Red Lake-focused Silver Dollar Resources has a Mexican ace

2020.07.04

If real estate is all about location, location, location, success in mineral exploration starts with people, people, people. High quality people are more apt to acquire the high-quality assets to develop. At AOTH we believe the following company is an excellent example of our theory.

Silver Dollar Resources (CSE:SLV) has a boatload of talent and experience at the management and board levels, and a tightly held share structure that includes ownership by acclaimed resource investor Eric Sprott. Having recently IPO’d on the Canadian Stock Exchange @ $0.15 a share, SLV has already started field work at one of two prospects in the famous Red Lake District of northwestern Ontario, where a number of gold juniors including 2019 belle of the ball Great Bear Resources (TSX-V:GBR), are proving up gold ounces in a new “Red Lake 2.0” area play.

Silver Dollar is also poised to activate a letter of intent (LOI) with First Majestic Silver (TSX:FR) for the La Joya silver-copper-gold property in Mexico.

Ahead of the Herd hopped on a call this week with Mike Romanik, President, CEO & Director of Silver Dollar Resources, who talked about the names behind the company, its Red Lake properties, and an exciting earn-in deal in the offing with Mexico-focused silver major First Majestic.

Team

A junior mining executive for the past 15 years, Mike Romanik specializes in corporate development, “putting people and projects together trying to create value that way,” he told me over the phone. Since 2009 the president and CEO of GoldON Resources (TSX-V:GLD), an early-stage explore-co with claims in the Red Lake gold camp, Romanik has built an impressive network of industry contacts over the years.

A great example is Perry English, who Romanik brought onto Silver Dollar’s board of directors. English has been a fixture of Ontario mineral exploration going back over three decades. In 2003 he sold his private company to Rubicon Minerals (TSX:RMX), a large Red Lake landowner, then continued to work for Rubicon under the extremely successful “English Royalty Division” – which for years generated an annual million dollars in free cash flow (cash + stock payments). In 2007 English was honored with the Ontario Prospector Association’s Prospector of the Year Award, and in 2014 he won the OPA’s Lifetime Achievement Award.

Notwithstanding these achievements, English’s notoriety stems from his ownership of Red Lake District mining claims. As one of the largest private claim holders in Ontario, Perry English is known in mining circles as “Mr. Red Lake”. Among the exploration companies he vended claims to, Great Bear Resources struck a deal five years ago to acquire the Dixie mining claims. The property would go on to host multiple high-grade gold discoveries, and Vancouver-based GBR now controls over 300 square kilometers of prospective ground across four projects in the Red Lake District.

In forming Silver Dollar Resources, Romanik arranged the purchase of eight claims covering 2,597 hectares owned by Perry English at the Longlegged Lake project, and has an option to earn a 100% interest in Pakwash Lake, a property consisting of 18 claims covering 4,252 ha, also owned by English, who retains a 1.5% net smelter returns (NSR) royalty.

“Perry knows Red Lake inside out and we’re fortunate to have him as a director of Silver Dollar Resources,” says Romanik.

And just late last month Silver Dollar appointed Perry Durning and Frank (Bud) Hillemeyer as technical advisors. Both are past recipients of the PDAC Thayer Lindsley International Mineral Discoveries Award.

A 37-year industry veteran, Bud Hillemeyer, M.Sc., Geology, has conducted extensive exploration programs in the western United States, Mexico, Honduras and Costa Rica. Former clients include Kennecott, Meridian Gold, BHP, Mount Isa Mines, Hecla Mining, Crown Resources, Monarch Resources, Silver SSR Mining, Canplats Resources, and The Electrum Group.

Perry Durning, M.Sc., Geology, also has deep experience in the western US, Mexico, Central and South America. He held positions with Amax Exploration, SAGE Associates and Occidental Minerals, before becoming exploration manager and then president of Fischer-Watt Gold Co.

La Joya earn-in

Romanik brought the decorated geos on to help explore the La Joya (pronounced “la hoya”) property – the subject of a recent LOI between Silver Dollar Resources and First Majestic Silver Corp. to acquire up to a 100% interest in the latter’s La Joya Silver Project, located in the State of Durango in the Mexican Silver Belt.

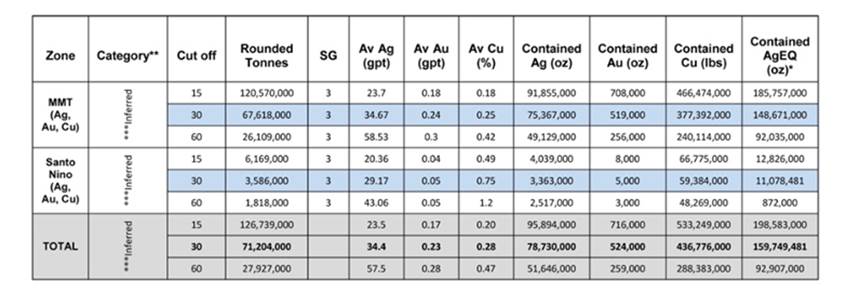

A 2013 resource estimate outlined 159.7 million inferred silver-equivalent ounces at a 30 grams per tonne cut-off. Doubling the cut-off grade to 60 g/t yields a more conservative 92.9 million AgEQ ozs, which is reasonable for a large open pit, imho.

The above resource estimate was published in 2013. While conforming to CIM definitions for resource estimation, Silver Dollar is not treating this historical resource estimate as a current mineral resource.

To acquire an 80% interest in La Joya, Silver Dollar will pay First Majestic $1.3 million in cash over four years, issue 19.9% of its shares, incur $1 million in exploration expenditures within five years, and grant FR a 2% NSR royalty. If Silver Dollar spends the million dollars within three years, First Majestic will waive nearly half, or $600,000, of the cash option payments.

SLV can earn the remaining 20% by issuing First Majestic additional shares equal to Silver Dollar’s then-outstanding common shares, within five years.

According to Silver Dollar, the exploration potential at La Joya is considered excellent, given that it hosts the La Joya Mineralized Trend as well as the Santo Nino and Coloradito deposits. The Ag-Cu-Au property consists of 15 mineral concessions totalling 4,646 hectares.

Appointing Durning and Hillemeyer as techncial advisors was a bit of a coup for Romanik, a young, sharp chief executive who clearly has a flair for bringing mining folks together. He met them through a mutual contact, Justin Tolman, an economic geologist with Sprott Resources. Romanik describes how, through a series of conversations, a feeling of trust developed, leading to an accepted invitation to work with Silver Dollar Resources.

“Justin’s a straight shooter, I told him we’re looking for some silver projects, he says I know Perry Durning, he may have something. The next thing, Perry brought me a couple of projects. We’ve been talking steady on the phone they’re just a nice, professional group of guys. I’ve learned lots from them already and within a month we’ve developed a strong enough relationship that they said they’d love to be involved with Silver Dollar.

Corporate structure

Silver Dollar Resources has a tight share structure, with just 19.6 million issued and outstanding shares after the May 2020 IPO. (fully diluted 29.6 million with warrants and stock options). A low share float shows a high level of commitment from early-stage investors, including Eric Sprott, who with 1.6 million shares, owns just under 10% of the company.

An oversubscribed IPO left SLV with a million dollars in the kitty, more than enough to carry out initial exploration programs in Red Lake and get the LOI with Majestic completed.

Silver Dollar has two properties, Longlegged Lake and Pakwash Lake, in the Red Lake Mining District, where around 30 million gold ounces have been pulled from 29 mines since the 1930s. Past producers include the Campbell, Cochenour, Red Lake, Madsen and Starratt Olsen mines.

Longlegged Lake

At the Longlegged Lake project, previous work by Laurentian Gold found anomalous gold in soil samples along the Pakwash Lake Fault Zone (PLFZ) – a major regional structure.

A sequence of metamorphosed felsic tuffs and sediments were found to occur adjacent to a regional basalt unit that can be traced through BTU Metals’ property north, along a regional fold structure, together with an adjacent conglomerate which is identical to the northerly outcrops. This basalt unit also occurs along the south side of the LP structure shown on sections by Great Bear Resources.

Therefore the Longlegged property has been found to host a repetition of the same sequence of rocks that hosts the LP Zone on the Dixie Lake property. Both the Pakwash Fault and LP Fault are outlined as deep-seated structures, according to regional seismic profiling by the Canadian government, and are similar in nature to the faults associated with the major mines at Red Lake.

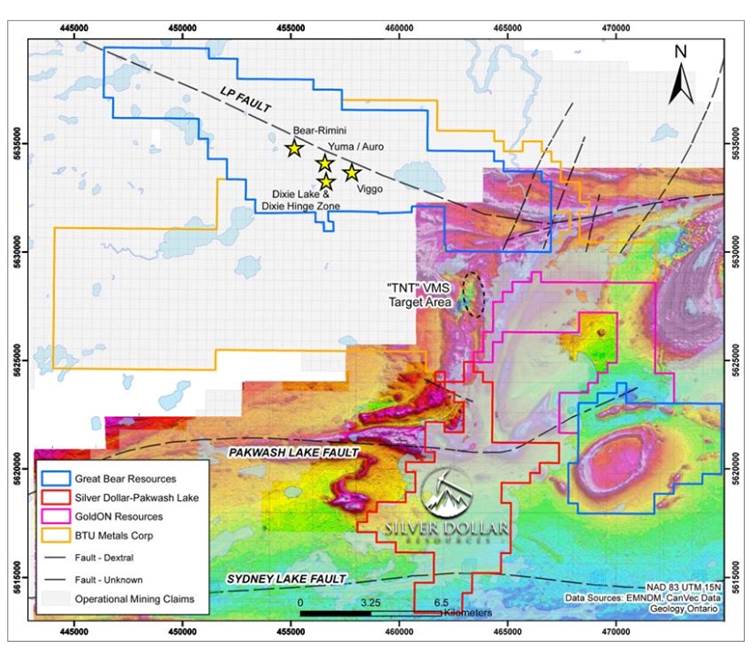

Exploration at Red Lake has been re-energized with the success of Great Bear Resources and the numerous high-grade gold discoveries on their Dixie property. Other active neighbors include BTU Metals, who announced last December they had staked a large claim package adjoining the northern boundary to expand their Dixie-Halo property, where they are drilling a potential Cu-Ag-Au VMS discovery called the TNT Target; and Golden Goliath Resources, who just announced their Kwai property to the northeast of Longlegged Lake, along the PLFZ, has been found to host a repetition of the same sequence of rocks that hosts the LP Zone on the Dixie property.

Deep Penetrating Regional Lithoprobe Seismic Survey

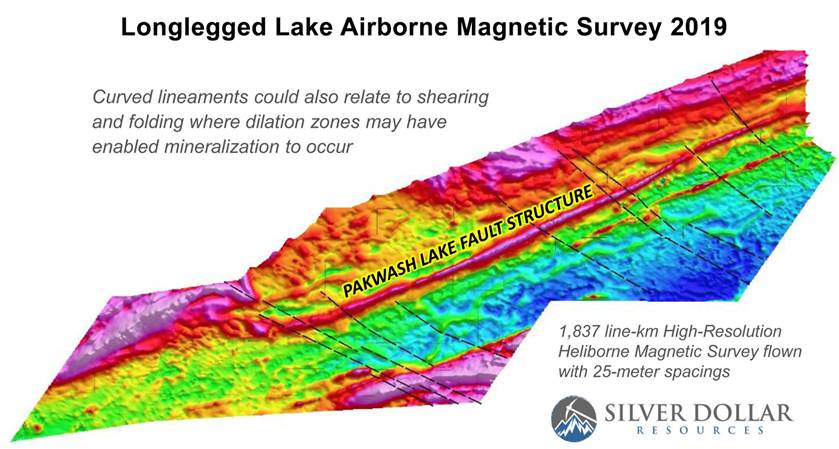

In the spring of 2019, Silver Dollar completed a helicopter high-resolution magnetic survey that identified northeast-southwest trending geological features interpreted to be the deep-seated Pakwash Lake Fault Zone.

The curved linear features identified by the 1,837 line-km survey (@ 25-meter spacings), could also relate to shearing and folding, where dilation zones may have enabled mineralization to occur.

MAG Survey Showing PLFZ Structure and Curved Lineaments

Romanik said the mineralization at Longlegged Lake is likely to be hosted in splays off the main crustal fault, which extends over 12 km deep. The idea is to try and match the very positive geophysical survey with geochemical results at surface.

Fieldwork currently underway includes soil sampling, geological mapping and prospecting to follow up on the key structures identified by the MAG survey.

The property is fully permitted and ready to drill once targets are identified.

Pakwash Lake

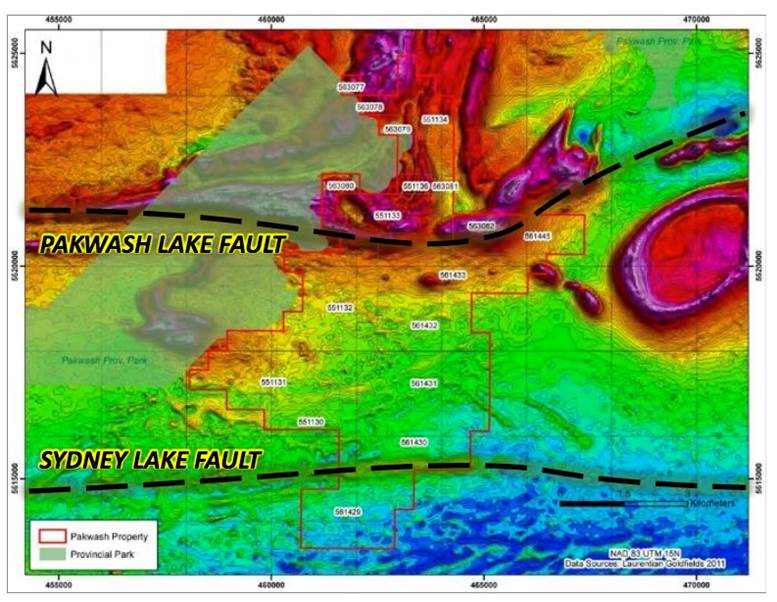

Orogenic gold deposits are typically associated with crustal-scale fault structures, such as the Pakwash Lake and Sydney Lake faults that run through Silver Dollar’s Pakwash Lake property.

The project adjoins BTU Metals’ Dixie Halo Project directly south of their new TNT Target, where they are drilling a Cu-Ag-Au VMS-style discovery. BTU has said repeatedly that the TNT target is open to the south.

Pakwash Lake contains numerous geophysical features that warrant further followup. Like Longlegged Lake, it is fully permitted and ready to drill.

Conclusion

Silver Dollar Resources has not been around for long, but I’m impressed with what they’ve accomplished in such a short period of time.

A seismic survey identified two major structural faults, the Pakwash Lake fault and the Sydney Lake fault, running through SLV’s Longlegged Lake and Pakwash Lake properties.

Longlegged is on the same mineralized trend as Golden Goliath to the northeast, BTU Metals, and Great Bear Resources further north, where six gold discoveries were made between 2018 and 2019. It’s exciting to think that this project might host something similar to GBR’s Dixie deposit.

Pakwash is a slightly different beast. There, Silver Dollar is looking at VMS-style mineralization, similar to BTU Metals’ TNT Target discovered in November, 2019. Over 2 km of strike has been drill-tested, with all holes intersecting mineralization consistent with a VMS model. TNT looks like a very large target. Success on their southern boundary will increase confidence in Silver Dollar’s theory of a look-alike deposit.

As mentioned at the top, mineral exploration is all about the people behind the projects. We like that Mike Romanik is a young, results-driven CEO with an impressive rolodex of contacts. Having “Mr. Red Lake” Perry English on the board of directors is a huge vote of confidence.

Perry Durning and Frank (Bud) Hillemeyer worked together for over a decade before forming La Cuesta I’ntl in 1993. Both are recognized for their incredible string of discoveries including:

- San Sebastian Silver-Gold Mine, Mexico – initially placed into production by Hecla Mining in 2001, this low-cost producer currently has mineral reserves and resources of over 45 million silver-equivalent ounces (AgEQ oz)

- San Agustin Gold Mine, Mexico – now in production (Argonaut Gold) with mineral reserves and resources totalling 1.06 million oz of gold and 41.6 million oz silver.

- Pitarrilla Silver Deposit, Mexico – owned by SSR Mining, this development-stage project hosts a measured, indicated and inferred resources of 552 million oz of silver.

- Camino Rojo Gold Project, Mexico – owned by Orla Mining, this development-stage project hosts proven and probable reserves of 1.0 million oz of gold and 20 million oz of silver and measured and indicated resources of 9.5 million oz of gold and 100 million oz of silver.

- Cerro Los Gatos Mine, Mexico – placed into production in 2019 by Sunshine Silver Mining & Refining and DOWA Minerals & Metals, the underground mine generates 9.2 million AgEQ oz annually. The Cerro Los Gatos deposit currently hosts a measured, indicated and inferred resources totalling 236 million AgEQ oz.

Your author believes all three gentlemen will prove to be a great resource for Romanik and the rest of his team.

Eric Sprott only gets involved in companies that show big potential, looking at Sprott’s record it’s safe to say he’s an asset investor. On a first-pass basis, both of Silver Dollar’s Red Lake projects appear to have similar geology to Great Bear and other juniors working this new “Red Lake 2.0” area play. This obviously remains to be seen, through additional survey work, followed by drill-testing.

However, we also believe that the real prize for Silver Dollar, and its high-profile backers, is to develop the La Joya silver project in Mexico – while Perry and Bud put their talents to work looking for other high quality assets for Romanik to acquire.

While it’s still very early days in the life of the earn-in agreement, we like the project and feel confident in Silver Dollar’s ability to move it forward to an updated resource, and beyond.

Silver Dollar has everything you’d want in a junior resource company – a whip-smart CEO with access to proven geological expertise on the technical board; a deep-pocketed investor in Eric Sprott who can help finance exploration/development; two highly prospective properties in Red Lake, one of the most important gold area codes in the world; plans to own a silver deposit in Mexico that already has a 160-million-ounce resource; and a tight share structure with just 19 million shares out.

I have extremely high expectations for this company and I’m looking forward to a steady flow of news over the coming months.

Silver Dollar Resources Inc.

CSE:SLV

Cdn$0.65, 2020.07.03

Shares Outstanding 19,600,001m

Market cap Cdn$12.7m

SLV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Silver Dollar Resources (CSE:SLV). SLV is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.