Scandinavia sees new age of mining renaissance

2020.11.04

For mining companies and explorers, Scandinavia is considered one of the most desirable jurisdictions for its geological and legislative advantages.

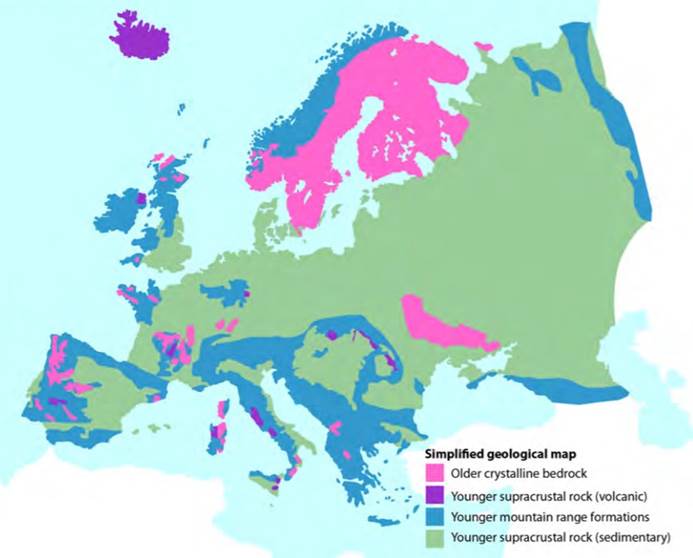

The Fennoscandian Shield, which forms a large part of the Nordic countries and is one of the most mineralized Paleoproterozoic areas in the world (see map below), has historically been one of the most active mining areas in Europe. Official mining activity in the region dates back as far as the 8th Century, when copper was first produced from the historic Falun mine in Bergslagen, Sweden.

Fennoscandian Shield. Credit: Geological Survey of Sweden

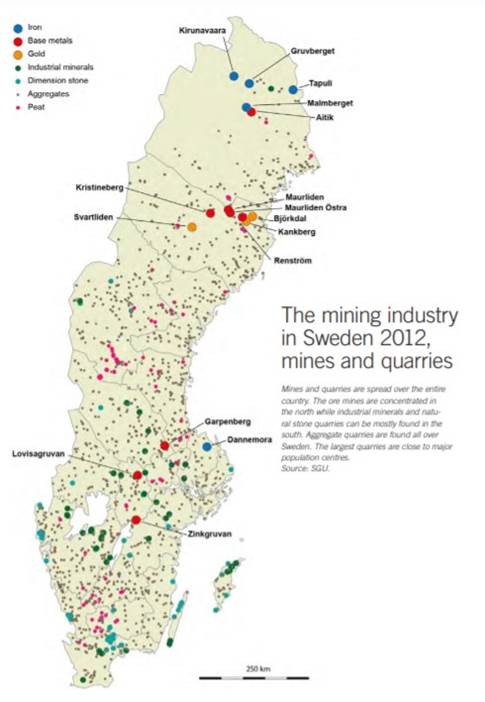

Scandinavia Mining Map. Credit: IntierraRMG

Today, Scandinavia is considered the most important metallic mining district in the European Union, containing a variety of deposit types such as volcanogenic massive sulphides (Cu, Zn, Pb, Au, Ag), orogenic gold (Au), layered intrusions (Ni, PGE, Ti+V), as well as new kinds like iron oxide-copper-gold (IOCG) and shale-hosted Ni-Zn-Cu deposits.

Sweden

In terms of ore and metal production, Sweden is currently Europe’s leading mining nation. The Scandinavian country accounts for 91% of the continent’s iron ore, as well as 9% of its copper and 24-39% of its lead, zinc, silver and gold.

Most of Sweden’s landmass is geologically part of the Baltic Shield, which has the oldest rock in Europe and a world-leading source of industrial metals such as iron, nickel, copper and platinum group elements. Due to its resemblance to the Canadian Shield and cratons in South Africa, the Baltic Shield is also a rich source of gold and diamonds.

The nation is now home to 16 metal-producing mines, the oldest of which has been around since the 13th Century, according to the Stockholm Environment Institute.

Mines in Sweden. Credit: Geological Survey of Sweden

Nearly 70 million tonnes of ore are produced from Sweden each year, but this figure may surge to 120 million tonnes beginning in 2020 with the number of mines potentially rising to 30 (Geological Survey of Sweden).

The prosperity of Sweden’s mining industry goes hand-in-hand with the nation’s political stability, which has provided a solid legal system.

All mining operations in the country are governed by Swedish Minerals Act, which sets out a well-defined regulatory framework for exploration permits and permits to mine concession minerals. Exploration rights are valid for three years and can be extended for up to 15. Once a concession is granted, it is valid for 25 years, with a possible 10-year extension.

The short permitting process represents a key advantage that Sweden holds over many other mining jurisdictions. Where getting a drill permit can take years or even decades in some places, in Sweden it would be a matter of months.

Owing to its heavy investments in transport infrastructure, Sweden boasts a rail network exceeding 15,000 km as well as more than 70 ports along its coastline. This coupled with its extremely low electricity cost presents another benefit for mining operations.

The nation is also known for innovation and green technologies. Three of the world’s leading mining equipment suppliers — Epiroc, Sandvik and ABB — are Swedish companies.

Norway

For years, Norway has been amongst the top producers of crude oil, but growing environmental pressures should see the economy looking to reinvigorate its minerals industry.

The first mining operation in Norway dates back 1,000 years to the Akersberg silver mine in Oslo. Copper and sulphides also became common products beginning in the early 1600s.

Nowadays, the Nordic nation produces titanium, iron ore and a number of industrial minerals including flake graphite. Most of its mines and quarries are located along the coast.

Similar to Sweden, Norway also has the benefit of low electricity cost and a low corporate tax in the mid-20% range. It also has a predictable and efficient administration, along with an excellent transportation system.

A new Norwegian Minerals Act was implemented in 2010, which effected an important change that required owners of mining concessions to conduct work to maintain the claims in good standing.

This meant that a large number of mining properties that were previously owned by corporations or individuals were subsequently made available to potential acquirers.

Last year, the country approved a plan to begin mining for copper in the Arctic.

Finland

Finland currently occupies the second spot on Fraser Institute’s latest ranking of attractive mining jurisdictions, trailing only behind Western Australia. This represents a significant jump from its 17th place ranking in the previous year.

What sets Finland apart from its peers is a combination of its geological database and ore potential, political stability, high educational level, and high-quality infrastructure.

As with other Scandinavian nations, Finland’s low corporate tax rate and energy cost offer an advantage for mining firms when compared to rivals such as Australia and the United States.

Holders of exploration permits have four years to conduct geological surveying and other work, with three-year extensions for up to 15 years. Finnish authorities are generally considered to be supportive of mining.

Mining in Finland dates back as early as 1540 with the production of iron ore. Since then, some 270 metals mines have been in operation. Now, Finland has an established cache of industrial metals including copper, nickel, cobalt, zinc and lead.

Sharing a border with Sweden and its eastern boundary with Russia, Finland has also quietly become one of Europe’s largest gold producers. Currently, it has four gold-producing mines, the largest being Agnico Eagle’s (TSX:AEM) Kittila operation.

Junior Miners in Scandinavia

Given its mining-friendly environment, it won’t come as a surprise that the more major discoveries are made from these Nordic countries. The following are up-and-coming miners that have already established land positions in Scandinavia, all with projects that have significant upsides.

Norden Crown Metals Corp. (TSXV:NOCR)

Formerly Boreal Metals, the company recently changed its name to reflect its new corporate strategy: the exploration of precious and base metals in Nordic countries. The miner currently holds two projects: one in Sweden and one in Norway.

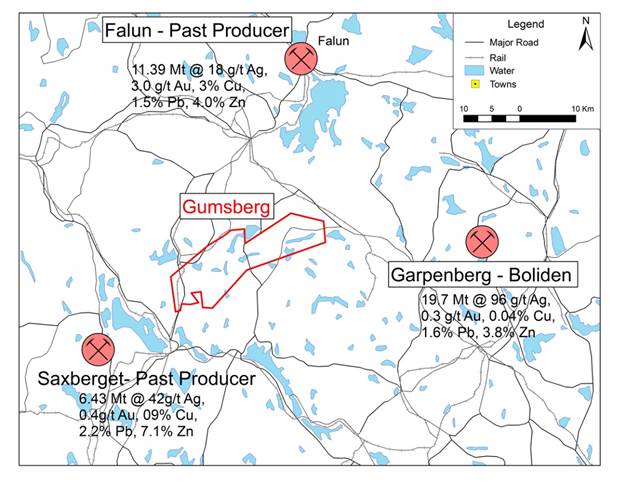

The first is Gumsberg, which consists of five exploration licenses totaling over 18,300 hectares in Sweden’s Bergslagen mining district, where multiple zones of VMS-style mineralization occur.

The mineralization at Gumsberg was mined from the 13th century through the early 1900s. Over 30 historical mines are present on the property, most notably the Östrasilverberg mine — the largest silver mine in Europe between 1300 and 1590.

The Gumsberg project is in the vicinity of Lundin’s Zincgruvan mine, which has been in continuous production since 1857.

Gumsberg project map

Norden’s main focus at Gumsberg is the Fredriksson target, a past-producing mine originally discovered in 1976. The company recentlybegan a soil survey at Fredriksson, which it says has the potential to become another Broken Hill-type discovery.

Norden is also exploring the Burfjord copper-gold project in Norway, consisting of a total of six licenses covering 5,500 hectares. The project is located 32 km west of the Kåfjord copper mines, the first major industrial enterprise north of the Arctic Circle.

Copper mining first took place in the Burfjord area during the 19th Century, with over 30 historic mines and prospects, but limited exploration has been documented in the modern era.

In the spring of 2019, Norden announced compelling drill results from the property including an intercept of 32 m averaging 0.56% Cu and 0.26 g/t Au (including 3.46 m of 4.31% Cu and 2.22 g/t Au) at shallow depths.

Earlier this year, Nordenjoined forces with Boliden to develop this project together, with the Swedish major agreeing to fund the entirety of the ongoing exploration program.

Norden Crown Metals

TSX-V:NOCR

Cdn$0.08 2020.11.03

Shares Outstanding 133,196,582m

Market cap Cdn$10.6m

NOCR website

Norra Metals (TSXV:NORA, FSE:1K0)

Norra Metals’ flagship Bleikvassli property is the last copper-zinc-silver-gold producing mine in Norway. Its geology and mineralization is reportedly similar to Lundin’s Zinkgruvan deposit in Sweden.

Bleikvassli location map

The Bleikvassli property is a past-producing sediment-hosted VMS lead-zinc deposit with minor gold, copper and silver credits.

The mine closed in 1997 following 40 years of continuous operation, which saw the extraction of 5 million tonnes grading 4.0% Zn, 2% Pb, 0.15% Cu, and 25g/t Ag. Resources remaining at time of mine closure, according to the Norwegian Geological Survey, were 720,000 tonnes grading 5.17% Zn, 2.72% Pb, 0.27% Cu, 45g/t Ag, 0.2g/t Au.

Meråker, the company’s other project in Norway, is less advanced than Bleikvassli but contains extensive areas of gold-rich VMS-style mineralization.

Meråker location map

There is a long history of mining on the Meråker property, with production of copper ore from VMS deposits dating back to the 1700s and continuing until the early 1900s. Also, it is located 100 km north of the prolific Roros mining district, where more than 30 million tonnes of copper-rich VMS material have been mined.

To unlock the mineral wealth in these two highly prospective projects, Norra Metals is in the process of preparing an inaugural exploration program, which will be funded by its recently closed $1.37 million private placement.

Norra Metals

TSX-V:NORA, FSE:1K0

Cdn$0.115 2020.11.03

Shares Outstanding 53,750,173m

Market cap Cdn$6.18m

NORA website

Palladium One (TSXV: PDM, OTC:NKORF, FRA:7N11)

Palladium One is currently focused on its Läntinen Koillissmaa (LK) project in north-central Finland, covering four mineralized target zones: Kaukua, Lipeavaara, Murtolampi and Haukiaho. The first phase of drilling at LK was completed in September.

LK Project in Finland

Geologists believe the deposit is an accumulation of copper, nickel and PGE that forms part of an intrusive belt that runs east-west across Finland and into Russia. The project draws comparison with the Platreef-type deposits of the Bushveld Igneous Complex in South Africa, which is the largest layered igneous intrusion within the Earth’s crust and where most of the world’s platinum is produced.

Drilling at Kaukua South, a strike extension of the Kaukua zone, yielded 11 successful discovery holes and increased the mineralized strike length from 600 m to 4 km, which validated the potential to significantly increase existing Kaukua mineral resource base.

Further results returned wide zones of magmatic sulfide mineralization at Murtolampi, located less than 2 km north of the Kaukua deposit. This also suggested to the company that mineralization extends over greater than a 600 m strike length, and the Murtolampi zone could rapidly add near-surface tonnage to existing resources.

Palladium One recently announced the best combination of grade and width of all the results from the LK Project to date (see figure below).

Kaukua South cross section

Hole LK20-016, starting at only 23.5 m downhole, returned 62.7 m at 3.52 g/t of palladium equivalent (PdEq), including 18.5 m at 4.58 g/t PdEq. Hole LK20-019 started in mineralization and hit 35.0 m at 2.76 g/t PdEq, also starting near surface after 17.3 m of overburden.

These holes are located 1.35 km east of a core zone at Kaukua South that yielded 33.0 m at 1.90 g/t PdEq earlier. Planning for Phase 2 drilling at Kaukua South is currently underway.

Conclusion

Among the most important criteria in deciding which junior mining companies to invest in, is the place where the exploration is being conducted.

Many a development project that by all indications looks to be outstanding, has been halted by a government either intent on expropriating the minerals for itself, or yields to public pressure to halt mining in an environmentally sensitive area – or other reasons that might fuel opposition.

Venezuela and Mongolia are among countries that have nationalized foreign-owned mines and are at risk of “resource nationalism”. Tax increases, royalty grabs and tighter regulations are other ways for governments to limit operations or skim the profits of mining companies.

Wise investors steer clear of such jurisdictions.

On the flip side are countries that have a reputation for being mining-friendly while at the same time upholding environmental and social legal frameworks. For mining companies and explorers, Scandinavia is considered one of the most desirable jurisdictions.

Palladium One

TSX.V:PDM, OTC:NKORF, Frankfurt:7N11

Cdn$0.195, 2020.11.03

Shares Outstanding 142,642,816m

Market cap Cdn$27.81m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Norden Crown Metals Corp. (TSXV:NOCR) NOCR is a paid advertiser on his site aheadoftheherd.com

Richard does not own shares of Norra Metals (TSX-V:NORA, FSE:1K0). NORA is a paid advertiser on his site aheadoftheherd.com

Richard owns shares of PDM (TSX.V:PDM, OTC:NKORF, Frankfurt:7N11) PDM is a paid advertiser on Richards site Ahead of the Herd

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.