Problems with current shipping routes Part II – Richard Mills

2024.12.27

Global trade routes are shifting Part I

Supply chain disruptions at key ocean shipping routes have become more prevalent in recent years, and that’s a problem, since 90% of goods are shipped by sea, states World Economic Forum.

Incidents have included the covid-19 lockdowns, the Ever Given container ship getting stuck in the Suez Canal, droughts at the Panama Canal, Russia’s blockade of Ukraine’s Black Sea ports, and the ongoing attacks on ships in the Red Sea by Houthis in Yemen.

Last month CNBC reported the Panama Canal Authority saw a 29% drop in vessel transits during fiscal 2024, with LNG and bulk dry shipments taking the biggest hit.

A two-year drought beginning in 2022 resulted in bottlenecks, when long cues of vessels waited to pass through the canal as a result of a drop in vessel transits in an effort to conserve water.

According to the PCA, via CNBC, CA, 50 million gallons of fresh water are used when a vessel traverses the canal.

Water-saving measures have been put in place and ships have had to lower their draft to continue using the locks.

The Suez Canal has long played a strategic role in trade and geopolitics, but last year and this year, the canal has been affected by attacks on commercial ships in the Red Sea, causing canal revenue to plummet.

The same goes for shipping companies operating in the Hormuz Strait.

The Malacca Strait, already prone to congestion and collisions, is expected to exceed its capacity by the end of the decade. Thailand has reportedly proposed a 100-km land bridge at the narrowest part of the Malay Peninsula, where goods could be offloaded and transported by rail and road, avoiding the Malacca Strait. (World Economic Forum)

Alternative trade routes

Belt and Road Initiative

An ambitious trade corridor first proposed by the Chinese regime under its current president, Xi Jinping, in 2013, the Belt and Road Initiative (BRI) is a “belt” of overland corridors and a “road” of shipping lanes.

It consists of a vast network of railways, pipelines, highways and ports that would extend west through the mountainous former Soviet republics and south to Pakistan, India and southeast Asia.

According to the Council on Foreign Relations, so far 147 countries —accounting for two-thirds of the world’s population and 40% of global GDP — have signed on to projects or indicated an interest in doing so.

The Belt and Road Initiative is seen by proponents as an economic driver of proportions never seen before in human history. It would not only allow Asia to relieve its “infrastructure bottleneck” i.e. an $800 billion annual shortfall on infrastructure spending, but bring less-developed neighboring nations into the modern world by providing a growing market of 1.4 billion Chinese consumers.

Opponents argue that is naive and the real intent of BRI is to carve new Chinese spheres of influence in Asia that will replace the United States, in-debt poor nations to China for decades, and restore China to its former imperial glory.

Chancay Port

Recently China expanded the BRI by opening a new port in Peru.

The $3.5 billion deep water port is in the small fishing town of Chancay, from which the port takes its name. Construction began in 2018, with the first phase finished this month. President Xi Jinping took time out of scheduled visits to South America to christen the new port.

The facility was built to provide China with a direct gateway to the resource-rich region. Key trade items include copper, blueberries and soybeans from Brazil. It also proximal to the “lithium triangle” formed by Chile, Argentina and Bolivia.

Peruvian cargo destined for Asia and Oceania currently transits through Central America or North America. To reach South America, bigger cargo ships first go to ports in the United States or Mexico and their goods are offloaded onto smaller ships.

China challenges US in South America with new port in Peru — Richard Mills

The Peru port, built under China’s Belt and Road Initiative (BRI), will reduce shipping times to China from 35 to 23 days, cutting logistics costs by at least 20%, a Chinese Foreign Ministry spokesperson said.

Majority-owned by Cosco Shipping, a state-owned enterprise, Chancay will be the first port to be controlled by China in South America. It can accommodate vessels up to 18,000 TEUs (20-foot equivalent units), the largest in the world. The ships can sail directly to and from Asia.

Chancay must be seen not only as a direct shipping route from China to Peru and vice versa, but as a challenge to the United States in its own backyard — Latin America — once protected from incursions by other European powers by the Monroe Doctrine.

Nobody at the time thought China would be a threat to US hegemony over Central and South America. According to Global Times, a Chinese state-owned newspaper whose reporting must always be seen as biased, The connection represents more than the BRI’s establishment in Peru, but the birth of a new Asia-Latin America land-sea corridor.

China will work with Peru to build a land-sea corridor between China and Latin America with Chancay Port as a starting point.

“The Chancay mega port aims to turn Peru into a strategic commercial and port hub between South America and Asia,” Peru’s trade minister Juan Mathews Salazar told Reuters. The publication added:

Beijing and Lima hope Chancay will become a regional hub, both for copper exports from the Andean nation as well as soy from western Brazil, which currently travels through the Panama Canal or skirts the Atlantic before steaming to China…

Peru’s government is planning an exclusive economic zone near the port and Cosco wants to build an industrial hub near Chancay to process raw materials that could include grains and meat from Brazil before shipping them to Asia.

China is Peru’s largest trading partner, having signed onto the Belt and Road Initiative along with at least 22 Latin American and Caribbean countries.

Beyond Belt and Road, some see China’s heightened presence in South America in purely economic terms. CNBC quoted William Reinsch, Scholl Chair in International Business at the Center for Strategic and International Studies, saying that “China’s own economy is slowing, and the government’s standard response to that is to try to export their way out of it. Among other things, that means looking at parts of the world that they have not yet extensively penetrated.”

Reinsch noted the Western Hemisphere has an abundance of commodities, agricultural products and minerals that China needs.

Once the Chancay Port is up and running, goods from Chile, Ecuador, Colombia and Brazil are expected to pass through it on their way to Shanghai and other Asian ports.

Brazil and China have been moving ever-closer both diplomatically and economically.

Xi and his Brazilian counterpart, Luiz Inacio Lula de Silva, have signed nearly 40 agreements on trade, technology and environmental protection.

Brazil’s ambassador in Peru says the Chancay Port is “an opportunity for grain and meat production,” naming four Brazilian states that would benefit. He added that “Brazilian businesses are delighted with the possibility of not using the Panama Canal to take their goods to Asia,” and noted there would need to be investment in the Interoceanic Oceanic Highway which runs from southern Peru across the Andes to Brazil. A rail link is in the study phase.

According to Al Jazeera, two-way commerce between China and Brazil exceeded $160 billion last year, with the South American country sending mainly soybeans and other primary commodities to China, which in turn sold Brazil semiconductors, telephones, vehicles and medicines.

Brazil and Chile, already worried about low-cost Chinese imports undercutting local businesses, have scrapped tax exemptions for individual customers on low-value foreign purchases.

Middle and Southern Corridors

A recent paper written for the United Nations Conference on Trade and Development (UNCTAD) argues that recent crises like the war in Ukraine have shifted trade routes, with freight flows through traditional routes such as the Northern Corridor falling.

The Atlantic Council explains that Currently, the primary land-based trade route between Europe and China is the Northern Corridor, a rail-freight system that runs through Russia with a cargo capacity of over 100 million tons. But following Russia’s full-scale invasion of Ukraine, the Northern Corridor has become a political and financial liability, particularly for NATO allies and partners anxious to reduce dependence on Russia and countries in the West who are reluctant to support Russia and aiming to counter the Kremlin’s adventurism.

East-west trade has also been hit by the Red Sea Crisis (the civil war in Yemen), requiring shipping companies to look for alternate routes.

The Middle Corridor connects China and Central Asia via the Caspian Sea with the Caucasus, Turkiye and Europe. The route, also known as the Trans-Caspian International Transport Route (TITR), is a multimodal network of railways and ports that begins in China and runs across Central Asia, the Caucasus and the Black Sea before reaching Europe.

Trade along the route has exploded in the past couple of years. The Atlantic Council reports it grew from 530,000 tons in 2021 to 2.3 million tons in 2023. During the first six months of 2023, the Middle Corridor experienced a 77% increase in tonnage compared to the first half of 2022, while the Northern Corridor’s tonnage fell by 56%.

The main reason for the shift is the war in Ukraine.

The Middle Corridor however isn’t without its challenges. The route’s infrastructure is dated and it is not well integrated across borders, which limits the amount of freight volume it could handle. It will thus be necessary to build out and expand the system. The World Bank estimates that with adequate infrastructure investment, Middle Corridor trade volumes could reach 11Mt by 2030.

One last point about the Middle Route is that, while it cuts out Russia, China has shown interest in it. Beijing previously invested in the Anaklia revitalization project in Georgia, although it was later shelved by a new administration there. The Atlantic Council notes that the Middle Corridor complements China’s Belt and Road Initiative, and that China contributed $1.5 billion for an industrial park at Alat, adjacent to the Port of Baku in Azerbaijan.

The Southern Corridor is a historical trans-Eurasian land corridor connecting Europe with India, Pakistan and Bangladesh. It was the oldest, longest, and most heavily used of the three corridors, and existed uninterrupted for 3,000 years until the Soviet Union was established (Google AI Overview).

According to the UNCTAD paper, the Southern Corridor is well placed to facilitate the flow of east-west trade, along which it is increasing.

On average, transport operations by Turkish operators from Türkiye to Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan increased by 44% from 2020 to 2023. In the case of foreign operators, it rose by 86%.

Transport from Lianyungang, China, to Türkiye or EU countries via these corridors takes between 13 and 23 days. In contrast, the maritime route via the Suez Canal takes between 35 and 45 days.

Meanwhile, cargo ships are being rerouted around the southern tip of Africa to avoid the Red Sea. The guerilla organization has carried out more than 100 attacks on vessels going through the Red Sea between mid-November 2023 and mid-July 2024.

According to Valdai Discussion Club, the port of Eilat has laid off half its workers and recorded million-dollar losses, while over 50 countries have been impacted by inflation and good shortages driven by the war. Containers shipping through the Red Sea have dropped to zero and Asian ports are experiencing delays as ships reroute and schedules are disrupted.

An almost-empty Red Sea, which has historically been a sea of globalization, and which usually handles 12-15% of global trade annually, has become one of the most powerful symbols of the dying international order. The Houthis’ asymmetrical warfare has truly made the Bab-el-Mandeb the Gate of Tears, at least for Western ships.

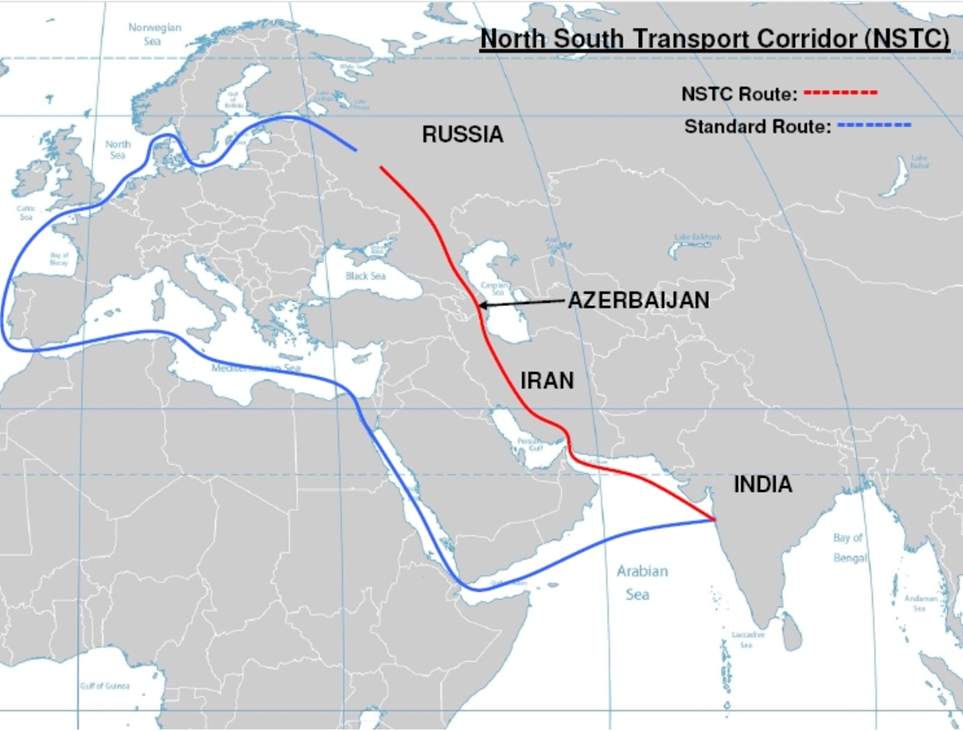

North-South Transportation Corridor

Another alternative is the North-South Transportation Corridor (NSTC), a 7,200-km-long route linking Indian ports to Iran, across the Caspian Sea, and finally to Russia.

According to Wikipedia, NSTC is “a multi-mode network of ship, rail and road route for moving freight between India, Iran, Azerbaijan, Russia, Central Asia and Europe.”

One source notes this corridor represents a means for Russia and Iran to circumvent Western sanctions.

It competes with the US-backed India-Middle East-Europe Economic Corridor (IMEC) which envisions a new trade route starting from India, moving to UAE ports, then via road and rail to Saudi Arabia, through through Jordan to Israeli ports, and finally reaching European markets via the Mediterranean. Though still mostly at the conceptual stage, this initiative aims to divert maritime transport from the Red Sea.

Development Road Project

Thirdly, the Iraq Development Road endeavors to connect Asia with Europe by establishing a network with railways, roads, ports and cities. Born out of a collaboration between Turkiye and Iraq, the project, says Wikipedia, will link the Grand Faw Port in southern Iraq to Turkiye’s border and further extend into Europe.

According to the Wilson Center, Turkiye’s President Erdogan’s first visit to Iraq earlier this year led to discussions on alternative pathways for the Middle East. Out of 26 memorandums signed, one was a memorandum regarding an infrastructure project known as the Iraq Development Road, or the Development Road Project.

Like the NSTC, the Development Road Project competes with the IMEC, offering higher speed and transportation capacity, although the capex has gone up:

The project’s objective is to establish an uninterrupted highway and rail corridor between Basra, [Iraq] and London, with the initial phase of the project anticipated to be completed by 2028. Although the project’s cost was announced at $17 billion, it will likely exceed $24 billion…

The Development Road’s greatest promise lies in its high speed and low cost. Transporting products to the European market from Al Faw via the Development Road offers a 10-day advantage over the Suez Canal…

Besides the planned infrastructure between Basra and Türkiye, the logistics lines in Türkiye are already mostly complete.

A further development occurred in August, when Turkiye hosted transport ministers from Iraq, Qatar and the UAE to discuss building the new trade route.

Bloomberg reports that Erdogan is seeking financing from the UAE and Qatar to build a rail and road network from Iraq’s Faw port on the Persian Gulf to its northern border with Turkey and a railway across Istanbul’s Bosphorus Strait bridging Europe and Asia.

For Erdogan, attracting UAE support is critical for the so-called Development Road project because the Gulf country is also involved in talks for a competing US-backed project, the India-Middle East-Europe Economic Corridor. Turkey has said the Development Road would be a shorter route and that cargo demand could be sufficient to support both projects.

The article concludes that Once a stop on the ancient Silk Road, Turkey is vying to become a conduit for exports to Europe amid growing competition over trade routes as China builds its own influence across the energy-rich Middle East.

The aforementioned trade corridors, says TRT World Research Centre, not only indicate the rise in global interconnectedness but also signal the shift towards multipolarity and a departure from a US-led international architecture controlling global commerce.

“The new situation allows countries to adopt a multi-aligned actor behaviour. For example, the US, in its strategy of competition with China, needs allies like India. Hence, India was rewarded with the IMEC starting route. However, India does not unquestioningly join such anti-China projects but also develops alliances with Russia and Iran. Similarly, the UAE takes part in the competition between the US and China but opts to be part of other alternatives, such as the Development Road Project. Türkiye, outside the scope of IMEC, forges its alternative with its neighbours while expanding its counter-terrorism campaign.

This environment is conducive to multi-alignment and gives a breathing space to countries confined to strictly following one camp or the other. As exemplified by the UAE, a middle power can invest in critical routes favoured by Washington while also signing multi-billion-dollar investment deals with actors like China or joining blocs like BRICS. Long-time American partners like Saudi Arabia and the UAE are wooed by BRICS, which also includes their arch-enemy, Iran. The game and its rules are changing. So, new scenarios arise, and previous arrangements dissolve.

Emanuel Pietrobon, author of the Valdai Discussion Club piece, says that great power competition-driven instability over the most-used trade routes, combined with climate change, is making the NSTC more attractive and the North Pole more navigable:

In the long-term, the new season of instability in the Middle East combined with climate change, against the backdrop of the great power competition, are set to re-configure rules and rulers of globalisation. Russia, the Caucasus and Central Asia are set to benefit the most from this epoch-making change.

For Russia and Iran, the NSTC opens new markets and reduces dependency on Western-controlled routes, he says. For India, it provides quicker and easier access to Central Asian and European markets.

The numbers just work. The NSTC cuts the traditional Mumbai-Moscow maritime route from 16,000 km to 7,200, decreases travel time from a month to 20-25 days, and reduces transportation costs by 30%.

Rethinking the polar routes

Russia has seriously started looking at a northeast passage through the Arctic thanks to global warming melting polar ice.

Pietrobon makes the following points on the subject:

- Not only is the Russian Arctic home to some of the world’s richest gas and oil reserves, which await to be exploited. Its transformation into a medium-to-high traffic seaway of globalization is as increasingly possible, thanks to climate change, as it is desirable for a number of Asian powers, including India and China.

- An ice-free Arctic might dramatically alter the balance of power and further shake up the already declining Western-centric model of globalization.

- The main beneficiaries of such an epoch-making development would be Russia and China, with the former gaining profits from transit fees and with the latter shortening shipping times to Europe by up to 50% in comparison with the Suez route.

- The Polar route is not only the shortest shipping corridor between European markets and Chinese factories, it features near-zero political risk. In fact, Chinese, Japanese and Korean goods would reach Europe through a piracy-free 5,600-kilometer-long route controlled by one country, resulting in low-cost insurance, lower transit fees and fewer custom checks for shipping companies.

- The need for crisis-proof routes is driving China to eye the Arctic and an ensemble cast composed of Azerbaijan, India and Iran to endorse the NSTC. In both cases, the Suez route is destined to experience a drop in terms of traffic in the long-term, while Russia is potentially projected to be the new centre of gravity of emerging trade routes.

- Several countries have already expressed an interest in the development of the Polar route, including India, Kazakhstan, Japan and South Korea, and that its growing attractiveness stems from the fact that the political risk in the Indo-Mediterranean region is likely to endure and increase over time.

- The stakes are so high, because the eventual building of the northern sea route and of the NSTC would be a long-lasting game changer for world trade.

As the map above shows, there are three potential routes that cargo ships could travel across the top of the world: the Northern Sea Route, the Northwest Passage and the Transpolar Sea Route. A fourth consideration is that Russia is building new Arctic ports and refurbishing old ones.

According to the Arctic Institute, one of the biggest challenges is that the Arctic is increasingly seen as an area for geopolitical competition among the US, China and Russia.

For example the Northern Sea Route. Russia claims the NSR is within its territorial waters, while the United States disputes this claim, throwing a curve ball of uncertainty over who controls this passageway. Note that Canada recognizes Russia’s claim over the NSR and Russia recognizes Canada’s claim over the NWP. China is reportedly working with Russia to develop the NSR.

The Northwest Passage also presents a jurisdictional quandary. Canada claims the passage is within Canadian waters while the United States and the European Union say it is an international strait.

And while states have expressed interest in new Arctic shipping lanes for shorter transit times, resource extraction, military activities, fishing and tourism, the downsides include rough seas, severe climate, high costs, and lack of infrastructure.

One of the biggest concerns for countries whose borders touch the Arctic Circle,is Russia’s militarization of the region. According to the Arctic Council, in recent years Russia has reopened more than 50 military bases in the Arctic:

No other state has as solid a presence in the Arctic as Russia does. Opening these ports, no matter how practical, send the signal that Russia wants to retain what it sees as a historic domination of the region.

Conclusion

In a recent Project Syndicate article, author Dambisa Moyo identifies the eight headwinds for economic growth in 2025 are geopolitical fissures; divisive domestic politics; technological disruption and the rise of artificial intelligence; demographic trends; rising inequality between and within countries; natural-resource scarcities; government debt and loose fiscal policies; and deglobalization.

Moyo further notes that new cross-country alliances have weakened the US-led international order and the Bretton Woods institutions, such as the World Bank and the International Monetary Fund. The expanded BRICS bloc – led by Brazil, Russia, India, China, and South Africa – is the most significant of these alliances, representing more than 40% of the world’s population and 36% of global GDP.

Meanwhile, so-called “swing states” like Turkey, Saudi Arabia, and other Gulf Cooperation Council countries are reshaping global trade routes, reconfiguring supply chains, and redirecting investment flows, altering the distribution and pricing of key commodities such as foodstuffs and critical minerals.

Over the past few years, problems have surfaced with existing trade routes such as drought-caused low water levels at the Panama Canal and Houthi rebels in Yemen attacking ships in the Red Sea. Suez Canal traffic has been significantly reduced as ships are forced to transit around the bottom of Africa.

The same goes for shipping companies operating in the Hormuz Strait.

The Malacca Strait, already prone to congestion and collisions, is expected to exceed its capacity by the end of the decade.

The two countries most likely to benefit from the shift in maritime trade routes from those involving the Panama and Suez canals, to overland routes from the Middle East to Europe and possibly even opening up a new polar route due to thinning ice cover, are Russia and China.

China’s Belt and Road Initiative consists of a vast network of railways, pipelines, highways and ports that would extend west through the mountainous former Soviet republics and south to Pakistan, India and southeast Asia.

According to the Council on Foreign Relations, so far 147 countries —accounting for two-thirds of the world’s population and 40% of global GDP — have signed on to projects or indicated an interest in doing so.

22 Latin American and Caribbean countries are now part of BRI, and while Brazil hasn’t joined yet, China has been Brazil’s largest trading partner for over a decade.

China’s latest foray into Latin America is the Chancay Port in Peru. The $3.5 billion deep-water port was built to provide China with a direct gateway to the resource-rich region.

Goods from Chile, Ecuador, Colombia and Brazil are expected to pass through it on their way to Shanghai and other Asian ports, bypassing the Panama Canal.

According to Chinese media, the connection represents the birth of a new Asia-Latin America land-sea corridor.

China has also shown interest in the Middle Corridor which connects China and Central Asia via the Caspian Sea with the Caucasus, Turkiye and Europe.

The trade route is an alternative to the Northern Corridor which has become a liability in recent years because it depends on Russia.

There’s also the Southern Corridor, a historical trans-Eurasian land corridor connecting Europe with India, Pakistan and Bangladesh.

The United States has thrown its support behind the India-Middle East-Europe Economic Corridor (IMEC) which envisions a new trade route starting from India, moving to UAE ports, then via road and rail to Saudi Arabia, through Jordan to Israeli ports, and finally reaching European markets via the Mediterranean.

However, the IMEC faces competition from two other new routes, the North-South Transportation Corridor and the Development Road Project. The former allows US adversaries Iran and Russia to skirt economic sanctions. NSTC is “a multi-mode network of ship, rail and road route for moving freight between India, Iran, Azerbaijan, Russia, Central Asia and Europe.”

Born out of a collaboration between Turkiye and Iraq, the Development Road Project would link the Grand Faw Port in southern Iraq to Turkiye and further extend into Europe.

Notice the common country in the Middle and Southern corridors, along with the Development Road Project, is Turkey, renamed Turkiye in 2021.

Bloomberg concludes that, Once a stop on the ancient Silk Road, Turkey is vying to become a conduit for exports to Europe amid growing competition over trade routes as China builds its own influence across the energy-rich Middle East.

Finally, we can’t discount the opportunity that reduced northern polar ice cover provides for shippers looking to transport goods between Arctic nations. Two examples are the Northern Sea Route and the fabled Northwest Passage, that early explorers hoped was a shortcut to Asia from Europe.

The main problem with new Arctic shipping routes is uncertainty of jurisdiction. The United States disputes both Russia’s claim over the Northern Sea Route and Canada’s claim over the Northwest Passage.

Canada sees both Russia and China as security concerns in the Arctic. A new Arctic policy announced earlier this month sets aside CAD$34.7 million over the next five years, along with diplomatic initiatives including a new “Arctic ambassador”, opening consulates in Alaska and Greenland, and starting talks with “like-minded states” such as the US and Nordic allies on security in the region.

According to the Toronto Star,

The strategy names Russia and China in particular, noting the two countries are united in opposing the international order that Canada and its western allies support. It notes that Russia has been “modernizing its Arctic infrastructure and military capabilities” in the region for over a decade, including what government officials described as “nuclear-capable forces.” Russia also conducted joint military exercises with China in the Russian north in the summer of 2024, the strategy says.

On top of this, China and Russia have sailed warships in international waters off the Aleutian Islands, conducted joint coast guard patrols in the Bering Sea, and flown military aircraft that were intercepted by the joint North American Aerospace Defense Command (NORAD) that Canada shares with the U.S.

China is also foremost among “non-Arctic states” that the strategy says are trying to play a greater role in the region, with Beijing aiming to take advantage of commercial shipping opportunities opened up by warmer temperatures from climate change, as well as the exploitation of the region’s minerals, fossil fuels and fish.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

#trade #traderoutes #supplychain #Houthi #Artic