Sentinel adds 7 silver concessions in Australia

2020.10.14

Last week we reported that Sentinel Resources has staked and acquired eight gold exploration concessions, encompassing 945 square km in the state of New South Wales, Australia.

This week the North Vancouver-based company adds to its portfolio with seven silver concessions, also located in New South Wales.

Sentinel Resources (CSE:SNL, OTC:SNLRF)

Having recently IPO’d on the Canadian Stock Exchange at a dime a share, SNL has already conducted field work at its Pass property near Nelson – one of three British Columbia projects the North Vancouver-based company has in its portfolio – and announced a work program at its Waterloo property, near Vernon. Sentinel has also gone on an acquisition spree, that includes the coveted Salama gold project in Peru, eight gold concessions and seven silver concessions in New South Wales.

Team

A junior resource company is only as good as the management and technical team behind it. Joining an already aggressive capital markets and development team are recognized industry veterans Dr. Peter Pollard (Chief Geologist), Danny Marcos (Exploration Manager) and Chris Wilson (Senior Advisor).

The new team is already bearing fruit with a robust, large-scale acquisition in a highly productive region of Peru; and a commanding land package in Australia, with numerous high-grade historic gold mines and showings.

The retail-focused company seeks to expand their shareholder base to a wide and engaged retail base so that small investors can be part of the company’s future.

Rob Gamley, Sentinel’s President & CEO, must have laid out a corporate plan impressive enough to sign a team of this caliber.

Peter Pollard is a regular speaker at major conferences and has presented short courses on ore deposit geology for more than 25 years. A 43-101- and JORC-compliant Qualified Person (QP), Dr. Pollard is a skilled communicator capable of breaking down and presenting complex technical material to analysts, shareholders and board members.

Danny Marcos was a key member of the WMC technical team that discovered the massive Tampakan deposit in the Philippines – 15 million tonnes of copper and 17.6 million ounces of gold. With over 30 years of field experience, he is a results-driven geologist with proven ability to effectively manage all aspects of international projects ranging from early stage (greenfields) to advanced/resource stage.

Chris Wilson was an Exploration Manager for Ivanhoe Mines Mongolia, responsible for an 11 million hectare portfolio. He is a 43-101- and JORC-compliant QP, bringing over 30 years of “international area selection and prospect generation, target generation, and the design and management of large resource definition drilling and pre-feasibility programs.”

Silver concessions

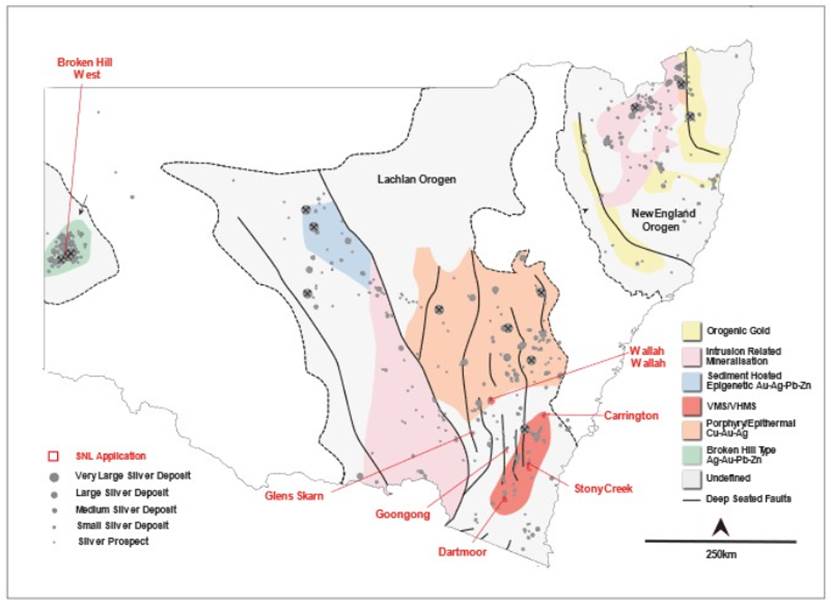

On Monday Sentinel Resources announced it has acquired, by staking, seven silver concessions – Wallah Wallah, Stony Creek, Carrington, Dartmoor, Glens Skarn, Broken Hill West and Goongong – totaling 386 square kilometers in New South Wales.

Among the silver projects are at least 23 historic silver mines and three past-producing gold mines. According to government documents, production records indicate that silver grades were generally high-grade and exceeded 1 kg/t Ag in some instances.

Six of the concessions are located with the well-mineralized Lachlan orogenic terrane (a fragment of the Earth’s crust), and one is in the renowned Broken Hill region of Curnamona Province.

According to Sentinel,

The Lachlan Orogen comprises a series of well-mineralized accretionary terranes formed during the Ordovician and Early Carboniferous Period. Despite being known as a major copper and gold producer — the exploration potential for silver is excellent.

- Wallah Wallah comprises 99 square km and covers six historic high-grade silver mines. An orogenic base-metal deposit, it consists of at least 10 mineralized lodes that crop out over a strike length of 2 km. Over 500m of historic underground workings are known over four levels. Historic production records state that more than 3,000t of material was mined at average grades of 950 g/t Ag and 30% Pb. More recent underground chip sampling has returned grades of 1,000 g/t Ag.

- Stony Creek includes four historic silver and three historic gold mines and prospects. The Stony Creek prospect comprises an 85m-wide alteration zone hosting a quartz-sulfide vein. Historic rock chip samples assayed up to 18.4 ppm Au and 212 ppm Ag. One historic drill hole returned an intercept of 5m @ 3.0 g/t Au. The historic Karawaree underground silver mine is located approximately 1.4 km northwest of Stony Creek and shares similar geology. Historic workings have been traced for over 2 km and returned historic rock chip grades of up to 44 g/t Au and 150 g/t Ag.

- At Carrington, the high-grade historic silver/gold mines and prospects are associated with the regional Yarralaw Fault. The historic Carrington mine comprises extensive historical shafts and open-cut drifts which exploited laterally extensive mineralized gossans that are up to 6m wide. Historic chip samples returned grades of up to 85 g/t Au, 6,037 g/t Ag, 24.8% Pb and 16.8% Sb.

- Dartmoor includes two historic polymetallic mines — Dartmoor and Dartmoor East — most likely of VHMS-Kuroko type. Mineralization presents as an extensive gossanous zone that can be traced along strike for over 1.5 km. Small-scale historical production records state average silver grades of 980 g/t Ag and 12% Cu.

- Glens Skarn includes four mineralized skarns which crop out over a strike length of 7.5 km. Historic surface rock chip sampling returned up to 80 g/t Ag, 5% Cu, 0.28% Pb, 1.26% Zn, 100 g/t Sn and 1,700 g/t W. These assays are highly significant given the oxidized and leached nature of skarn outcrops.

- Goongong hosts four historic silver mines and prospects. The most prospective is Goongong Skarn which comprises several gossanous outcrops over a strike length of 1.5 km. Limited historic drilling intercepted pods of distal volcanogenic and/or skarn mineralization. One interval assayed 14.7m at 0.14 g/t Cu, 0.1% Pb, 0.49% Zn and 63 g/t Ag.

- The Broken Hill deposits lie within the Willyama Blockor Broken Hill Domain of the Curnamona Province, which extends from far western New South Wales into eastern South Australia. Mineralization at Broken Hill occurs as a series of lodes which have been folded into an anticline with a mineralized strike length of at least 8 km. Broken Hill West is located 2.5 km west of the Broken Hill mine and shares the same geological setting and structure. Despite its proximity to the mine, the concession remains poorly explored due to extensive Quaternary surface cover.

All seven concessions will be 100% owned with no royalty obligations or back-in rights.

Sentinel has acquired these projects at remarkably low cost – just AUD$10,000 per concession, plus required exploration expenses amounting to $25,000 in the first year and $50,000 in the second.

The company’s technical team is currently reviewing historic data, to fast-track reconnaissance follow-up and to define drill-ready targets.

“The acquisition of seven strategically located silver projects, within the prolifically mineralized Lachlan orogenic terrane and the world famous Broken Hill Block, provides an excellent complement to the Company’s New South Wales gold projects,” states Rob Gamley, President & CEO.

He adds that the silver properties come with a significant historic database, and encompass a range of deposit including skarn mineralization associated with porphyry intrusions, volcanic massive sulfide (VMS) deposits, orogenic vein deposits, and Broken Hill-type.

“The company believes that targeting different styles of mineralization significantly reduces exploration risk,” Gamley states.

Conclusion

Sentinel is shifting its focus from the Waterloo project in BC, to its newly acquired silver and gold concessions in Australia.

This makes sense, given they can work there year-round; there are some 3,000 data points compiled from historical exploration of the eight gold projects, providing practically endless news flow; and the fact that they now have an in-country team – two members of the technical team live in Australia and have expertise in the continent’s complex geology.

The silver projects look incredibly prospective. Among them are at least 23 historic silver mines and three past-producing gold mines. Production records indicate that silver grades were generally high-grade and exceeded 1 kg/t Ag in some instances!

Sentinel Resources is retail investor-focused, which I like, and management appears to be good stewards of capital. Gamley told me they’ve really excelled at finding projects that have low cost of entry, and minimal carrying costs as they are developed.

Indeed. At just AUD$10,000 per concession, plus required exploration expenses amounting to $25,000 in the first year and $50,000 in the second, this is a great deal for Sentinel and its shareholders.

We are talking major upside at rock-bottom acquisition costs. Not only are stockholders exposed to blue-sky exploration potential, in Australia, the second-largest gold producer in the world, known for its favorable geology and easily extractable ore – resulting in low costs and high margins for the country’s gold mining industry – they are also getting exposure to silver prices at an ideal point in time.

Sentinel Resources Corp.

CSE:SNL, USOTC:SNLRF

Cdn$0.70 2020.10.14

Shares Outstanding 18,555,000m

Market cap Cdn$12.98m

SNL website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Sentinel Resources (CSE:SNL, US OTC PINK:SNLRF). SNL is a paid advertiser on his site aheadoftheherd.com

The white metal is poised to move higher on the back of continued strong investment and industrial demand, and silver juniors have historically offered the best leverage to rising prices.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.