Rare earths in the cross-hairs of new high-tech arms race

2018.10.13

A decision by the Chinese government to slash production of rare earth elements (REEs) has spooked customers of the materials used in everything from cell phones to electric vehicles to smart bombs. And for those who follow the rare earths market, it’s like deja vu back to 2009, when China suddenly reduced its exports of REEs by 40%.

Bloomberg covered the story and published it on Wednesday. The article says that for the second half of 2018, China’s quota for rare earths separation and smelting has been cut by 36%, quoting research firm Adamas Intelligence. That means 45,000 tonnes will be produced – only providing enough material for domestic manufacturers. The move is a shock, since buyers had seen the H1 quota rise 40% from the first half of 2017, to 70,000 tonnes.

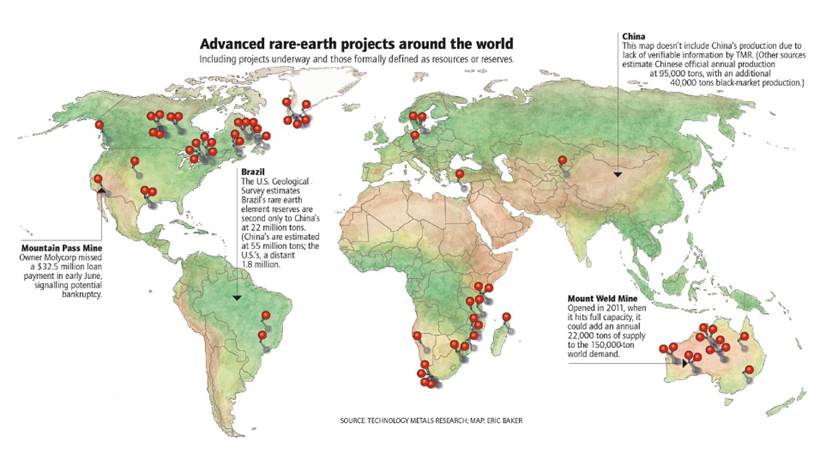

China typically supplies about 80% of the global rare earths market, or 156,000 tonnes. The only supplier outside China right now is Lynas Corp, which mines REEs from its Mount Weld Mine in Western Australia and processes them in Malaysia. But speculation that the plant will be assessed by Malaysian authorities (its operating license is up for renewal next September) dented the company’s stock price by 23%, and has further rattled manufacturers who are worried about their supply chains.

Electric automakers, consumer electronics manufacturers, clean energy technology industry leaders and the military–industrial complex are concerned.

The last time that China manipulated the REE market by putting a cap on exports, in 2009, prices exploded up to 2,000%, sparking a global hunt for the 17 elements on the periodic table, and an investor frenzy as hundreds of junior rare earths companies formed and began exploring for deposits. For some, stockholders enjoyed great runs, but no company has so far succeeded in building a new mine.

The restriction on rare earth elements by China, the primary producer, comes at a particularly bad time for the United States. Not only will it mean higher prices of inputs for US high-tech manufacturers, it also puts a sharper focus on US insecurity of supply of critical minerals needed for national defense, including rare earth elements. China supplied nearly 60% of the $234 million worth of REEs imported into America last year according to the US International Trade Commission – five times more than the next largest exporters, France and Japan.

China and the United States are embroiled in a trade war that shows no signs of letting up. As part of the tit for tat tariff exchange, in July the US imposed a 10% tariff on rare earths as part of $200 billion in tariffs levied on China. However, perhaps thinking better of it, the Trump Administration in September withdrew rare earths from the list of targeted Chinese imports.

That’s definitely a good thing, because Trump recently upped the ante on nuclear weapons. Building missiles and other military hardware requires rare earths.

The President is threatening to abandon the 1987 INF Treaty between the US and Russia because Russia is not abiding by it. Russia has reportedly been testing ground-launched cruise missiles banned by the treaty since 2013. And China isn’t party to the treaty, allowing Beijing to advance its missile program unencumbered by a nuclear arms ban. This has put the US in a vulnerable position, militarily.

So here we are. On the one hand the stage is set for a high-tech arms race between two nuclear adversaries plus China, an emerging military power and certainly a dominant economic one. But at the same time, we are facing a likely bottleneck in getting rare earths to build weapons. Will this dog hunt? Not without cutting into China’s monopoly, something the rest of the world has been unable to do since the mid-90s, when the United States ceded control of new magnet technology requiring rare earth elements, to the Chinese. In this article we’ll explain how that happened, along with some background on rare earths, their military applications, and how we might rebuild the broken rare earths supply chain before it’s too late.

Rare earths 101

Composition

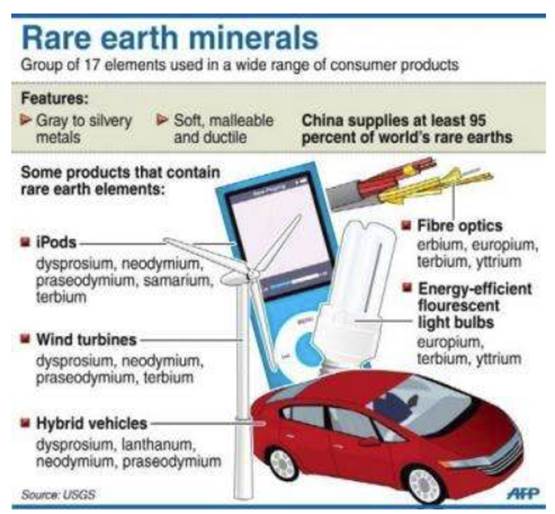

The rare earths are a group of 17 elements comprising scandium, yttrium, and the lanthanides. The lanthanides are a group of 15 (cerium, dysprosium, erbium, europium, gadolinium, holmium, lanthanum, lutetium, neodymium, praseodymium, samarium, terbium, thorium, thulium, ytterbium) chemically similar elements with atomic numbers 57 through 71, inclusive.

Yttrium isn’t a lanthanide but is included in the rare earths because it often occurs with them in nature – it has similar chemical properties. Scandium is also included in the group although it usually occurs only in minor amounts.

The most abundant rare earth elements are found in the Earth’s crust in amounts equal to nickel, copper, zinc, molybdenum or lead. Cerium is the 25th most abundant element of the 78 common elements in the crust. Even the two least abundant REEs (thulium, lutetium) are nearly 200 times more common than gold. Overall REEs have an abundance greater than silver and similar amounts to copper and lead.

The “rare” in rare earth elements came from frustrated 19th century chemists who decided they were uncommon after trying to isolate these chemically related elements. REES are also very hard to find in economic concentrations.

The lanthanides are divided into light rare elements, LREE, and heavy rare earth elements, HREE. Light REEs are made up of the first seven elements of the lanthanide series: lanthanum (La, atomic number 57), cerium (Ce, atomic number 58), praseodymium (Pr, atomic number 59), neodymium (Nd, atomic number 60) promethium (Pm, atomic number 61) and samarium (Sm, atomic number 62).

HREEs are made up of the higher atomic numbered elements – europium (EU, atomic number 63), gadolinium (Gd, atomic number 64), terbium (TB, atomic number 65), dysprosium (Dy, atomic number 66), holmium (Ho, atomic number 67), ebium (Er, atomic number 68), thulium (Tm, atomic number 69), ytterbium (Yb, atomic number 70) and lutetium (Lu, atomic number 71).

The principal economic sources of LREE are the minerals bastnasite and monazite. In most rare earth deposits the first four REEs – La, Ce, Pr, and Nd – constitute 80 to 99% of the total.

Deposits of bastnasite in China and the United States represent the largest percentage of the world’s rare earth economic resources.

The second largest percentage of the world’s LREE rare earth economic resources is monazite. Monazite contains less La, more Nd and some HREE, usually with elevated levels of thorium compared to bastnasite.

Ion-adsorbed REEs in clays from South China provide the bulk of HREE to the market.

Uses

Many REE applications are highly specific and substitutes are inferior or unknown:

- Color cathode-ray tubes and liquid-crystal displays used in computer monitors and televisions employ europium as the red phosphor

- Terbium is used to make green phosphors for flat-panel TVs and lasers

- Lanthanum is critical to the oil refining industry, which uses it to make a fluid cracking catalyst that translates into a 7% efficiency gain in converting crude oil into refined gasoline

- Rechargeable batteries

- Automotive pollution control catalysts

- Neodymium is key to the high-strength permanent magnets used to make high-efficiency electric motors. Two other REE minerals – terbium and dysprosium – are added to neodymium to allow it to remain magnetic at high temperatures

- Fiber-optic cables can transmit signals over long distances because they incorporate periodically spaced lengths of erbium-doped fiber that function as laser amplifiers

- Cerium oxide is used as a polishing agent for glass. Virtually all polished glass products, from ordinary mirrors and eyeglasses to precision lenses, are finished with CeO2

- Gadolinium is used in solid-state lasers, computer memory chips, high-temperature refractories and cryogenic refrigerants used in improving high-temperature characteristics of iron, chromium, and related alloys

- Y, La, Ce, Eu, Gd, and Tb are used in energy-efficient fluorescent lamps. These light bulbs are 70% cooler in terms of the heat they generate and are 70% more efficient in their use of electricity

- REEs are used in metallurgy as an alloying agent to desulfurise steels, as a nodularising agent in ductile iron, as lighter flints, and as alloying agents to improve the properties of superalloys and alloys of magnesium, aluminium and titanium

- Rare earth elements are used in the nuclear industry in control rods, as dilutants, and in shielding, detectors and counters

- Rare metals lower the friction on power lines, thus cutting electricity leakage

Mineralogy and metallurgy

There’s a saying regarding the search for economic quantities of rare earths:

“You are not looking for a REE deposit, you are looking for a bastnasite deposit.” anon

Practically all light REEs are extracted from bastnasite and monazite, while the heavy REE comes from xenotime and ionic clays. The process of extracting REEs from these four minerals has not changed in over two decades. When you review their minerals chemical compositions you will see they are not complex. The more complex, the harder it is to extract what you want and get the ultra-high-purity oxides, metals, alloys and powders required.

Mineralogy is mineral composition, metallurgy the process of extraction. Complicated mineralogy can mean complex, expensive, power-intensive, time-consuming metallurgy.

Mining REEs is fairly straightforward but separating and extracting a single REE takes a great deal of time, effort and expertise.

- Rare earth ore: the ore is ground up using crushers and rotating grinding mills, magnetic separation (bastnasite and monazite are highly magnetic, they can be separated from non-magnetic impurities in the ore through repeated electromagnetic separation) and flotation gives you the lowest-value sellable product in the rare earth supply chain: the concentrated ore. The milling equipment – crushers, grinding mills, flotation devices, and electrostatic separators – all have to be configured in a way that suits the type of ore being mined. No two ores respond the same way.

- Concentrated ore: chemically extract the mixed rare earths from the concentrated ore (cons) by chemical processing. The cons have to undergo chemical treatment to allow further separation and upgrading of the REEs. This process, called cracking, includes techniques like roasting, salt or caustic fusion, high-temperature sulfidation, and acid leaching which allow the REEs within a concentrate to be dissolved. This separates the mixed rare earths from any other metals that may be present in the ore. The result will be still-mixed-together rare earths.

- Rare earth oxide (REO): the major value in REE processing lies in the production of high-purity REOs and metals – but it isn’t easy. A REE refinery uses ion exchange and/or multi-stage solvent extraction technology to separate and purify the REEs. Solvent-extraction processes involve re-immersing processed ore into different chemical solutions in order to separate individual elements. The elements are so close to each other in terms of atomic weight that each of these processes involve multiple stages to complete the separation process. In some cases it requires several hundred tanks of different solutions to separate one rare earth element. HREEs are the hardest, most time consuming to separate.

- The composition of REOs can also vary greatly. They can and often are designed to meet the specifications laid out by the end product users – a REO that suits one manufacturer’s needs may not suit another’s.

For more read our Mine to Magnet

Rare earths and clean tech

The rare earths needed for electric vehicles are neodymium and praseodymium – used for making the magnets in electric motors and generators. The market for the neodymium-iron-boron magnet, installed in Tesla’s Model 3 Long Range electric car, is estimated at $11.3 billion. Demand for neodymium has been growing steadily. Most neodymium comes from China.

Scandium

Scandium is usually a byproduct of mining for battery metals – particularly cobalt and nickel needed for lithium-ion batteries. Scandium is said to be so obscure, that rocks on the moon have higher concentrations than Earth rocks. When added to aluminum the silver-white metal delivers a potent combination – lighter, stronger and more malleable, making the alloy ideal for aircraft, cars or ships that can save on fuel costs. It is also used in solid oxide fuel cells (SOFCs) and sports equipment like baseball bats and tennis rackets. Smith & Wesson has even used scandium-aluminum alloys in revolvers.

According to the USGS, the market for scandium oxide is estimated at just 10 to 15 tonnes per year. No scandium is currently mined in the United States. The US gets most of its scandium and scandium components from China.

Military applications

Rare earths are central to the whole spectrum of defense technologies that are vital to every military. Without them, countries would be unable to produce much of the military hardware and equipment required for national defense. In most case there are no substitutes. Moreover, switching from current suppliers (ie. China) would cause major disruptions to supply chains. According to the US Government Accountability Office, it would take 15 years to overhaul the defence supply chain, meaning any changes to it need considerable lead time. The American Mineral Security Act, passed in 2015, is meant to evaluate which minerals are critical and create new frameworks to address gaps in supply, according to the NATO Association of Canada.

Among the military applications of rare earth elements are:

- Radar and sonar used to prevent collisions, for surveillance and navigational aids. The Patriot Missile Air Defense System employs radio frequency circulators to magnetically control the flow of electronic signals in the radar and missiles. Rare earths required: gadolinium, samarium, yttrium.

- Communications and displays required by soldiers, sailors and airmen to see analog and digital data. Examples are lasers that help line-of-sight communication links in satellite and ground-based systems; old and new computer monitors; and avionics terminals. Rare earths required: dysprosium, erbium, europium, neodymium, praseodymium, terbium and yttrium.

- Lasers employed on vehicle-mounted systems like tanks and armored vehicles. They can identify enemy targets up to 22 miles. According to DefenseMediaNetwork, “The laser-equipped computer main gun sight on the Abrams M1A/2 tank combines a Raytheon rangefinder and integrated designator targeting system used to obtain a high-probability first hit.” Rare earths required: europium, neodymium, terbium and yttrium.

- Precision-guided munitions (PGMs) take in a number of missile classes including cruise, anti-ship (ASM) and surface-to-air (SAM), as well as bunker busters. The heat-seeking AIM-9 Sidewinder missile has four fins on its fuselage that use rare-earth magnets to control its flight trajectory. Rare earths required: dysprosium, neodymium, praseodymium, samarium and terbium.

- Guidance and control systems that steer missiles and bombs towards their targets. Rare earths required: terbium, dysprosium, samarium, praseodymium and neodymium.

- Electronic warfare refers to a range of equipment that includes high-capacity power sources, storage batteries and electronic jamming devices. Rare earths required: yttrium-iron-garnet.

- Electric motors that require permanent magnets, of which the US Military is an important buyer. New equipment requiring powerful permanent magnets in the next generation of electric motors will include the US Navy’s Zumwalt DDG 1000 guided military destroyer, hub-mounted electric traction drives and integrated starter generators. Rare earths required: terbium, dysprosium, samarium, praseodymium and neodymium.

- Jet engines. The rare earth element erbium is added to vanadium to make it more malleable for use in vanadium-infused steel that goes into jet engines. While not specifically a rare earth element, the rare element rhenium is alloyed with molybdenum and tungsten. The F-22 Raptor and the F-35 Lightning II stealth fighter reportedly use 6% rhenium in their engines. The electrical systems in aircraft employ samarium-cobalt permanent magnets to generate power.

How China burned the US

It’s a little known fact that the United States was once the largest producer of rare earths in the world. The first and still the only American rare earths mine was discovered in California in 1949. The story goes that geologists were actually looking for uranium when they came upon the Mountain Pass rare earths deposit. While the ore did contain uranium, it also had rare earths in high concentrations – around 40%. By comparison copper ore is economically viable at about 0.6%.

Little happened at Mountain Pass during the 1950s except for the odd bit of research by the defense and scientific communities, but that all changed in the 1960s with the color TV. The discovery of europium, which emits a brilliant red light when bombarded with electrons, ushered in the age of technicolor, and Mountain Pass, which had abundant europium, flourished. Rare earths mined there were also used in medical scanners, lasers, fluorescent lights and microchips.

Things continued to go well into the 70s and 80s, but in the 1990s, Mountain Pass ran into trouble. The company faced legal action in 1997 after it was discovered that repeated spills from its wastewater pipes had contaminated the Mojave National Preserve with trace amounts of radioactive thorium, barium and uranium.

It was around this time that China started a program to develop its own rare earths. The Chinese began mining the massive Bayan Obo mines north of Baotou, Inner Mongolia – containing an estimated 70% of the world’s rare earths reserves. A flood of Chinese rare earth oxides into the market hurt the owner of Mountain Pass, Molycorp, which shut down the processing facilities in 1998. Four years later, facing low prices and exorbitant cleanup costs, the mine closed. Processing plants in the US owned by German and Japanese firms moved their operations to China. There are none left.

China wouldn’t have been able to develop its REE industry in the way it did if it wasn’t for the dubious acquisition of Magnequench, a division of General Motors established in 1986. The purpose of Magnequench was to produce neodymium-iron-boron (NdFeB) magnets, a superior type of permanent magnet that GM needed for its vehicles. The story of how Magnequench and its technology was ceded to the Chinese in the 1990s and early 2000s is told by Jeffrey St. Clair in a 2006 article; the most pertinent excerpts are printed below:

In 1995, Magnequench was purchased from GM by Sextant Group, an investment company headed by Archibald Cox, Jr – the son of the Watergate prosecutor. After the takeover, Cox was named CEO. What few knew at the time was that Sextant was largely a front for two Chinese companies, San Huan New Material and the China National Non-Ferrous Metals Import and Export Corporation. Both of these companies have close ties to the Chinese government. Indeed, the ties were so intimate that the heads of both companies were in-laws of the late Chinese premier Deng Xiaopeng.

At the time of the takeover, Cox pledged to the workers that Magnequench was in it for the long haul, intending to invest money in the plants and committed to keeping the production line going for at least a decade.

Three years later Cox shut down the Anderson plant and shipped its assembly line to China. Cox [presided] over the closure of Magnequench’s last factory in the US, the Valparaiso, Indiana plant that manufactured the magnets for the [Joint Direct Attack Munition (JDAM)] bomb. Most of the workers were fired.

It’s clear that Cox and Sextant were acting as a front for some unsavory interests. For example, only months prior to the takeover of Magnequench San Huan New Materials was cited by US International Trade Commission for patent infringement and business espionage. The company was fined $1.5 million. Foreign investment in American high-tech and defense companies is regulated by the Committee on Foreign Investments in the United States (CFIUS). It is unlikely that CFIUS would have approved San Huan’s purchase of Magnequench had it not been for the cover provided by Cox and his Sextant Group.

One of Magnequench’s subsidiaries was a company called GA Powders, which manufactured the fine granules used in making the mini-magnets. GA Powders was originally a Department of Energy project created by scientists at the Idaho National Engineering and Environmental Lab. It was spun off to Magnequench in 1998, after Lockheed Martin took over the operations at Idaho National Engineering and Environmental Laboratory (INEEL).

In June 2000, Magnequench uprooted the production facilities for GA Powders from Idaho Falls to a newly constructed plant in Tianjin, China. This move followed the transfer to China of high-tech computer equipment from Magnequench’s shuttered Anderson plant. According to a report in Insight magazine, these computers could be used to facilitate the enrichment of uranium for nuclear warheads.

GA Powders wasn’t the only business venture between a Department of Energy operation and Magnequench. According to a newsletter produced by the Sandia Labs in Albuquerque, New Mexico, Sandia was working on a joint project with Magnequenchinvolving “the development of advanced electronic controls and new magnet technology”.

Dr. Peter Leitner is an advisor to the Pentagon on matters involving trade in strategic materials. He says that the Chinese targeted Magnequench in order to advance their development of long-range Cruise missiles. China now holds a monopoly on the rare-earth minerals used in the manufacturing of the missile magnets. The only operating rare-earth mine is located in Batou, China.

“By controlling access to the magnets and the raw materials they are composed of, US industry can be held hostage to Chinese blackmail and extortion,” Leitner told Insight magazine last year. “This highly concentrated control – one country, one government – will be the sole source of something critical to the US military and industrial base.”

For more read our Magnequench Has Left the Building

The result of the Magnequench saga is that in less than a decade, ownership of the permanent magnet market shifted completely. Whereas in 1998, 90% of the world’s production was in the US, Europe and Japan, today permanent magnets are sold almost exclusively by China using rare earth oxides produced there.

America seemingly gave up on rare earths, but China didn’t. Despite horrendous environmental degradation such as the toxic Baotou lake, a dumping ground for REE mining byproducts, in the 2000s Chinese production boomed, as rare earths became higher in demand due to the introduction of LED light bulbs and small, powerful magnets found in computer hard drives, smart phones, hybrid vehicles and wind turbines.

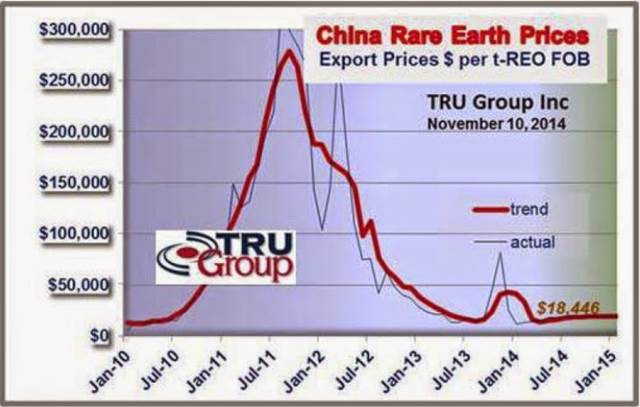

In 2009 everything changed. The Chinese government imposed export controls on its rare earths, meaning a 40% drop in exports. Beijing said it had to implement quotas to protect the environment, but critics saw them as naked protectionism.

A year later, an international incident sent rare earth oxide prices into the stratosphere. In September 2010 a Japanese naval vessel interdicted a Chinese fishing boat near the Senkaku Islands, which Japan and China both claim ownership of, and detained the captain. The response hardly seems balanced in retrospect, but the Chinese decided to ban all rare earth exports to Japan, then an industrial powerhouse and China’s largest REE customer. The rare earths market panicked, and within months, all of the rare earth oxides gained in price.

The result was the re-opening of the Mountain Pass Mine, including a $130 million investment by Japanese conglomerate Sumitomo to upgrade the mine. Mountain Pass started up again in 2012 and by 2014 was producing 4,700 tons a year.

While the spike in rare earths prices was good for miners like Molycorp and the numerous exploration companies that sprang up in search for them, buyers of products made from rare earths balked and pressured governments to do something about it. The US, European Union and Japan brought a case to the World Trade Organization to try and settle the dispute and get China to lift the restrictions.

In 2015 it did, resulting in a torrent of Chinese rare earth exports into the market and the inevitable collapse in prices. The move caught Molycorp off-guard. The company had just spent over a billion dollars on another upgrade at Mountain Pass but within months, the company fell deeply in debt and went bankrupt.

The mine was put on care and maintenance and eventually sold at auction in the summer of 2017 for a shocking $20.5 million – a fraction of its previous worth. The new owner is MP Mine Operations LLC, an American-led consortium, with Chinese rare earths miner Leshan Shenghe Rare Earth Co. holding a non-voting minority interest. Mountain Pass currently ships rare earths concentrate for refining in China, although the owners say they plan to build processing capacity in the US in about 18 months, according to a recent Bloomberg article.

High-tech arms race developing

Donald Trump’s threat to withdraw from the 1987 INF Treaty with Russia may be the catalyst that starts a new arms race between the United States, Russia and China as each projects military power in defense of spheres of influence outside their borders. We are seeing this in the constant tension between the US and China in the South China Sea and Taiwan – which China claims as its own – and Russian expansion into the Ukraine and military support for Syria.

If the US in no longer tied to a treaty that prohibits short – and intermediate -range nuclear and conventional missiles, the Military will have a freer hand in the South China Sea. Up to now the Pentagon has been unable to to match China’s increasingly sophisticated land-based missile forces due to the treaty, Reuters reported recently. For instance China’s DF-26 intermediate-range ballistic missile has enough range (2,500 miles) to reach the US Mainland if fired from Guam.

But if the Military is allowed to deploy missiles to places like Guam and Japan, it would deter China from a first strike against US ships and bases in the region, the news outlet added, and also force Beijing into a costly arms race.

Not being party to the INF Treaty would also allow the United States to counter Russian aggression in Eastern Europe. Trump was right to call out the Russians for failing to live up their end of the treaty bargain, by testing ground-launched cruise missiles since 2008 when they invaded Georgia, a former Soviet republic.

The President appears to be making good on his threat – on Monday warning that the US intends to build up its arsenal of weapons to pressure Russia and China.

But there’s a problem with American saber-rattling, which should be obvious to those who have read this far. To expand its Military, the US must break its import dependence on rare earth elements. Because without REEs, you can’t build conventional or nuclear weapons. Why would China, engaged in a trade war with the United States, continue to supply the country with materials needed to make its Military stronger?

Up to now, the US has focused on exploring for rare earths – for example in Alaska and Wyoming – “rather than creating an infrastructure that spans from raw materials to refining to creating end-use products, such as magnets,” notes Ryan Castilloux, the founder of Adamas Intelligence mentioned at the top of this piece, as quoted in a South China Morning Post article.

The article goes on to mention that not only is China dominant in rare earths mining, it also controls refining and making components that use REES. That’s because in China, the industry is controlled by six state-owned companies whose output and level of integration is very difficult for other countries to match. Its “Made in China 2025” policy is China’s own version of “Make America Great Again”. It wants to be independent of foreigners.

Is China friend or foe? In Canada the consensus around Liberal government circles seems to lean towards the former, with talk of creating a trade agreement with China despite a clause in NAFTA that would allow the US or Mexico to withdraw from the revised agreement should one of its partners begin a trade relationship with a non-market economy, which is code for China.

In the US it’s a different matter, with Trump clearly indicating that China is an enemy that needs countering economically and if necessary, militarily. China is mentioned alongside Russia as one of two competitor nations in the Pentagon’s Offset Strategy – which envisions America’s next round of surprise weapons. Indeed the element of surprise is key to military superiority. To keep using the same equipment over and over again puts the military a step behind.

In an op-ed piece, Dean Popps, former acquisitions executive at the US Military, says the Military needs rare earths for future wars, and he regards the country’s dependence on China as a threat to national security.

Every one of the current and next round of super and unimaginable US weapons relies on REEs, an exotic assortment of 17 metals and elements, that are neither mined nor processed into ores in the US. We remain completely at the mercy of foreign governments and markets for these vital supplies, which are the building blocks for every major piece of military equipment or weapons system.

From the Joint Strike Fighter to the next generation B21 deep strike bomber, from avionics to computers, REEs are irreplaceably pivotal to America’s military superiority. Their unique properties, such as strong magnetic qualities at high temperatures, help precision-guided munitions pinpoint targets, facilitate GPS navigation, and allow fighter pilots to eject safely. Given REE’s undeniable military and commercial value, it is difficult to overstate their importance to our national security.

But there is no clear path to a secure supply. Where’s the government funding?

Both the House and Senate Armed Services Committee authorization bills included additional funds for development of domestic rare earth capability, though the all-powerful Appropriations Committees have not matched this investment to date. We need to put some money toward fixing this critical supply chain issue before we get caught short and embarrassed when it’s a matter of life and death in defense of the nation.

Though seemingly unimportant things like a $2 rare earth element magnet steering a billion dollar weapons platform may sound inconsequential, when our adversaries cut off our supply leveraging our greatest weakness against us, we won’t have anywhere to turn. With unpredictable international relations, we can no longer ignore our greatest strategic liability. We must act now to establish a coherent rare earth policy and end our dependence on China. When it comes to keeping America safe, we can’t take any chances.

Another Military man, retired US Army Brig. Gen. John Adams, believes the country needs to rebuild America’s industrial supply chain before it’s too late – “we have allowed ourselves to become unnervingly comfortable in China’s vise,” he writes in an editorial published in DefenseNews.

There is hope in the 2019 National Defense Authorization Act prohibiting the Department of Defense from acquiring rare earth magnets – along with certain tungsten, tantalum and molybdenum products – from China, Russia, Iran and North Korea. But where is the US to turn? There is currently no mine in the United States, besides Mountain Pass, even close to producing rare earth elements. The small stockpile the US keeps of some of these minerals is a drop in the bucket for what the US needs to develop futuristic weapons, let alone what it would take to ramp up the military-industrial complex in the event of a major conflict.

Gen. Adams points out an amendment to the act that brings long-needed reforms to mine permitting should be supported. He notes it can take a decade or more to open a mine in the United States.

He concludes with a compelling call to action:

We shouldn’t wait a minute longer to enact the commonsense mine-permitting reforms our defense supply chain so desperately needs. Whether or not China uses its mineral production dominance as a weapon, we should act to eliminate such vulnerability. Fortunately, America possesses vast mineral reserves that can reduce import dependence. U.S. industry, supported by the federal government as necessary, must collaborate to recapture a larger presence of the minerals’ mining industry. With national security at risk, the time for action is now.

Conclusion

As we have written before, the world is becoming a more dangerous place. We only have to read the headlines this week about letter bombs sent to critics of President Trump, plus the daily diet of death and carnage, to realize that the United States is vulnerable to domestic and overseas terrorism, continued instability in the Middle East (Syria, Yemen, Iraq, Afghanistan, the spat between Turkey and Saudi Arabia over a murdered journalist), Russian meddling, Chinese military aggression…the list goes on.

When the Berlin Wall came down in 1989, it was thought that the end of communism would usher in a new era of peace. Politicians started talking about “peace dividends”, referring to all the money that would be freed up for other things besides defense, now that there was no longer an obvious enemy: the Soviet Union or the USA, depending on which side of the Iron Curtain you were on.

We did have peace for awhile, with relatively few hot spots requiring US and Canadian involvement during the 1990s and 2000s. Then came 9/11. No longer was the enemy red, bold and easily identified. The new threat came from shadowy figures like bin Laden and the current leader of al-Quaeda, Ayman al-Zawahiri. An expanded NATO, led by the US, struck Afghanistan, then Iraq, creating the beginning of what would become the next Cold War: the West vs Islam.

At the same time, globalization took hold as the winning economic formula, and the name of the game was deregulation. That all came crashing down with the financial crisis of 2008-09, which seemed to crush the globalist ideal of a world without borders, and free trade, leading to unfettered prosperity.

The next 8 years were not so kind to many in Europe and the United States, with the spoils of globalization failing to be shared with the more vulnerable, who rose up in anger. Enter the current era of nationalism, or nativism, with Trump the most potent symbol. Brexit and the continued popularity of Vladimir Putin, the strong man of Russia, are other examples.

In the United States part of the peace dividend, post-1988, meant a decline in military expenditures. The maxim “If you want peace prepare for war” went out the window, as the chart below proves.

Between 1988 and 2000, spending on the Military dropped by about $200 billion. After 9/11, it rose steadily, and is currently sitting at around $600 billion – the same as 1988, the year before the wall fell.

It’s no coincidence that globalization and reduced military spending corresponded with the time when the United States gave up its monopoly on rare earths to China. Despite their importance for the building of military equipment and technology, and the defense of the nation, few in government thought to defend the National Defense Stockpile, created after World War II to acquire and store critical strategic materials for national defense purposes. In 1992, Congress directed that the bulk of these stored commodities be sold.

With virtually no government-directed plan to rebuild that stockpile including rare earths, the country has gradually allowed itself to become dependent on foreign sources of these materials. The Trump Administration is finally waking up to the importance of breaking the Chinese monopoly on REEs and other critical minerals like lithium needed for the new energy economy. This is a step in the right direction, particularly in the current situation where three nations – the US, Russia and China – appear to be jostling for power.

I’ve got a new high-tech arms race and the need for the US to rebuild its rare earths supply chain on my radar. What’s on your screen?

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.