Sentinel ramping up gold, silver project reviews in Australia

2020.10.30

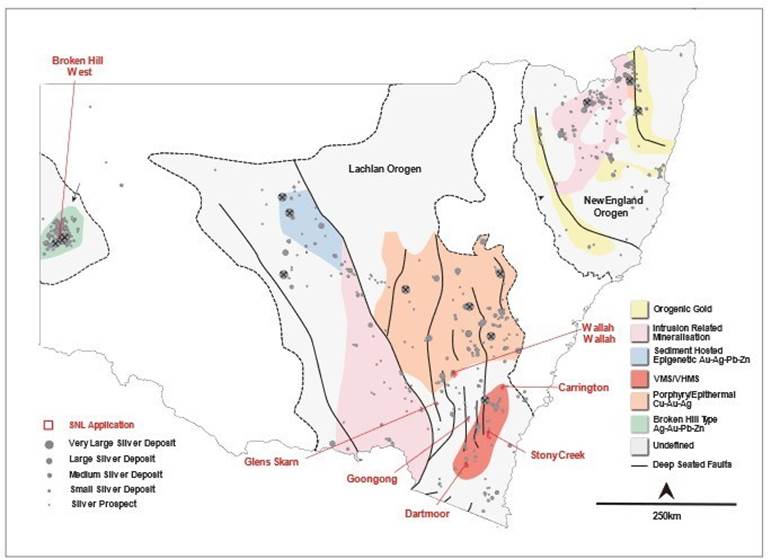

Shortly after expanding its exploration focus towards Australia with the purchase of seven silver-focused exploration concessions in New South Wales, Sentinel Resources Corp. (CSE: SNL) (US OTC PINK: SNLRF) and its seasoned team went ahead quickly to complete a “first pass” review of these highly prospective licenses, known as Wallah Wallah, Stony Creek, Carrington, Dartmoor, Glens Skarns, Broken Hill West and Goongong.

The licenses — covering an area of 386 km2 — are located in a significantly silver-mineralized part of the southern Lachlan orogenic belt that dominates and within the world-famous Broken Hill Block.

Sentinel silver project map

The Lachlan Fold Belt in southeastern Australia — also known as Lachlan Orogen — represents a marginal mobile zone that developed at the edge of the palaeo Australian Plate during the Ordovician to Early Carboniferous Period.

New Lachlan orogen

The area is host to some of the world’s best porphyry copper-gold deposits like Newcrest Mining’s giant Cadia mine that is currently undergoing expansion.

However, it also has an excellent exploration potential for silver, with a variety of deposit styles present including volcanic-associated massive sulfide (e.g. Woodlawn and Lewis Ponds), epithermal (e.g. Bowdens), orogenic base metal (e.g. Browns Reef), Mississippi Valley type (carbonate and sandstone hosted such as the Manuka Deposit) and intrusion related (e.g. Peak and CSA).

At least 23 historical silver mines, three historical gold mines and exploration showings are believed to be present across Sentinel’s concessions, with six of the licenses found within the Lachlan orogenic terrane.

The initial review of historical data by the company, which was led by Dr. Peter Pollard (director and chief geologist) and Dr. Christopher Wilson (senior advisor, previously head of exploration at Ivanhoe Mines), has determined that Wallah Wallah, Stoney Creek and Carrington are high-priority projects.

Silver Project Overview

Wallah Wallah

This project comprises a 99 km2 license hosting six historical silver mines and showings with reported rock chip grades of over 1,000 g/t Ag. The historical prospect consists of mineralized lodes which crop out as gossans over a 2 km strike length.

One of these lodes, as past record shows, was exploited to a depth of at least 46 m on four levels. A research paper published in 1988 indicates that several thousand tonnes of material were processed here at grades of 950 g/t Ag and 30% Pb.

The entire system at Wallah Wallah is relatively unexplored, but Sentinel’s exploration team believes the presence of minor tin, topaz and tourmaline with the silver-lead mineralization suggests it forms part of an intrusion-related system, possibly related to nearby Devonian granites.

Stoney Creek

This 81 km2 license hosts seven high-grade, historical silver and gold mines and showings. Mineralization is likely of a low-sulphidation epithermal type, characterized by vein-hosted high-grade shoots.

The Stoney Creek prospect comprises quartz-sulphide veins within an 85 m wide zone of alteration. Past rock-chip grab samples assayed up to 18 g/t Au and 212 g/t Ag.

Carrington

The project contains a number of historical mines and workings within gold-silver mineralized gossanous lodes. Three of the historical silver-gold mines targeted mineralized gossans. Rock chip grab samples of this material assayed up to 85 g/t Au, 6,037 g/t Ag, 24.85 Pb and 16.75% Sb.

According to an NSW government website, over 0.5 Mt of iron gossan is present, which the company believes is significant given silver-gold mineralization is associated with gossans developed above primary sulphide mineralization. The tonnage cited suggests a robust system.

Other Projects

Review of the remaining licenses (Broken Hill West, Glens Skarns, Goongong and Dartmoor) is still ongoing, but so far each of the projects has given a reason for the company to continue assessing their upside.

- Broken Hill West is located 2.5 km to the west of the Broken Hill mine complex and shares similar geology and structure. There has been minimal exploration due to an extensive cover of recent alluvium.

- Glens Skarns has four mineralized skarns over a strike length of 7.5 km. The Sentinel team believes these are four priority targets.

- Dartmoor hosts Kuroko-style VMS mineralization which can be traced as gossanous outcrops over a strike length of 1.5 km. Small-scale production records cite silver grades of up to 900 g/t.

- Goongong hosts four historical silver mines and prospects of polymetallic skarn style with anomalous silver, copper, lead, zinc, tin and tungsten.

Gold Project Overview

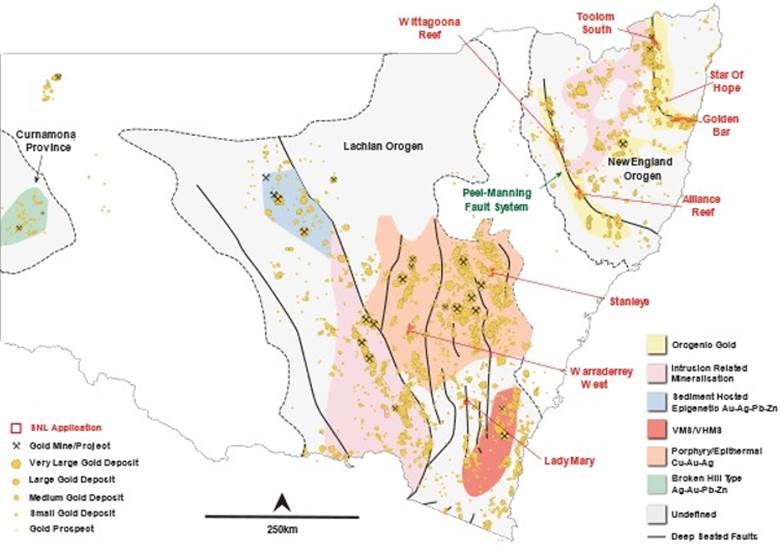

Of course, silver is not the only metal of focus for Sentinel in New South Wales. On the same day that it acquired the above projects, the company also purchased eight gold-focused concessions totaling approximately 945 km2 in that area.

Earlier this week, the exploration team completed its initial review of these gold properties, known as Star of Hope, Golden Bar, Alliance Reef, Stanleys, Lady Mary, Waddery West, Wittagoona Reef and Toolom South.

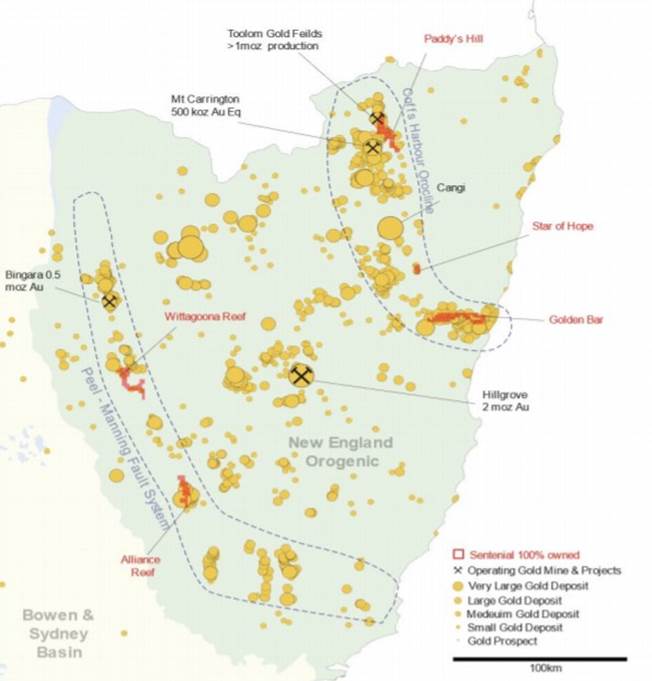

Sentinel gold project map

The licenses are situated within the Lachlan and New England orogenic terranes, the latter of which forms the basement throughout NSW and is home to a large number of historical underground gold and silver mines (see map below).

New England orogen

Review of available data for the gold projects indicates that Alliance Reef and Wittagoona Reef on the Peel-Manning fault system, as well as Toolom South in the Mount Carrington gold camp, host extremely robust exploration targets. These projects are all located within the New England orogenic terrane.

Alliance Reef

This 102 km2 concession is host to 28 historical gold mines with reported production grades of up to 15 g/t Au. The property is along strike and immediately adjacent to the historical Nundle alluvial goldfield that produced more than 225,000 ounces of gold.

Past operations in the area include the Marquis of Lorne gold mine with a cited historical resource estimate of 336,000 tonnes at 4.75 g/t Au for 51,000 ounces of gold.

The property contains deposits that are analogous to the Californian Motherlode, Bralorne in British Columbia and large high-grade gold deposits in the shield area of Saudi Arabia.

Toolom South

This license is situated within the Toolom alluvial goldfield with reported past production of more than one million ounces. Data for over 60 historical gold mines — some with reported multi-ounce grades — were found.

The Phoenix deposit is situated approximately 5 km NW of the concession, classified as an intrusion-related gold-rich breccia pipe. Highlight intercepts from initial drilling include 48 m at 2.21 g/t Au.

Other Projects

The Golden Bar license, also within the New England orogenic terrane, is revealed to host significantly gold endowed targets as well. The 198 km2 concession comprises more than 50 historical gold mines and showings, most likely of a low-sulphidation type. Past production grades were regularly above 50 g/t Au.

The Stanleys project situated within a prolific gold camp of the Lachlan Fold Belt is another priority target. It is the site of at least 17 historical small-scale mines with cited production grades of up to 185 g/t Au.

Review of the remaining projects is still in progress. Nevertheless, has already an aggressive field program initially focused on the four highest priority targets outlined above.

Administrative Team

With these highly prospective projects on hand, the company must also ensure it has the administrative support down in Australia, which is why it has hired experienced geologist Mart Rampe to oversee regulatory filings, landholder access, and to provide additional geological services.

Rampe, who previously held senior positions in several ASX-listed explorers, has 45 years of experience in bringing grassroots projects through to pre-mine development. Most importantly, he has accumulated years of expertise in staking ground throughout Australia and especially in New South Wales.

Conclusion

Now that it has set up shop in one of the world’s top gold-producing regions, Sentinel looks ready to make each and every one of its mining concessions count, especially as many parts of the mineral-rich New South Wales state remain vastly underexplored.

A first look at its projects seems promising, as many have had a large number of historical work and showings to validate their quality and potential.

All gold exploration licenses have been approved since, with more approvals for silver exploration in the offing, so it would just be a matter of time before the company and its team of experts “hit the ground running.”

Bolstered by its recently closed $1 million private placement, the company is fully prepared to begin exploration soon.

Sentinel Resources Corp.

CSE:SNL, USOTC:SNLRF

Cdn$0.67 2020.10.29

Shares Outstanding 18,555,000m

Market cap Cdn$12.43m

SNL website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Sentinel Resources (CSE:SNL, US OTC PINK:SNLRF). SNL is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.