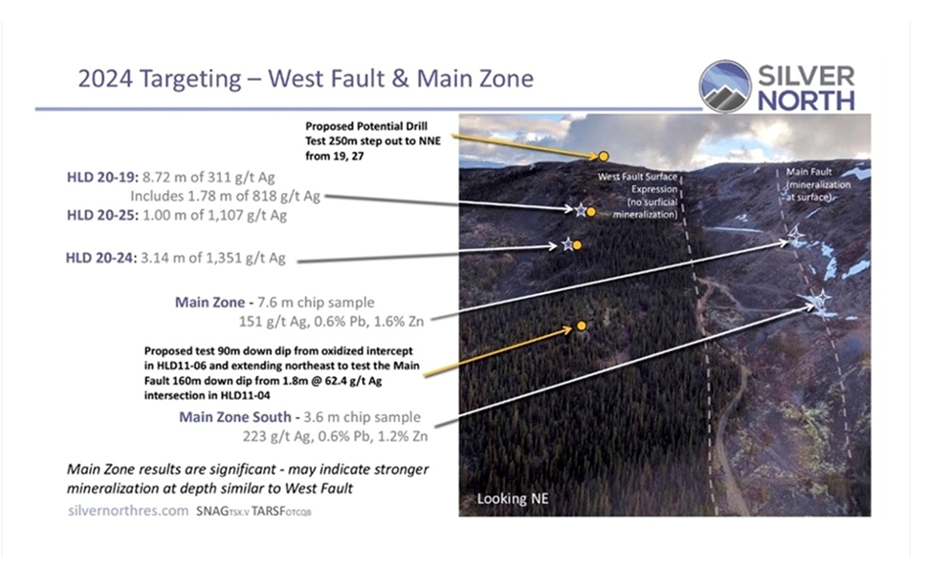

In addition to continuing step-out tests of the West Fault target, an important goal of the 2024 program was to test the Main Fault below the level of oxidation for a true representation of the target’s potential for high-grade silver mineralization. The surface expression of the Main Fault indicates potential for a large structure, with historical oxidized vein samples at surface averaging 151 g/t silver over 7.6m and 223 g/t silver over 3.6m at the Main Zone and Main Zone South showings.

Heavily oxidized, poorly recovered intersections in 2011 and 2013 drilling by previous operators intersected similarly anomalous results.

Hole HLD24-29 intersected a somewhat oxidized structure above the Main Fault from 158.6 to 162.0m, followed by an un-oxidized Main Fault breccia and siderite vein from 171.0 to 176.7m. The width of this zone warranted a follow-up hole, targeting the structure 50 meters down dip. Hole HLD24-30 accomplished this, intersecting the same partially oxidized structure above the Main Fault from 171.0 to 172.5m and the Main Fault as a much wider, unoxidized, structural zone from 183.5 to 203.0 meters down hole, exhibiting multiple fault splays with strong gouge and breccia zones as well as quartz-siderite sulfide veins.

Being the first holes in this target, silver grades cannot be reliably estimated for these intersections, but regardless, the program has successfully shown that the Main Fault is a viable silver target with strong Keno District characteristics, indicating its potential to host high-grade silver mineralization as seen elsewhere in the district.

Despite a fourth hole at the Bighorn target being dropped from the program due to deteriorating conditions that made drill pad access difficult, Bighorn remains a high priority target. A pad was constructed early in the program that will be available for use in the next drill campaign at Haldane.

Tim CRD project

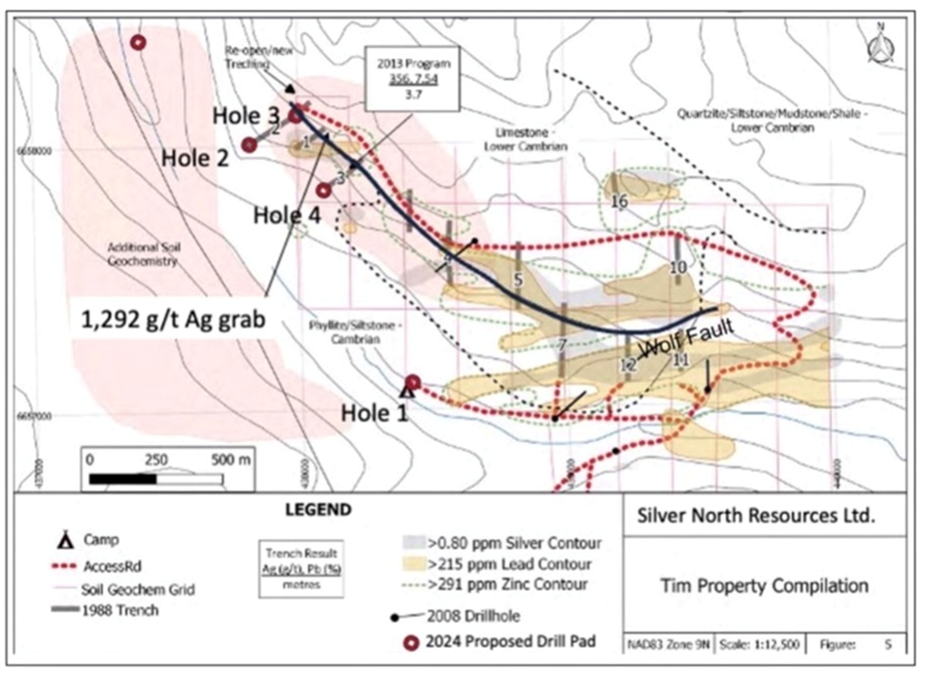

Silver North is working with partner Coeur Mining (NYSE:CDE) to develop the Tim property, located on the Yukon side of the Yukon-British Columbia border.

Silver North has an option agreement with Coeur, which can earn a 51% interest in the Tim property by spending a minimum $3.15 million on exploration and making cash payments totaling $275,000 by the end of 2026. Coeur must spend at least $700,000 in 2024. Coeur can boost its ownership to 80% by making two additional cash payments of $100,000 in 2027 and 2028, completing a feasibility study, and informing Silver North of its intention to develop a mine at Tim by Dec. 16, 2028.

As outlined in Silver North’s Aug. 19 update, drill core observations from the first three holes of the program include diagnostic features that are commonly associated with significant CRD mineralization and have been observed at the Silvertip deposits. Such characteristics include fugitive calcite veining that fluoresces in UV (ultraviolet) light, displaying the classic barbeque (pink and orange fluorescence) and recrystallization of the host limestones.

A 2022 program conducted by Coeur to verify previous trench sampling returned 468.1 g/t silver, 21.1% lead, and 0.3% zinc over 4.0 meters from one re-opened trench. Another, located approximately 200 meters along strike, returned 265.0 g/t silver, 6.7% lead and 0.9% zinc over 8.8m.

Both Coeur and Silver North view Tim as a high-priority exploration target as it exhibits similar geological characteristics to Coeur’s Silvertip project.

CRD deposits

Carbonate Replacement Deposits (CRD) are for many geologists their favorite type of deposit because they contain some of the most interesting assemblages of mineralization.

These deposits are also known as high temperature carbonate-hosted gold-lead-zinc deposits because their formation requires high temperatures over 250 degrees C. The orebody is formed by the replacement of sedimentary, usually carbonate rock, by minerals-laden solutions found near a porphyry intrusion.

This replacement process results in the formation of deposits that are remarkably similar in terms of their mineralogy, how the minerals are spread throughout the deposit as well as in the formation of crystals in open space dissolution cavities.

Examples of CRD discoveries based on this model include:

- Bingham Canyon in Utah, a long-running open-pit mine that extracts a huge porphyry copper deposit containing 17 million tonnes of copper, 23 million ounces of gold, 190Moz of silver and 850 million pounds of molybdenum. The Bingham porphyry deposit was surrounded by a series of CRD deposits that were originally mined before the porphyry.

- MAG Silver’s Cinco de Mayo property in Chihuahua state, Mexico.

- Arizona Mining’s Taylor deposit which South 32 bought for $1.8 billion.

- RC Consortium’s Resolution Copper deposit estimated to contain enough copper to produce 40 billion pounds over 40 years. The Resolution Copper Deposit lies beneath a trend of copper-bearing veins and CRD mantos including the Magma mine and Old Dominion mine.

- Newmont’s Penasquito mine in Mexico, which is the fifth largest silver mine in the world @ 17.8 million ounces of gold and 1.08 billion ounces of silver.

Besides their common formation, CRD deposits are polymetallic, meaning they have various metals in them including precious (gold, silver) and base metals (copper, lead, zinc). The mineralization may extend up to 7 or 8 kilometers from the intrusive stock, the porphyry, and the mineralogy changes as you move out from the hotter core to cooler fringes.

They are especially important for mining because of their large scale and high grades, containing between 10 and 150 million tons of economically mineable minerals. Moreover, they can be closely related and proximal to large porphyry systems.

2024 drilling

Coeur started drilling at Tim in July with plans to target silver-lead-zinc Carbonate Replacement Deposit (CRD) mineralization similar to that found at Coeur’s Silvertip property 19 km south of Tim.

The now-completed 2,252-meter program was conducted under the direction of Coeur’s exploration team based at Silvertip.

At Tim, the drills were targeting the potential for CRD mineralization along over 2,000 meters of strike length. Drilling targeted both structurally-hosted “chimney-style” mineralization and stratigraphically controlled “manto” mineralization.

The Wolf Fault is a northwest striking and steeply southwest dipping structure that parallels the regionally significant Kechika Fault. Large conductivity anomalies defined by SkyTEM airborne geophysical data are associated with the Wolf Fault, as is silver mineralization and/or heavily oxidized fault breccias in historical trenches.

As outlined in Silver North’s Aug. 19 update, drill core observations from the first three holes of the program include diagnostic features that are commonly associated with significant CRD mineralization and have been observed at the Silvertip deposits. Such characteristics include fugitive calcite veining that fluoresces in UV (ultraviolet) light, displaying the classic barbeque (pink and orange fluorescence) and recrystallization of the host limestones.

According to Silver North, as of Aug. 19, drilling indicates the presence of a CRD system at Tim.

Coeur completed six holes for a total of 2,252m, and carried out additional geophysics.

SNAG’s CEO Jason Weber said he’s impressed with the way Coeur is approaching the exploration.

“The late addition of two airborne geophysical surveys to augment this year’s drilling is an example of the big-picture approach they are taking at Tim to identify how it fits into the regional CRD setting. We eagerly await the receipt of analytical results this fall,” he told AOTH.

Coeur has been generous with their time and gracious in sharing information with Silver North’s management team. Weber said it’s clear that Coeur sees Silvertip and Tim as part of the same district.

“I don’t think they are going to make any mining decisions or restart of the [Silvertip] mine decisions until they know what size of mill they want to build and what type of ore they will eventually process,” he said, adding they keep hitting more mineralization at Silvertip.

This certainly bodes well for Tim, whose ore could possibly be used as mill feed.

“They’re thinking big and it’s very refreshing to see,” said Weber.

He added that Coeur’s size allows it to realize cost savings that a junior like Silver North couldn’t, such as commissioning more drilling or new geophysical surveys on the fly that SNAG would have had to raise money for, as well as having mine infrastructure and camp facilities at Silvertip already.

They’re probably doing it twice as efficiently as we could do it,” he said.

“We are extremely pleased with Coeur’s progress to date at Tim,” concurred Rob Duncan, VP Exploration for Silver North after a site visit. “Given that the Wolf Fault has been identified in several historic trenches, in the current drill holes and anomalous soil geochemistry over a cumulative strike length of >2 km, we believe that the Tim project displays the necessary characteristics of a potentially productive CRD system.”

Conclusion

Silver North Resources offers exposure to one of the most prolific silver districts in Canada — Keno Hill in the Yukon Territory. A recent discovery by Snowline Gold (TSXV:SGD, OTCQB:SNWGF) has rekindled interest in the Yukon, and Keno Hill is seeing major investment from Hecla Mining (NYSE:HL), the largest silver producer in the United States, following Hecla’s 2022 takeover of Alexco Resources.

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at Keno Hill.

Between Haldane and its Tim carbonate replacement deposit (CRD), on the BC-Yukon border, Silver North offers strong discovery/ development potential.

Silver North Resources

TSXV:SNAG, OTCQB:TARSF

Cdn$0.09 2024.10.18

Shares Outstanding 43.3m

Market cap Cdn$4.2m

SNAG website

Subscribe to AOTH’s free newsletter

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Richard does not own shares of Silver North Resources (TSXV:SNAG). SNAG is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of SNAG

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

$SNAG #SilverNorth #Silver #KenoHill #CoeurMining $CDE #CarbonateReplacementDeposits #CRD #SnowlineGold #SGD #HeclaMining #HL