Red-hot nickel, copper and palladium bodes well for Palladium One

2022.03.21

The current commodity price surge puts Palladium One Mining (TSXV:PDM, OTC:NKORF, FSE:7N11) in the driver’s seat, as it embarks on its next phase of exploration.

By giving investors exposure to palladium and nickel, primarily, but also copper, cobalt and platinum, PDM ranks, in AOTH’s opinion, as one of the best energy metal exploration companies.

And at just CAD$0.25 a share, it is also, in our view, among the most undervalued.

Palladium One is fortunate to have a palladium focus at its LK project in Finland. If it becomes a mine, LK could supply the PGE raw materials for gas-powered catalytic converters expected to serve as a bridge between fossil-fueled internal combustion engines and all-electrics. And Palladium is expected to play a major role in the hydrogen economy, read more below.

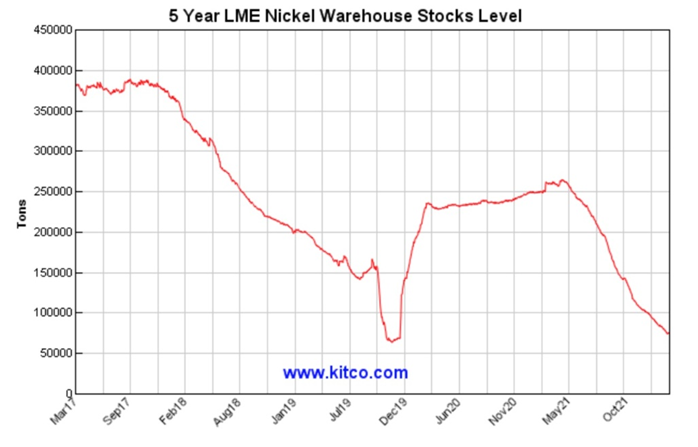

The war in Ukraine has lit a fire under commodities and none is hotter than nickel. On March 8, nickel trading was suspended in London after prices more than doubled.

Activity on the London Metal Exchange (LME) was so frenzied, the 145-year-old bourse had to cancel trading after an unprecedented price spike saw brokers struggling to pay margin calls against unprofitable short positions.

The base metal used in stainless steel and electric-vehicle batteries surged more than 250% in two days, briefly hitting $100,000 a ton, as investors and industrial users who had sold nickel scrambled to buy the contracts back after prices rallied.

The largest-ever price move on the LME began shortly after the US suggested banning Russian crude oil imports. (a ban was imposed the next day) This sparked a massive squeeze in commodity markets, including oil, gas, nickel, aluminum and palladium. All hit multi-year highs or new record highs, according to Bloomberg.

Palladium

A string of annual supply deficits starting in 2018, combined with higher sales of gasoline vs diesel units, culminated in palladium’s historic price pinnacle of $2,830 per ounce in May, 2021.

The platinum-group metal has enjoyed a spectacular ride since Russia invaded Ukraine at the end of February. With Russia mining 40% of the world’s palladium, there is concern that Western sanctions will make it difficult for the country to supply its customers.

Year to date, spot palladium has climbed an astonishing 37%.

Palladium use in hybrid vehicles, seen as stop-gap between gas-powered cars and pure electrics, is a growing source of demand. Hybrids require about double the PGE loadings (palladium, rhodium), found on gasoline-only cars.

Although hybrids and all-electrics are the modern vehicles of choice for the time being, some believe that lithium-ion batteries are a stop-gap technology that will eventually be replaced by hydrogen fuel cells.

Platinum and ruthenium play a large role in this technology, platinum being the catalyst which converts hydrogen and oxygen to heat, water and electricity. Palladium will likely also play a role in the fuel cell, but it is unknown yet how big.

An article in ‘Materials Today’, via Science Direct, says Palladium is a unique material with a strong affinity to hydrogen owing to both its catalytic and hydrogen absorbing properties. Palladium has the potential to play a major role in virtually every aspect of the envisioned hydrogen economy, including hydrogen purification, storage, detection, and fuel cells.

There is evidence suggesting that using silver to manufacture fuel cells containing palladium, makes the fuel cells more effective.

Since both palladium and platinum are small markets with annual mine production of about 6 and 7 million ounces, respectively, having Pd in the mix allows for more capacity to install hydrogen transportation solutions. That is, constrained platinum supply limits the ability to deploy fuel cells widely; using palladium therefore doubles the potential.

Companies that can supply raw materials for an expanding hydrogen economy, if the technology moves in that direction, will in AOTH’s opinion, do very well.

“We’re seeing the European Green Deal more and more take hold, and the expectation is that the penetration rate of hydrogen is only going to increase as the next stage of energy transition takes place beyond the battery-powered transportation,” said Palladium One’s President and CEO Derrick Weyrauch, in a recent talk with me about the metals the company is exploring for, at its projects in Finland and Ontario, Canada.

Copper

Copper hit a new record high on May 4, with futures briefly touching $4.94 per pound, as traders stocked up over concerns about supply disruption, along with historically low global stockpiles.

Of course, the big story for copper is tight supply.

Diminishing supply from currently operating mines, combined with the projected increase in demand for copper concentrate over 2021-2030, could result in a 3.85Mt production shortfall in 2025, according to S&P Global estimates.

BloombergNEF projects that in 20 years, the world’s copper miners must double the amount of global production — from the current 20 million tonnes annually to 40 million tonnes — just to match the demand for a 30% penetration rate of electric vehicles.

This is a tough ask considering some of the world’s largest mines are seeing depleted copper reserves and lower ore grades, so it would be difficult for global production to even maintain a 20-million-tonne-per-year pace.

CRU estimates that without new capital investments, global copper mined production will drop below 12 million tonnes in 2034, leading to a supply shortfall of more than 15 million tonnes.

Palladium One Mining (TSXV:PDM, OTC:NKORF, FSE:7N11)

Palladium One Mining has been working diligently to advance two projects with mineral deposits applicable to both the battery metals designation familiar to most readers, and future-facing metals like platinum and palladium that will find a market in hydrogen fuel cells.

At Palladium One’s Tyko project in Ontario, its main metals are nickel and copper, while at the LK project in Finland, PDM is exploring for palladium, platinum, nickel, copper and cobalt.

LK

In Finland, months of drilling success on Palladium One’s Läntinen Koillismaa (LK) PGE-Cu-Ni property have culminated in a much-increased resource endowment, further confirming the project’s potential to host a large bulk-tonnage deposit.

About 50% of the recovery metal value is a combination of palladium, platinum and gold. The other 50% is nickel, copper and cobalt.

The Kaukua Zone of LK is mostly a palladium-platinum-gold play, however it may surprise readers to learn there are significant base metal values particularly at Haukiaho, where two-thirds of the zone’s value is in nickel and copper compared to the Kaukua Zone where 66% of the value is in palladium and platinum.

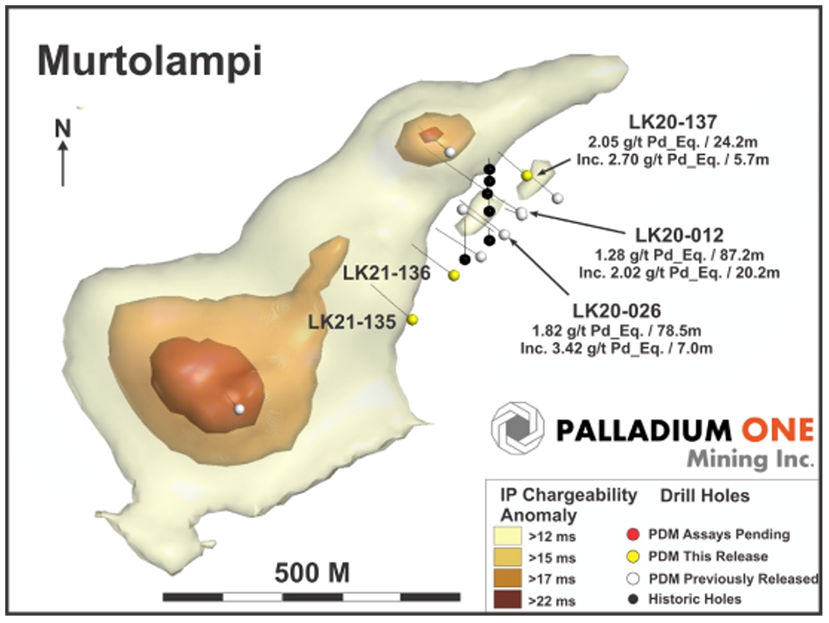

Over at the Murtolampi Zone, Palladium One this week reported more high-grade assays.

Hole LK21-37 intersected up to 2.7 g/t PdEq over 5.7 meters, within 2.1 g/t PdEq over 24.2m, starting at a true depth of 5m (Figure 1 and 2), said the company.

In the March 17 news release, CEO Weyrauch commented: “The Murtolampi zone has again delivered a high grade, at surface drill intercept, and represents a potentially valuable satellite open pit in the greater Kaukua Area. Additional regional exploration will be conducted in 2022 starting with an Induced Polarization (IP) survey which began this month on the far eastern portion of the Haukiaho Trend wherein the favourable marginal series changes orientation toward the north.”

Located 2 km north of the Kaukua resource estimate, Murtolampi is the site of 11 drill holes (1,514m), with values of up to 3.4 g/t PdEq over 7.0m, within 1.8 g/t Pd over 78.5m in hole LK21-026.

PDM interprets Murtolampi to be a faulted offset of the Kaukua Trend and shares many similarities with the Kaukua resource pit area. The zone has been traced over 600m of strike. Murtolampi’s 350m Core Zone is exposed on surface and represents a low strip satellite open pit opportunity beside the main Kaukau open pit.

Tyko

Palladium One also continues to outline a high-grade nickel-copper system at its Tyko Ni-Cu-PGE project in Ontario.

The project boils down to two types of mineralization: nickel-dominated material at Smoke Lake (about two to one nickel to copper, with some PGEs); and the Bulldozer intrusion, which is more copper-rich than Smoke Lake, with elevated cobalt.

Geologically, the sulfides at Smoke Lake have been heated and moved around, resulting in high-grade nickel at surface.

All 13 holes drilled at the Smoke Lake target intersected magmatic sulfides, with widths ranging from 1 to 15 meters. A second-phase, 2,000m drill program started last April, following up on high-grade hits of 9.9% nickel equivalent (NiEq) over 3.8m. A number of high-grade intersections were reported, all near surface.

Excited as Palladium One is about its nickel results, there are also notable copper and nickel occurrences, in particular the RJ and Tyko zones located about 18 km west of Smoke Lake. Drilling in 2015 returned several intercepts over 1% nickel + copper with a high of about 1.5% Ni + Cu.

The 7,000-hectare mafic-ultramafic Bulldozer intrusion, which has seen virtually no geological mapping nor exploration, also has significant historical copper showings.

According to Neil Pettigrew, Palladium One’s VP, Exploration, it was the Smoke Lake discovery, made only last year, that really opened up PDM’s eyes to the potential of the Tyko project, especially considering it had never been mapped by the Ontario Geological Survey.

“We’ve been working on trying to fill in that knowledge gap for the rest of the property,” Pettigrew told me over the phone. “We flew the whole project with 100m spaced high-resolution VTEM Max system last summer, that really helped because it actually produced four new multi-line conductors. Two of which, the Bulldozer intrusion, had never been detected before by two previous less-sensitive surveys, so we went out and did soils [sampling] over those four new multi-line anomalies, and lo and behold we got copper-nickel signatures on all four. Some of them in the Bulldozer, up to almost 900 ppm nickel, our new copper in soils. So it’s very much a mature target, we’re really keen to get out there.”

Pettigrew expects to drill targets at Smoke Lake later this spring.

Weyrauch noted one of the most exciting things about the Tyko project is the fact that the mineralization is well-spaced out, rather than clustered in a small area — as seen in the map above.

“There’s a lot of mineralization I think to be found here, we just need to do the field work, to build out the property. There’s a lot of opportunity.”

Tyko is also notable for its high nickel tenor and its relatively easy metallurgy, given a fairly standard assemblage of sulfide minerals chalcopyrite, pentlandite, pyrrhotite and pyrite.

Otherwise known as sulfide metal content, nickel tenor is defined as the concentration of Ni contained in 100% sulfides. It’s important because this is the nickel that can actually be extracted from the ore. Pettigrew told me the nickel tenor at Smoke Lake is quite high, above 10% and even approaching 14% in some samples. The RJ and Tyko zones also have good tenor, and the tenor at the Bulldozer intrusion is still to be determined.

“Just to give you an idea, even at 6% nickel, that roughly works out to 131 pounds nickel per tonne,” Weyrauch chipped in. “You look at the current pricing of nickel, I’m not sure what it is at this moment with all the volatility we’re seeing, but 131 times a big number gets you to a very high-valued piece of rock. That’s really what we’re chasing.

Conclusion

To review, Tyko’s main metals are nickel and copper, while at the LK polymetallic project in Finland, PDM is exploring for palladium, platinum, nickel, copper and cobalt.

Pettigrew had an interesting take on where he sees Palladium One on the development path, stating:

“We’ve been around the block a long time, we picked up this [LK] project that had a little over a million ounces on the books and we’re going to deliver a new resource very shortly so this has been a growth story in the palladium space. That is a bit of a rare thing actually, with many of these very established deposits like Marathon, Stillwater or some of these other projects. This is a company that’s in the growth stage of its life cycle.”

Asked how he feels about the current state of the markets, Weyrauch told me:

“We’ve seen a tremendous amount of volatility since the Russian invasion of Ukraine. Russia represents a very significant portion of the sulfide nickel supply globally as well as palladium. We saw a huge margin squeeze in the nickel space which had a curtailment of trading on the LME, unwinding the trades. As the situation continues I think we should expect to see ongoing volatility for these metals.” He continued:

“I don’t think anything has fundamentally changed with regards to the demand side of things so there should be that much more of a deficit situation certainly in the palladium space going forward, given we’ve been in a deficit for about 10 years. Neil and I have been very pleased to be operating in both Canada and Finland, given these are very safe political jurisdictions, and we’ve been harping on the fact that security of supply for industry, for these metals is really important, as is the jurisdictional exposure. So now that we’re seeing the impact of supply coming from lesser jurisdictions, I think that just makes our situation that much more interesting.”

Palladium One Mining

TSXV:PDM, OTC:NKORF, FSE:7N11

Cdn$0.25, 2022.03.18

Shares Outstanding 248m

Market cap Cdn$64.0m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Palladium One Mining (TSXV:PDM). PDM is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.