RooGold racking up high-grade rock chip sample assays in NSW

2022.08.31

RooGold (CSE:ROO) (OTC PINK:JNCCF) (Frankfurt:5VHA) has been making remarkable progress on its New South Wales, Australia properties, delivering sample after sample of high-grade gold. This report concerns the results of prospect sampling from the Gold Star, Lorne and Arthurs Seat projects.

Before getting into the nitty gritty, some background on what ROO is focusing on in New South Wales.

New South Wales properties

Consistently ranked as one of the world’s top three gold producers, Australia has, by a wide margin, the largest reserves, with nearly 10,000 tonnes of gold or 20% of the global total.

New South Wales is the country’s second-largest gold producer behind Western Australia. The state’s gold endowment is said to exceed 100 million ounces, plus about 1 billion ounces of silver.

Compared to other states, NSW is prolifically mineralized with multiple metallogenic belts that are largely unexplored outside of the main camps. Past exploration mostly centered on the Cadia-McPillamys camp, North Parks trend, the Conwall-Giginburg trend and Broken Hill.

The New England Orogen is considered to be a significant mineral province that forms the basement throughout the northeast of NSW. The presence of alluvial gold fields and showings, the large number of historical underground mines, and the variety of terranes (pieces of crust) all indicate that the area is highly prospective for gold and silver.

The Lachlan Orogen, which spans New South Wales, Victoria and eastern Tasmania, comprises a series of prolifically mineralized terranes hosting a variety of deposit types. In NSW, these include porphyry and related skarn Cu-Au, epigenetic and hydrothermal Au and Pb-Zn-Cu, and orogenic Au.

The Peel-Manning Fault System is a crustal scale structure that is strongly gold-mineralized along its 350-km strike length. The system hosts ocean floor mafic and ultramafic rocks present as listwanite (quartz-carbonate) altered serpentinites.

Listwanite-associated gold deposits are considered to be highly attractive exploration targets. Multi-million-ounce deposits such as the Californian Motherlode, Bralorne in British Columbia, and numerous large high-grade gold systems throughout the shield area of Saudi Arabia, are hosted in listwanites.

Major gold deposits include Hillgrove in New South Wales, and Mount Morgan (>7Moz) and Gympie (>3Moz) in neighboring Queensland. Significant gold resources have been recently discovered at Gympie, Cracow, Tooloom and Mount Rawdon.

By Australian mining standards, a large part of NSW remains relatively unexplored. Highly prospective ground, most with high-grade historical showings, remains available for further exploration.

RooGold commands a portfolio of 14 gold and silver concessions that span 2,696 square kilometers. The district-scale property is home to 139 historical mines and prospects. Yet despite its massive size, only 28 historical holes have been drilled across the entire land position.

In assembling its portfolio, potential projects had to meet four criteria:

- Properties with limited historic exploration

- Deposit types controlled by known regional geological structures

- Targets had historical mining activity

- High-grade mineralization

Nine gold properties cover 106 historical gold mines and prospects, all located within the highly mineralized but underexplored New England Orogenic Terrane and prolifically mineralized Lachlan Orogenic Belt.

In addition, ROO has four silver properties and 31 historical gold-silver mines and prospects, within the New England Orogenic Terrane.

The chances of RooGold appreciating in value due to neighboring discoveries, is enhanced by the presence of US major gold miner Newmont, which is exploring 35 km away.

The company’s three targets on the Peel-Manning Fault System are Trilby, Lorne and Gold Belt, see on the right side of the map above. Newmont has also recognized the importance of this structure and has staked a 1,200 km² land package covering a 125-km strike length of a parallel structure 30 km east of the Peel Manning Fault Zone.

Other major mining operations in the area include Newcrest’s Cadia, Australia’s second largest open-pit gold mine; and Evolution Mining’s large Cowal open pit, with an estimated 3.7Moz of gold reserves.

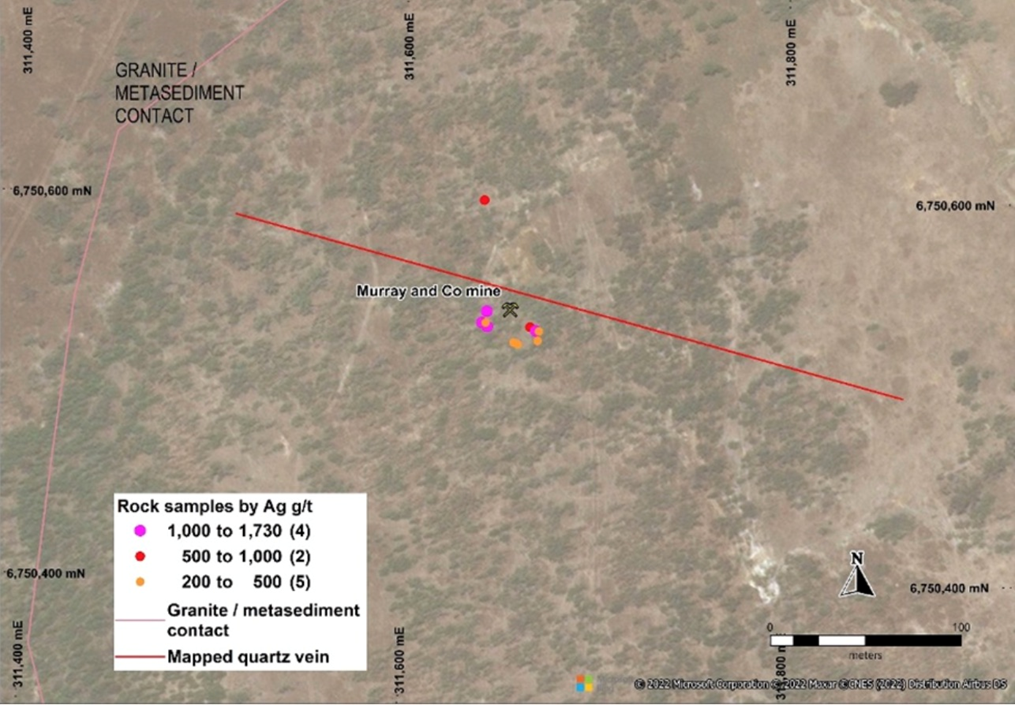

Tucked into the northwestern part of the New England Orogen, the 42-square-km Arthurs Seat project is characterized by intrusion-related mineralization with multiphase quartz-tourmaline stockworks and polymetallic Au/Ag rich veins.

The project hosts three historical silver-tungsten- antimony mines and prospects, including the Murrays and Co Mine, which returned chip samples grading over 1,200 grams per tonne Ag. Murrays and Co was mined in the late 1890’s, including development of underground adits and shafts driven into silver- and tin-rich quartz and tourmaline veins.

The property, also known as Exploration License (EL) 9144, is centered on the regional Severn Thrust Fault and mineralized granitic/sandstone contact. The fault potentially represents a 7-kilometer-long underexplored target.

In June, RooGold announced the completion of a preliminary rock chip sampling program at Arthurs Seat.

A total of 274 rock chip samples were collected at historical prospects and along structural and geological contacts, from which 159 samples were sent to the lab for analysis. The samples featured significant hydrothermal alteration with multiple quartz veins visible.

The field work sampled mullock dumps and shafts at the Murray and Co Mine and McDonalds prospect, as well as along the north-south fault and the greisen-altered granite contact at the Arthurs Seat prospect.

Twenty-seven samples were collected from Murray and Co’s mullock heaps and historical shafts. Highly anomalous gold and silver assays were returned over a 40m strike length at the mine, as shown in Figure 1, which is located within a zone of quartz-veined metasediment approximately 350m in east-west strike length.

Forty-seven samples from the McDonalds prospect returned anomalous gold and silver assays over a 600 x 350m area. Visual observations of some samples included massive stibnite, and returned antimony (Sb) values up to 12.75% Sb.

According to RooGold, the rock chip sample assays confirmed historical assays at the Murray and Co Mine and McDonalds prospect.

“These results are highly encouraging and show the potential for a polymetallic precious and base metal deposit along strike from the high-grade silver values at the Murray and Co Mine located 2.75 km to its west,” the company states.

The highest gold value of 6.27 g/t Au and 1,385 g/t Ag (silver) was returned from a brecciated and silicified metasediment in the westerly most shaft, containing multiple quartz veins. Table 1 shows significant assay results from rock chip sampling at the Murray and Co Mine. According to RooGold, very little historical work has been done at the mine; the gold assays are the first to be reported from there.

Within the mullock heaps and shafts at Murray and Co, nine samples were over 400 grams per tonne silver, including four samples greater than 1,000 g/t Ag; and five samples >1 g/t Au, of which one sample was >5 g/t Au.

The nine samples were over 1,000 parts per million (ppm) copper including one sample at 1.1% Cu.

“Our first pass rock chip sampling program at Arthurs Seat has returned high-grade gold-silver assays. These results confirm the historic assays of known prospects and are highly encouraging for follow up work,” said RooGold’s CEO Carlos Espinosa, in the Aug. 10 news release.

Lorne

The Lorne property encompasses 28 historical gold mines and prospects, including the Golden Star Mine. It also covers up to 500m of underground workings at the Marquis of Lorne Mine, which reported grades of up to 15 g/t Au. The project area spans a 12-kilometer-long strike within the significantly mineralized Peel-Manning Fault System.

On Aug. 23 RooGold reported the receipt of high-grade gold assays from first-pass prospect sampling at Lorne, formally known as EL 9232.

Rock chip sampling at the Brands Reef prospect and the Norton Mine confirmed the existence of high-grade gold mineralization on the property, returning assays up to 22.1 grams per tonne Au.

A total of 22 rock samples were collected from these two areas, which contain filled-in mine workings. Table 1 below details significant assay results, with the highest-grade 22.1 g/t sample coming from “a vuggy, gossanous, hydrothermal quartz vein with minor pyrite / arsenopyrite” at Brands Reef. According to RooGold, the results show the high-grade nature of these prospects, and are the first rock samples to be reported there in modern times.

“The first pass prospect sampling at our Lorne Project has returned several high-grade gold results from historical workings that confirms the potential for significant mineralization. We have identified numerous other highly prospective gold targets within this tenement covering a further 10 km strike distance that our field team is looking to sample as soon as access is available,” CEO Carlos Espinosa said in the Aug. 23 news release.

Gold Star

The latest project to be sampled is Gold Star, comprised of six historical silver/gold mines and prospects. The property is located just 2 km south of Walcha, the highest-producing gold field in the Southern New England region of New South Wales.

Mineralization is of a low-sulfide, orogenic quartz-type associated with regional structures, analogous to West African and Abitibi-type styles.

The first payable gold was discovered at the Golden Star prospect in 1870, followed by additional reefs found in 1872 and 1873. Spectacular grades of between 445 and 840 g/t were reported at the time, however the gold rush was short-lived; the workings were filled in and Golden Star has received little exploration since.

Limited drilling by Balmoral Resources in 1987 and Tellus Resources in 2014 focused on the area surrounding the mine workings, returning 1.0m of 6.45 g/t and 12.0m of 0.67 g/t, respectively.

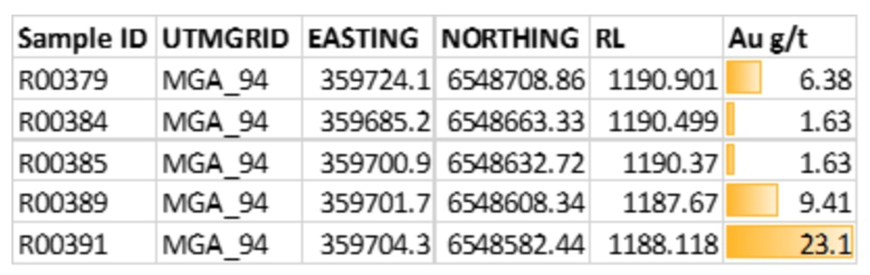

On Aug. 30 RooGold reported that rock chip sampling at the Golden Star and Golden Bar historical gold mines returned assays up to 23.1 g/t, confirming high-grade gold mineralization on the property.

The 65 total rock samples collected in and around these two prospects consist of two northwest-striking quartz vein systems located about 200 meters apart. According to the company,

The highest assay came from float near the historical mine workings returning significantly high grade of 23.1 g/t Au (R00391) from a smokey quartz vein containing mudstone margins and fragments. Two other high-grade samples were returned from smokey quartz veins containing sulfide stringers of pyrite and arsenopyrite in the workings, including assays grading 9.41 g/t Au (R00389) and 6.38 g/t Au (R00379). Additional lower grade, but still significant, assays were reported from the workings, grading 1.63 g/t Au each (R00384 and R00385), see Table 1.

The localization of high grade gold in quartz veins confirms the structurally-controlled nature of mineralization and supports an orogenic model.

“The prospect sampling at our Gold Star Project has returned very high-grade gold assays from the historical workings at Golden Bar and Golden Star prospects. These results confirm the potential for significant gold mineralization. We have identified numerous other highly prospective gold targets within this tenement and our field team is looking to sample as soon as surface access is available,” CEO Carlos Espinosa said in the Aug. 30 news release.

According to RooGold, numerous additional high-grade, past-producing prospects have been identified along a 10-kilometer strike to the south, that will be sampled once access is granted. They include the Comet and Bull targets, where reports from historical mine workings record an average grade of 36.6 g/t.

Conclusion

Collecting rock chip samples then assaying them for high-grade gold is a good way to attract investors, and hopefully boost the stock price, but how does it fit into RooGold’s strategy?

When I talked to RooGold technical advisor Chris Wilson, he told me that discovery-focused exploration is basically a numbers game. Thirty-five years of reviewing projects and working around Ivanhoe Mines’ founder Robert Friedland, has taught Wilson that to make a discovery, you need to have enough projects.

“One of the things I’ve learnt over the years is exploration is a game of statistics. So even if you’ve got the best portfolio in the world, they’re not all going to make it. So what we’ve tried to do, by going at the high-grade historical structures & workings, is move ourselves up the chain on acquisitions,” Wilson said in our March, 2022 Under the Spotlight interview. He added,

“These projects are a little more advanced than your normal early-stage. I’ve said we’re not going to settle on one concession with 15 occurrences, we went for as much as we could possibly get, because then statistically you have a real chance at discovery.”

He said New South Wales has the same feel as when Ivanhoe went into Mongolia and found the third-largest copper-gold porphyry deposit in the world, at Oyu Tolgoi. “It’s not to say that there is going to be that discovery, but we’ve got sufficient size and diversity on these big structures to have a real shot at discovery. And that was important.”

So far the “more is better” strategy seems to be working out well. The company has identified three very good prospects in Gold Star, Lorne and Arthurs Seat, all of which have delivered high-grade rock chip sample assays. And they’ve only just scratched the surface.

At Arthurs Seat, very little historical work has been done at the Murrays and Co Mine; the gold assays are the first to be reported from there.

At Lorne, the field team has identified numerous other highly prospective gold targets covering a further 10-km strike distance. And at Gold Star, there are several highly prospective gold targets that the field team is looking to sample as soon as surface access is available.

RooGold commands a portfolio of 14 gold and silver concessions that span 2,696 square kilometers. The district-scale property is home to 139 historical mines and prospects. Yet despite its massive size, only 28 historical holes have been drilled across the entire land position.

That kind of upside doesn’t come along often in a gold junior. I like how RooGold is approaching its field program, by going out and sampling historical mines and prospects, with an eye to working up high-priority exploration targets. And with gold and silver prices poised for the next up-leg amid uncertain economic times, a major discovery in New South Wales is exactly the kind of fresh news the junior gold sector needs to bring back excitement and investors.

RooGold Inc.

(CSE:ROO) (OTC PINK:JNCCF) (Frankfurt:5VHA)

Cdn$0.05, 2022.08.30

Shares Outstanding 69.7m

Market cap Cdn$3.6m

RooGold Inc

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of RooGold Inc. (CSE:ROO). ROO is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.