Prudent Minerals sitting on high-grade gold exploration target in Colombia – Richard Mills

2023.05.30

Gold mining companies, already facing depleted gold reserves, are beginning to feel the pressure to consolidate to sustain themselves in the current economic environment, hence the growing momentum in mergers and acquisitions.

Naturally the industry will need to converge towards places where high-grade ores are abundant and gold deposits are guaranteed to be economically viable.

Another avenue to consider is looking at gold mining assets within the world’s most well-endowed, and yet, still underexplored regions. In the mineral-rich continent of South America, one country that fits this description is Colombia.

Geographically, Colombia is a diverse country with thousands of square kilometers of unexplored prospective ground, with high potential for the exploration of valued minerals such as gold and copper. Currently, only 1.1% of the country’s territory is occupied by mining titles in the production phase, while only 2.3% is covered by exploration projects.

Colombia is the third biggest gold producer in South America behind Peru and Brazil at about 60 tonnes per year.

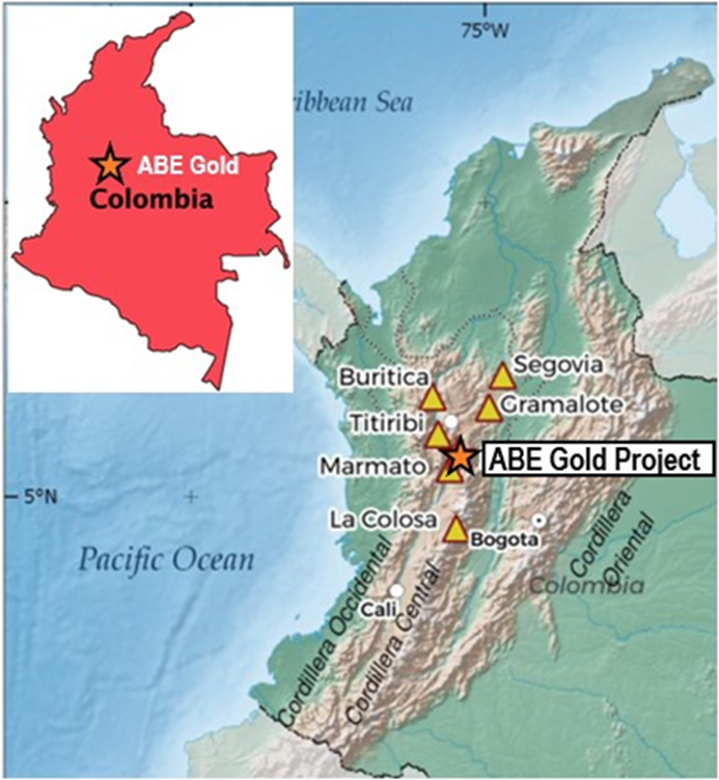

The most important gold mines in Colombia include Segovia, a multi-million-ounce operation that has been in production for more than 150 years, owned by Canada’s Aris Mining; and the ultra-high-grade Buriticá, held by Chinese giant Zijin Mining. Both mines are located in the mountainous Antioquia province.

Further to the south, there is the Marmato mine in the Caldas Department, also operated and being expanded by Aris, with an over 17-million-ounce resource base. Then there’s AngloGold’s La Colosa, a large porphyry gold deposit near Cajamarca, estimated to contain 28.3 million ounces, the largest in Colombia.

ABE Gold Project

Within the same mineral district hosting these established mines is an early-stage project called ABE, being acquired by Prudent Minerals Corp. (CSE: PRUD), a Canadian junior explorer that went public in April 2022.

The ABE gold project is located about 70 km south of Medellín, Antioquia’s capital city, covering a mining concession area of approximately 4,500 hectares including the Purimac gold mine, a long active operation dating back to the colonial period.

The property lies adjacent to the Romeral fault system and the Middle Cauca metallogenic belt of north-central Colombia, which hosts several large-scale gold and copper-gold deposits (see map below).

Prudent has exclusive rights to earn 100% of the ABE project through its acquisition of Berlin Precious Metals Corp. which was announced in December 2022 and is anticipated to close within the next fiscal quarter.

Berlin is the name of the past-producing gold deposit located 150 km to the north of ABE, in an identical geological setting (orogenic/mesothermal quartz veins). Between 1936-1946, the Berlin deposit produced a total of 413,000 oz.

So far, exploration at ABE has been designed to enhance the understanding of the gold mineralization currently exploited at the Purimac gold mine.

The quartz vein-hosted mineralization at Purimac is located along a 30m wide structural corridor that has been traced for over 2 km and mined underground over 17 levels and 2 km along strike; the mineralization remains open in all directions. The mined mineralized shoots averaged a grade of 26 g/t Au, with highlight muck grab samples of 96 g/t Au.

Modern Exploration at ABE

Modern exploration on the ABE property was first undertaken by Berlin in November 2020.

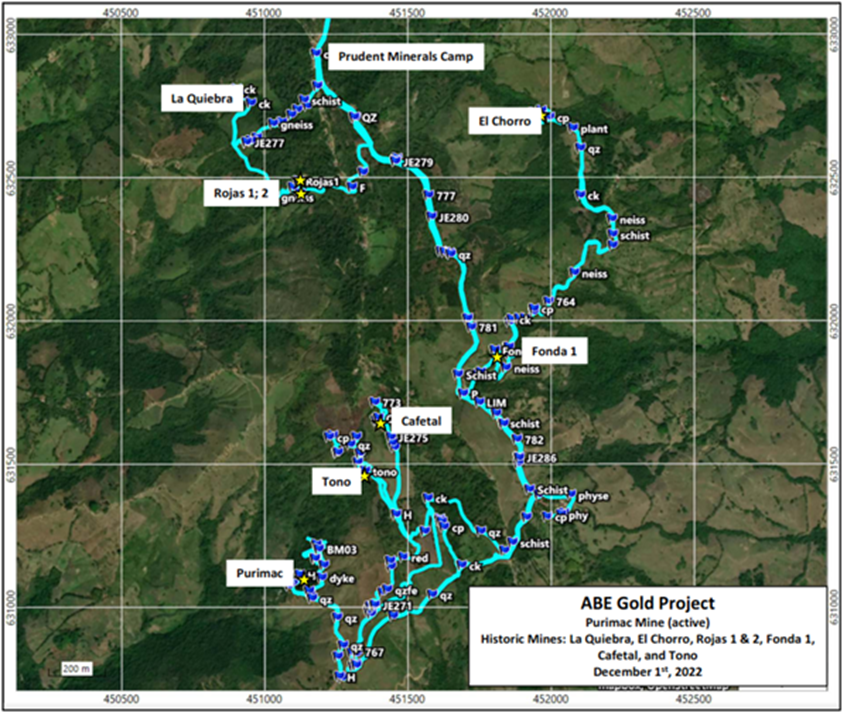

Activities included mapping at the Purimac mine, LIDAR over 20 km², and geochemistry over 119ha within the ABE mining concession identifying gold targets in parallel and sub-parallel geologic structures and 17 historical gold mines.

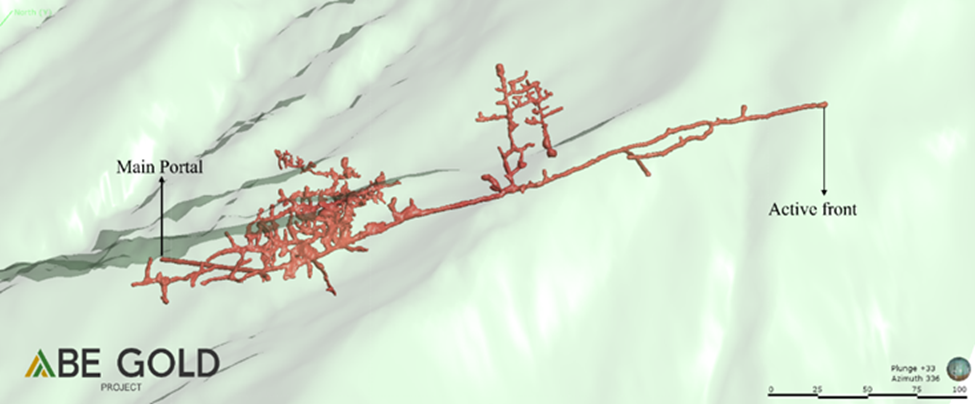

Mapping of the +1,500m of workings in the Purimac mine is in progress. The main level has 700m of advances in multiple veins. Shafts and stopes account for another 800m of workings. These workings connect to even older historical mine workings dating back to the year 1751.

The Purimac mine contains four shoots of mineralization, three of which have been intensely mined above the main level and are untouched below the main level. The newly discovered Shoot 4 is open above, below, and to the north of the currently advancing drift.

Mapping of historical mines indicates an association with intense multi-directional quartz vein systems within the Purimac shear zone (PSZ).

A Laser 3D model of the Purimac mine was completed in early 2022. At the time of the laser mine mapping, there were three known shoots of mineralization with stopes and shafts in multiple veins. The result from the 3D mine model gave the geologic model the plunge and dip of the shoots, therefore the geologic team is able to project the vein system to depth and strike length, thus creating drill targets.

Shoot 4 in the Purimac mine was undiscovered at the time of laser mapping; additional shoots are expected to be regularly spaced along the strike of the PSZ.

Mapping of the Purimac mine has confirmed at least 1,500m of accessible workings, including three extensively mined high-grade mineralized shoots, which are open to depth, and a newly discovered Shoot 4, open 250m above, and open to depth, and to the north. The mine is currently testing the north principal front at 400m inside the mountain.

A long section of the workings was undertaken to show how historical mining has only scratched the surface of the mountain (see below).

A LIDAR survey covering 20 km² was carried out in late 2021 along the strike of the PSZ. Using LIDAR, structural geologic mapping was made from interpretations along with detailed structural mapping of underground exposures.

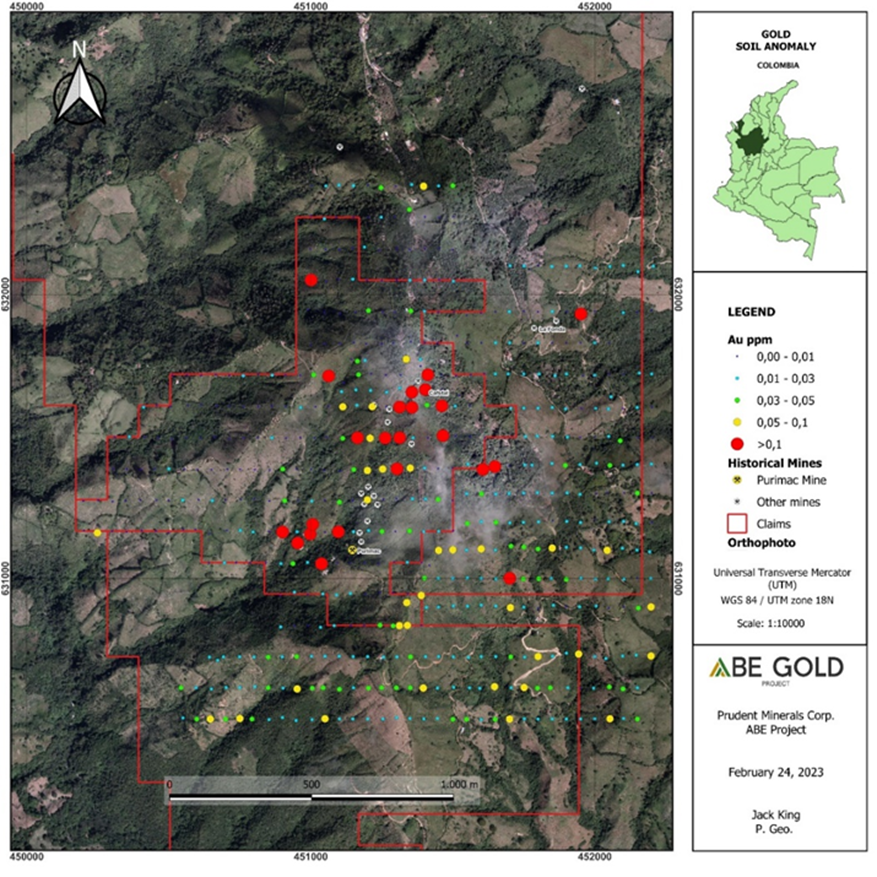

Extensive soil geochemistry and geophysical programs were conducted from November 2021 through to October 2022. The soil geochemistry combined with other associated elements indicated that there are multiple parallel gold mineralized structures to the east and west of the known shear zone.

In addition, a ground magnetic survey covering 137ha was done in 2022 and indicated a strong correlation between gold mineralization and magnetic highs. A ground induced polarization (IP) geophysics survey was also completed, showing a southern strike length extension of the known Purimac mineralized shear zone.

High-Grade Gold Target

In its first update since the acquisition announcement, Prudent summarized in a technical report the results of the soil geochemistry program, showing that the quartz veins are hosting gold mineralization with values that have exceeded 100 g/t gold over 1.8m.

A total of 167 samples were tabulated from surface, underground and mill feed or concentrate sampling. Elevated gold values have been returned from sampling with 131 of the 167 samples collected thus far returning values greater than 1 gram per tonne of gold. Highlights include: 162.00 g/t gold over 1.0m, 80.37 g/t gold over 1m and 97.33 g/t gold over 1.0m.

But the biggest takeaway from the March update was the confirmation of an exploration target estimated to be up to 6.3 million tonnes with potential grades of 5.0 to 15.0 g/t gold, which the company says “clearly demonstrates the project’s large-scale potential.”

The estimation is based on the following assumptions: 1) The size and extent of the historic workings, which occur between 1,600m and 1,350m; 2) A strike length of 800m was used of the 1,600m outlined by the coincident NE trending workings, magnetometer and induced polarization resistivity responses; 3) Four underground quartz veins displaying widths of 1.0 to 3.0m, an average dip of -65° resulting in estimated true widths of 0.90 to 2.90m of all veins; and 4) A specific gravity of 2.72 is estimated for the quartz.

“Prudent is currently focussed on defining the strike potential and continuation of the Purimac gold vein system from the underground mine to surface, initially through an extensive soil geochemistry program, also advancing delineation of drill targets,” PRUD president Brett Matich said in the news release.

According to the company, the Purimac veins appear continuous and are projected with orientations that are coincidental with seven historical workings (see above), soil geochemistry, ground magnetics and induced polarization resistivity responses. This coincidental trend extends over 1,600m and spans a width of approximately 680m and is open in all directions.

An extensive soil chemistry program is underway over the 1,600m by 680m zone, with the objective of extending the underground Purimac gold vein system and advancing delineation of drill targets.

SAT Project

Another project that Prudent is working on is SAT, an exploration-stage porphyry copper-gold prospect located in west-central British Columbia.

This 5,617-hectare property lies 12 km SW of the Bell copper-gold porphyry deposit and 13 km W of the Granisle copper-gold porphyry deposit, both of which were producers of copper- gold-silver concentrate in the past.

“The geological setting, with the historic Bell and Granisle mines lying 12 km to the northeast and 13 km to the east, respectively, makes the SAT Property an intriguing porphyry copper target in a prolific porphyry belt,” PRUD president Matich said.

Earlier this year, the company initiated the notice of work process with the BC Ministry of Energy, Mines and Low Carbon Innovation for a drilling permit. The plan is to apply for a multi-year area-based (MYAB) permit to drill test several geochemical/geophysical anomaly targets within the historically drilled SAT Main zone

A two-hole diamond drill program has been recommended at this zone, with proposed hole depths of at least 550 metres in order to effectively evaluate the potential for copper grades beneath the historical drilling to date.

Conclusion

The gold mining industry is entering a new era where assets in prime jurisdictions are continuously being sized up; any project with a decent chance of a significant discovery would make a good acquisition target.

Though it’s still early days at Prudent’s ABE project with just over two years of modern exploration, the fact that a large, million-tonne target with grades as high as 15 g/t Au has been identified makes it worth monitoring.

The company is working on understanding the geologic model to unlock more drill targets, as historic mining has “only scratched the surface of the mountain,” as the company says. More details on the ABE project will be unveiled as it “digs deeper” into the network of the large gold vein system.

It’s also worth noting that Brett Matich, its president, has over 25 years of success in the industry, overseeing several mining projects across the globe. He’s also the CEO of Max Resource, which is sitting on a district-scale silver-copper project in northeast Colombia that’s still growing in size.

Prudent Minerals Corp.

CSE: PRUD

Cdn$0.09, 2023.05.29

Shares Outstanding 25m

Market cap Cdn$2.4m

PRUD website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Richard does not own shares of Prudent Minerals Corp. (CSE: PRUD). PRUD is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of PRUD

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.