Renforth Resources aims for ounces in Quebec’s Cadillac Break

2020.07.10

Quebec is one of the best jurisdictions to explore for gold. Not only do the Canadian province’s rocks contain just about every mineral known to modern society. Quebec is also steeped in mining culture, with an experienced, bilingual workforce, a rich ecosystem of mine suppliers, and high-quality mining infrastructure including paved access roads, low-cost hydroelectric power, and mineral processing facilities.

In 2018 the Fraser Institute ranked la belle province fourth in the world for mining investment, largely due to the Quebec government’s open-ness to mining companies, the relative ease of obtaining permits, and a tax regime friendly to mineral explorers.

Under Quebec’s Taxation Act, an exploration company can issue flow-through shares, which allow an individual investor instead of the company to deduct exploration expenses. Flow-through shares offer investors a possible 150% deduction of the amount invested, including 100% of the cost of the shares, a 25% deduction if expenses are incurred in Quebec, and an additional 25% if exploration is conducted from surface.

The tax incentive program also grants the explore-co a rebate if money is raised outside of Quebec.

Cadillac Break

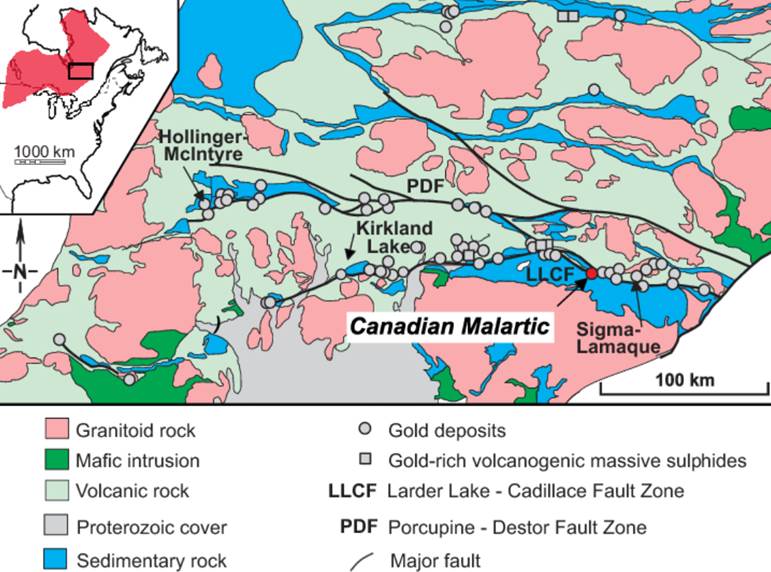

Much of the mining in Quebec has taken place along the Abitibi Greenstone Belt, one of the largest Archean greenstone belts on Earth. For the past century, over 100 mines operating along the belt have churned out nickel, copper, zinc, diamonds, and of course, gold.

650 kilometers long and 150 km wide, the Abitibi runs from west of Kirkland Lake, Ontario to Chibougamau, Quebec.

In the heart of the Abitibi Greenstone Belt, Quebec’s Cadillac Break is a regional fault zone thought to host a whopping 45 million gold ounces. The world-renowned structure stretches from west of Kirkland Lake in Ontario to east of Val d’Or, Quebec, which translates to “valley of gold”.

The Cadillac Break has been mined to various extents since the early 1900s, but it wasn’t until the 1990s that new mines were discovered along the gold trend, which revitalized mining and mineral exploration in the area. They include Agnico Eagle’s LaRonde mine, the old O’Brien mine now owned by Radisson Mining, and the Canadian Malartic mine, a joint venture between Agnico Eagle and Yamana Gold that is currently Canada’s largest gold mine.

Renforth Resources Inc. (CSE:RFR)

Among the most active gold juniors in Quebec, Renforth Resources is hoping to, a/ expand upon its existing resources, and b/ find new mineralization.

It currently has five gold projects including the two main gold-bearing properties, New Alger and Parbec. Renforth is also exploring near the Canadian Malartic mine at its West Malartic project, and among a collection of claims it recently consolidated into a new project it is calling Surimeau. Additionally, the company owns the Nixon-Barleman gold project located 45 km outside of Timmins, Ontario.

An important clarification: Renforth Resources is not looking for mineralization; it has already found it at New Alger and Parbec, which contain updated resource estimates. Renforth is focused on increasing the resources at these brownfield projects, by proving mineralized structures and occurrences not fully defined, and open to expansion.

“Renforth is not engaged in searching for mineralization, we have several mineralized assets we can mature with field operations, continuing to define their extent and de-risk the deposits. Renforth is engaged in adding value to our properties while moving toward initial production at New Alger,” says Nicole Brewster, Renforth’s President and CEO.

A couple of other things about Renforth impress me, including the fact that CEO Brewster and her CFO, Kyle Appleby, are being paid in shares not a salary. The CEO is the main shareholder with over 8 million to her name (Renforth’s CFO almost as many), and has held the corner-office position for seven years – long enough in my view to know the project inside out, as well as having survived a few lean years in the sector.

And how about this: 90% of the capital raised goes straight into the ground. With a lot of juniors, a high percentage of funds gets spent on G&A – this is virtually unheard of, and to me, very impressive. It shows a company bent on exploration, and that they’re working to grow their assets and build shareholder value, without carrying out large capital raises that dilute the share structure.

“We know that every dollar we deploy is at a minimum going to add to the knowledge base, but realistically it’s going to lead to additional gold ounces,” Nicole Brewster told me over the phone this week.

New Alger

New Alger is located along 1.4 km of the Cadillac Break, next to Agnico Eagle’s LaRonde mine and the former O’Brien mine. The property is surrounded by access roads, power lines and an available pool of labor in the numerous mining towns dotted throughout the region.

There is also excess processing capacity in several of the nearby mills – an important factor in Renforth’s business model, to be explained shortly.

Renforth is looking at two primary areas of exploration at New Alger: the past-producing Thompson-Cadillac mine; and the Discovery Veins, an open-pit target about 250m south of the mine where bulk sampling is planned.

Historical drill results were used to compile an inferred resource of 237,000 ounces at the mine area, at a grade of 2.1 grams per tonne, in 2014. An updated resource estimate shows 61,500 indicated ounces in a pit-constrained resources, and 123,300 oz inferred, at a respective 1.88 and 1.65 g/t.

A 2019 exploration program intersected all three main veins at the Thompson-Cadillac mine, including 4.8m of 5.38 g/t gold, and identified a new exploration target, 200m below the inferred resources. Conceptual tonnage for this area is between 1.7 million tonnes and 2.2Mt, at a grade range of 2.0 to 2.35 g/t.

At the Discovery Veins, a large surface stripping campaign in 2017 uncovered 275m of bedrock that exposed gold in quartz veins, found to extend up to 120m deep.

Renforth has identified a 565-square-meter bulk sample area with an average grade of 0.76 g/t in two veins, with a setting in the Pontiac sediments, similar to the Canadian Malartic, the veins are the same as those found in the Thompson-Cadillac mine/Cadillac Break part of the property.

2019 drilling discovered a new Sericite Zone within the Cadillac Break which assayed 11.2 g/t over half a meter, and remains open on strike.

Brewster said the Discovery Veins at New Alger line up perfectly with the headframe of Agnico-Eagle’s now-shuttered Lapa mine, and share the same structure as its neighbor to the east – the O’Brien mine which operated to a depth of 1,500m.

“The grade gets better the deeper you go in the mining camp we are in, so we’re scratching the surface at New Alger, and we’re scratching the surface at Parbec,” she said.

According to the company, assay results illustrate the presence of high grades with a nugget effect and significant width due to the “halo” effect unique to New Alger.

The “nugget effect”, where the gold is unevenly distributed across a deposit, can complicate resource calculations, but according to Brewster, frequently fire assay can under-report the gold values as when there is coarse gold present it can be flattened in the grinding process before assaying and not pass through the screening done before the gold sample is melted in a clay crucible with a mixture of fluxes.

The process of calculating a resource also guards against the “nugget effect”, if some coarse gold were to make it through the sampling process it could give a high value, the geologists and engineers therefore cap the grades to calculate the resource are capped, to remove any high grade “nugget” effect values, so values above 15 g/t Au at New Alger and 20 g/.t Au at Parbec which exist were not used in the resource calculation.

The 2020 exploration program at New Alger will involve prospecting and sampling the western extension of the Discovery Veins; geophysics using a “beep map” survey, allowing Renforth to carry out a non-invasive survey at depth; and most importantly, obtain a mini-bulk sample from the Discovery Veins. The latter has two goals – to create fresh rock exposure for geological analysis; and to process the sample.

More than that, the mini-bulk sample feeds into Renforth’s plan to generate a source of cash, by having the material they dig up processed at one of the area’s many mills, through a toll milling arrangement. Toll milling a limited amount of mini-bulk-sampled material makes sense. It would yield Renforth sufficient cash flow to do additional drilling, and lessen the need to seek financing.

The area’s mines are mining deep. Volumes are slowing and decreasing. They would likely welcome another source of ore that could easily be crushed and trucked in from Renforth. “There’s definitely opportunity to utilize excess capacity and vulnerability,” said Brewster.

The next step at New Alger is to blast the mini-bulk sample. That’s expected to happen next week, after which Brewster said they plan on doing some infill drilling and stepping out to the west, to carry out a small, 1,000m drill program.

Bringing in crews for a small program, in most instances, does not make sense. But in Renforth’s it does, mineralization is close to surface, crews have a 40 minute (or less) drive to the projects. They travel back and forth from home to work every day. Renforth is operating in a long-established mining camp, all services related to mining exploration and drilling and a trained experienced work force is close.

Parbec

The brownfield Parbec project, on the Cadillac Break, borders the Canadian Malartic mine, and is adjacent to the past-producing East Amphi mine, where the joint venture has been drilling.

2019 drilling by Renforth proved that mineralization at Parbec is continuous for 1.8 km along the Cadillac Break, right up to the border with East Amphi – where resources were left underground following the cessation of mining in 2007.

Among the highlights are three areas of mineralization on the property, the discovery zone, with the. Cadillac Break, where the gold resource is largely above 200m, with the zone open to depth; the “Island Trench Zone”, sampled on surface and pierced to 738m, where 0.96 g/t gold was drilled over 0.5m; and the “Diorite Splay Zone” where gold is present on surface,within cross-cutting faults, and at contacts between sediments and diorite intrusives, in the Pontiac sediments, a unique setting, similar to Canadian Malartic.

An updated resource at Palbec, filed in May 2020, shows a pit-constrained 101,400 oz in the indicated category, and 100,300 oz inferred.

Malartic West/ Surimeau

At the largely unexplored Malartic West property, Renforth plans to follow up channel and grab samples that revealed a copper and silver mineralized system known as the Beaupré Copper Discovery. In the northern part of the property this system has been traced over 175m and remains open.

The southern portion of the property hosts a ~21-km-long magnetic feature composed of mafic and ultramafic bodies which have only been explored historically at either end, where elevated nickel and zinc occurrences are noted. A similar magnetic feature in the central portion of the property is known to host gold.

Very recently, Renforth confirmed the presence of historic mineralization in the southern portion of Malartic West, including sphalerite, a zinc sulfide mineral, and minor chalcopyrite, a copper mineral. In a news release, the company also said that claims on the southern part of the property, hosting three areas of historic mineralization, has consolidated this system into the Surimeau project, keeping the claims separate from the Malartic West Block.

Conclusion

Renforth Resources (CSE:RFR) is in a very unique position for a junior mining company. It has outlined pit-constrained resources on two potential open-pit mines, one at New Alger, the other at Parbec – both of which are on the Cadillac Break, a deep crustal structure on the Abitibi Greenstone Belt, one of the largest gold districts on Earth.

And this is in Quebec, in 2018 rated the fourth-best jurisdiction for mining investment.

There are a lot of reasons to like this tiny 8-million-market-cap stock. Let’s start with location. Having so many neighboring mines affords Renforth certain advantages over other explorers. There is no need to set up a remote mining camp and figure out logistics for moving people and equipment in and out. Workers and management can literally drive to the property in the morning and come home at night.

Second is the advantage of milling infrastructure close by. Renforth is not looking at a large mine. We’re talking around 500,000 oz between the two pits. Figuring out a toll milling arrangement would allow Renforth to conduct mini-bulk sampling, at least temporarily, to earn some cash, enabling the company to pay for exploration programs that add more ounces.

Even if Renforth gets one or both pits into production, the volumes wouldn’t require construction of a mill; the material could become part of the existing toll milling arrangement, saving RFR millions on capital and operational expenditures.

If the company gets that far, it would surely be a good take-over candidate, considering there are mines in the area that could use more mill feed, and Renforth’s properties are all close by. Brewster told me, “I have the benefit of lots of neighbors who are milling the same rock.” She added,

“It’s not a bad position to be in with relatively high grade on surface in a camp that’s known to get better grades as you go deeper.”

Indeed, it will be interesting to see what grades come out of the mini-bulk sample, compared to the fire assays. RFR can use that information to do further drilling and add ounces for shareholders.

Combine all of the above with a tight share structure, a management philosophy that values conserving cash (90% of capital raised goes into the ground; the CEO and CFO are paid in shares) and the fact that Renforth doesn’t even have to hunt for mineralization, they already have it, and you have the makings of a very interesting gold play worth following.

Renforth Resources

CSE:RFR

Cdn$0.05, 2020.07.10

Shares Outstanding 213,836,539m

Market cap Cdn$10.69m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd YouTube

Ahead of the Herd Facebook

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.