Renforth bringing in experts to advance Surimeau battery metals project, based on Finland deposit analog and bioleaching process – Richard Mills

2023.10.07

The urgency to expand and diversify the world’s critical minerals supply chain has become a major investment theme in recent years, driven by strong demand for raw materials to feed the global energy transition.

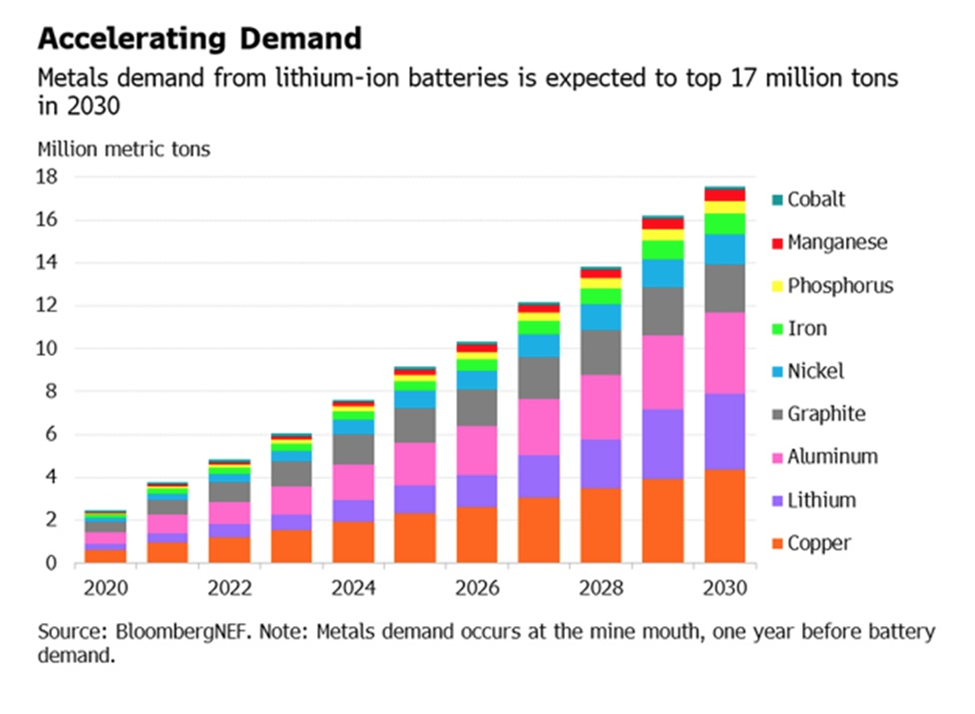

BloombergNEF estimates that total demand for battery metals could surpass 17.5 million tons by the end of the decade, with lithium set to grow the fastest, surging more than sevenfold between 2021 and 2030.

The International Energy Agency forecasts mineral demand for use in electric vehicles and battery storage will grow at least 30 times by 2040.

Lithium grows by over 40X in its Sustainable Development Scenario, followed by graphite, cobalt and nickel (around 20-25 times). The expansion of electricity networks also means that copper demand could more than double over the same period, the agency estimates.

To reach net-zero, demand for these key metals needed for the deployment of energy transition technologies such as solar, wind, batteries and electric vehicles will grow fivefold by 2050, BloombergNEF research finds.

The challenge for the industry is to develop more mines. For nickel alone, as many as 60 new mines will be needed by 2030 to meet global net carbon emissions goals, the IEA estimates.

Diversification is also a challenge, as a highly concentrated critical minerals supply endangers future supply security. The latest edition of the IEA’s Critical Minerals Market Review reveals that supply sources of key EV metals like nickel and cobalt remain heavily concentrated (in Indonesia and the DRC, respectively), despite efforts to rectify that.

A key takeaway from the report is that the West still has a long way to go before having a reliable, sustainable supply of critical minerals, and more mining projects must be developed domestically. A potential hot spot is Quebec, and Renforth Resources (CSE:RFR, OTCQB:RFHRF, FSE:9RR) stands to benefit from its continued exploration of its Surimeau property.

Surimeau project

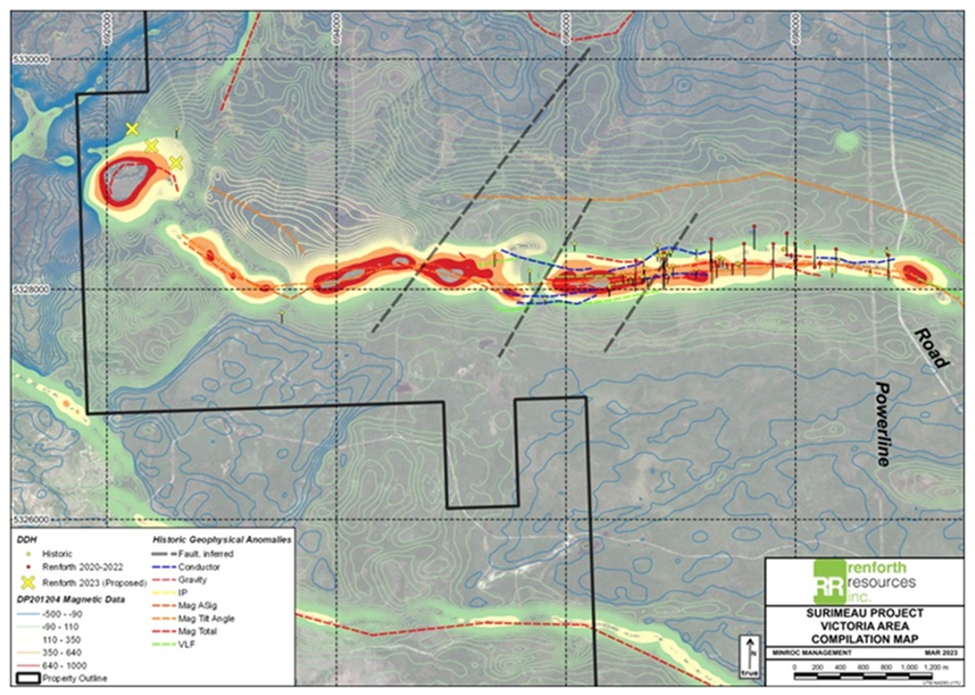

For the past two years, Renforth’s exploration focus has been on the more advanced Victoria mineralized battery metals horizon and parts of the longer Lalonde horizon lying parallel to the north.

Victoria is a ~20-km-long magnetic structure bearing nickel, copper, zinc and cobalt mineralization at surface. It stretches between the Victoria West mineralization, the central area which has been drilled over 2.2 km, and the Colonie mineralization, historically drilled and surface-sampled by Renforth in the eastern part of the property.

The Lalonde mineralization, ~3 km north of Victoria West, was only recently drilled by Renforth. This surface mineralized system, similar to Victoria, currently stretches over ~9 km of ground-truthed strike.

Both zones are about 250-500 meters thick, running east-west across the central portion of the property. The two systems are interpreted by the company as two arms of a fold, with the fold nose located off the property and to the east.

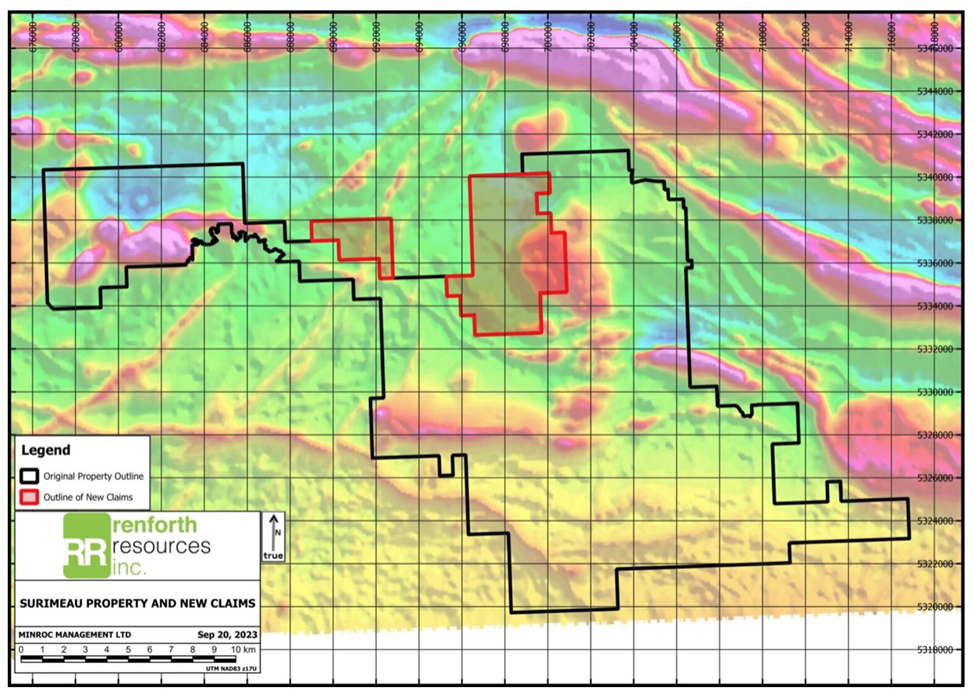

While the defined area of mineralization spans a total length of ~29 km, which by industry standards is a long distance to cover, this is still just a small portion of a district-scale property that remains underexplored.

Earlier this year, the Renforth team started to move farther out, drilling in an area about 4 km west of the Victoria structure where work first began on the property.

In September, Renforth staked an additional 62 claims north of Lalonde — the balance of the mineralized magnetic anomaly discovered in the latest prospecting program — as well as historical government soil samples. When field operations resume this month, an effort will be made to prospect certain areas of the newly acquired claims.

An airborne electromagnetic/magnetic survey interpreted the western end of Victoria as showing an interesting curvature, possibly representing folding which may have resulted in mineralized fluid entrapment.

As far as we know, the ~20 km Victoria trend consists of ultramafic flows intercalated with graphitic mudstones, albite shears and calc-silicate rocks. The ultramafics and calc-silicates are what host most of the higher-grade nickel and cobalt mineralization, while the graphitic mudstones and albite shears host most of the higher-grade zinc and copper mineralization as sphalerite and chalcopyrite, respectively.

Surface sampling identified mineralization within the ultramafic rocks, with bands of calc-silicates typical of the Victoria system. Except for Renforth’s prospecting, the western end of Victoria had not been previously explored or drilled.

A six-hole drill program was carried out in March/April, with each hole encountering graphitic mudstones hosting copper, zinc and nickel. These holes were drilled over an approximate 700-meter strike length.

The main finding of the drill program, as indicated by Renforth in a June 20 press release, is an increase in the frequency and thickness of the graphitic mudstone layers. Moreover, this mudstone is like the mineralization seen in the first holes drilled at Surimeau, about 6 km to the east, and it is also exposed at surface south of the previously drilled 2.2 km of Victoria strike.

Based on visuals and XRF readings, the mudstones deliver a consistent nickel value, along with higher levels of zinc and copper.

Zinc-rich graphitic mudstones at Surimeau are characteristic of a VMS environment, some of which may host economic VMS mineralization. According to Renforth, the mudstone is in direct structural contact with the surrounding ultramafic bodies. Alteration of the ultramafics to calc-silicates along this contact is at times significant with widths of up to several meters. The calc-silicate-rich rock adjacent to the graphitic mudstones often host zinc and nickel, occurring as a significantly wider mineralized horizon in localized zones along strike. These wider mineralized areas are priority targets for ongoing exploration.

Renforth is looking at two examples of similar mineralization as models to guide its interpretation and exploration planning at Surimeau: the Outokumpu model and the Talvivaara mine, both in Finland.

Victoria’s geological setting includes graphitic shale, mafic and ultramafic rocks, a setting like the Outokumpu polymetallic district in eastern Finland.

Surimeau-Outokumpu comparison

Surimeau’s geology is best described as a sulfide nickel magmatic sulfide deposit, juxtaposed with a copper-zinc massive sulfide deposit. The nickel-containing ultramafic orebody has been fused with the VMS deposit alongside it, giving it a unique geological flavor.

This style of mineralization is rare; however, it is known to occur in the Outokumpu District, which contains sulfide deposits with economic grades of copper, zinc, cobalt, nickel, silver and gold.

These deposits are formed by structural juxtaposition of two types of mineralization — magmatic nickel-copper-platinum group metals, and stratabound syngenetic zinc-copper VMS types. Additionally, in the Outokumpu mines, black graphitic schist hosts the deposits.

According to a technical paper,

Outokumpu-type deposits contain Cu-Co-Zn-Ni-Ag-Au. The first deposit of this type was found in the village of Kuusjärvi, North Karelia. The deposits are associated with ophiolites and enclosed in what is called Outokumpu assemblage. Similar deposits have been found around the world, but the Outokumpu area has the most and largest mineralizations to be found to date. There are numerous mineralizations found in the Outokumpu area. The Keretti, Vuonos, Luikonlahti and Kylylahti deposits having been mined and are the most significant ones. The current view is that the deposits have formed in a three-phase process. First deposition of hydrothermal sulphides at ultramafic ocean floor forming Cu proto-ore, then during obduction alteration of peridotite body margins forming Ni proto-ore. Final phase happened during regional deformation which remobilized the Cu and Ni proto-ores forming the current Outokumpu-type deposits.

Mining from 1913 to 1988 exploited three major deposits — Outokumpu, Vuonos and Luikonlahti — with total production of around 50 million tonnes of ore containing 2.8% copper, 1% zinc, 0.2% cobalt, and minor amount of nickel and gold.

The Outokumpu analog was first proposed by Dr. James Franklin. CEO Nicole Brewster brought him on as a technical advisor in 2021. Franklin is a member of the Canadian Mining Hall of Fame, and the former chief scientist for the Geological Survey of Canada.

Dr. Franklin agreed to look at Surimeau in part due to his expertise in VMS mineralization, he “wrote the book” in several exploration techniques for vectoring towards a “black smoker” VMS, which is a blind structure. The mineralization and its setting Renforth is seeing at Victoria, in the centre of Surimeau, might suggest a “feeder system” for a VMS, which Dr. Franklin has confirmed he sees indication of in his geochemical analysis of Renforth’s assay results.

In a press release Brewster stated:

“I consider Renforth fortunate to have at our disposal the knowledge and experience that is Dr. Franklin, the cumulative result of a long, successful career spanning the globe, discovering and developing a multitude of mineral deposits. This will focus and accelerate Renforth’s task, unlocking the true potential of our VMS discovery at Surimeau, in as efficient a manner as possible, with an experienced and high-profile industry veteran on our team.”

According to Renforth, the zinc-rich graphitic mudstones at Surimeau are characteristic of a VMS (volcanogenic massive sulfide) environment, some of which may host economic VMS mineralization, as the mudstone is in direct structural contact with the surrounding ultramafic bodies.

Alteration of the ultramafics to calc-silicates along this contact is at times significant with widths of up to several meters. The calc-silicate-rich rock adjacent to the graphitic mudstones often hosts zinc and nickel, occurring as a significantly wider mineralized horizon in localized zones along strike. These wider mineralized areas are priority targets for ongoing exploration.

The “Outokumpu model”, as designated by Renforth’s technical team, is based upon the company’s initial 2020 drilling which intersected significant mineralized graphitic mudstone in 2 of the 3 holes drilled, as well as its follow-up 2021 drilling. The results of the most recent drilling also support this model.

Dr. Franklin has also stated that Victoria evidences many characteristics of an “Outokumpu style” system, a mineralized setting Dr. Franklin is personally familiar with having visited and worked there. Outokumpu refers to a district in Finland where several deposits are located and have been mined, beginning in the early 1900s, there are similarities between them and differences, Surimeau fits geologically in this framework.

Bioleaching

Bioleaching refers to the extraction of metal from sulfide ores or concentrates using materials found in the environment.

In nature, bioleaching is triggered spontaneously by microorganisms in the presence of air and water. Commercial bioleaching technologies use the same phenomenon but accelerate this natural process.

Microorganisms catalyze the oxidation of iron sulfides to create ferric sulfate and sulfuric acid. Ferric sulfate, a powerful oxidizing agent, then oxidizes the copper sulfide minerals, and the contained copper is then leached by the sulfuric acid.

The world’s first bioheapleach project for nickel, and other battery metals, occurs just north of the Outokumpu District, at the Talvivarra mine, hosting mineralization containing nickel, copper, zinc and cobalt.

The heap-leach mine extracts ore from two small open pits, producing nickel and cobalt sulfates for batteries. Operator Terrafame states:

“The main factor behind the small carbon footprint is our bioleaching method, which consumes considerably less energy than conventional methods. The ore does not need to be crushed nor grinded as fine as in the traditional process, and high-temperature metallurgical processes are not used in further processing.”

At Talvivaara the bacteria used in the bioleaching process grow naturally in the ore. The company reports recovery rates of up to 98% of metal from ore to solution.

The heap leaching operates in two stages: a primary heap pad residence time of 1.5 years, and a secondary pad residence time of 3.5 years.

The process plant design includes two parallel circuits each rated at 600m3/h of pregnant leach solution (PLS). Each circuit consists of copper recovery, zinc recovery, neutralisation and aluminium removal, nickel and cobalt recovery, iron removal and then final precipitation.

The copper and zinc recovery units precipitate the metals from their sulphides in the PLS using hydrogen sulphide. The precipitates are then recovered in thickeners and filtered to produce saleable products. (Mining Technology, Nov. 16, 2008)

The potential for using bioleaching to process the ore at Surimeau is behind Renforth’s latest news announcing the appointment of its second technical advisor.

Dr. Nadia Mykytczuk’s focus will be on “the research and development of responsible and sustainable technology and practices for the processing of mineralized material at Surimeau in the future,” states the Oct. 4 press release. Mykytczuk, who won the Innovation Award at the 2022 Northern Ontario Business Awards, is president and CEO of Sudbury’s Mining Innovation Rehabilitation and Applied Research Corp. (MIRARCO), a non-profit research arm of Laurentian University; and the executive director of the university’s Goodman School of Mines.

Renforth’s CEO Brewster says, “Dr. Mykytczuk’s expertise is in the use of biological agents to remove elements from the environment, the biggest use of this in Northern Ontario is in the remediation of old mine sites which have left deleterious elements behind causing pollution. I was introduced to Nadia through a mutual professional acquaintance, we could both see a synergy between Renforth’s Surimeau and Nadia’s work in bleaching, along with the Centre she is building that will give her the ability to test material from Surimeau to determine if we can process using bioheapleaching, as is done at Talvivaara for their low grade nickel polymetallic.”

Brewster continues, “As a well-regarded academic Dr. Mykytczuk has already signed agreements, formed relationships, and visited Finland in order to take the initial steps to advance our mutual agenda of testing Surimeau material. In addition, Dr. Mykytczuk gives us additional access to the academic world as she is actively publishing and working within the grant/research/R&D funding world as she uses that ecosystem to advance the not-for-profit MIRARCO she runs with Laurentian university.

Because this work can take time, Renforth management says it “has determined it is prudent to start R&D now, while it continues to advance the central portion of the Victoria mineralized structure at Surimeau geologically,” and “with the intent that the R&D timeline, and the geological timeline, will converge at some point in the future.”

In a note to shareholders, Brewster said Mykytczuk’s expertise will potentially help Renforth avoid building a crushing circuit that feeds a waste-generating smelter, that would have to be safeguarded and managed.

Brewster compared bioleaching at the Talvivaara mine to RFR’s own research and development of the technology, to be led by Mykytczuk.

“If our R&D works, then we are doing something no one else is here, in Quebec, employing new technology in a new deposit style to produce battery chemistry….without building a smelter. That is an end worth working towards,” she wrote.

Conclusion

The summer prospecting program at Renforth Resources’ Surimeau project has concluded with the discovery of a new, previously unrecorded battery metals mineralization in an albitized shear zone on surface northeast of the Lalonde area.

In addition, there were numerous pegmatites not previously mapped or sampled in the southern part of the property. More samples were taken from these and other locations in the latter half of the program and have been delivered for assay.

Renforth is now filing permit applications to drill in the central area of Victoria this fall. The purpose of this program is to tighten the drill pattern within 2.2 kilometers of the mineralized horizon, which the company says is a requirement as it moves towards an initial resource statement.

Along with progress at the drill bit, Renforth is working to prove that its deposit model fits the Outokumpu model proposed by Dr. James Franklin, one of two technical advisors. The cluster of deposits is analogous to what Renforth has at Surimeau. The nickel-containing ultramafic orebody has been fused with the VMS deposit alongside it, giving it a unique geological flavor.

The Talvivaara mine just north of Outokumpu shares similar geology and is notable for its “green” bioleaching process.

“I am very happy that Renforth will have the privilege of directly working with Dr. Mykytczuk as we take inspiration from operating mines in Europe and work to implement it in Canada, for the first time, and work towards producing battery chemistry, in Quebec, a province which is supportive of mining in general, and critical minerals in particular,” Brewster stated. “Our foray into direct R&D is, I think, fairly unique for a junior exploration company, but we are fortunate to have a very unique property in Surimeau which supports this effort with the mineralization in the ground and our corporate desire to innovate and do better in terms of the development of this property and our willingness to embrace new technology in the mining space.”

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.025; 2023.10.05

Shares Outstanding 325m

Market cap Cdn$8.1m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of RFR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.