Renforth drilling at Surimeau hits visible net-textured sulphides commonly seen on magmatic deposits – Richard Mills

2023.05.23

Electrification and decarbonization continue to be one of the most dominant investment themes in the world, as we’ve established earlier.

The move away from fossil-fuel-powered vehicles to electric ones that run on batteries is happening in almost every country. Governments are spending billions on EV charging infrastructure and subsidies to incentivize consumers to switch to hybrids and plug-in electric cars, vans and trucks.

Last year the amount of money invested in decarbonizing the world’s energy system surpassed a trillion dollars for the first time. It was also the first year that the $1.1 trillion which poured into the energy transition matched the $1.1 trillion global investment in fossil fuels.

While a trillion is obviously megabucks, it’s still far from enough to meet net-zero requirements by 2050. To get there, the world would need to immediately triple this spend — and add hundreds of billions of dollars more for the global power grid, Bloomberg estimates.

Part of this massive capital outlay will involve the search for more raw materials. These can be copper, the cornerstone of all electric-related technologies, whose demand is set to grow by 53% to 39 million metric tons by 2040, according to BloombergNEF.

These can also be EV battery metals like lithium, cobalt and nickel, for which demand would rise even faster, averaging more than three times the current demand levels by 2030, says BNEF.

To reach net-zero by 2050, demand for key metals used in energy transition technologies such as solar, wind, batteries and electric vehicles must grow at least fivefold, BNEF adds. Metals analyst Yuchen Huo estimates that it would take almost $10 trillion worth of metals between now and then to hit our climate goals.

Calling For New Mines

The transition to clean energy would be all well and good if we have enough mineral resources, but the reality is, the world is running out of supply for these metals.

Take copper, for example, analysts at Goldman are predicting that “we’ll be at the lowest observable inventories that have ever been recorded at 125,000 tonnes” in 2023. By year-end, the copper market is expected to be undersupplied, and sometime in 2024, peak supply will arrive, generating deficits from that point, the bank said.

“The market overall is pretty tight,” Robert Edwards, copper analyst at CRU, concurred in a Wall Street Journal piece. “Longer term there’s a narrative around resource scarcity and the green transition with EVs and renewables as well as the build-out of electricity grids. On paper, it’s quite a substantial supply gap opening up over the next 10 years.”

As for battery metals, a report by the International Energy Agency (IEA) showed that literally hundreds of new mines must be built to meet the projected needs by 2030. This, based on IEA calculations, equates to a 10x increase over the current critical minerals supply chain.

Of all the key metals needed, nickel is facing the largest absolute demand increase as high-nickel chemistries are the current dominant cathode for EVs and are expected to remain so, the IEA report found.

As many as 60 new nickel mines would be needed by 2030 to meet global net carbon emissions goals, the IEA estimates. BHP, the world’s biggest miner, expects global demand for nickel to grow as much as fourfold over the next 30 years as electric vehicles almost entirely replace traditional cars.

All this means is that companies must up their exploration efforts to locate the next critical minerals deposit containing lots of nickel, copper, and other metals, and are large enough to support the global energy transition efforts.

District-Scale Polymetallic Project

Locating such a mineralized system is never easy, but the chances are much better when exploration consistently gets rewarded with positive results, especially over a large area with sufficient samples to show. This is what Canadian junior miner Renforth Resources (CSE:RFR, OTCQB:RFHRF, FSE:9RR) has been doing at its Surimeau project in Quebec.

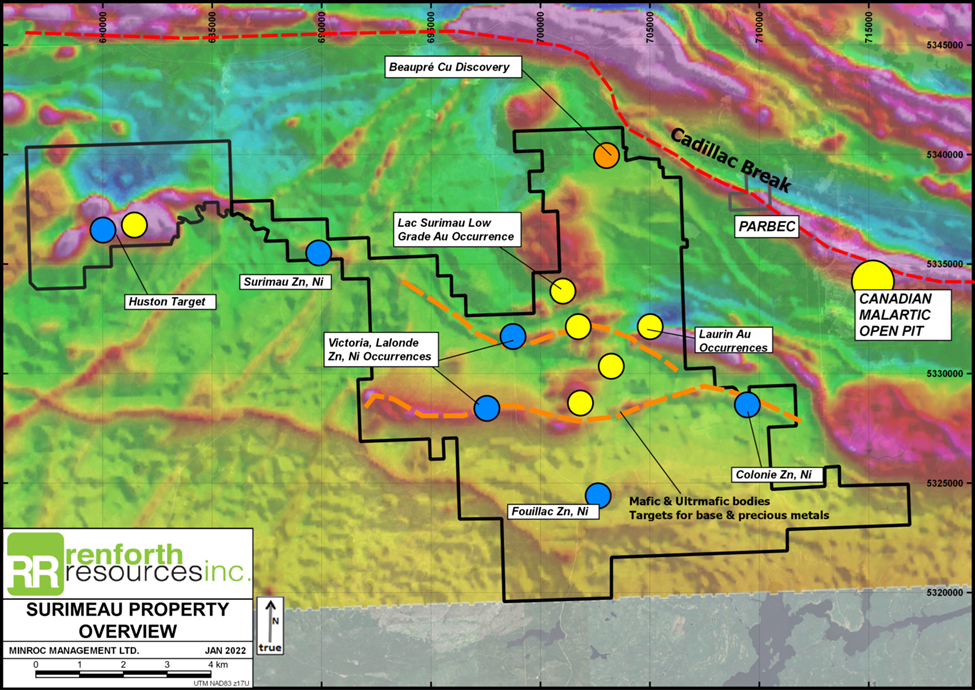

Surimeau represents a district-scale property hosting several areas prospective for gold/silver and battery/industrial metals (nickel, copper, zinc, lead, cobalt, lithium and manganese). It is located south of the Cadillac Break, a major regional gold structure.

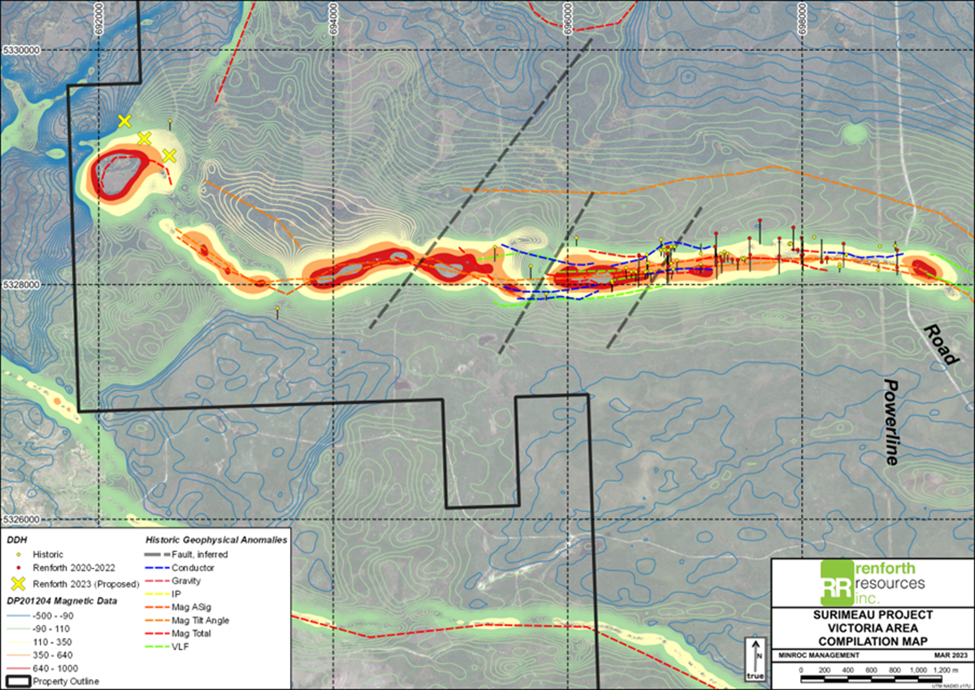

For the better part of two years, Renforth’s exploration focus has been on the more advanced Victoria mineralized battery metals horizon and parts of the longer Lalonde horizon lying parallel to the north (see map below).

Victoria is a ~20km long “ground truth” magnetic structure bearing nickel, copper, zinc and cobalt mineralization at surface. It stretches between the Victoria West mineralization, which has been drilled over 2.2 km in the west, and the Colonie mineralization, drilled and surface sampled by Renforth in the east.

The Lalonde mineralization, located ~3 km north of Victoria West, was only recently drilled by Renforth. This surface mineralized system, similar to Victoria, currently stretches over ~9 km of ground-truthed strike.

Both zones are about 250-500 metres in thickness, running east-west across the central portion of the property. The two systems are interpreted by the company as two arms of a fold, with the fold nose located off the property and to the east.

While the defined area of mineralization spans a total length of ~29 km, which by industry standards is a long distance to cover, this is still just a small portion of a district property that remains underexplored.

Drilling in New Area

This year, the Renforth team started to move farther out, drilling in an area about 4 km west of the Victoria structure where work first began on the property.

The initial results had three holes intersecting visible mineralization similar to those encountered in the east, which the company describes as “quite exciting”, as they confirmed the accuracy of their geophysics and interpretation.

To recap, an airborne electromagnetic (EM)/magnetic (mag) survey by Renforth had interpreted the western end of Victoria as showing an interesting curvature, possibly representing folding which may have resulted in mineralized fluid entrapment.

As far as we know, the ~20 km Victoria trend consists of ultramafics flows intercalated with graphitic mudstones, albite shears and calc-silicate rocks. The ultramafics and calc-silicates are what host most of the higher-grade nickel and cobalt mineralization within the structures, while the graphitic mudstones and albite shear host most of the higher-grade zinc and copper mineralization as sphalerite and chalcopyrite respectively.

Surface sampling by the company had identified mineralization within the ultramafic rocks, with bands of calc-silicates typical of the Victoria system. Except for Renforth’s prospecting, the area of the aforementioned curvature has not been previously explored or drilled.

Renforth CEO Nicole Brewster previously said the drilling under surface mineralization, known as undercutting, represents “a huge 4 km step out on strike” from where the company last drilled. This more or less indicates that the Victoria structure could be even bigger.

“While we have been talking about a mineralized structure that is approximately 20 km long, which we see in our mag survey, and which has measured EM anomalies along its entire length, and which we have surface sampled all along, there are some people who will not take this seriously until it is drilled,” Brewster noted.

Drilling Sneak Peek

Renforth is now moving closer to uncovering the true potential of the Surimeau polymetallic mineralization, as demonstrated in its follow-up exploration update.

A six-hole drill program has now been completed on the property, as per the company, with each encountering mineralized graphitic mudstones hosting copper, zinc and nickel. These holes were drilled over an approximate 700-metre strike at the western end of the Victoria polymetallic mineralized structure.

What’s noteworthy was that this drilling intersected net-textured sulphides, which Renforth considers to be of interest as its aim is to discover the source of the VMS stringer mineralization observed in this, and prior, drill programs at Surimeau.

The westernmost, and high-priority geophysical (mag & EM) anomaly at the western end of Victoria was the target of this drill program; The six drill holes into the structure in this area revealed that the mineralized graphitic mudstone, seen all along the 20km strike of Victoria in drill holes and surface prospecting, is in fact thickening, as observed by the Renforth team.

In this area, based upon visuals and XRF readings, the mudstones deliver a consistent nickel value, along with higher levels of zinc and copper mineralization. Samples have been submitted for assay, results will be released as available.

Conclusion

On the drilling that was just completed, this was what Renforth CEO Brewster had to say: “We are having success in an area which has never been drilled before, in a very underexplored part of one of Canada’s most established and successful mining camps.”

The fact that all six holes hit net-textured sulphides towards the west is actually quite significant, as about 80% of the magmatic Ni-Cu-PGE (platinum group element) deposits found in Ontario’s Ring of Fire area have this kind of textural facies, studies found.

Remember, the Victoria structure is one of two critical minerals systems defined on the Surimeau district property with significant open pit potential. First drilling at the northern Lalonde trend has revealed grades and widths comparable to what was seen on surface, warranting further exploration.

Speaking of critical minerals, there’s also a Surimeau wildcard: lithium. Through limited prospecting and sampling last year, the company discovered that most of the Surimeau property, in particular the southern portion, is prospective for pegmatites. In 2023, the team plans to find new pegmatites and continue mapping and sampling of existing ones on the property, which is another plotline to monitor.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.02; 2023.05.22

Shares Outstanding 326m

Market cap Cdn$6.5m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com. This article is issued on behalf of RFR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.