Prudent Minerals closes acquisition of Berlin Precious Metals, officially taking over ABE gold project in Colombia – Richard Mills

2023.07.28

Prudent Minerals Corp. (CSE: PRUD) has successfully completed the acquisition of all of the issued and outstanding shares of Berlin Precious Metals Corp., a Colombia-based gold mining company.

As per the terms of an agreement signed last December, Prudent has issued 8 million common shares plus 8 million share purchase warrants to Berlin’s shareholders. Each warrant allows its holder to acquire a Prudent share for $0.50 for a period of five years. The stock is currently trading at $0.10 apiece.

With the acquisition of Berlin, Prudent now holds the exclusive right to earn 100% of the ABE gold project in Colombia.

ABE Gold Project

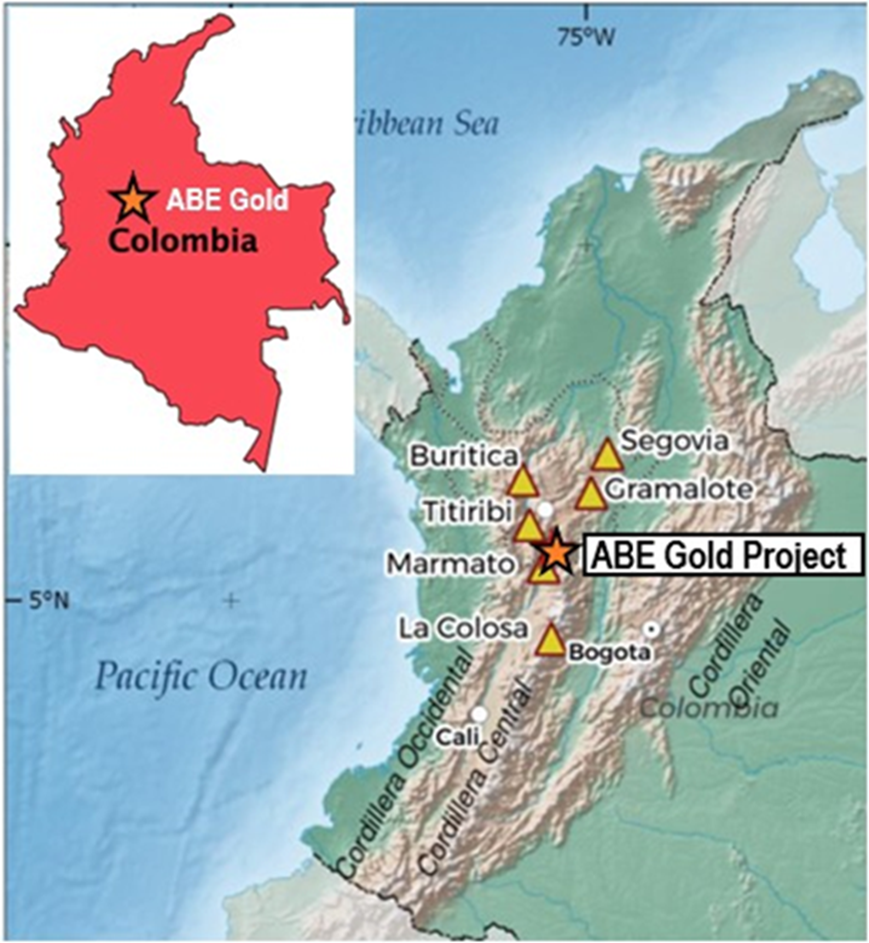

The ABE gold project is situated 70 km south of the city of Medellín, the capital city of Antioquia.

It consists of five concession applications covering 4,512 hectares, including a 110-hectare mining concession that covers the Purimac gold mine, site of a long active operation dating back to the colonial period.

The ABE property lies adjacent to the Romeral fault system and the Middle Cauca metallogenic belt of north-central Colombia, which currently hosts several large-scale gold and copper-gold deposits. Notable names include: La Colosa (+28Moz), Marmato (+17Moz), Buritica (+11Moz), and the Segovia district (+3Moz).

A December 2022 technical report published on the ABE property outlined an exploration target of up to 6.3 million tonnes, with potential grades of 5 to 15 grams gold per tonne.

The report revealed the ABE project is located on the western side of the Central Cordillera within a belt of metamorphic rocks known as the Cajamarca Complex. This complex surrounds the Antioquia Batholith, which, along with a group of smaller granitic batholiths and stocks, is host to a multitude of gold deposits.

The geological setting is analogous to that in the Berlin-Rosario Gold District located approximately 150 km northwest, in similar metamorphic rocks surrounding the batholith.

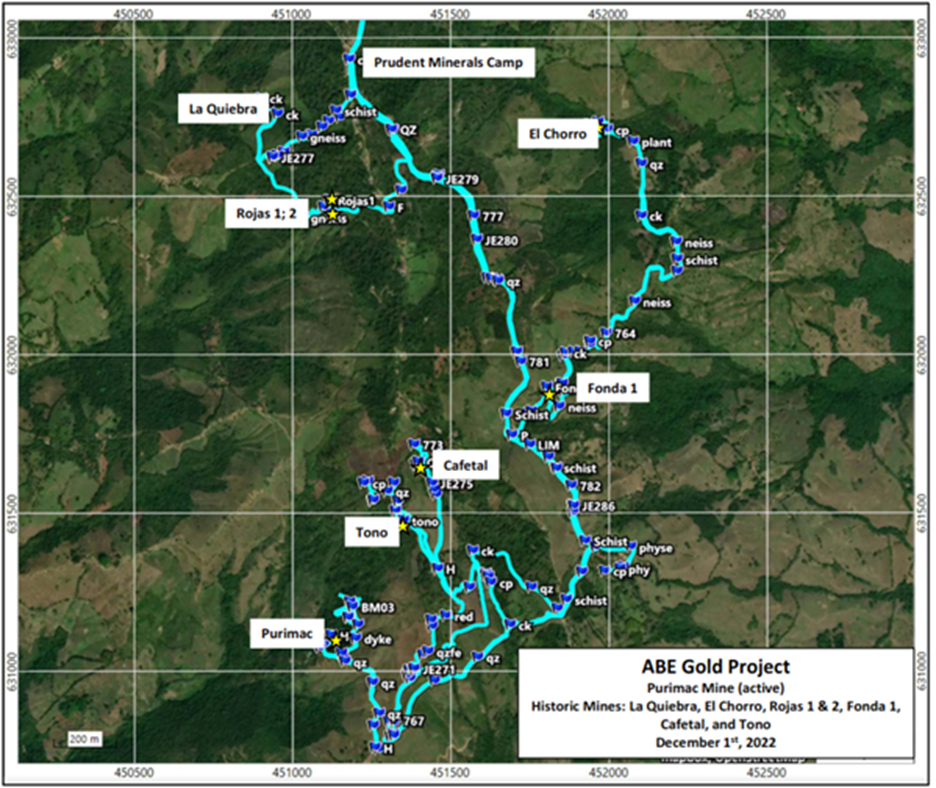

Previous exploration by Berlin Precious Metals included mapping at the Purimac mine, LIDAR, and geochemistry over 119 hectares within the ABE mining concession, identifying gold targets in parallel and sub-parallel geologic structures and seven historical gold mines.

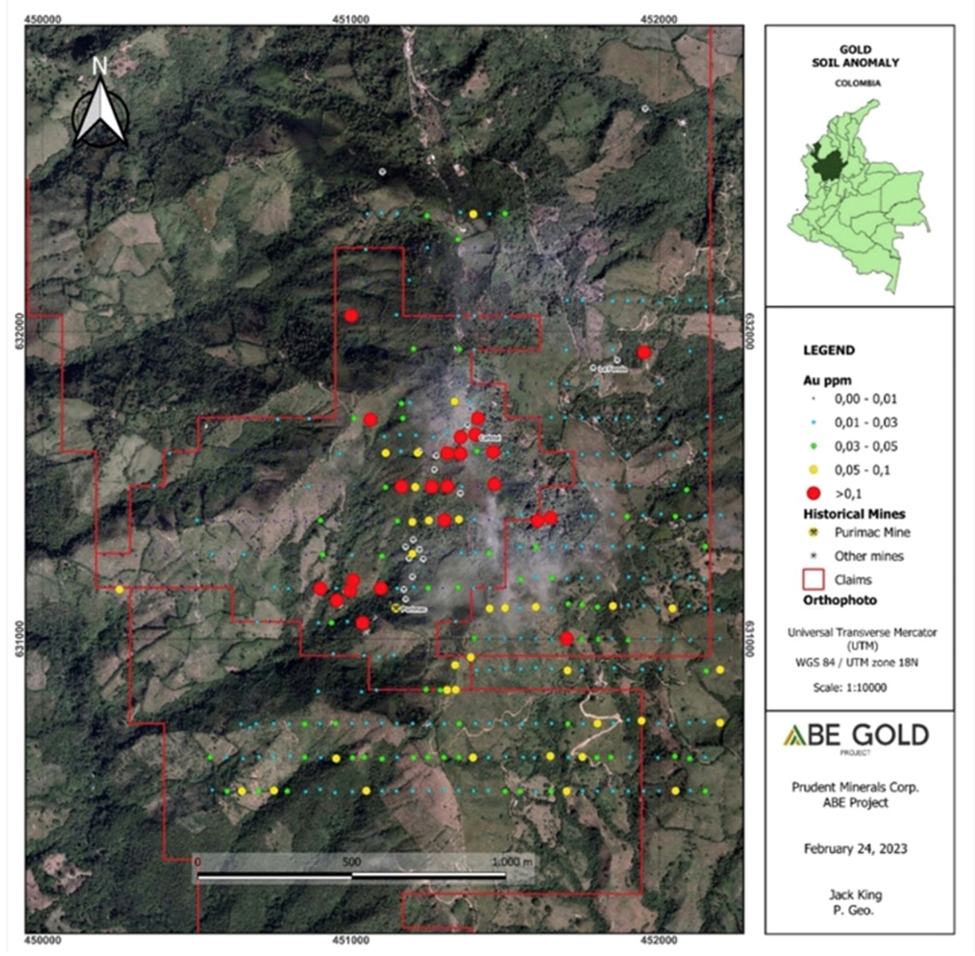

Highlight gold values of 3.4 g/t in surface soil samples and 6.61 g/t in historical mines have been recorded. Berlin has reportedly spent over half a million dollars in exploration over the past two years.

So far, exploration at the ABE property has been designed to enhance the understanding of the gold mineralization currently exploited at the Purimac gold mine. Rock sampling at the mine has shown that the quartz veins host gold mineralization with values exceeding 100 g/t over 1.8m.

This mineralization, located along a 30-meter-wide structural corridor, has been traced for over 2 km, and mined underground over 17 levels and the historical gold mines span over 2 km along strike; it remains open in all directions. The mined mineralized shoots averaged 26 g/t Au, with highlight muck grab samples of 96 g/t.

The Purimac veins appear continuous and are projected with orientations that are coincidental with seven historical workings (see below), soil geochemistry, ground magnetics and induced polarization resistivity responses. This trend extends over 1,600m, spans a width of approximately 680m, and is open in all directions.

Sampling & Mapping in Progress

Clearly, from the work to date and results of underground rock sampling, Prudent has identified a solid exploration target characterized by high grades and further expansion potential.

According to the aforementioned technical report, the project assumptions are based on the size and extent of the historical workings, which occur between 1,600 and 1,350 meters above sea level. The targeted quartz veins hosted in the Purimac shear outlined by the coincidental northeast trending magnetometer and IP resistivity suggest a strike length of 1,600 meters; however for the report, 800 meters was used.

The four quartz veins identified in the underground workings have widths ranging from 1 to 3 meters and estimated true widths of 0.90 to 2.90 meters. A specific gravity of 2.72 is estimated for the quartz.

Using these parameters, the Purimac vein set represents an exploration target of 2 to 6.3 million tonnes, with potential grades of 5 to 15 g/t gold. These figures, according to Prudent president Brett Matich in an earlier news release, “clearly demonstrate the large-scale potential” of the ABE project.

“Prudent is currently focused on defining the strike potential and continuation of the Purimac gold vein system from the underground mine to surface, initially through an extensive soil geochemistry program, also advancing delineation of drill targets,” Matich added.

Sampling is currently underway over the 1,600m by 680m zone, with the objective of extending the underground Purimac vein system and delineating drill targets.

Mapping of the +1,500m of the Purimac and historic mines are also well in progress. These workings connect to even older historical mine workings dating back to 1751.

The Purimac mine contains four shoots of mineralization, of which three have been intensely mined above the main level and are untouched below the main level. Newly discovered Shoot 4 is open above, below and to the north of the currently advancing drift.

A ground-induced polarization (IP) survey is now completed showing a southern strike length extension of the known Purimac Mineralized Shear Zone. The survey consisted of 27 line kilometers, with lines spaced 100m and 200m apart.

According to Prudent, the geologic model indicates that the Purimac mineralized shear zone has multiple veins containing high-grade mineralized shoots. The model will be used to pick high-potential drill targets.

Exploration in British Columbia

Another project that Prudent has an exclusive right to acquire is SAT, an exploration-stage porphyry copper-gold prospect located in west-central British Columbia, Canada.

This 5,617-hectare property lies 12 km southwest of the Bell copper-gold porphyry deposit and 13 km west of the Granisle copper-gold porphyry deposit, both of which were producers of copper- gold-silver concentrate in the past.

The SAT property is located within the Intermontane Tectonic Belt, a partly collisional tectonic belt comprising a series of accreted terranes.

The Stikinia terrane, largest of these terranes, underlies the SAT property as well as a large portion of central British Columbia. Stikinia consists of a series of Jurassic, Cretaceous and Tertiary magmatic arcs and successor basins which unconformably overlie Permian sedimentary basement rocks

“The geological setting, with the historic Bell and Granisle mines lying 12 km to the northeast and 13 km to the east, respectively, makes the SAT Property an intriguing porphyry copper target in a prolific porphyry belt,” PRUD president Matich said.

Earlier this year, the company initiated the notice of work process with the BC Ministry of Energy, Mines and Low Carbon Innovation for a drilling permit. The plan is to apply for a multi-year area-based (MYAB) permit to drill test several geochemical/geophysical anomaly targets within the historically drilled SAT Main zone

A two-hole diamond drill program has been recommended at this zone, with proposed hole depths of at least 550 metres in order to effectively evaluate the potential for copper grades beneath the historical drilling to date.

Conclusion

Prudent’s two projects both present interesting propositions to investors looking to capitalize on the mining industry’s long overdue concern of reserve depletion.

At AOTH, we previously highlighted that the world’s gold mine reserves have already surpassed their peak, meaning that gold is only going to become scarcer as time goes on; that is, if gold miners continue on the current pace of production against rising demand.

Copper, the metal critical in clean energy applications and many more, faces a similar, if not worse, fate. Global consulting firm McKinsey forecast that the world will see a 6.5-million-tonne deficit by the start of next decade.

At the mercy of resource depletion, it’s really up to the exploration companies to fill the gap with new discoveries that could one day help refill the supply gap.

Wood Mackenzie, another well-known consultancy group, says to avoid a perpetual decline in mined gold, we must see a rise in the number of gold projects under development that have a good chance of becoming mines. The firm crunched the numbers and found that by 2025, the industry will need to commission 8 million ounces of projects.

Sam Crittenden, an analyst with RBC Dominion Securities, recently estimated that the energy transition’s copper requirements will mean an additional 1% of copper supply, the equivalent of one large copper mine (a la Escondida) coming online every year.

These represent a tough mountain to climb by the looks of it, making investing in exploration-stage projects all the more important for a secure future. Prudent has two projects that fit the profile; the newly acquired ABE project looks particularly exciting, given that much of Colombia remains underexplored, and the country, being one of the largest gold producers in South America, wants to shift away from coal mining and towards other minerals. Many prominent gold deposits are already found in the Andean nation, invested by some of the world’s biggest mining companies (Newmont, AngloGold etc.).

With the completion of the Berlin acquisition, thereby taking over the ABE project, the company is now well set up for future partnerships.

Prudent Minerals Corp.

CSE: PRUD

Cdn$0.10, 2023.07.26

Shares Outstanding 24.9m

Market cap Cdn$2.49m

PRUD website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Richard does not own shares of Prudent Minerals Corp. (CSE: PRUD). PRUD is a paid advertiser on his site aheadoftheherd.com.

This article is issued on behalf of Prudent Minerals Corp.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.