Renforth taking a closer look at lithium- and rare-earths bearing pegmatites – Richard Mills

2023.01.27

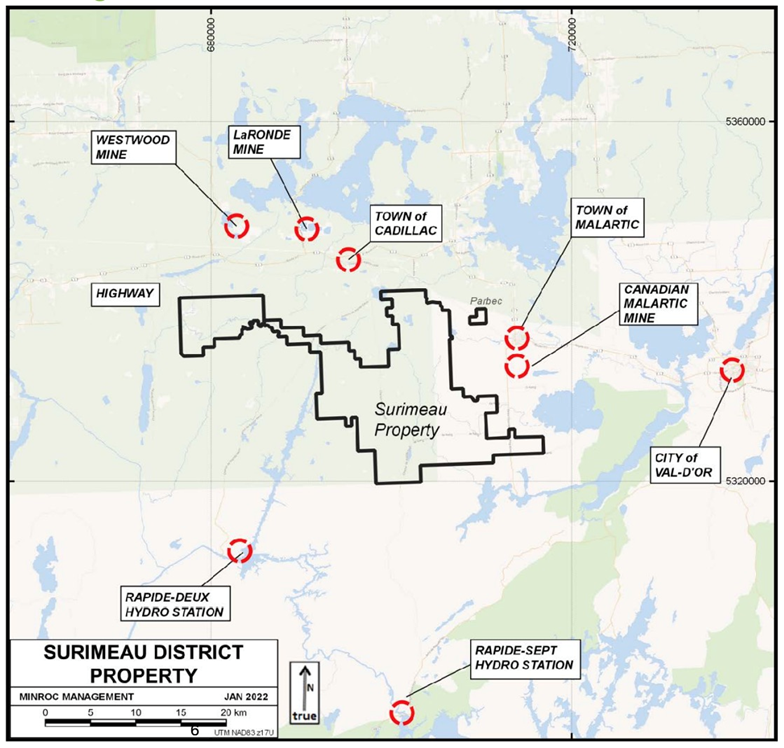

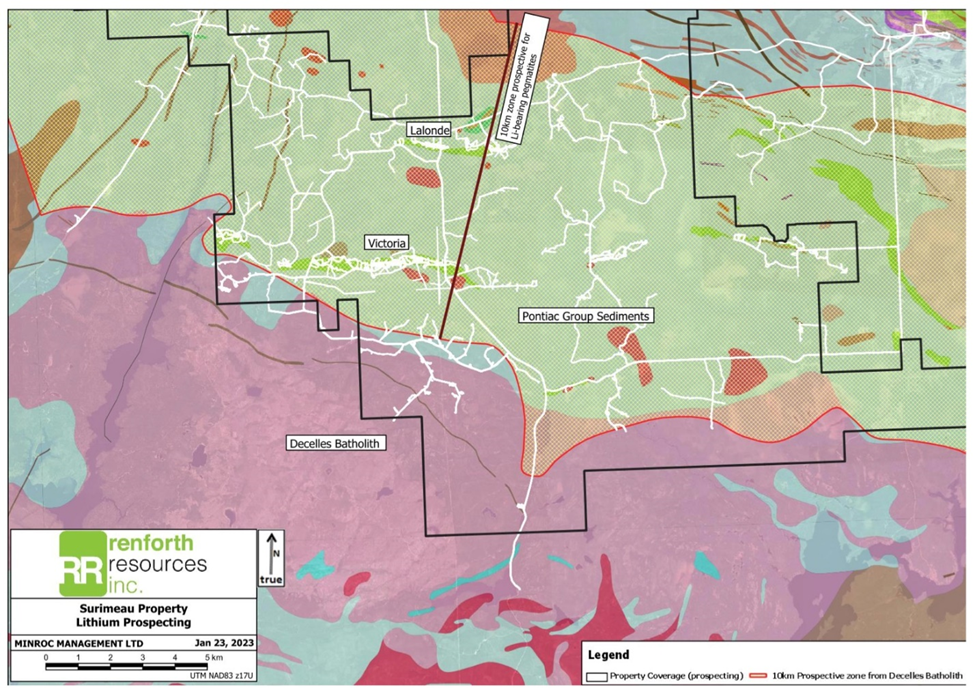

Renforth Resources (CSE:RFR, OTCQB:RFHRF, FSE:9RR) wants to know how much lithium and rare earths is present at its Surimeau battery metals project in Quebec. Field crews have therefore begun investigating the pegmatites on the 330-square-km property.

Pegmatites are igneous rocks composed almost entirely of crystals that are over one centimeter in diameter. Pegmatites are sometimes sources of valuable minerals such as spodumene, a lithium ore, that are rarely found in economic amounts in other types of rocks. They form from waters that separate from magma in the late stages of crystallization; this activity often occurs in small pockets along the margins of a batholith — which is a large igneous intrusion that forms when magma crystallizes underground and is later partially exposed following uplift and/or erosion. Read more

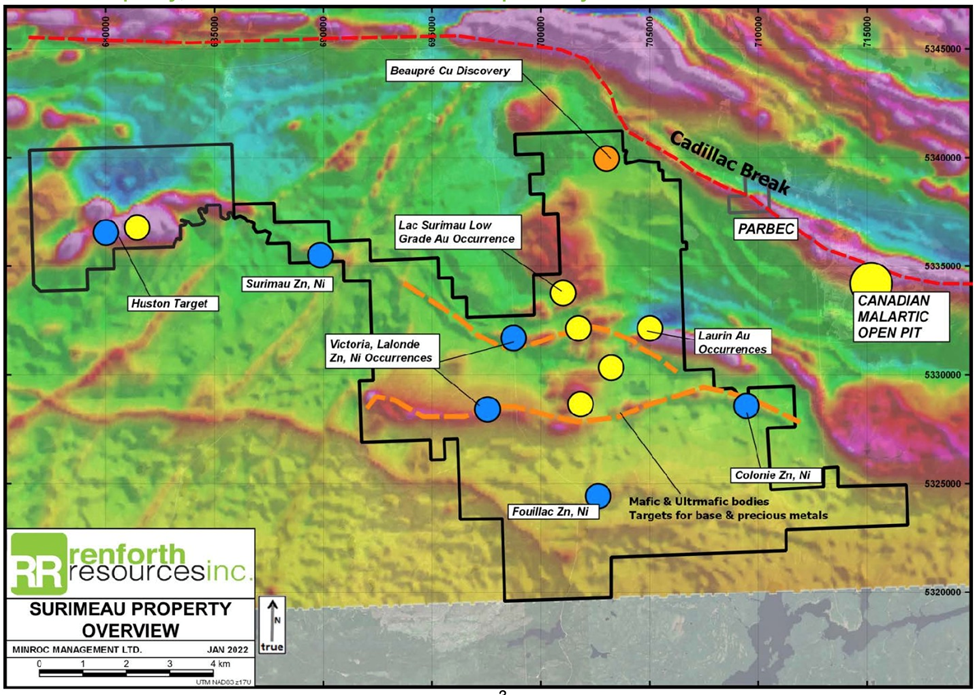

Up to now, Renforth has mainly focused on the polymetallic “battery metals” package of nickel, cobalt, copper, zinc, platinum and palladium that is present in at least six known areas of the property.

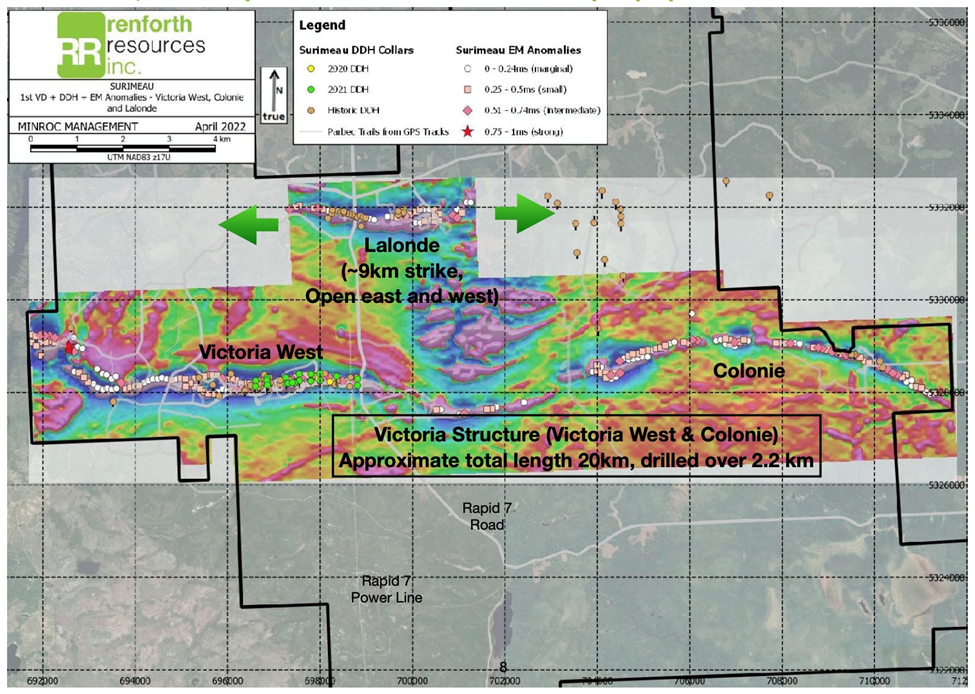

The Victoria mineralized structure is estimated at about 20 kilometers long, and the Lalonde structure measures 9 km in length. The company continues to define the surface and sub-surface polymetallic mineralization, evidenced by outcrops, trenching, drill results and geophysics. (read more about Victoria and Lalonde below)

Last year, Renforth devoted only a few days to prospecting for lithium in a limited area; this work was focused only on the pegmatites mapped by Metals Tech Lithium, and noted by the Quebec government’s SIGEOM database in the southwest part of the property.

However, in addition to pegmatite sampling, Renforth has determined that the Decelles batholith, which forms the southern portion of Surimeau, is a fertile batholith and has an area of influence for pegmatite formation of 10 km. The company therefore considers most of the property prospective for pegmatites (remember, pegmatites often form along the edges of batholiths); with pegmatites noted as far north as Victoria and Lalonde.

“Renforth has hardly looked at lithium at Surimeau, mainly because our battery metals systems, mineralized starting at surface, are the obvious, and the easiest, thing to explore and create value for shareholders. However, we do have pegmatites and they deserve to be properly considered, separately from Victoria and Lalonde, for not only lithium potential but also rare earth elements potential. So, we have begun that process in advance of the summer fieldwork season,” Renforth’s President and CEO Nicole Brewster said in the Jan. 24 news release.

According to Renforth, only the area west of the Rapid 7 road and south of the Victoria mineralization was prospected, with accessible pegmatites and granites visited and sampled. Sampling resulted in elevated lithium, cesium, rubidium and tantalum at various locations, generally within the sediments near to, or in contact with pegmatites.

This could be interpreted as either a halo effect due to the mobility of various elements, or indicative of unseen lithium-bearing pegmatite.

All of the documented pegmatites were visited and sampled, though this work covers only a small percentage of the prospective ground; new pegmatites were also found and sampled.

Of all the grab samples, there was limited assaying for rare earth elements; Renforth has since concluded that any future work with respect to lithium should assay for rare earths.

Lithium assay values ranged from background up to 800 parts per million (a re-assay of a sample that originally assayed 410 ppm), for cesium from background up to 169 ppm, rubidium from background up to 1,170 ppm, and tantalum from background up to 149.5 ppm.

Renforth notes the work was only designed as initial, early-stage prospecting; it is not comprehensive. Pegmatites will therefore be the focus of summer, 2023 prospecting, including searching for new pegmatites, along with mapping and sampling of known pegmatites and proximal sediments.

Renforth has commissioned a lithium targeting report to be generated by spectral analysis of available satellite data; this can be done during winter conditions. Renforth is also consulting with experts regarding exploration techniques for lithium and rare earth pegmatites, to develop a comprehensive exploration plan for Surimeau using best practices and the latest knowledge available.

“Really it tells you we have smoke, in lithium terms. We are acknowledging it, getting the best help we can, and will work on it more — stay tuned,” Brewster said in a note to shareholders, regarding the Jan. 24 news release.

Lalonde and Victoria update

Meanwhile, Renforth is receiving assays from the December, 2022 drill program at Lalonde and Victoria. Once completed, they will be made public. Renforth has also submitted permit applications for Surimeau. After receiving permits, drilling will be announced. Brewster said in her communication with shareholders that she hopes to have a drill turning at the western end of the Victoria horizon in March.

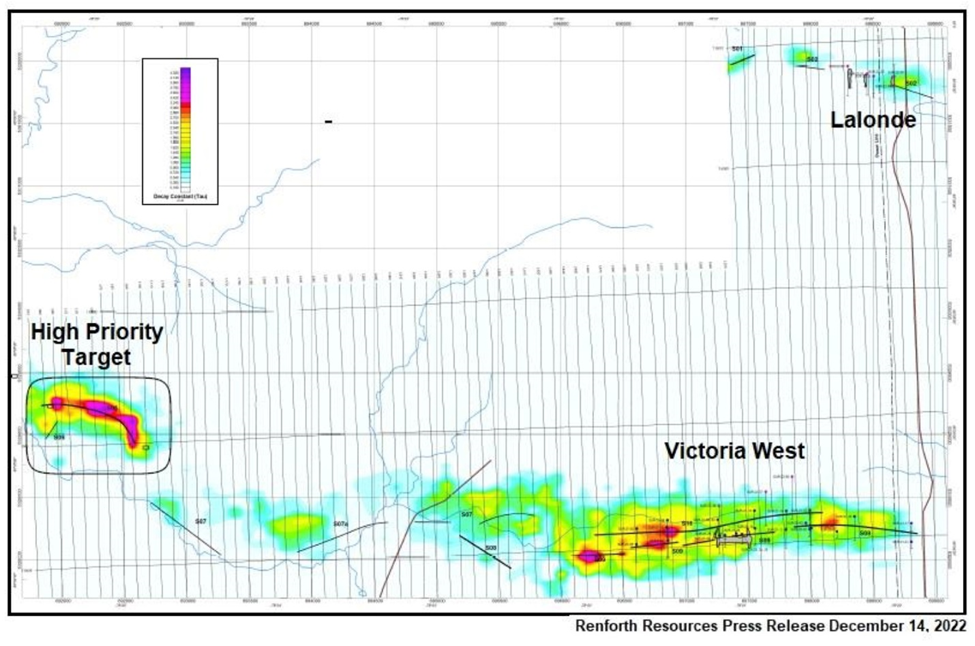

At Victoria West, information gleaned from drilling and trenching, along with surface sampling, creates an area of interest that includes over 5 kilometers of strike on the western end of a 20-kilometer magnetic anomaly.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside, and is intermingled with, VMS-style copper-zinc mineralization.

So far, drilling from the 2.2 km of known strike length has yielded results that allude to the presence of a large polymetallic camp richly endowed with nickel, copper, cobalt and zinc, along with some PGEs (platinum group elements).

In addition, samples taken from the Lalonde target have delivered consistent elevated values from the exposed mineralized horizon.

On Dec. 14 Renforth press-released the completion of 3,076 meters drilled in 11 holes, all of which intersected mineralization, resulting in the visual identification of nickel, copper and zinc sulfides.

It was the first time Renforth drilled the Lalonde mineralized structure, consisting of seven drill holes designed to undercut the mineralized trenches and drill-test an anomaly identified by interpretation of the magnetic and electromagnetic survey data.

At Victoria, four holes were drilled within the 2.2 km east-west strike footprint of the drilling to date.

Renforth is focusing the first-quarter, 2023 drill program on the never-before-explored-or-drilled western anomaly at Victoria. Initial prospecting in 2021 delivered surface mineralization in this area, which coincided with the subsequently flown mag/EM survey, and again delivered surface mineralization in confirmation prospecting in 2022.

“The mag/EM has been a great tool, a roadmap to mineralization, between the magnetic ultramafic and the EM sulfide targets, when we could expose bedrock, but now it is even better — we have more detail and that detail correlated to visual results in drill core,” Brewster wrote in a Dec. 14 update to shareholders.

“The accuracy of the interpretation supports our Q1 2023 drill program — about 4 km west of the current 2.2 km we are working at Victoria.”

According to a recent synopsis by Zacks Small-Cap Research,

Renforth Resources has made consistent progress in the process of proving-up the assets at its Surimeau Property, an early stage polymetallic (Ni-Cu-Co-Zn) project that is in the discovery & exploration stage. Surimeau is highly significant to Renforth Resources for three reasons. First, the breakthrough discoveries could be indicative of a district-scale nickel-copper-zinc project that is geologically similar to the commercially successful Outokumpu deposit in Finland. Second, the nickel mining industry is coming into favor as nickel demand for EV batteries is projected to outstrip supply within the next five years. Importantly, nickel is more easily and much less expensively recovered from nickel sulfide than from nickel laterite ore. And third, there is a meaningful valuation disparity between gold and nickel sulfide junior mining companies. Any change in the perception that Renforth has transitioned from a junior gold company to a junior nickel sulfide company potentially would close that gap.

The Surimeau Property appears to have a litany of cost advantages: polymetallic surface mineralization that can be cost-effectively accessed by roads and surface open pit mining methods and that is located in a mine-friendly jurisdiction and near a source of green hydroelectric power. In addition, the Surimeau Property is situated about only 70km from Glencore’s Horne Copper Smelter.

Conclusion

Exploration results to date have reinforced Renforth’s view that its Surimeau project in Quebec is richly endowed with battery metals like nickel and cobalt.

However, a significant amount of ground remains untested, leaving heaps of upside for Renforth shareholders, in a project that is already showing district-size scale.

Surimeau occurs within a unique geological setting where two types of mineralization, formed from different geological processes, are “mashed together” in one distinct orebody. It is best described as a magmatic nickel sulfide deposit, juxtaposed with a copper-zinc volcanogenic massive sulfide (VMS) deposit.

Up to now, Renforth has mainly focused on the polymetallic “battery metals” package of nickel, cobalt, copper, zinc, platinum and palladium that is present in at least six known areas of the property.

To this collection, we could potentially add lithium and rare earths.

I’m looking forward to seeing the results of pegmatite prospecting, and I am also eagerly awaiting the assay results from the December, 2022 drill program at Lalonde and Victoria. Expect more news from Renforth in the coming weeks, including details of the 2023 drill program.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.03; 2022.12.15

Shares Outstanding 325m

Market cap Cdn$9.75m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.