Renforth encounters highest concentration of visible nickel to date from summer drilling at Victoria West

2021.07.24

Exciting drill results have become a norm for Renforth Resources Inc. (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) as it continues to explore the areas surrounding the mineral-rich Cadillac Break regional fault zone.

This week, the company announced it has completed the planned four-hole drill program at the 5 km long nickel, copper and zinc mineralized Victoria West target on its wholly owned 260 km2 Surimeau district property in Quebec.

These four holes from the June/July 2021 program are located within the 2.2 km of mineralized strike length drilled off by Renforth earlier this year. They were drilled using pads cut for the April/May drilling, where each hole had intersected visible nickel, copper and zinc sulfides.

The first hole (SUR-21-19) was previously announced on June 29. Like all the holes drilled in the prior 2021 program at Surimeau, this one encountered visual mineralization in the form of copper.

Specifically, the drill hole intersected mineralization from 175.5-178.65m down the hole with 5-10% fine to medium-grained disseminated pyrite and pyrrhotite. The best (visual) bit is from 176-176.7m, where there are fine clotty chalcopyrite stringers (5%), semi-massive pyrite and pyrrhotite (15-20%), and trace sphalerite.

The latest announcement on July 20 concerns the second hole (SUR-21-20), in which visible massive pentlandite was encountered within a vein located 160m down the hole, an approximate vertical depth of 139m.

Not only that, this occurrence is the highest concentration of visible nickel encountered in Renforth’s drilling at Victoria West, following the highest concentration of visible copper intersected to date seen in SUR-21-19, the first hole.

That makes it back-to-back hits for the company at this sulfide-rich VMS target, with two more drill holes still left to report.

Photos of the two drill cores (SUR-21-20 and SUR-21-19) are shown below:

Commenting on the visible nickel in SUR-21-20, Renforth’s president and CEO Nicole Brewster said: “The visible pentlandite in the second hole of our just completed program, along with the visible copper in the first hole, which was pictured in our last press release, is exciting to me as it is occurring as we drill deeper that we have before at Surimeau.

“Unfortunately, equipment issues affected the end of this program, however, it is incredibly exciting to create new data on our battery metals project,” she added.

The drill core will be detail logged and samples submitted for assay. The company is also waiting on assay results from the April/May program.

Surimeau – Victoria West

Victoria West is currently one of six polymetallic target areas on the Surimeau property historically documented as hosting mineralization, with several targets confirmed as mineralized and explored by Renforth.

The Victoria West target area is located within the western 5 km of a 20 km magnetic anomaly that hosts proven mineralization at either end, with the Colonie Target area at its eastern end.

The first drilling at Surimeau by Renforth occurred in October 2020 with 2.5 short holes completed. Those results supported the April/May drilling earlier this year, and visual results of that program were subsequently used for the June/July drilling.

A total of 15 holes for 3,456 m of drilling were completed during the prior 2021 program, drilling off 2.2 km of strike within the approximately 5 km long Victoria West Target area.

Another four holes totaling about 1,000 m were drilled this summer from the previously used drill pads located within the magnetic anomaly at Victoria West (the southern collar in each pair of holes), with the hole drilled to the north as an attempt to obtain depth extension of the mineralization seen in the spring 2021 drilling.

Results for both programs are still outstanding.

The 2020 drilling previously returned assays of 0.156% Ni over 13m, including 0.483% Ni over 1.0m (SUR-20-003; this hole ended due to equipment breakdown); 0.126% Ni over 20.5m, including 0.209% over 2.4m (SUR-20-002); and 1.16% Zn and 0.132% Cu over 4.03m from the bedrock surface down to 4.0m, followed by 0.147% Ni over 7.9m (SUR-20-001).

The Victoria target was last explored in the 1990s by LAC Minerals looking for gold. In addition to the presence of gold, which did not meet the criteria then used (in a much different gold price environment) for further development, LAC and previous operators determined that there was nickel, zinc and copper present, plus a few more minerals.

Renforth’s initial fieldwork validates the presence of the mineralization, and the company’s focus now is to determine the scope of the battery metals on the largely underexplored property.

Significance of Nickel Sulphides

The apparent presence of nickel mineralization at Victoria West, from surface to some depth, is an important development. The reason being — there is a severe shortage of the metal coming.

Nickel is earmarked as one of the key minerals for achieving a “green economy”, as it is essential for building our electric vehicle batteries.

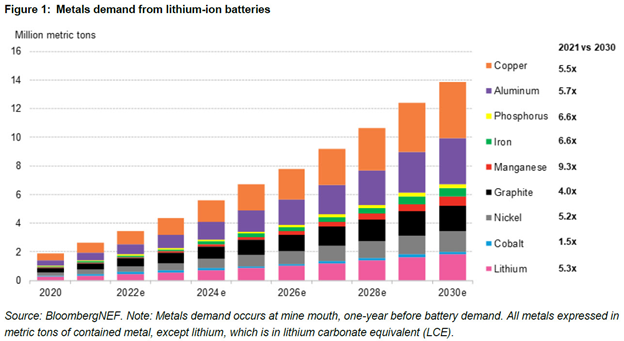

According to CRU, global nickel usage in batteries is expected to grow seven-fold from 70,000 tonnes in 2017 to 240,000 tonnes in 2023, a compound annual growth rate (CAGR) of 20%.

The Bank of America projects that, based on an estimated 13.6 million EVs sold in 2025, the world would need 690,00 tonnes of nickel. That represents nearly the entire mined supply of Indonesia, the world’s top nickel producer.

So, the straightforward solution would be to mine more nickel. But there’s one critical problem: not all nickel is suitable for making EV batteries.

In fact, not even half of the world’s nickel resources can be considered battery-grade.

A majority, about 60%, of the world’s known nickel resources are laterites, which tend to be found in the Southern Hemisphere and mostly go into stainless steel production.

The remaining 40% are sulfide deposits, formed through the precipitation of nickel minerals by hydrothermal fluids. The main benefit of sulfide ores is that they can be processed at relatively low cost, and with minimal waste, using a simple flotation technique.

Battery cathodes require high-purity nickel, in the form of nickel sulfate, derived only from ‘Class 1’ high-grade nickel sulfide deposits, which are not easy to find around the globe.

Historically, nickel production from sulfide ores came from only a few places, including the giant (>10 million tonnes) Sudbury deposits in Canada, Norilsk in Russia and the Bushveld Complex in South Africa.

However, existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting, nickel laterites such as those in the Philippines, Indonesia and New Caledonia.

According to BloombergNEF, demand for Class 1 nickel is expected to outrun supply within five years, fueled by rising consumption by EV battery suppliers.

Where will mining companies look for new sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically, technically and environmentally feasible? The pickings are slim.

Next Nickel Sulfide Deposit?

Decades of underinvestment explain the lack of large-scale greenfield nickel sulfide discoveries over the years. Only one nickel sulfide deposit has been discovered in the past decade and a half: Nova-Bollinger in Western Australia.

The result of such limited nickel exploration is a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions.

Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers.

This brings us back to Renforth and its Surimeau project, where successive drilling at the Victoria West target is already alluding to higher concentrations of nickel mineralization as it gets deeper. And with that, the company is now on the verge of defining the nickel (and copper, zinc) sulfide mineralization at Surimeau.

Unlike most copper-zinc VMS systems around the world, this district property also happens to host an ultramafic sulfide nickel system at surface in Victoria West.

Renforth has compared this to another “Outokumpu-like” occurrence, referring to a district in eastern Finland known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold.

Between 1913 and 1988, about 50 million tonnes of ore averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined from three deposits in that district.

Remember, Victoria West is only one of several base metals targets identified on the Surimeau property, so there may be more surprises to come from future exploration.

But for now, even one potential nickel discovery could prove to be significant, seeing as there’s already a dire need of the battery metal, and the “right kind” of nickel only exists in sulfides, which in itself are extremely rare.

With the electrification and decarbonization process in full motion across North America, more of these high-quality, scalable sulfide nickel deposits will be called upon as existing ones begin to tap out.

Given that a global nickel shortage is not too far away, it becomes evident where Renforth would fit in the equation.

Renforth Resources

CSE:RFR, OTC:RFHRF, WKN:A2H9TN

Cdn$0.085 2021.07.23

Shares Outstanding 251m

Market cap Cdn$21.3m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.