Silver North about to drill Haldane in the Keno Hill Silver District after completing 2,252m program at Tim CRD project – Richard Mills

2024.09.07

Silver North Resources (TSX-V: SNAG, OTCQB: TARSF) isn’t wasting any time in completing its drilling goals this summer. Days after finishing a 2,252-meter drill program at Tim, an earn-in project with partner Coeur Mining (NYSE:CDE), the company announced that equipment and crews are being mobilized to Silver North’s other project, Haldane, located within the historic Keno Hill Silver District in the Yukon Territory.

“We are eager to begin drilling at Haldane again, following on the heels of the Tim drilling program in southern Yukon,” said Jason Weber, president and CEO of Silver North, in the Aug. 27 news release. “In fact, the drill will move north from Tim to Haldane once the final hole at Tim is complete in early September.”

Tim CRD project

Coeur started drilling at Tim in July. The revised plans were to drill 2,200 meters, targeting silver-lead-zinc Carbonate Replacement Deposit (CRD) mineralization similar to that found at Coeur’s Silvertip property 19 km south of Tim.

Silver North has an option agreement with Coeur, which can earn a 51% interest in the Tim property by spending a minimum $3.15 million on exploration and making cash payments totaling $275,000 by the end of 2026. Coeur must spend at least $700,000 in 2024. Coeur can boost its ownership to 80% by making two additional cash payments of $100,000 in 2027 and 2028, completing a feasibility study, and informing Silver North of its intention to develop a mine at Tim by Dec. 16, 2028.

A 2022 program conducted by Coeur to verify previous trench sampling returned 468.1 g/t silver, 21.1% lead, and 0.3% zinc over 4.0 meters from one re-opened trench. Another, located approximately 200 meters along strike, returned 265.0 g/t silver, 6.7% lead and 0.9% zinc over 8.8m.

Both Coeur and Silver North view Tim as a high-priority exploration target as it exhibits similar geological characteristics to Coeur’s Silvertip project.

The 2024 program was conducted under the direction of Coeur’s exploration team based at Silvertip.

At Tim, the drills were targeting the potential for CRD mineralization along over 2,000 meters of strike length. Drilling targeted both structurally-hosted “chimney-style” mineralization and stratigraphically controlled “manto” mineralization.

The Wolf Fault is a northwest striking and steeply southwest dipping structure that parallels the regionally significant Kechika Fault. Large conductivity anomalies defined by SkyTEM airborne geophysical data are associated with the Wolf Fault, as is silver mineralization and/or heavily oxidized fault breccias in historical trenches.

As outlined in Silver North’s Aug. 19 update, drill core observations from the first three holes of the program include diagnostic features that are commonly associated with significant CRD mineralization and have been observed at the Silvertip deposits. Such characteristics include fugitive calcite veining that fluoresces in UV (ultraviolet) light, displaying the classic barbeque (pink and orange fluorescence) and recrystallization of the host limestones.

Coeur completed six holes for a total of 2,252m, and carried out additional geophysics.

“The late addition of two airborne geophysical surveys to augment this year’s drilling is an example of the big-picture approach they are taking at Tim to identify how it fits into the regional CRD setting. We eagerly await the receipt of analytical results this fall,” said SNAG’s CEO Jason Weber.

Silver North’s 2024 drill program at the Tim property is now complete. The drill was demobilized and is en route to Silver North’s Haldane property in the historic Keno Hill Silver District, where the company’s technical team is on site.

Haldane silver project

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at the Keno Hill Silver District in Canada’s Yukon Territory.

The property is 25 kilometers west of the main Keno Hill deposits, and next door to Banyan Gold’s ~7 M oz gold inferred resources at its AurMac project.

The 8,579-hectare land package hosts structurally controlled silver veins containing galena, sphalerite, and tetrahedrite-tennantite in quartz-siderite gangue.

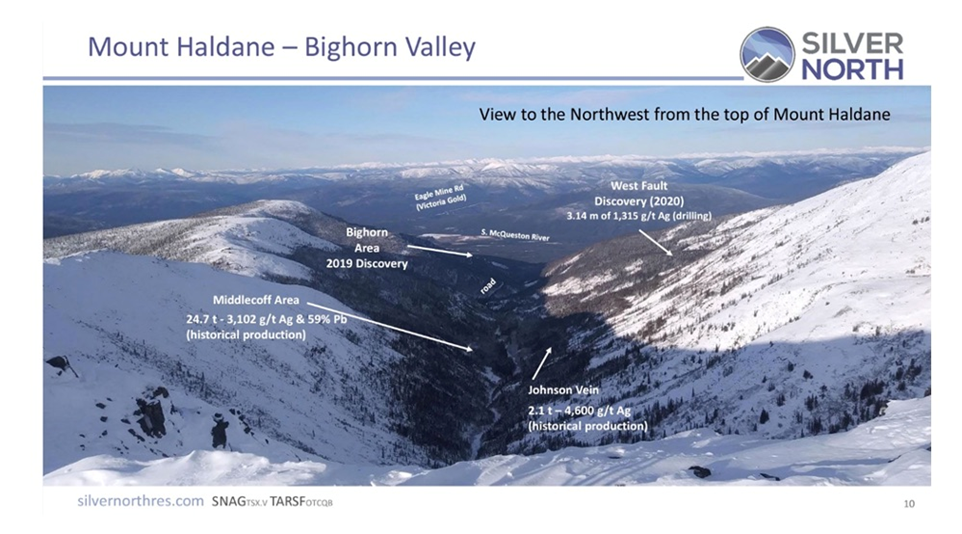

The corporate presentation on Silver’s North’s site shows historic small-scale mining — underground workings developed at the Middlecoff and Johnson veins — produced 24.7 tons of 3,102 g/t Ag and 59% lead, and 2.1 tons of 4,600 g/t Ag.

The property showed the potential to double the combined strike length of of known veins currently totalling 12 km, with new discoveries in 2019 and 2020 at West Fault and Bighorn.

In 2021, a hint of what might be hidden below surface manifested in a drill hole of 1.2m @ 3,267 Ag.

The re-branded company says the project is located adjacent to, and has the same rocks as Hecla’s high-grade Keno Hill silver mine.

“In terms of geology, we have the exact same geological environment [as Keno Hill]…the same structural regime, the same mineral assemblages, everything. It’s a dead ringer, but it’s vastly underexplored. Even today, with all of our work on it, there’s only a total of 27 drill holes that’s ever been completed on the project,” Weber told Crux Investor in a recent report.

Approximately 12 kilometers of cumulative vein exploration potential exists at the Haldane project, with the 27 drill holes completed from surface to date testing less than 600 meters. The best mineralization occurs where the mineralized structures cut the Keno Hill quartzite unit — a similar geological setting for mineralization as at the main Keno Hill deposits mined for over 100 years.

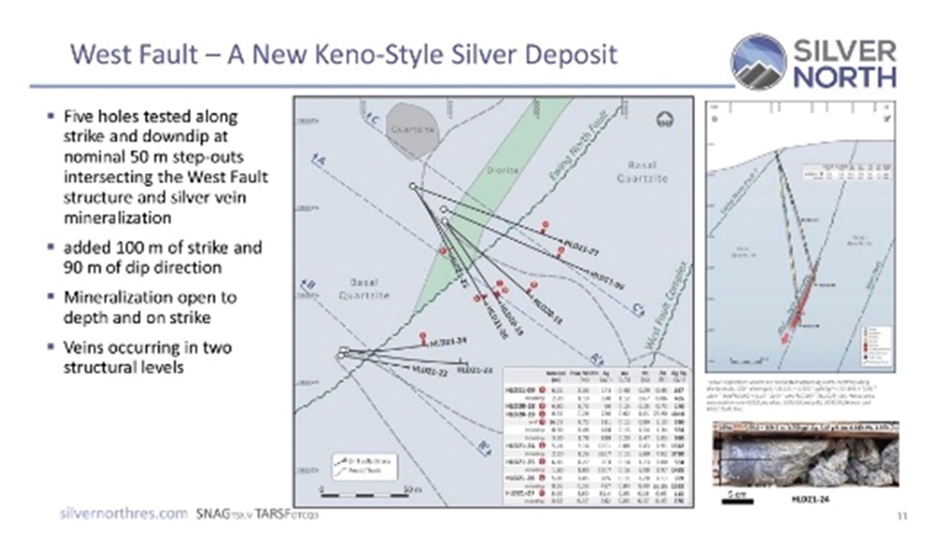

In 2021 Silver North announced a new discovery at the West Fault Zone, where drilling intersected 311 g/t silver over 8.7 meters (true width), This was followed by 3.14m of 1,351 g/t silver.

According to Silver North, this new zone has been traced over a 100- by 90-meter area with room to expand along strike and at depth.

Silver North’s goal was to find Keno-type mineralization and at least 300 grams-per-tonne rock over a comfortable mining width of 4 meters. They achieved that with the West Fault discovery of 311 g/t Ag over 8.7m.

Weber said Silver North’s thesis is to find new mineralization at Haldane not discovered by “old-time prospectors”. Again, results are encouraging. Apart from the discovery at West Fault, the company has found almost 2 ounces (1 troy oz = 31.2 grams) of silver in soils at Bighorn with high lead concentrations.

“We drilled one hole into that target and found new Keno-style veins and so that was kind of the proof in the pudding for us, that this was a potentially viable target,” he said.

According to SNAG’s Aug. 27 news release, crews will be mobilizing to the property in the first week of September, with drilling commencing by mid-September.

Drilling will target the West Fault and Bighorn areas. Drilling at West Fault will aim to expand upon high-grade silver mineralization intersected in recent drilling such as 3.14 meters (true width) averaging 1,351 g/t silver, 2.43% lead and 2.91% zinc (the 2021 discovery). The West Fault structure has been traced for over 650 meters of strike length and is interpreted to extend to 1.1 km in length before merging with the 2.2 km-long Main Fault structure.

The Main Fault is known to host strongly oxidized silver mineralization on surface at the Main and Main South targets. If drilling conditions permit, one hole at the West Fault will be continued to depth to intersect the Main Fault target as well.

Drilling will also target the silver-bearing vein mineralization intersected in the only hole drilled at the Bighorn target. Drilling in 2019 intersected four separate veins, the best of which returned 2.35m averaging 125 g/t silver and 4.39% lead. The structure hosting mineralization at Bighorn has been traced for over 525m of strike length within a 900m-long lead-silver soil geochemical anomaly. In total, approximately 1,000m of drilling is planned for the current program.

Silver market

Silver North’s activities at Tim and Haldane are taking place within the context of a booming silver market.

The transition to an electrified economy doesn’t happen without copper and silver, which is why in my opinion they are among the most highly investable commodities now, and for the foreseeable future. The danger, for end users, and opportunity, for resource investors, of coming shortages for both metals, only strengthens my thesis.

Silver and gold largely move together, as both offer similar macro- and currency-hedging properties. While gold has hit record highs this year, silver remains undervalued, says John Ciampaglia, CEO of Sprott Asset Management.

Ciampaglia said with gold now above $2,500, silver prices should trend higher. Silver usually rallies after gold.

“It’s mind-boggling to us that silver is still below $30. It is obviously way off its 2010 highs, and we would love to see it get back to the $50 level,” said Ciampaglia. “We think it has the ability to do that over time.”

One way to gauge the relative value of gold versus silver is to calculate the gold-silver ratio. Simply divide the spot gold price by the spot silver price.

According to Sprott Money, a breakout is coming because silver cannot continue to be so undervalued compared to gold. Using a median gold-silver ratio of 80:1 (80 ounces of silver to buy one ounce of gold), a gold price of $2,300 implies a silver price of $28.75. If gold reaches $2,500, as it has, maintaining that same ratio means $31.25 silver.

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

However, much of silver’s value is derived from its industrial demand. It’s estimated around 60% of silver is utilized in industrial applications, like solar and electronics, leaving only 40% for investing.

The lustrous metal has a multitude of industrial applications. This includes solar power, the automotive industry, brazing and soldering, 5G, and printed and flexible electronics.

Schiff Gold reported in May that silver demand in three sectors is expected to double in the next decade: industrial applications, jewelry production and silverware fabrication.

A report by Oxford Economics commissioned by the Silver Institute found that demand for these sectors is forecast to increase by 42% between 2023 and 2033.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. A Saxo Bank report stated that “potential substitute metals cannot match silver in terms of energy output per solar panel.”

About 100 million ounces of silver are consumed per year for this purpose alone.

In May, a report by the International Energy Agency said global investment in solar PV manufacturing more than doubled last year to around $80 billion. This accounts for roughly 40% of global investment in clean-energy technology manufacturing.

Much of the growth is coming from, no surprise, China. The IEA says China more than doubled its investment in solar PV manufacturing between 2022 and 2023.

This is only going to continue.

According to Sprott, demand for silver from the makers of solar panels, particularly those in China, is forecast to increase by almost 170% by 2030, to about 273 million ounces — one fifth of total silver demand.

Last year the country commissioned as much solar as the entire world did in 2022. The IEA expects China to maintain an 85-90% market share of global solar supply chains and to double its manufacturing capacity again by the end of this year.

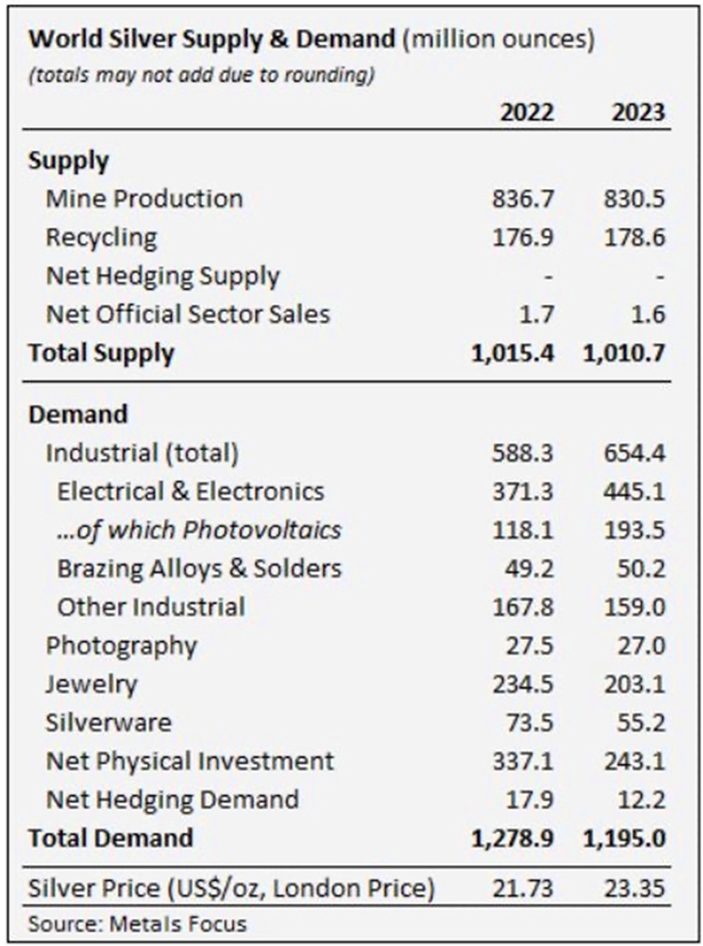

In a recent commentary, the Silver Institute said industrial demand rose 11% last year to a new record of 654.4Moz, smashing the old record set in 2022.

Higher-than-expected photovoltaic (PV) capacity additions and faster adoption of new-generation solar cells raised electrical & electronics demand by a substantial 20%, to 445.1Moz, the institute said.

Chinese silver industrial demand rose by a remarkable 44% to 261.2Moz, primarily due to growth for green applications, chiefly PV. Last year, China’s rapid expansion of PV production accounted for over 90% of global panel shipments. Industrial demand in the United States stood at 128.1Moz, essentially flat over 2022, while Japan’s industrial offtake was also basically unchanged at 98Moz.

FX Street quotes a research paper by the University of New South Wales that found “solar manufacturers will likely require over 20% of the current annual silver supply by 2027. By 2050, solar panel production will use approximately 85–98% of the current global silver reserves.”

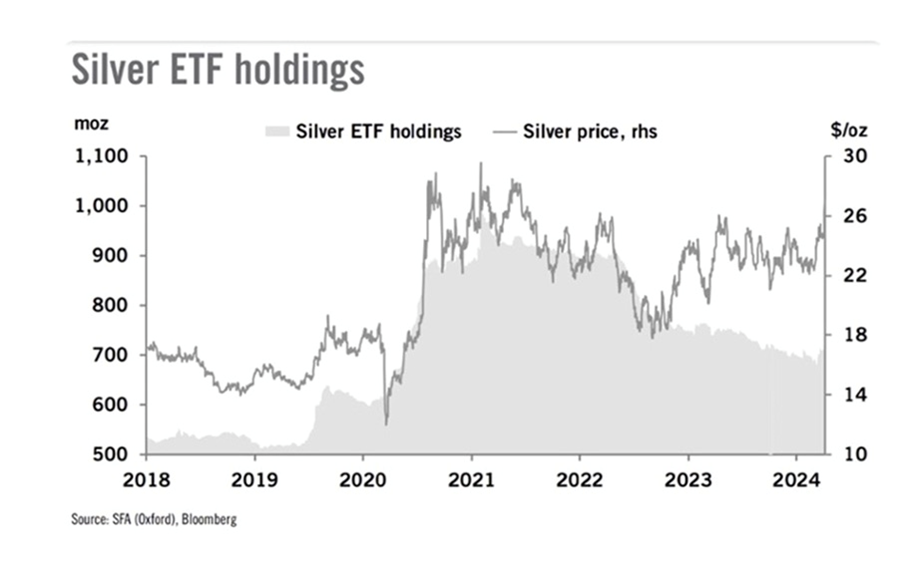

Who’s buying all the silver? India, China and silver-backed ETFs.

India in February purchased a whack of silver bullion, with silver imports surging 260%. The country bought 2,295 tonnes compared to just 637t in January — a new monthly record.

Putting that into perspective, it’s about 70 million ounces, more silver than the US Mint produced in American Silver Eagle coins over the past three years combined.

ABC News quoted a Canaccord senior mining analyst saying that silver is a more obtainable precious metal for “mum and dad” investors than more expensive gold, especially during uncertain times.

“The Chinese consumer loves silver as well [and] that’s been another impact,” said Tim Hoff.

The role of silver in Chinese history — Richard Mills

Kitco reported on April 8 that silver appears to be benefiting from both investment and industrial demand. Many investors are choosing to ride silver in an ETF investment vehicle.

On the supply side, global silver mine production fell by 1% to 830.5Moz in 2023. Output was constrained by a four-month suspension of operations at Newmont’s Penasquito mine in Mexico due to a strike; lower ore grades; and mine closures in Argentina, Australia and Russia.

The Silver Institute reported a 184.3 million-ounce deficit in 2023 on the back of robust industrial demand.

The Silver Institute expects demand to grow by 2% this year, led by an anticipated 20% gain in the PV market. Industrial fabrication should post another all-time high, rising by 9%. Demand for jewelry and silverware fabrication are predicted to rise by 4% and 7%, respectively.

Total silver supply should decrease by 1%, meaning 2024 should see another deficit, amounting to 215.3Moz, the second-largest in more than 20 years.

In fact it’s the fourth year in a row that the silver market is in a structural supply deficit.

The numbers can be misleading.

The deficit actually fell 30% last year but at 184.3 million ounces it’s still massive. Global supply has been broadly steady at around 1 billion ounces but last year industrial silver demand grew 11%, reaching a new record of 654.4 million ounces. Usage was mostly in the green economy sector.

Total silver demand was 1.195 million ounces compared to 1,010.7Moz of total supply, which included mine production of 830.5Moz (-1%) and recycling of 178.6Moz.

Conclusion

Silver is undervalued as reflected by the current gold-silver ratio which sits at 87. The 20-year average is 68. Even though silver has gained 22% year to date, it still has a lot more room to run.

Silver North Resources offers exposure to one of the most prolific silver districts in Canada — Keno Hill in the Yukon Territory. A recent discovery by Snowline Gold (TSXV:SGD, OTCQB:SNWGF) has rekindled interest in the Yukon, and Keno Hill is seeing major investment from Hecla Mining (NYSE:HL), the largest silver producer in the United States, following Hecla’s 2022 takeover of Alexco Resources.

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at Keno Hill.

Between Haldane and its Tim carbonate replacement deposit (CRD), on the BC-Yukon border, Silver North offers strong discovery/ development potential against an increasingly bullish backdrop for silver.

Silver North Resources

TSXV:SNAG, OTCQB:TARSF

Cdn$0.10 2024.09.05

Shares Outstanding 43.3m

Market cap Cdn$4.7m

SNAG website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Richard does not own shares of Silver North Resources (TSX.V:SNAG) SNAG is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of SNAG

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

#Silver #SilverNorth #SNAG $CDE $HL #Hecla #Coeur