Renforth continues to unlock huge VMS/ sulfide nickel system at Surimeau, Quebec

2021.04.01

Renforth Resources (CSE:RFR, OTC:RFHRF, WKN:A2H9TN) is making good progress at its Surimeau polymetallic project in Quebec, adjacent to the Canadian Malartic Mine, currently the largest gold mine in Canada, and about 20 km south of Agnico Eagle’s LaRonde Mine. The sprawling 215-square-km property hosts a known copper and zinc mineralized system, with additional geophysical anomalies. There is also an ultramafic sulfide nickel system nearby.

Four new holes

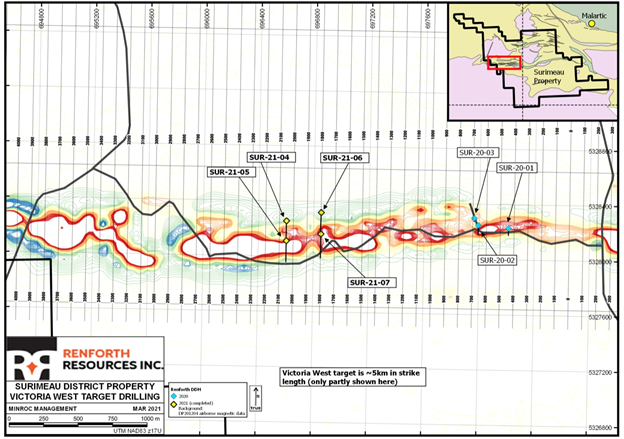

In the latest news, announced on Wednesday, March 31, Renforth said step-out drilling (1,350m) at its Victoria West target hit visible nickel, copper and zinc sulfides, a promising result from last fall’s short (194m) drill program.

Out of four new holes drilled to the west of the first three holes (SUR21-01 to 03), two (SUR21-04 and 07) intersected Ni, Cu and Zn sulfides, hosted primarily in bands of graphitic siltstones and quartzites within thick bands of ultramafics. The most common sulfide is pyrrhotite, with chalcopyrite, a copper mineral, often seen within silica-rich veinlets and stringers. The zinc sulfide mineral sphalerite, and pentlandite, an iron-zinc sulfide, are also present.

Samples from the four holes have been split and delivered to the lab for assaying.

The 2021 drill program at Surimeau was announced on March 25, with 3,500m in 16 holes planned.

According to Renforth, information gleaned from drilling and trenching the Victoria West target, along with surface sampling, create an area of interest that includes about 5 kilometers of strike on the western end of a 20-kilometer anomaly.

The company interprets this anomaly to be a nickel-bearing ultramafic body, which occurs alongside, and is intermingled with, sediment- and volcanic-hosted copper-zinc VMS-style mineralization.

In fact, Renforth considers the style of mineralization to be an “Outokumpu-like” occurrence, referring to a district in eastern Finland known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold. About 50 million tonnes of ore averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined from three deposits between 1913 and 1988.

At Surimeau, about 3 km of the 5-km strike length will be drill-tested this year as a follow-up to Renforth’s earlier surface and sub-surface sampling programs which confirmed the presence of sulfide nickel, zinc, copper and silver mineralization.

Drilling so far has revealed that the ~200-meter-thick mineralized lithologies dip north at about a 50-degree angle, indicating a potential relationship between the Victoria West target and the LaLonde target about 3 km to the north. “The mineralized material intersected by the drill is visually identical to the material observed on surface at LaLonde. This observation will require follow up work,” the company states.

Large-scale potential

Renforth is fortunate enough to have a nickel sulfide deposit at surface whose secrets it is just starting to reveal to the market.

Just how large this nickel sulfide system is, remains to be seen.

RFR is clearly hoping to find high-sulfidation nickel appropriate for lithium-ion batteries that would make the project and/ or the company attractive to potential acquirers. Evidence of the nickel purity was announced on Feb. 18. According to the company, grab samples taken from surface showed an average 68% sulfide nickel content, supporting its exploration thesis that “with 5 kms of mineralization observed at Victoria West alone, is a large- scale battery-grade nickel discovery on surface.”

Interestingly, all the samples except one were taken from Victoria West. The other lone sample taken from LaLonde returned the highest sulfide percentage, suggesting the possibility of higher nickel sulfidation in the northern part of the anomaly.

A little back-of-the envelope math by yours truly shows the potential for an impressive sulfide nickel/ VMS deposit of significant scale at Surimeau, to interest a major mining company or funding partner.

From the Feb. 9 drill results, we have:

- 0.156% nickel over 13m, including a higher-grade 1-meter section of 0.483% Ni in hole 3

- 0.126% Ni over 20.5m, including 0.209% Ni over 2.4m in hole 2

- 1.16% zinc, and 1.132% copper over 4m, followed by 0.147% Ni over 7.9m in hole 1

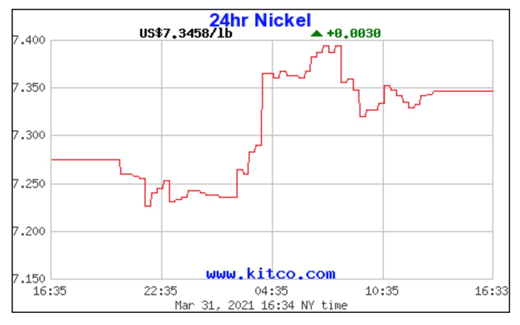

Setting an average grade of 0.224% Ni at current nickel prices of US$8.47 per tonne works out to US$41.83/ Cdn$53.04 per tonne rock.

Of course, a percentage of the rock will not be ultramafic and some of it will not be recoverable. But even at a very conservative potentially mineable estimate we are talking about belonging to an enviable peer group!

If the Surimeau property can manage an only nickel grade – using no other metal credits like the contained copper and zinc – of 0.224%, the in-situ value per tonne would be equivalent to a copper deposit of 0.48% Cu (US$41.38/tonne rock).

Electrification and decarbonization

Renforth is exploring Surimeau at a very interesting time for battery and energy metals, including nickel, copper and zinc found on the property.

As countries gradually recover from the pandemic, substantially better economic growth rates naturally will push the demand for commodities higher. This is one of several factors behind what many believe is a new commodities super-cycle.

The last super-cycle, starting in 2003, was driven by China, which demanded almost every commodity under the sun to meet double-digit annual increases to its GDP. This time is different. I believe we are going to see demand across the board for nearly every type of commodity, based on infrastructure renewal, electrification, reduction of carbon, and food demand.

The fossil-fueled based transportation system needs to be electrified, and the switch must be made from oil, gas, and coal-powered power plants to those which run on solar, wind and thorium-produced nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

In a recent report, commodities consultancy Wood Mackenzie said an investment of over $1 trillion will be required in key energy transition metals over the next 15 years, just to meet the growing needs of decarbonization.

A green infrastructure spending push will mean a lot more energy metals will need to be mined, including lithium, nickel, and graphite for EV batteries; copper for electric vehicle wiring and renewable energy projects; silver for solar panels; rare earths for permanent magnets that go into EV motors and wind turbines; and tin for the hundreds of millions of solder points necessary in making the new electrified economy a reality.

Metal supply however will not be able to match this unprecedented level of demand, without the discovery of new mineral deposits from which to mine the metals of the future.

We already have current and emerging structural deficits for several metals, that will keep prices buoyant for the foreseeable future. This includes copper, nickel, zinc and lead.

Nickel

Nickel is an interesting metal to watch, considering the challenges that nickel mining companies face in ramping up production to meet skyrocketing demand for high-purity nickel required in electric vehicle batteries.

In addition to its traditional role in stainless steelmaking, the base metal is becoming more and more important due to its use in nickel-cobalt-aluminum (NCA) and nickel-cobalt-manganese (NCM) lithium-ion batteries. NMC 811 battery cells (8 parts nickel, 1 part each lithium and cobalt) are being produced on a greater scale, because they deliver higher energy density and greater storage capacity, at lower cost.

However, the nickel market is currently under-supplied, in relation to demand, a condition that is supporting higher prices. Spot nickel recently hit a six-year high of US$8.40 a pound. It is up amid rising demand expectations pertaining to the electric vehicle battery sector, and strengthening macroeconomic conditions (especially in Asia) as some economies lift coronavirus-related restrictions, that have led to higher consumption of raw materials for making stainless steel.

In fact nickel market participants are eyeing the $20,000/tonne threshold that analysts believe could spur investment in new supply. What could push nickel to such lofty heights? In a word: EVs.

According to a recent report by Roskill, released by the European Commission’s Joint Research Centre, nickel demand is in for an exponential growth spurt.

Based on the premise that automotive electrification will represent the better part of global nickel demand for the next two decades, the report says demand will shoot from 92,000 tonnes in 2020, to 2.6Mt in 2040, a 28X increase!

In 2020, global production of mined nickel for all uses, was only 2.5 million tonnes.

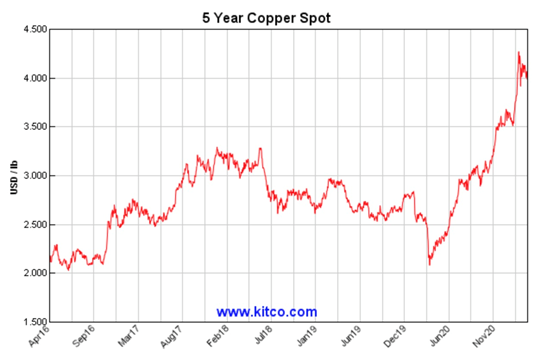

Copper

Copper is trading over $4.00 a pound this year on rapidly tightening physical markets, rebounding economic growth especially in China, the top metals consumer, and the expectation that the era of low inflation in key economies may soon be over.

Rising more than 22% in 2020, copper had its best year since 2017, with prices boosted by hopes for “green” stimulus (the red metal is an important component of electric vehicles and renewable energy systems. The United States, EU and China have all promised trillions worth of green infrastructure spending), the global 5G build-out, China’s recovery from the coronavirus, and virus-related supply disruptions in top copper producers Chile, Peru and Mexico.

“This current price strength is not an irrational aberration, rather we view it as the first leg of a structural bull market in copper,” Goldman Sachs analysts said in December, with the investment bank raising its 12-month forecast to $9,500 a tonne, or $4.30/lb.

On the spot market, the base metal has advanced 14% year to date, and its run is likely far from over. Reuters quotes the chairman of Chinese metals trader Maike Group, saying that copper will surge to an all-time high over the next 12 months, as a result of strong demand from China’s clean energy drive and years of under-investment in global mine supply.

He Jinbi, who founded Maike in the 1990s, believes as top consumer China builds metals-intensive renewable energy and electric vehicle infrastructure, copper and other base metals will see serious supply deficits in the future and be subject to capital inflows.

“The market will gradually accept it, because with the recovery of the global consumption market there will also be a shortage of copper in the European and American markets,” he said.

“Global investment in mineral resources “has been seriously inadequate in the past five years,” Jinbi told Reuters.

Frenzied copper buying is reflected in plummeting inventories, as the 5-year LME copper warehouse stocks level chart shows.

Zinc

Primarily used to coat and protect steel from corrosion, zinc is unquestionably a staple in a nation’s infrastructure buildout. What also makes zinc a critical commodity is the metal’s fundamental role in building a green energy future.

Like copper and nickel, zinc has clean energy applications. It can be used as anode material for batteries, making it a key part of energy storage systems as we move towards a world of renewables.

“These minerals and metals are essential to lowering emissions, they are essential to net-zero by 2050; they are essential to our economic competitiveness and our energy security; they meet the needs of our partners and the demands of emerging global trends,” Canadian Natural Resources Minister Seamus O’Regan said at the recent PDAC convention.

Recent research also shows batteries built around zinc can be a cheaper, safer, and more effective alternative to the lithium-ion battery systems commonly used in electronics and electric vehicles today. This finding could even potentially alter the landscape of the global energy storage market.

According to the International Zinc Association (IZA), annual demand for zinc in batteries was only 600 tonnes in 2020, but that figure is projected to rise to 77,500 tonnes by 2030.

Indeed, zinc demand has already been on the rise over the past months as economies emerge from the pandemic looking to ramp up industrial activities. This was evident in the metal’s price movements: Following last March’s low of $0.83/lb, spot zinc ran to nearly $1.30/lb, its highest in more than 18 months.

In December, commodities research firm CPM Group said it sees zinc trading at around $2,628/t ($1.19/lb) this year, up 17% from the average price in 2020. In 2022, the galvanizing metal should rise another 8.7% from the 2021 level to $2,857/t ($1.29/lb), it added.

So far, those bullish predictions have been upheld by stronger demand for industrial metals around the world. In China, zinc prices last week jumped to their highest in three years, buoyed by prospects of demand improvement in what is by far the largest consumer of the metal.

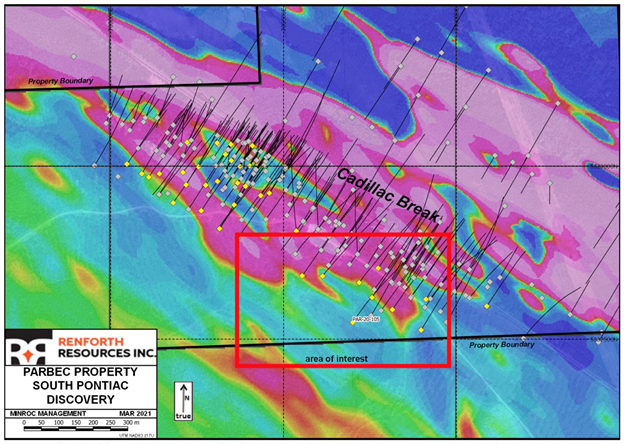

Parbec

Along with Surimeau, Renforth continues to advance its Parbec gold project, also in Quebec, releasing a cache of drill results to the market on March 9. The highlight from was 21.45 meters grading 5.57 grams per tonne (g/t) gold, between 254.8m and 276.2m meters in hole PAR-20-112. Two higher-grade sub intervals returned 6.27 g/t Au over 16.7m and 37.3 g/t Au over 1m. Renforth expects that the high-grade interval from drill hole PAR-20-112, other above-noted highlights, and the previously released assays from holes PAR-20-100 to 104 will have a positive impact on a future re-calculation of the resource estimate for Parbec.

The current pit-constrained resource contains 101,400 indicated ounces of gold at a grade of 1.77 g/t Au and 100,300 inferred ounces @ 1.56 g/t Au.

More good news came on March 21, when Renforth announced discovery of a new gold zone in the Pontiac sediments just south of the Cadillac Break, a regional fault zone thought to host a whopping 45 million gold ounces. The world-renowned structure stretches from west of Kirkland Lake in Ontario to east of Val d’Or, Quebec.

Excitingly, the discovery it outside of the current resource model.

Samples taken from the top of hole PAR-20-105 returned assay highlights of 5.34 g/t Au over 1.5m; 15.8 g/t over 0.5m; and 6.43 g/t over 3.0m.

According to Renforth, The current interpretation for the presence of gold in this location is that the large magnetic anomaly may be a diorite which we have not yet seen on surface, or in prior drillholes, which pinches out (as indicated by the black dashed line), making the area around this nose prone to deformation and the emplacement of quartz veins… This is a new gold setting at Parbec which will require additional investigation in order to determine the extent.

The drill program at Parbec started by Renforth in September 2020 finished with 5,925m in 22 holes, leaving a total of 15,569 meters drilled.

However, the news flow is far from over, with 42 holes still to report.

The drill has now been moved to Surimeau where the crew will focus on completing the planned 3,500m.

Conclusion

Though early stage, the possibility of widespread sulfide nickel mineralization at Surimeau looks promising. The grades and rock value given here are conservative; the 0.224% Ni used to calculate the rock value of US$41.83 per tonne is based on only three intercepts from three holes drilled at Surimeau, less than 200m. Highlights from summer 2020 grab sampling show grades up to 0.495% Ni. If those grades start showing up in drill core, Renforth could really be onto something.

The last four holes hit visible nickel, copper, and zinc sulfides — a very good sign.

Over at Parbec, an extensive drill campaign of 15,569 meters surely has given Renforth a lot of data for updating the resource model. Assays released in early March showed some high-grade hits (the highlight was 21.45 meters grading 5.57 g/t Au), and the discovery of a new gold zone in the Pontiac sediments is encouraging. With many more holes still left to report, it seems likely that RFR will add to the current May 2020 resource (pit-constrained + out of pit) of 104,500 indicated oz @ 1.78 g/t Au and 177,300 oz inferred @ 1.77 g/t Au.

Renforth is advancing both properties at an interesting time for metals. Joe Biden’s $1.9 trillion covid-19 relief bill, the planned $4 trillion in infrastructure spending and an additional $2 billion for clean energy, looks inflationary to me.

Gold is a hedge against inflation, so it is generally bought when inflation goes up, or looks like it will, to guard against currency devaluation. I believe the current pull-back in gold prices is temporary, and the bull market will resume when we get inflation, a lower dollar, a higher debt to GDP ratio (even higher than the current 129%), negative real interest rates (always good for gold) or some combination of all four.

Battery and energy metals including nickel, copper and zinc are on a tear due to global infrastructure build-out promises, along with the burgeoning needs of the new green economy.

The world’s top carbon emitters are a long way from aligning their climate goals with the Paris agreement, something that shareholders are demanding, meaning soon they are likely to seek higher amounts of raw materials required for decarbonization and electrification.

Reducing their carbon footprint though, is unachievable without a major push by the mining industry to find and produce more battery- and clean-energy metals.

In our opinion, as the competition for materials needed to go clean and green heats up, prices can only go higher.

Renforth Resources

CSE:RFR, OTC:RFHRF, WKN:A2H9TN

Cdn$0.075 2021.03.31

Shares Outstanding 251m

Market cap Cdn$17.0m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Renforth Resources (CDE:RFR). Renforth is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.