Renforth Resources: Twinned holes at Parbec support historical drill results

2021.08.08

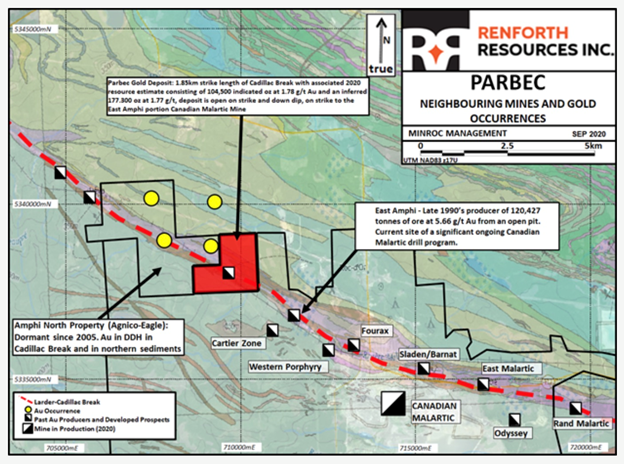

The Parbec project being developed by Renforth Resources (CSE:RFR, OTCQB:RFHRF, FSE:9RR) is an open-pit constrained gold deposit located in the town of Malartic, Quebec.

It sits on 1.8 km of the Cadillac Break, a prolific regional gold structure, and is adjacent to Canadian Malartic, Canada’s largest open-pit gold mine.

Parbec currently has an NI 43-101 resource estimate of 104,000 indicated ounces at a grade of 1.78 grams per tonne (g/t) Au and 177,000 inferred ounces at the same grade.

However, this estimate prepared in May 2020 is considered by Renforth to be out of date because it does not include the results from its recently completed 15,569m drill program.

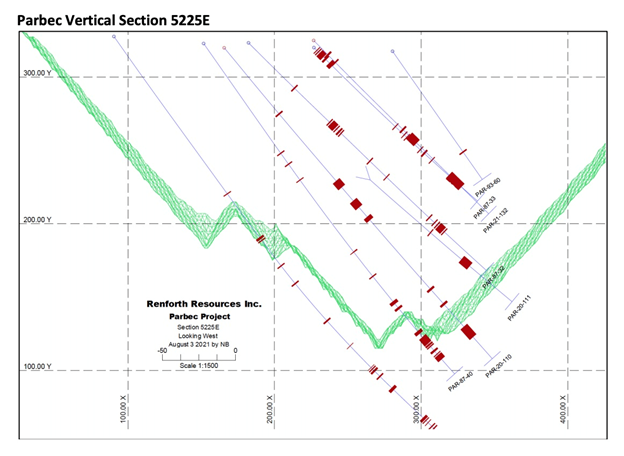

This program was designed to twin, infill and undercut existing drill holes at Parbec to support a rebuild of the geological model and a new resource estimate, expected to be released in coming weeks.

In addition to new data, Renforth intends to incorporate the results of 62 drill holes completed between 1986 and 1993 in the upcoming resource estimate, assuming that the lab results from half a dozen holes twinned in the winter of 2021 support the historical assays.

The latest results are encouraging.

This week Renforth announced that hole PAR-21-132, the final hole twinned by the exploration team, reported several mineralized intervals, including 11.75 meters of 3.3 g/t Au, identified between a relatively shallow 130.15m and 141.9m down hole. There was also a higher-grade sub-interval of 15.53 g/t Au over 1.75m.

The result is within Renforth’s “top 10” Parbec intervals tabulated below.

Twinning is an exploration term that refers to re-drilling a historical hole to determine if the old assays and the new assays are a reasonable match.

The 15,569m drill program successfully twinned 10% of the 62 previously drilled holes, with each “twin” delivering assay results comparable to or better than historical ones.

According to Renforth, the twinned holes when combined with all the holes drilled near (ie., 10m or less) old intercepts serve to validate the assay data between 1986 and 1993, which [as mentioned] was excluded from the 2020 resource estimate. This means that the historical data, along with the >15,000m of new data, can be utilized in the next resource estimate at Parbec.

The company notes there are still 15 holes left to report from this past year’s drill program.

Surimeau update

Meanwhile at Renforth’s other active project, Surimeau, the lab continues to receive assays from a recent 3,456m drill program.

The four-hole drill program, focused on the 5-kilometer-long Victoria West target, mineralized with nickel, copper and zinc, was completed in July.

According to Renforth, each hole intersected visible nickel, copper and zinc sulfides along the 2-km strike.

Moreover, the news release states, our technical team can see that the nickel vs. the zinc (and copper) systems are remarkably separate structures juxtaposed upon each other. This observation supports the choice of our technical working model, the “Outokumpu” deposit model.

The latter requires some explanation. Unlike most copper-zinc VMS systems around the world, the 260-square-kilometer Surimeau property in Quebec also happens to host an ultramafic sulfide nickel system at surface in Victoria West.

Renforth has compared this to another “Outokumpu-like” occurrence, referring to a district in eastern Finland known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold.

Between 1913 and 1988, about 50 million tonnes of ore averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined from three deposits in that district.

Conclusion

Renforth continues to deliver positive results from both Parbec and Surimeau, the two projects it is actively exploring in Quebec.

At Parbec, a collection of recently drilled holes, twinned with holes completed between 1986 and 1993, are a reasonable match. The 15,569m drill program successfully delivered assay results comparable to or better than historical ones.

This is very good news for Renforth. It means that data left out of the latest (2020) resource estimate, including the results from the historical drill holes and the current drill holes, can be included in the new resource estimate.

How many new ounces are we talking about? It’s too early to say, there are still 15 holes left to report, but the prospect of a significantly higher number of gold ounces, in addition to the 278,000 oz indicated and inferred “in the bank”, tickles my tastebuds, so to speak.

Good progress is also being made at Surimeau. In July Renforth encountered the highest visible nickel to date from summer drilling at Victoria West. We don’t yet know the grades, but Renforth reports that pentlandite, an iron-nickel sulfide, was encountered within a vein 160m down hole, in the second of four holes. The first hole saw the highest concentration of visible copper intersected to date, making it back-to-back hits for the company at this sulfide-rich VMS target.

It’s also important to recognize that Victoria West is only one of several base metals targets identified on the large Surimeau property. There is still plenty of ground left to explore.

I’m expecting more surprises to come from future drilling, including, hopefully, a rich nickel sulfide discovery which would certainly raise Renforth’s profile among battery metal investors.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.07 2021.08.06

Shares Outstanding 251m

Market cap Cdn$19.1m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Renforth Resources (TSX.V:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.