Rising inflation pressure builds strong case for gold’s next rally

2021.10.30

Gold prices recently saw a rebound above the key $1,800/oz level — the highest in over a month — as the momentum of fear continues to build on inflation, one that is more concerning than central bankers had tried to portray.

Having recently given our view on the phenomenon of higher prices seen around the globe, AOTH, too, is of the view that the inflation we’re experiencing is more than “transitory”, as the US Federal Reserve called it on several occasions.

With that in mind, we believe in holding gold (and silver) as insurance for inflation getting out of hand, given bullion’s traditional role as safe haven and its historical performance during times of high national debt.

Inflation Pressures

With the way gold has performed this year, one may not think this market could still be in bullish territory.

But delving deeper into what has transpired around the global economy, you can see why we remain confident in the precious metal.

In the past few weeks, we’ve seen how commodity prices, from aluminum to natural gas, have soared to their highest in decades (and in some cases, record highs), as supply chains continue to be rocked by the aftershocks of the Covid pandemic.

And while gold has remained largely stagnant over that period, there are enough warning signs of mounting inflation pressures around the globe, which would result in more and more investors cueing up for gold buying as protection.

As of now, that realization has not fully set in, but once it does, the safe-haven appeal of gold could send prices much higher, perhaps even beyond its record high set in August 2020.

Bullish Outlook

In a recent Bloomberg interview, David Garofalo and Rob McEwen — two of the biggest names in the Canadian mining industry — predicted investors will soon catch on that global inflationary pressures are far more intense than suggested, which could send gold prices to $3,000/oz from the current $1,800/oz level.

While it’s not particularly surprising that Garofalo and McEwen, both known for serving executive roles in major gold companies, are giving a bullish outlook, predicting such a gigantic leap within a short time requires a great deal of confidence.

“If other metals are any indication, the gold rally, when it comes, will be dramatic,” Garofalo said in the interview alongside McEwen.

“I’m talking about months,” he said. “The reaction tends to be immediate and violent when it does happen. That’s why I’m quite confident that gold will achieve $3,000/oz in months, not years.”

However, Garofalo’s price target would represent a “down payment” in comparison to the long-term outlook of $5,000/oz given by McEwen.

Central Bank Reaction

The way in which the US Federal responded to the growing inflation expectations had analysts even more convinced that gold will receive extensive support from investors.

While the US central bank is preparing to reduce its asset purchases, any talks of raising the short-term interest rate to tackle inflation may be “premature”, as suggested by Fed chair Jerome Powell last week.

He maintained that the global shortages and higher prices are mostly a result of the pandemic’s impact on supply lines, which will get resolved over time.

The comments from Powell, plus those recently made by other Fed officials, did next to nothing to assuage the ongoing inflation concerns. If anything, to many observers, this showed that the Fed is slow to react to inflation.

Investors, though, are trying not to fall behind, having steadily increased their gold and silver purchases over the past month.

According to Alexander Kuptsekevich, analyst at online brokerage FxPro Financial Services, investors have been looking at inflation differently from the central bank since late September.

“They see inflation as less transitory than before: never-ending supply chain problems, high energy prices and accelerating wage growth amplify pro-inflationary factors,” Kuptsekevich said.

In a recent CNBC interview, billionaire hedge fund manager Paul Tudor Jones said he believes “it’s time to double down on inflation hedges, including commodities.”

“What they’re telling you by their actions, is that they’re going to be slow and late to fight inflation,” said the Tudor Investment Corp. founder.

Bob Haberkorn, senior market strategist at RJO Futures, shared similar views in a Reuters article:

“There is a global concern on what is going on with supply crunches and the lack of action from the Federal Reserve. It seems like the Fed is behind the ball on inflation.”

“With supply chain and inflation issues, how will stocks continue to make new highs?” Haberkorn said, adding that “there is a flight to safety into gold that will go on for the next couple of months.”

Remember, long-term interest rates have been trending up for the better part of a month, which normally would draw investors away from the non-yielding bullion. But that has not been the case, as gold has fared quite well given the circumstances.

Daniel Pavilonis, senior commodities broker with RJO Futures, told Kitco News last Friday that the rise in yields could indicate that inflation expectations are becoming unanchored and with economic activity starting to slow, the Federal Reserve will have limited tools.

“I don’t think the Federal Reserve has the ability to bring inflation back under control,” he said. “We are seeing the risk of stagflation continue to grow and that will be good for gold and all commodities. Gold will do well as investors will see it as a value play.”

Peter Boockvar of Bleakley Advisory Group predicts that “gold has the potential to double once the Federal Reserve begins to tighten and hike rates to fight off hotter-than-expected inflation.”

“You have the most intense inflationary pressure since the 1970s. And the Fed is going to do seven months of tapering, and rates are still going to be at zero,” Boockvar told Michelle Makori, editor-in-chief of Kitco News, in an Oct. 21 interview.

“If you inflation-adjust gold for its 1980 high, it can go to $2,500, it can overshoot $3,000 plus,” he predicted.

Next Resistance Level

In the near term, analysts believe there is potential for gold to test the $1,830/oz level. These include IG Group’s Kyle Rodda and Equiti Capital market analyst David Madden.

“There is some short-term momentum building in gold as some investors look for an inflation hedge and see gold as a potential provider of that,” Rodda recently wrote to Reuters, suggesting $1,830 as a key resistance level should gold break above $1,800 (which it has done since).

In the long term, though, gold’s trajectory hinged mainly on how aggressive central banks would act to contain inflation, Rodda added.

Technical analysis by FX Empire’s David Becker showed that gold prices have indeed broken out above trend line resistance and are poised to test higher prices. Analysis using MACD (moving average convergence divergence) pointed to gold moving into positive territory with an upward sloping trajectory.

DBS Bank strategist Benjamin Wong also noted that XAU/USD’s technical chart demonstrated the possibility of a near-term bullish inverse head-and-shoulders pattern, but that requires a break over $1,830 for validation.

“Gold is quietly making a bullish inverse head-and-shoulders since June – thus the nascent gold bull is quietly knocking at the door. The neckline stands around $1,830, for that pattern to take off,” Wong said.

Gold Alternatives

While building a bullish case for bullion, some analysts are also keeping an eye for assets generally viewed as gold alternatives: the dollar and cryptocurrency.

The US Dollar Index (DXY), which has managed to hold support at 93.50 and saw a slight rebound over the past week, remains a headwind for gold investors.

Equiti Capital’s David Madden sees this week’s European Central Bank (ECB) meeting as a significant risk event for the gold market.

Specifically, Madden points out that if ECB President Christine Lagarde also downplays the inflation outlook, that could weaken the euro against the US dollar, which would in turn be negative for precious metals.

However, those around the gold industry believe the pro-inflationary narrative is strong enough for safe-haven assets to hold value.

“The global monetary and debt expansion to cope with the pandemic, as well as secondary drivers associated with supply disruptions, will have people turning back to traditional methods of protecting wealth,” McEwen said during the Bloomberg interview.

The former Goldcorp founder went on to say that: “It’s not just the dollar. All currencies are buying less than what they were buying a year ago.”

“So, I look at that as an unprecedented development at least in our lives that is going to affect the value of fiat currencies around the world.”

Gold & Crypto

Speaking of currencies, gold is facing increased competition from a much more recent form of money: cryptocurrency.

Bitcoin, the world’s leading digital currency, is just coming off another all-time high of about $67,000, showing that investor interest remains strong in this sector. As we speak, the global crypto market cap stands at $2.46 trillion, an increase of nearly 220% over what it was at the beginning of the year.

The latest rally in the crypto market coincided with the recent launch of a new Bitcoin exchange-traded product (ETF), which, according to analysts, added a new layer of legitimacy to the digital coin market.

However, some don’t see this as a game-changer for gold.

“Yes, bitcoin has taken some momentum and capital away from the gold market, but gold is far from being obsolete,” Ole Hansen, head of commodity strategy at Saxo Bank, told Kitco News. “Will every gold investor sell their gold to buy Bitcoin? No.”

“Its universality and 4,000 year-old history mean gold is better positioned than cryptocurrencies as a hedge against an inflationary environment that will have deep and meaningful impacts on our capital,” said David Garofalo, now CEO at Gold Royalty Corp.

A recent article by Forbes senior contributor Clem Chambers, who is also the CEO of investment website ADVFN, highlighted that Bitcoin et al. might be an alternative to gold in some arenas, but as a hedge against inflation, people have long been programmed to buy gold.

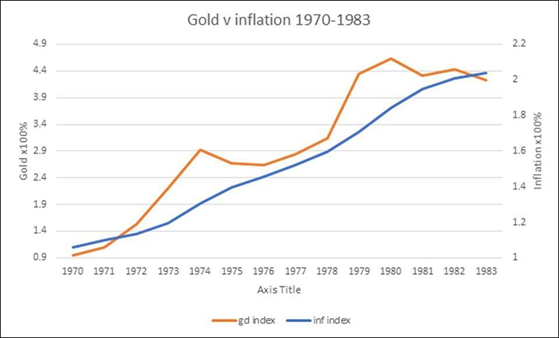

In his article, titled “The Gold Inflation Paradox”, Chambers compared the current period to the 70s, when inflation took off and exploded. During that time, right up to 1983, gold pretty much outperformed inflation by a factor of 2 (see graph below).

But what really stuck out to readers was the years during which gold actually fell when inflation was rising (i.e. 1974-75), which, according to Chambers, “clearly demonstrates that gold can be relied upon in the long term to protect against inflation but not week to week.”

“You might say gold doesn’t track inflation, but instead, like other commodities, lies dormant then explodes,” Chambers deduced.

“This is what I think we are seeing. There is a lot of sizzle out there in markets. It might be natural gas one week, nickel the next, Bitcoin, then the S&P 500 going wild. This is what the participants chase. Assets take their turn for a vertical move, and this is where we are with gold.”

In a sense, gold’s luster — or lack thereof — simply has to do with where the spotlight is. Perhaps all it takes is one single catalyst to make a giant leap.

What About Silver

As gold’s sister metal, silver would also benefit from an investor run-on to hedge against inflation.

Unlike gold, however, silver is more than just a safe haven; the metal is used as an essential component in applications such as solar panels, electronics, automotive and 5G technology.

As such, most of silver’s value is derived from its industrial demand and supply fundamentals, which are all supportive of higher prices.

On the demand side, the solar industry alone is projected to ramp up its annual silver consumption by 85% to 185 million ounces within a decade, according to a report by BMO Capital Markets.

The latest market study by The Silver Institute also gave favorable projections for varying industrial sectors over that period.

Silver demand for “printed and flexible electronics” is forecast to increase 54% within that period, rising from 48 million ounces in 2021 to 74 million ounces by 2030, it predicted. The automotive market should also see a strong rebound in 2021, consuming over 60 million ounces.

Another big driver will be the 5G sector, which is expected to more than double its current demand of 7.5 million ounces to 16 million ounces by 2025, then rising to as much as 23 million ounces by 2030.

A separate report by Sprott Asset Management titled ‘Silver’s Clean Energy Future’ found that three areas of growing demand for silver — solar, automotive and 5G — potentially account for more than 125 million ounces in 10 years.

The other side of the equation paints an even more bullish picture for silver, as supply of the metal is once again on pace to be outstripped by demand this year, according to the 2021 World Silver Survey.

In fact, the global supply crunch may well become a seven-year event starting from now, according to Midas Consulting’s Korbinian Koller, who believes that the spring is already loaded for another silver rally.

According to Koller, accelerators for the next monthly time frame leg up include: Increase in demand for physical silver purchases during the previous 18 months; $11 trillion pumped into the economy over the last 18 months (inflation); electricity prices rising, which equals higher demand for solar panels; and supply logistic constraints all over the world.

His analysis shows should silver prices close above $24/oz this month, if so we could very well see another bullish run.

As we’ve mentioned previously, due to an increasing demand from green energy applications, silver prices are more likely to track closer to copper than gold.

Copper, also a foundational piece in our civil infrastructure, has received a lot of market attention lately following a historic inventory squeeze on the London Metal Exchange (LME). Just recently, the base metal shot up to another all-time high as surging demand drained LME warehouses to its lowest inventory level in 47 years.

Given the close correlation between copper and silver prices over the March-August period, it’s entirely possible for the latter to follow suit.

In an interview with Kitco, TJM Institutional Services managing director Jim Iuorio said that silver has been “dead money” for the past six, seven months, and the market has been treating it as a precious metal and trading it like so.

However, Iuorio believes that its fortune is about to change with the precious metal’s fundamentals, pointing to a breakout towards $35.

“I’ve been long silver for quite a while, and it’s been a painful trade. Copper broke out of a pretty significant technical pattern last week, and I believe silver is following it today,” Iuorio said.

Bleakley’s Peter Boockvar was even more bullish on silver, predicting that it can get back to its highs of $50 plus because of the inflation and slower growth outlook.

“Name me one asset that’s down 50% from its record high. I can’t really think of many other than silver,” he said.

Conclusion

We’ve seen the gold and silver market enter a long period of consolidation after last year’s impressive rally, but that hasn’t deterred those around the investment world from holding their ground on a positive outlook.

Many were already convinced that the commodity bull market will naturally find its way towards precious metals, and after seeing how the inflation pressure keeps on mounting and the central banks are being more reactive than proactive, analysts now hold an even stronger conviction than before.

While it’s rare for industry leaders to agree on one thing, most are in accord with the idea that prices are going higher, not only this year but even the next. This effect is also going to “trickle down” to the economy.

As Dr. Ron Paul puts it in a recent interview with Stansberry Research: “It’s a fallacy to keep gold prices low to show the economy is doing alright.”

The former US presidential candidate believes that “price inflation is playing havoc with the economy, where some Americans are feeling the effects of this much more than others.”

In such periods, we have always sought haven in gold, and it won’t be any different this time around.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks.

Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.