Renforth samples highest-grade nickel and copper yet at Surimeau, 1.9% Ni and 1.38 Cu

2021.10.05

The news from Renforth Resources (CSE:RFR, OTCQB:RFHRF, FSE:9RR) keeps getting better, with the Central Canada-focused company releasing a fresh set of assays from its Surimeau battery metals play in Quebec.

Last week Renforth reported that summer prospecting on the southwestern part of the Huston area returned 1.9% nickel, 1.3% copper, 1,170 parts per million (ppm) cobalt and 4 grams per tonne silver, from a grab sample taken from strongly foliated diorite. Patchy oxidation on the weathered surface gives the sample a reddish color, as shown in the photo below. Diorite is a coarse-grained intrusive igneous rock.

The little-explored Huston area is located about 18 km northwest of the Victoria West target, where recent drilling, trenching and surface sampling reveal an area of interest that includes about 5 kilometers of strike on the western end of a 20-kilometer magnetic anomaly.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside, and is intermingled with, VMS-style copper-zinc mineralization.

Renforth management says the spectacular result from Huston (grades above 1% nickel and copper are today considered high grade) is the first documented nickel occurrence in the Huston target area, which is largely unexplored except for a limited gold-focused drill program by Hecla Mining in the 1980s.

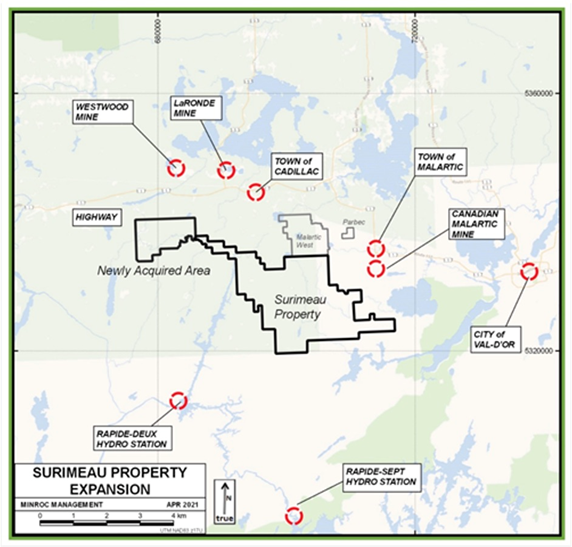

The two images below are useful in explaining the significance of the assay result. Current and prospective shareholders are reminded that the sample area was selected by a geologist and may not be representative of mineralization across the Surimeau project.

On the location map, notice the inset map in the bottom right corner. The yellow box denotes the 5-km Victoria West trend that has been drilled and trenched and from which assay results are awaited. The red box is where the sampling at Huston was done.

Next is a photo of the mineralized outcrop. Notice the quartz vein running through the host rock. In gold exploration quartz veins are sought after because they often contain gold pathfinder minerals such as pyrite and arsenopyrite. However in this case, Renforth is more interested in the gray host rock which contains streaks of rust-colored diorite. In other words, it was the diorite, not the quartz vein, that assayed 1.9% Ni and 1.3% Cu. This is clearly good news. Why? Because we know there is more host rock than quartz veins. What we don’t know is how prevalent the nickel and copper (+ cobalt and silver) are within the diorite. This was just one sample taken from one outcrop within the Huston target, which has only been explored for gold, not battery metals, especially copper, nickel, cobalt and silver. It suggests more Ni-Cu-Co-Ag mineralization is yet to be unearthed at Huston. How much more remains to be seen.

Surimeau

The 260 square-kilometer Surimeau property hosts several target areas for gold and industrial metals (nickel, copper, zinc, cobalt, silver) located south of the Cadillac Break, a major regional gold structure in Quebec.

In July, Renforth completed a four-hole drill program at the nickel, copper and zinc-mineralized Victoria West target.

Victoria West is one of six polymetallic target areas on the Surimeau property historically documented as hosting mineralization (Huston is the fourth area to be prospected).

It is located at the western end of a 20-km-long magnetic anomaly that hosts proven mineralization at either end, with the Colony target at its eastern end.

Renforth’s first drilling at Surimeau occurred in October 2020 with 2.5 short holes completed. A total of 15 holes for 3,456m were drilled during the 2021 program, drilling off 2.2 km of strike within the approximately 5 km-long Victoria West target. Another four holes totaling about 1,000m were drilled this summer; they delivered visible sulfides in the core.

The company plans to return to the field within the next few weeks to conduct surface stripping, to expose on surface a portion of the Victoria West mineralized system. The geological team will likely revisit Huston later this fall after hunting season ends and before snow blankets the ground. Renforth also intends to fly a detailed magnetic survey of Victoria West using drones. Assays are pending for the bulk of the 2021 drilling at Surimeau.

Potentially, more drilling could occur during the last three months of the year at Victoria West, Huston and Malartic West.

Malartic West

At the under-explored Malartic West property, Renforth plans to follow up channel and grab samples that revealed a copper and silver mineralized system known as the Beaupré Copper Discovery. In the northern part of the property this system has been traced over 175m and remains open.

The 53-square-kilometer project is contiguous to Victoria West and lies adjacent to the western border of Canadian Malartic, Canada’s largest open-pit gold mine. Osisko Mining started commercial operations there in 2011.

The southern portion of the property hosts a ~21-km-long magnetic feature composed of mafic and ultramafic bodies which have only been explored historically at either end, where elevated nickel and zinc occurrences are noted. The project is situated within the Pontiac Sediments, a geological feature it has in common with the Canadian Malartic mine, and in some instances is within 200 meters of the Cadillac Break. Malartic West is therefore considered prospective for gold.

Renforth confirmed the presence of historical mineralization on the southern portion of Malartic West, including sphalerite, a zinc sulfide mineral, and minor chalcopyrite, a copper mineral.

The company last year consolidated three of these areas, previously referred to as Lalonde, Victoria and Colonie, into the Surimeau project.

Electrification metals

Renforth is making progress on these two Quebec properties at a very interesting time for both precious and industrial metals.

New emissions targets being set by countries like Canada, the US, Britain, China and Japan, will mean large-scale deployment of electric vehicles, renewable power and electrical transmission, all of which will require copious metal content.

The United States is back in the fold of countries pledging to reduce greenhouse gas emissions, and that is helping to drive demand for an assemblage of metals that a global push to decarbonize and electrify is expected to require.

The new “green economy” rejects dirty sources of energy and transportation, namely coal, oil, and natural gas. Instead, it relies on carbon-friendly modes of transport and energy production, including electric vehicles, renewable power, and energy storage, as well as mobile technology (5G) and rapid adoption of artificial intelligence (AI) technologies needing increased computing power.

Transportation makes up 29% of global emissions, so transitioning from gas-powered cars and trucks to plug-in vehicles, as well as high-speed rail, is an important part of the plan to wean ourselves off fossil fuels.

However, to accomplish all the above will require a colossal boost in the production of mined materials, including copper, nickel, silver, graphite, zinc, iron ore and steel.

A brand-new report from Bloomberg NEF states that the transition from fossil fuels to clean energy could require as much as $173 trillion in energy supply and infrastructure investment over the next three decades.

Among the demand drivers of these “future-facing metals” are solar panels, wind turbines, lithium-ion batteries, charging stations and electricity transmission.

The Biden administration is gung-ho to advance major funding for clean and green energy programs which are included within the $1.2 trillion and $3.5 trillion spending packages that have passed the Senate and are currently before the US House of Representatives.

China and the European Union have grand plans of their own to decarbonize and electrify their economies, putting even more pressure on the mining industry to provide the necessary metals.

In contrast to only a few years ago, electrification is now supported by the auto industry. US carmakers expect to spend $250 billion on up-shifting to EVs by 2023. As reported earlier this year by Utility Dive,

The Alliance for Automotive Innovation (AAI) representing GM, Ford, Honda and others has committed to working with the new administration on a national electrification program that would bring all automakers “under a unified set of common requirements” that could include rising percentages of EV sales.

Specifically, Ford and Korean battery supplier SK Innovation plan to spend a whopping $11.4 billion to build two new lithium-ion battery plants in central Kentucky and a 3,600-acre campus in west Tennessee. The latter will include another battery plant built by SK, along with a supplier park, recycling center and a new assembly plant for Ford’s electric F-series trucks.

The iconic American automaker has already said it plans to spend $30 billion on electric vehicles through 2025, of which $7 billion has already been invested. Rival GM, meanwhile, is spending $4.6 billion through a joint venture with LG Chem, another Korean battery manufacturer, for battery production starting in 2023, CNBC said.

Detroit News last month had Ford CEO Jim Farley calling for EVs to be made more affordable, and for bringing mining back to the US — something we at AOTH whole-heartedly endorse:

“We have to bring battery production here, but the supply chain has to go all the way to the mines. That’s where the real cost is and people in the U.S. don’t want mining in their neighborhoods,” said Farley.

“So are we going to import lithium and pull cobalt from nation-states that have child labor and all sorts of corruption or all we going to get serious about mining? … We have to solve these things and we don’t have much time.”

Another mining executive, Hudbay Minerals’ CFO Steve Douglas, is also speaking in favor of building more mines, despite the fact that such moves may be seen as “environmentally unappealing”.

At Bloomberg’s recent Canadian Fixed Income Conference, Douglas said electrification will exacerbate expected copper supply shortages, and noted the red metal is facing a structural deficit of 5-7 million tons in the next three to four years.

Douglas also joined common cause with AOTH in asserting something I’ve been saying for years: that any energy transition can’t happen without copper:

“The table is being set at least for those metals that will contribute to the decarbonization of the world,” Douglas said. “You’re going to have to either stimulate or allow to be built an awful lot of the extractive-type industries that would get the scarlet letter in the environmental side — you’re not going to decarbonize the world without it.

Even former oil traders are losing their thirst for oil and placing bets on renewables. Reuters reported this week that Alex Beard, the former Glencore executive whose team once traded up to 7% of the world’s oil, is now raising money to build a portfolio of strategic battery sites across the United Kingdom to support the renewable energy industry.

Wind and solar have the highest copper content of all renewable energy technologies, making the metal more important in achieving our climate goals.

According to the Copper Alliance, wind turbines require between 2.5-6.4 tonnes of copper per MW for the generator, cabling and transformers. Photovoltaic solar power systems use approximately 5.5 tonnes of copper per MW.

Research by Fitch Solutions shows that green demand from the power and renewables sector as well as autos will each account for 7.9% of total copper demand by 2030.

In 20 years BloombergNEF says copper miners need to double the amount of global copper production, just to meet the demand for a 30% penetration rate of electric vehicles. That means an extra million tonnes a year, over and above what we mine now, every year for the next 20 years!

Copper has been one of the biggest winners in the commodities market since 2020.

The apparent presence of nickel mineralization at Victoria West, from surface to some depth, is an important development. The reason being there is a severe shortage of the metal coming.

Nickel is earmarked as one of the key minerals for achieving a “green economy”, as it is essential for building electric vehicle batteries.

According to CRU, global nickel usage in batteries is expected to grow seven-fold from 70,000 tonnes in 2017 to 240,000 tonnes in 2023, a compound annual growth rate (CAGR) of 20%.

The Bank of America projects that, based on an estimated 13.6 million EVs sold in 2025, the world would need 690,00 tonnes of nickel. That represents nearly the entire mined supply of Indonesia, the world’s top nickel producer.

So, the straightforward solution would be to mine more nickel. But there’s one critical problem: not all nickel is suitable for making EV batteries.

In fact, not even half of the world’s nickel resources can be considered battery-grade.

A majority, about 60%, of the world’s known nickel resources are laterites, which tend to be found in the Southern Hemisphere and mostly go into stainless steel production.

The remaining 40% are sulfide deposits, formed through the precipitation of nickel minerals by hydrothermal fluids. The main benefit of sulfide ores is that they can be processed at relatively low cost, and with minimal waste, using a simple flotation technique.

Battery cathodes require high-purity nickel, in the form of nickel sulfate, derived only from ‘Class 1’ high-grade nickel sulfide deposits, which are not easy to find around the globe.

Historically, nickel production from sulfide ores came from only a few places, including the giant (>10 million tonnes) Sudbury deposits in Canada, Norilsk in Russia and the Bushveld Complex in South Africa.

However, existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting, nickel laterites such as those in the Philippines, Indonesia and New Caledonia.

According to BloombergNEF, demand for Class 1 nickel is expected to outrun supply within five years, fueled by rising consumption by EV battery suppliers.

Commodities consultancy Wood Mackenzie says about 200,000 tonnes of nickel went into precursor materials for rechargeable batteries last year. The expectation is that this year, it will increase to as much as 300,000t, close to the availability of Class 1 briquettes and powder.

Where will mining companies look for new sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically, technically and environmentally feasible? The pickings are slim.

Decades of underinvestment explain the lack of large-scale greenfield nickel sulfide discoveries over the years. Only one nickel sulfide deposit has been discovered in the past decade and a half: Nova-Bollinger in Western Australia.

The result of such limited nickel exploration is a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions.

Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers.

This brings us back to Renforth and its Surimeau project. Renforth has compared Surimeau to another “Outokumpu-like” occurrence, referring to a district in eastern Finland known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold.

Precious metals

While nickel and copper mineralization rightly hogs the limelight at Surimeau, it must be remembered that gold and silver mineralization is not far away.

The 53-square-kilometer Malartic West project is contiguous to Surimeau’s Victoria West target, and the property lies adjacent to the western border of Canadian Malartic, Canada’s largest open-pit gold mine. Malartic West shares a geological feature with the Canadian Malartic mine, the Pontiac Sediments, making it an enticing exploration target.

Conclusion

Renforth is fortunate enough to have a nickel sulfide deposit at surface whose secrets it is just starting to reveal to the market.

Just how large this nickel sulfide system is, remains to be seen.

RFR is clearly hoping to find nickel sulfides that when refined would be appropriate for lithium-ion batteries. This would make the project and/ or the company attractive to potential acquirers.

A total of 15 holes for 3,456m were drilled during the 2021 program, drilling off 2.2 km of strike within the approximately 5 km-long Victoria West target. Another four holes totaling about 1,000m were drilled this summer. We don’t yet have the assays for the majority of 2021 drilling, but four holes delivered visible nickel, copper and zinc sulfides in the core, which is very encouraging.

On top of that, Renforth’s recent news about a new target, Huston, shows exceptional copper and nickel grades. Anything above 1% these days is considered high-grade and the outcrop sample assayed 1.9% Ni and 1.3% Cu. A Kitco “Rocks in the Box” computation values this rock at $464 per tonne. Great stuff. The fact that the mineralization is in the host diorite rather than the quartz veining suggests it could be widespread throughout the country rock.

Surimeau shows promise of becoming a district-scale mining project, given its unique geological similarities to the Outokumpu District in Finland, as well as being analogous to a number of current and past-producing Canadian VMS deposits, some of which, like Kidd and LaRonde, are still in production decades after mining started.

It’s fascinating to think that this district could contain not only battery metals like nickel and cobalt, but industrial metals copper and silver, and even gold, prospective next door at Renforth’s adjoining Malartic West project.

It never hurts to have a little gold in your portfolio. Despite gold pulling back since last year’s bull run, we haven’t lost faith in the precious metal, which despite more modern alternatives, remains a hardy safe haven and a tried and true inflation hedge.

Three leading economists are predicting that stagflation is what’s next in store, if inflation in metals, crops, food, fertilizer, energy, rent, shipping costs, wages, etc. — continues to accelerate.

Meanwhile, global debt has more than doubled since 2007 and now sits at a jaw-dropping $281 trillion.

There is a clear link between a rising debt to GDP ratio and gold prices. In October 2020 the US ratio surpassed 100% for the first time since the Second World War; it now sits at 125%, not much lower than Italy’s 155%. Italy has long been considered a debt-ridden basket case of an economy, incomparable to the United States backed by the mighty greenback. Yet some commentators are beginning to see the United States heading down the same financial road to ruin.

According to Renforth, Surimeau is big enough that several discrete mineral occurrences could be mined from one central processing facility, thereby reducing capital expenditures and lowering the grade requirements. Presumably multiple drill programs for the different metals could be run concurrently and the programs could share drill equipment and crews, further ratcheting down costs.

Battery metals and precious metals combined make for an intriguing investment opportunity at Surimeau and in Renforth.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.07 2021.10.04

Shares Outstanding 251m

Market cap Cdn$18.3m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.