Renforth Resources investing in critical minerals

2022.06.27

Unlike poorer nations whose populations need the metals revenue to pay for important social services and to earn hard currency to buy imports, in the rich, developed West, citizens have the luxury of protest. They are comfortable.

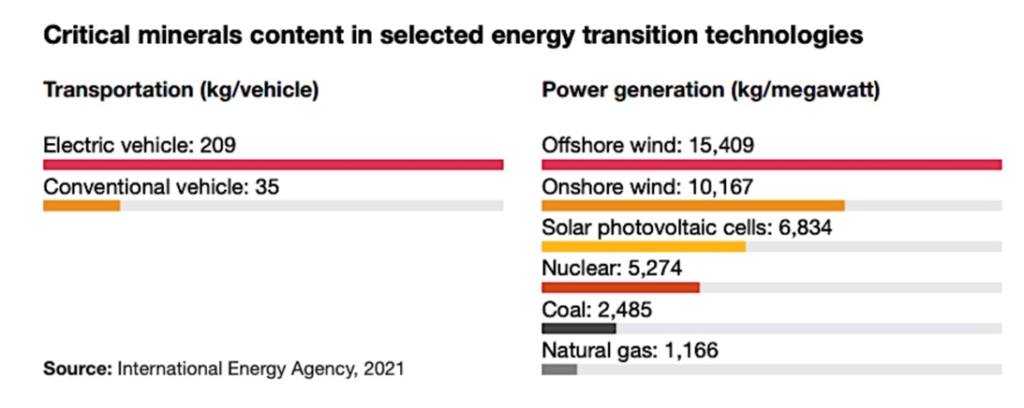

Mining is seen by some as a necessary evil whose environmentally destructive practices should be stopped, or at least, shouldn’t take place anywhere near them. They don’t realize or care that without mining, there would be no modern society: no steel to make bridges, no copper wiring that powers homes and businesses, no uranium to fuel nuclear reactors, no jewelry, no rare earths to make smart phones, solar panels, color monitors and TVs. Usually they want resource extraction halted, at all costs — the minerals or the oil kept in the ground.

The Biden administration in the US and the Trudeau government in Canada have both come out with policies considered anti-mining.

The leaders seem to have their heads in the sand when it comes to an appreciation of the limits to resource extraction. Biden is content to let US allies do the mining, and for American companies to buy their minerals. The assumption is there will always be enough.

In fact the world’s largest mining companies will need to aggressively invest in critical minerals, if they want to avoid being accused of holding back the transition from fossil fuels to green energy.

According to global accounting firm PwC’s ninth annual review of the top 40 mining companies, combined net profit last year reached $159 billion, 127% higher than the $70 billion made in 2020. Revenues rose 32% on the back of high commodity prices and cost control.

The problem is that miners aren’t spending enough, likely reluctant to cut into profitability. According to data from Bank of America, via the Wall Street Journal, project spending by 10 of the largest mining companies, including BHP, Rio Tinto and Glencore, is expected to stay at about $40 billion this year and next. That would put capital expenditures well below a 2012 peak of close to $80 billion.

The steep cut in capex is taking place at precisely the wrong time. Figures from the International Energy Agency suggest that annual critical minerals demand from clean energy technologies will reach more than $400 billion by 2050.

PwC notes that miners must overcome obstacles, including development timelines, price volatility, geopolitical risks, stakeholder expectations, economies of scale and economic resource scarcity.

It’s not as though there aren’t enough minerals. Given its vast resources, skilled workforce and high ESG standards, Canada could become a world leader in the energy transition. The country is rich in lithium, graphite, nickel, cobalt, copper, aluminum and manganese, all key ingredients of lithium ion batteries.

At the opening ceremonies of the annual PDAC conference in Toronto, Natural Resources Minister Jonathan Wilkinson highlighted the fact that Canada produces more than 60 minerals and metals, has more than 200 mines and is home to almost half of the world’s publicly listed mining and minerals exploration companies. He said the country holds deposits of 31 critical minerals that will be “in greatest demand” as the world shifts to cleaner energy sources.

However, exploiting such resources will require changes, Wilkinson said in a speech, pointing to the need to lessen the time required to develop and bring into production a new mine. Doing so can currently take up to 20 years.

Moreover, some of these minerals are facing severe supply constraints, such as copper, lithium and cobalt. PwC warns this could affect the cost and pace of the energy transition. Fortunately, Canada is starting to tackle this problem, with Ottawa setting aside CAD$3.8 billion in the recent federal budget to implement a new critical minerals strategy over eight years.

Renforth Resources

Canada definitely has the resources to help make the transition to green energy. A good example is Renforth Resources (CSE:RFR, OTCQB:RFHR, FSE:9RR) and their Surimeau critical minerals play in Quebec.

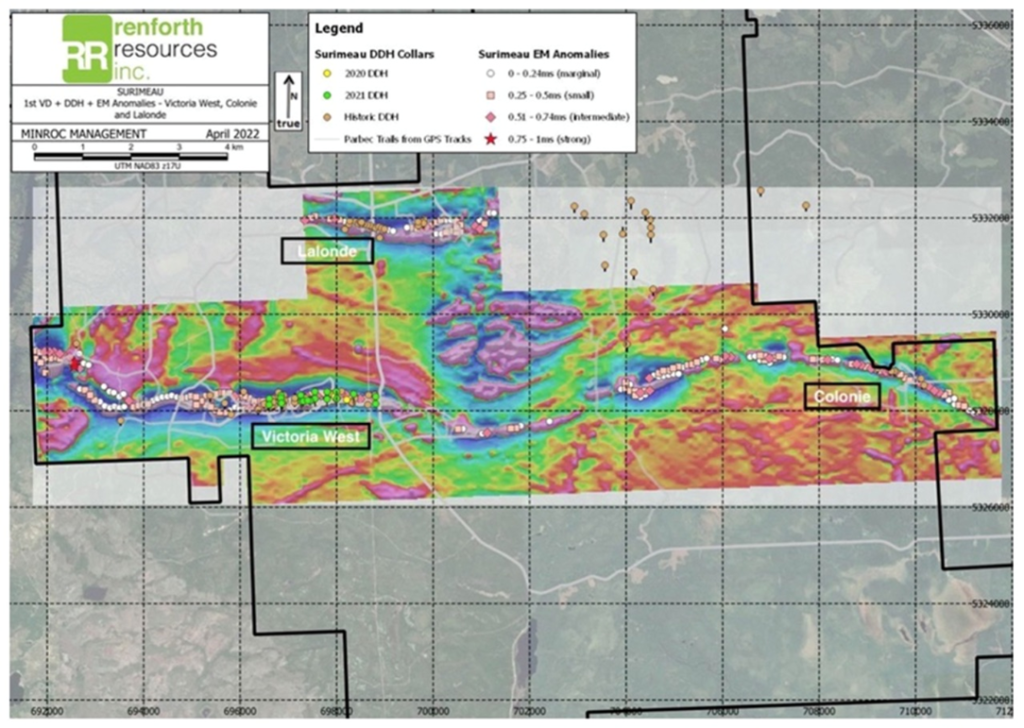

Recently concluded prospecting at Surimeau, located adjacent to the Canadian Malartic mine and the town of Malartic, has extended the battery metals nickel, copper, cobalt and zinc to surface.

A field crew visited all of the targets across the district-scale, 330-kilometer land package, took samples and submitted them to the assay lab. Results are expected in a few months. In some instances the sulfide mineralization present at the Victoria magnetic structure and at the Lalonde showing, was confirmed by X-ray fluorescence (XRF).

“Our first round of prospecting our district-scale Surimeau property this year went very well, our EM [electromagnetic] survey is proving to be an excellent road map to mineralization,” said Nicole Brewster, Renforth’s president and CEO, in the June 9 news release. “Everything we are learning will be utilized in the next round of prospecting at Surimeau and, eventually, our next drill program. We have new targets for the next round, based on what we learned this round, which we will target as we continue to learn about and develop Surimeau, Quebec’s newest battery metals district.”

After a brief hiatus, geological crews are back in the field for follow-up channel sampling, in areas of the best visual mineralization (not yet assayed) discovered during the May sampling program. The geologists will also be conducting additional prospecting and mapping in the area.

Targets include mineralization at the western end of the ~20-km Victoria magnetic/ electromagnetic structure and the newly revealed mineralization at Lalonde.

“We are still waiting for lab results from May but, fortunately, the sulfides are visually distinct and measurable in the field with an XRF. Our team knows which areas to revisit, to create greater exposures of mineralization to channel cut and extend,” Brewster wrote in a note to shareholders.

Surimeau overview

The Surimeau project hosts several areas prospective for gold/silver and battery/ industrial metals (nickel, copper, zinc, cobalt and lithium). It is located south of the Cadillac Break, a major regional gold structure.

The property occurs within a unique geological setting where two types of mineralization, formed from different geological processes, are “mashed together” in one distinct orebody. It is best described as a magmatic nickel sulfide deposit, juxtaposed with a copper-zinc volcanogenic massive sulfide (VMS) deposit.

The first type of deposit, which may contain nickel, cobalt and platinum group elements (PGEs), is associated with ultramafic rocks. The second type, VMS, was formed on or near the ocean floor during ancient underwater volcanic activity.

VMS deposits are sought after for mining because they usually contain a mix of base metals such as zinc, lead, copper, and sometimes precious metals including silver and gold. The minerals often form massive sulfide mounds or layers, making them relatively easy to extract.

Surimeau’s mixed style of mineralization, however, is very rare; the best comparison so far is the Outokumpu district of eastern Finland.

Outokumpu contains sulfide deposits with economic grades of copper, zinc, cobalt, nickel, silver and gold. Mining took place from 1913 to 1988, and involved the exploration of three deposits — Outokumpu, Vuonos and Luikonlahti. Approximately 50 million tonnes of ore, averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined.

Up until now, Renforth has mainly focused on the polymetallic “battery metals” package of nickel, cobalt, copper, zinc, platinum and palladium that is present in six known areas of the property. This year the company is looking to broaden its exploration efforts at Surimeau by including lithium.

On top of lithium, Renforth will also look for rare earth elements by following up on various geochemical anomalies in the SIGEOM system to determine if they are pegmatites and/or REE occurrences. This includes a highly anomalous scandium value in the NW portion of the property that is 3x higher than any other scandium value in the dataset. At this location, the REEs dysprosium and neodymium also gave unusually high values.

Victoria West

To date, the exploration focus at Surimeau has been the sulfide nickel-rich VMS targets, in particular the Victoria West prospect, which has been the site of drilling for over a year.

Information gleaned from drilling and trenching, along with surface sampling, creates an area of interest that includes over 5 kilometers of strike on the western end of a 20-kilometer magnetic anomaly.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside, and is intermingled with, VMS-style copper-zinc mineralization.

So far, only 5,626 meters have been drilled over 2.2 km of the known strike length, yielding results that allude to the presence of a large polymetallic camp richly endowed with nickel, copper, cobalt and zinc, along with some PGEs (platinum group elements).

Assays came from seven holes (1,200m) drilled within the 275m strike length of the stripped area at Victoria West (see below), where channel sampling earlier revealed consistent nickel-cobalt mineralization.

One drill hole returned 3.46% Ni and 491 ppm Co over 1.5m between depths of 196.5m and 198m, demonstrating the high-grade nickel potential present at Victoria West.

The high-grade intercept was within a broader mineralized zone of 170.55m, which averaged 0.16% Ni and 100.2 ppm Co. A 12m-long zone, between 187.5m and 199.5m down hole, averaged 0.54% Ni and 138.7 ppm Co.

These results followed up on the promising assays reported last fall, where each of the 21 holes returned mineralization as expected, with the four deeper holes demonstrating an increase in grade.

The plan for Renforth now is to move as quickly and as efficiently as possible to deliver an inferred resource at Victoria West.

Lalonde

As further proof of Surimeau’s potential to host a large polymetallic system, Renforth on May 31 announced that fieldwork resulted in the discovery of surface battery metals sulfides at the Lalonde target.

Surface sampling of EM anomalies on the magnetic structure hosting Lalonde has extended the battery metals mineralization to the east by 1.7 km and to the west by 400m, bringing its total strike length to 2.4 km.

Lalonde is located 3.7 km north of the Victoria West mineralization, which as mentioned, was previously drilled by Renforth over 2.2 km of strike length.

Unlike the Victoria West area and the Victoria magnetic structure, the Lalonde area has only seen limited work to date.

However, it should be noted that both Victoria and Lalonde were discovered in 1943 during the construction of the powerline for the Rapide Sept generating station south of Surimeau, which in both instances revealed surface mineralization.

A total of 2,318m was drilled at Lalonde in 1958 and 1968 in 23 drill holes. These were assayed for copper, nickel and zinc, revealing the presence of mineralization. Later drilling took place to the east and northeast of Lalonde, but the drill holes were only assayed for gold.

At Lalonde, Renforth previously took 34 grab samples during prospecting in 2020 and 2021, with each demonstrating the presence of elevated copper, nickel and zinc. The best grab sample results include the highest nickel result: 0.2% Ni, 578 ppm Cu and 785 ppm Zn.

Importantly, the prior sampling results from Lalonde were similar to those received from Victoria West. This gives credence to Renforth’s theory that mineralization at Victoria West and Lalonde, as well as the Colonie showing at the eastern end, all belong to the “Outokumpu” model of polymetallic system described earlier.

Recent prospecting at Lalonde has delivered one of the best visually mineralized samples at Surimeau to date, validating the accuracy of EM anomalies indicating the presence of sulfides within magnetic structures.

Conclusion

Renforth continues to advance the Surimeau battery metals play in a difficult junior resource market. I’m looking forward to seeing the assay results from the May sampling program when they become available, and potentially, the discovery of more mineralized outcrops on the property.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.04; 2022.06.24

Shares Outstanding 262.3m

Market cap Cdn$11.2m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.