Sentinel pivots to Australia, picks up 8 concessions in New South Wales

2020.10.08

This year’s gold’s bull has resulted in hundreds of juniors flocking to new and historical mining camps, all of them seeking to profit from renewed investor interest in the sector and record-high gold prices that climbed above $2,000 an ounce in August.

Here at AOTH we have been following developments closely, and have taken positions in companies that are exploring in Nevada, Scandinavia, Mexico, Colombia, Peru, the Fenelon Gold Camp, Quebec, the famed Red Lake Gold District in Ontario, Newfoundland, and British Columbia’s Golden Triangle.

Lower on the radar of North American retail investors, are junior gold plays in Australia. Most of these companies are listed on the Australian Stock Exchange and the overall market is therefore truncated between juniors that live on the Toronto Venture Exchange, and exploration companies that trade on the ASX (or sometimes, the London Stock Exchange).

That’s a shame, because there is a whole ‘nother world of opportunity Down Under. As one of the world’s top gold-producing countries – second only to China in 2019, and expected to overtake China in 2021 – Australia has been attracting some of the industry’s premier mining companies for decades, with no signs of slowing down. The continent boasts the largest gold reserves on Earth, due to its favorable geology and easily extractable ore – resulting in low costs and high margins for the country’s gold mining industry. Most Australian gold is produced from open-pit mines, which generally cost less to run than underground operations.

Add in a supportive yet responsible regulatory climate, and you end up with one of the most important economic drivers of the island country.

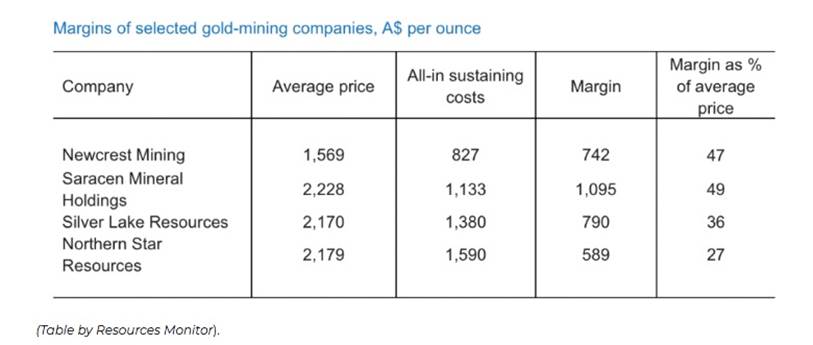

According to Resources Monitor, Australia’s role as a cost-effective producer gives it the advantage it needs to take a leading position, globally. Not only that, when especially high margins are paired with strong gold prices, north of $1,800 an ounce, it means that Australia’s explorers can economically develop new mines, and producers can expand their operations.

Significant expansions include Newcrest Mining’s Cadia Valley mine in New South Wales; Saracen Minerals’ Carosue Dam project in Western Australia; and Newmont Australia’s Tanami operation in the Northern Territory.

New mines that are expected to start operating are Bardoc Gold’s Bardoc project in Western Australia, which hosts a mineral resource of 3Moz @1.9g/t Au; Capricorn Metals’ Karlawinda project in Western Australia, 1.5Moz @ 0.93g/t Au; and Regis Resources’ Mcphillamys project in New South Wales, which hosts a total resource estimate of 2.3Moz @ 1.04 g/t Au.

One way to tap into Australia’s golden potential is to invest in a junior with properties in Aus.

Sentinel Resources (CSE:SNL, USOTC:SNLRF)

A great example is Sentinel Resources. Having recently IPO’d on the Canadian Stock Exchange at a dime a share, SNL has already conducted field work at its Pass property near Nelson – one of three British Columbia projects the North Vancouver-based company has in its portfolio – and announced a work program at its Waterloo property, near Vernon. Sentinel has also gone on an acquisition spree, that includes the coveted Salama gold project in Peru, and most recently, 8 concessions in the Australian state of New South Wales. Below we describe each of these projects, in the order they have been acquired.

Waterloo

British Columbia is home to one of the largest, most productive mineral trends on Earth. The Quesnel Terrane (more commonly known as the Quesnel Trough) is a Triassic‐Jurassic age arc of volcanic sedimentary rocks that hosts a number of large copper and gold porphyry deposits, several of which are currently in production.

Geoscience BC, in conjunction with the BC Geological Survey, mounted a major program in 2007 to build up a modern geoscience database over the Quesnel Trough in order to facilitate the discovery of hidden resources. Now, this data set is likely the most comprehensive of its kind in North America and possibly the world.

It’s now understood that the southern region of the Quesnel Trough is deserving of careful and comprehensive exploration, by directly applying the knowledge and techniques developed in the important producing areas to the south.

The Waterloo project hosts numerous high-grade silver and gold showings exposed over an area of 4.0 by 0.7 kilometers. Central to the property is the historic Waterloo mine that has seen sporadic production of high-grade silver since 1903.

Encompassing 3,130 hectares, Waterloo has never been systematically drill-tested, although several high-grade drill targets have been identified by previous operators – defining a 4.5-kilometer E-W strike.

The project is underlain by Mesozoic Quesnel Terrane rocks that also host nearby copper-gold porphyry deposits (New Afton, Ajax, Copper Mountain), copper-silver skarn (Phoenix), mesothermal gold (Greenwood camp), polymetallic lead-zinc-silver (Slocan camp) and epithermal gold (Knob Hill, Washington).The historic Waterloo mine has seen sporadic production of high-grade silver with gold since 1903, resulting in numerous shipments of ore to the Trail, BC smelter in 1954, 1967 and 1983. The mine is centered on a structurally controlled easterly striking zone (Waterloo structure) of high-grade silver, lead and zinc mineralization associated with quartz and carbonate vein material. This zone is apparently mineralized along its mined length (550 meters in the #4 adit) including numerous higher-grade sections.

Previous operators speculate that this structure extends below thick cover, with a total strike length of up to 2 km. Gold-dominant showings (for example the gold showing located 550m north of the mine) are hosted in north-trending sulfide and quartz veins, with associated iron carbonate wallrock alteration.

According to Sentinel, the Carbonate Replacement Deposit (CRD) model fits with known mineral occurrences (porphyry to skarn to base metal sulfide replacement to epithermal) and needs testing.

The road-accessible property has undergone small-scale production from high-grade gold and silver prospects since the early 1900’s. A shallow drill program was conducted by a previous operator, producing 12 short holes.

“The Waterloo project, which includes the historic Waterloo Mine, has clearly shown the potential to host high-grade silver and gold mineralization. Historic work on the project such as geological mapping and prospecting have produced compelling results of high-grade silver and gold – metals which have been mined in the region for over 100 years,” says Sentinel’s President & CEO, Rob Gamley.

Salama

Not content with limiting its portfolio to Canada, earlier this month Sentinel picked up the Salama gold project in western Peru. The project consists of four mining concessions totaling about 2,700 hectares.

Salama is located within the prolific gold-polymetallic Miocene skarn and porphyry belt — one of several metallogenic belts parallel to the coast, that host a number of large deposits in Peru. They include Lagunas, Nortem Rasario, De Belen, La Arena and La Virgen gold mines, which together host over 20 million ounces of gold within a 45-km radius of the Salama concessions.

According to Sentinel, there is potential for high- and low-sulfidation epithermal gold mineralization, and breccia pipe stockwork-style gold-silver deposits.

“The acquisition of four prospective gold concessions in this historical gold-silver producing region in Peru shows the ability of our exploration team to identify and acquire key gold assets notwithstanding current administrative challenges in Peru,” says Gamley. “With the skill and local knowledge of our in-country team, we are well placed to quickly build a robust portfolio of gold-focused assets in this region of Peru.”

Extensive areas of quartz veins with localized silicified breccias have been the focus of historic production by artisanal and small-scale miners. These miners targeted high-grade areas where oxidation of bedrock resulted in the formation of free gold amenable to gravity recovery.

Preliminary review of regional satellite imagery indicates that two major structures intersect in the northeast of the concession, in a similar geological setting to the La Virgin gold mine 20 km to the north. Historic production at La Virgin was 120,000 oz per annum.

According to the news release, the first property visit is planned for the week of Oct. 12.

Sentinel’s field team will initially comprise three in-country geologists, allowing for rapid first pass reconnaissance and rock-chip grab sampling. The team has robust project review and target generation experience, especially with respect to Peruvian low and high sulfidation epithermal deposits, such as Lagunas Norte, La Arena and Rosario De Belen. This will allow the mineralization at Salama to be placed within the wider context of an epithermal deposit, and for key controls on the mineralization and high-value targets to be established. Sentinel will submit samples to ALS Lima for preparation and analysis.

Australian concessions

Sentinel Resources announced Tuesday it has staked and acquired 8 gold exploration concessions totaling a sprawling 945 square km in New South Wales, Australia.

The 8 concessions are named Star of Hope, Golden Bar, Alliance Reef, Stanleys, Lady Mary, Waddery West, Wittagoona Reef and Toolom South.

According to the company, the gold projects host nearly 200 historic gold mines and exploration prospects, with historic production records indicating multi-ounce gold grades. The concessions are located with the prolifically mineralized Lachlan and New England orogenic terranes (pieces of crust) and will be 100% owned with no royalty obligations or back-in rights.

Sentinel has acquired these projects at remarkably low cost – just AUD$10,000 per concession, plus required exploration expenses amounting to $25,000 in the first year and $50,000 in the second.

The company has engaged an experienced exploration team to commence a reconnaissance work program on high-grade historic mines and showings in November. The focus is to identify drill-ready targets.

“I’m really impressed with the properties that [technical team member] Chris Wilson has assembled for us. They offer the possibility of drill-ready targets with a small amount of field work and sampling,” Gamley told me over the phone, Wednesday. He added,

“This is really something unique. For those that are looking for a high reward to outweigh the risk, given where our market cap is, at sub $15 million, I think it’s as good a shot as anything out there. I truly believe that what Fosterville was to the Victoria region, I believe Sentinel will be to New South Wales.”

New South Wales has a gold endowment exceeding 100 million ounces, and much of the state remains under-explored. According to the New South Wales Government, the state’s gold-rich systems include:

- Porphyry Cu–Au (Cadia, Northparkes, Copper Hill, Temora district) and granite-related gold (GRG) (Mt Adrah and Dargues Reef) deposits

- ‘Cobar-type’ (distal intrusion-related Cu–Au) deposits (Peak Gold Mines and CSA) which also may have associated skarn mineralization (e.g. Hera)

- Orogenic Au (McPhillamys, Hillgrove, Tomingley)

- High, intermediate and low sulfidation epithermal Au systems (Gidginbung, Mineral Hill, Drake)

- Gold-rich volcanic associated massive sulfide (VAMS) deposits such as Woodlawn and Lewis Ponds

- Significant gold in some Broken Hill-type (BHT) base metal systems within the Curnamona Craton.

Regarding the Lachlan and New England orogenic terranes, mentioned by Sentinel in its news release, the state government says The mainly Ordovician to Carboniferous Lachlan Orogen is generally poorly explored for gold. Recent discoveries (McPhillamys – maiden ore reserve announced September 2017, Tomingley and Hera) highlight the prospectivity of these provinces. Important prospective areas include:

- The Macquarie Arc — several belts of volcanic-dominated rocks of Ordovician to Early Silurian which host approximately 59 Moz of gold including the world class Cadia deposits

- Silurian to Early Devonian rift basins (Hill End Trough, Goulburn Basin, Cobar Basin)

- The Gilmore Fault Zone (a major crustal structure)

- The Early Devonian Braidwood Granodiorite.

The Devonian to Triassic New England Orogen is under- explored by Australian standards. The orogen is host to the Hillgrove orogenic Au–Sb deposit, the Drake epithermal system and the Timbarra and Uralla GRG goldfields.

Sentinel’s Australian acquisitions come at a particularly good time in the Aussie gold market. Not only is the country on track for overtaking China as the world’s top gold producer, there have also been a number of gold junior success stories that, despite happening on the other side of the world, have grabbed the attention of gold enthusiasts in the key investment markets of North America, Australia and Europe.

The most obvious is Kirkland Lake Gold (TSX:KL) and its super-high-grade Fosterville gold mine in south-central Australia. The project’s Swan Zone became a 2Moz deposit at almost one ounce per tonne. That’s about 30 g/t! Within four years the Canadian miner’s stock had become a 40-bagger, and the chart kept getting steeper as the market realized Kirkland Lake was becoming the lowest-cost gold, highest-grade gold mine in the world.

Recently Fosterville South Exploration (TSX-V:FSX) spun off two of its gold projects to create a new company, Leviathan Gold. Under the deal, Fosterville South retains ownership of its four core properties, including Lauriston which adjoins Kirkland Lake’s Fosterville tenements in the state of Victoria. In early September, FSX announced they intersected a number of long intervals of gold mineralization at their Golden Mountain Project.

There’s also Musgrave Minerals (ASX:MGV) which continues to confirm the high-grade nature of its Starlight gold discovery within its Cue project in Western Australia’s Murchison district; Bardoc Gold (ASX:BDC), Capricorn Metals (ASX:CMM) and Regis Resources (ASX:RRL), all of which rose sharply between April and August, on the back of surging gold prices.

Team

A junior resource company is only as good as the management and technical team behind it. Joining an already aggressive capital markets and development team are recognized industry veterans Dr. Peter Pollard (Chief Geologist), Danny Marcos (Exploration Manager) and Chris Wilson (Senior Advisor).

The new team is already bearing fruit with a robust, large-scale acquisition in a highly productive region of Peru; and a commanding land package in Australia, with numerous high-grade historic gold mines and showings.

The retail-focused company seeks to expand their shareholder base to a wide and engaged retail base so that small investors can be part of the company’s future.

Rob Gamley, Sentinel’s President & CEO, must have laid out a corporate plan impressive enough to sign a team of this caliber.

Peter Pollard is a regular speaker at major conferences and has presented short courses on ore deposit geology for more than 25 years. A 43-101- and JORC-compliant Qualified Person (QP), Dr. Pollard is a skilled communicator capable of breaking down and presenting complex technical material to analysts, shareholders and board members.

Danny Marcos was a key member of the WMC technical team that discovered the massive Tampakan deposit in the Philippines – 15 million tonnes of copper and 17.6 million ounces of gold. With over 30 years of field experience, he is a results-driven geologist with proven ability to effectively manage all aspects of international projects ranging from early stage (greenfields) to advanced/resource stage.

Chris Wilson was an Exploration Manager for Ivanhoe Mines Mongolia, responsible for an 11 million hectare portfolio. He is a 43-101- and JORC-compliant QP, bringing over 30 years of “international area selection and prospect generation, target generation, and the design and management of large resource definition drilling and pre-feasibility programs.”

Conclusion

Sentinel is shifting its focus from Waterloo in BC to the Australian concessions, which makes sense, given they can work there year-round; there are some 3,000 data points compiled from historical exploration of the eight projects, providing practically endless news flow; and the fact that they now have an in-country team – two members of the technical team live in Australia and have expertise in the continent’s complex geology.

As we have mentioned, but bears repeating, Sentinel Resources is retail investor-focused, which I like, and management appears to be good stewards of capital. Gamley told me they’ve really excelled at finding projects that have low cost of entry, and minimal carrying costs as they are developed.

“It gives us that flexibility where we don’t have to embark on these large programs, drain capital, to give us survivability whether the gold price fluctuates up or down,” he said. “In addition to that, we’ve helped the retail shareholder by not taking massive dilution at low levels in order to give them the best opportunity for capital appreciation.”

Sentinel Resources Corp.

CSE:SNL, USOTC:SNLRF

Cdn$0.65 2020.10.07

Shares Outstanding 18,555,000m

Market cap Cdn$12.06m

SNL website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Sentinel Resources (CSE:SNL, US OTC PINK:SNLRF). SNL is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.