Positioning for the next precious metals up-leg

2022.07.27

Gold is a commodity with limited supply, therefore it cannot be “created” by simply printing a piece of paper; it must be mined and processed into gold bars or coins. Therefore, gold’s value stays fairly stable over a long period of time, making it an ideal hedge against inflation, which makes fiat money “cheaper”.

And because gold carries no credit or counterparty risks, it is trustworthy in all economic environments, making it one of the most crucial reserve assets worldwide. An added appeal for gold is its inverse relationship with the US dollar, the reserve currency; so long as the dollar is falling and gold is climbing.

Today, central banks hold more than 35,000 metric tons of the metal, which equates to about a fifth of all the gold ever mined. This is also the largest amount of gold maintained in global reserves since 1990.

The leading gold holders are some of the world’s most powerful nations, such as the US, Germany, Italy and France, all of which are keeping 60% of their foreign reserves as gold. This is a testament to the significance of gold in the central banking system.

If gold is so great as an inflation hedge, many must be wondering why the gold price has languished in the face of inflation levels last seen 40 years ago, in the early 1980s.

The answer, of course, is the Fed. The US Federal Reserve started off declaring that historically high levels of inflation were “transitory”, and would go away with the resolution of covid-related supply chain bottlenecks. When inflation rocketed from 5.4% a year ago to 8.5% in March, then 9.1% in June, all the Fed’s talk of transitory inflation dissipated, and its strategy switched to fighting inflation through a series of aggressive interest rate hikes.

The ”tightening” policy hasn’t worked, so far. Inflation has actually accelerated since the Fed began raising rates in March, prompting officials to hike them by a half-percentage point that month, instead of the earlier 25 basis-point expectation, and 75 basis points in June rather than the 50 points the Fed thought would be sufficient. Now, the central bank is targeting another 0.75% increase in July when the Federal Open Market Committee meets this Wednesday.

It has certainly been disappointing to watch the gold price, and gold mining company valuations, crumble since March. Yet those who think that gold’s appeal has been permanently tarnished due to the Federal Reserve’s interest rate increases, should consider this:

Ultimately gold is a monetary metal that performs best during times of weak (weakening) economic growth and increasing money supply, as fiscal and monetary policy actors attempt to counter economic weakness through lowering the price of money and stimulating demand. This is what we witnessed from the end of March 2020 through late-2021.

As the chart above shows, from January 1, 2019 to its August, 2020 peak of $2,034 an ounce, gold rose more than 60%! @Goldfinger notes that even after gold’s relative decline, it is still up around 10% from the very start of the pandemic in January, 2020, when spot gold was down around $1,570.

Also consider that gold’s meteoric rise in 2020 corresponded with a major expansion of the money supply globally, as many central banks engaged in “quantitative easing” during the covid-19-induced recession. QE involves the purchase of government bonds by “printing money”. At the same time, central banks dropped their interest rates to near zero, to encourage borrowing and economic activity. Low interest rates and expansionary monetary policy are always good for gold. In other words, the gold price behaved exactly as it was supposed to!

As for the current situation, it’s no surprise that rising interest rates have dented the gold price, since higher yields make income-generating assets like bonds a better option than gold, which offers neither a yield nor a dividend. Although, in most countries, the real interest rate (rate minus inflation) is still deeply negative, which for gold is a bullish price signal.

Inevitably the future gold price will turn on what happens with interest rates at the Federal Reserve, since the Fed controls monetary policy for the largest economy in the world and the biggest gold holder.

Fed pivot

Gold skeptics point to continually rising interest rates as a good reason to stay away from the precious metal. But increasing rates only makes sense if the economy can handle them; at a certain point, especially if the economy is weak, high inflation plus high interest rates will squeeze economic growth, prompting the Fed to reverse course, and begin lowering interest rates again.

There is ample evidence to show we are closer to this point than many think, and that the Fed could switch to lowering rates as early as the fall.

Frank Holmes, CEO of US Global Investors, and a respected gold market commentator, recently gave two reasons he thinks the Fed will “hit the panic button” and start cutting interest rates by American Thanksgiving. The first relates to supply shortages, and the second is the deteriorating Producers’ Manufacturing Index (PMI), a leading indicator of economic health.

According to Holmes, “Climate change is basically embedding inflation.” He refers to ill-conceived policies such as shutting down nuclear power plants in Spain and Germany, and taxing gas-powered cars and trucks. ESG (and friend-shoring) policies can cause supply shortages and more money-printing, as governments seek capital for green energy schemes. This leads to more inflation. Holmes pointed to Sri Lanka’s recent political upheaval as an example, telling David Lam of Kitco News, “They forced organic food everywhere in Sri Lanka, and they got a 20 to 30% drop in production. Inflation went through the roof, and there are already huge riots in the streets.”

Holmes suggests that widespread civil unrest, including in the States, could trigger the Fed to reduce interest rates. “All we have to do is get a big protest like they’re having in Europe… there’s a trend that’s going on in countries around the world,” he explained.

As for the PMI, Holmes said, “The PMI is shrinking globally. If the world [economy] all of a sudden starts contracting, panic buttons will set off and there will be a spigot open of more money printing.”

Weak economic indicators

It’s not only the Producers’ Manufacturing Index that is showing weakness, as high inflation impacts customers’ ability to pay, and higher interest rates make borrowing more expensive. As the chart below shows, the US Private Sector PMI, known formally as the S&P Global Flash US PMI Composite Output Index, fell for the first time in over two years (26 months), led by services.

“The preliminary PMI data for July point to a worrying deterioration in the economy. Excluding pandemic lockdown months, output is falling at a rate not seen since 2009 amid the global financial crisis, with the survey data indicative of GDP falling at an annualized rate of approximately 1%. Manufacturing has stalled and the service sector’s rebound from the pandemic has gone into reverse, as the tailwind of pent-up demand has been overcome by the rising cost of living, higher interest rates and growing gloom about the economic outlook,” said Chris Williamson, chief business economist at S&P Global Market Intelligence. He added:

“An increased rate of order book deterioration, with backlogs of work dropping sharply in July, reflects an excess of operating capacity relative to demand growth and points to output across both manufacturing and services being cut back further in coming months unless demand revives. However, with companies’ expectations of future growth slumping to the lowest since the early days of the pandemic, any such revival is not being anticipated. Instead, firms are already reassessing their production and workforce needs, resulting in slower employment growth.”

The S&P PMI confirmed figures that came out last week from the Philadelphia Fed Manufacturing Index, showing the index plunged for the fourth straight month. Even more worrying was the gauge of future economic activity, with -18.6 indicating the worst reading since 1979.

Mish Talk remarks, “In case you did not believe it before, this report should make it clear. A recession has started. The only questions are how deep and how long.”

If we are already in a recession, or close to it, one would think that would influence the Federal Open Market Committee’s rumored decision to raise interest rates by 75 basis points this week, or an even more aggressive 100 bps.

Bankrate notes that hiking interest rates a full percentage point would mark the first time the Fed has done this since the early 1980s, when the Fed led by Paul Volcker raised rates so high and so quickly that it caused the 1982 recession, one of the worst on record.

The website also makes the interesting observation that, Assuming the Fed hikes rates by its originally expected 75-basis-point increment, borrowing costs will be back at 2018 levels and on the verge of restraining economic growth for the first time in nearly three years.

Fed officials often cite the low unemployment level as evidence the US economy is in good enough shape for it to notch interest rates higher. While the number of unemployed is at a half-century low, and claims have remained stable, Bankrate reports they are drifting up:

[T]he labor market looks like it’s hitting a slowdown. Major companies from Apple to Google have slowed hiring plans; some companies like Shopify are yanking internship offers. Coupled with record-low consumer sentiment, job security looks like it could be taking a turn.

Economists see a sharp slowdown in job growth of 193,000 on average over the next 12 months, while the unemployment rate could edge up to 4.2% from 3.6%, according to Bankrate’s poll of the nation’s top economists.

Moreover, economists in Bankrate’s Second-Quarter Economic Indicator poll put the chances of a recession in the next 12-18 months at 52%, on account of the Fed’s more aggressive stance.

“The Fed itself doesn’t know when it’s going to stop,” Michael Farr, founder and CEO of Farr, Miller and Washington, a DC-based investment advisory firm, told the personal finance website.

“Peak inflation to me is like saying, ‘This is as hot as the forest fire is going to get.’ But that doesn’t change my plans if I have a house just over the next hill. They really want to see the forest fire go out, and until then, they’ll continue raising rates, markets will remain volatile and the risks are significant.”

A separate poll by Reuters found a 40% likelihood of a recession over the next year, and 50% within two years.

If that isn’t enough to convince you a recession is coming, it’s written in the charts.

In a typical healthy market, the yield curve (typically the spread between the US 10-year Treasury note and the 2-year note) shows lower returns on short-term investments and higher yields on long-term investments. This makes sense, as investors earn more interest for tying up their money for longer. The yield curve is said to “invert” when short-term yields are higher than long-term yields.

The yield curve has inverted 28 times since 1900, and in 22 of those times, a recession followed. For the last six recessions, a recession began six to 36 months after the curve inverted.

In a recent article, Real Investment Advice notes there are two indicators warning of a recession, both of which have near-perfect track records. The first is that currently, 50% of the 10-year spreads they track are inverted, as the chart below shows.

The second is the Leading Economic Index’s 6-month annual rate of change. According to RIA, the chart below showing the 6-month rate of change turning negative, either precedes outright recessions or near-recessionary environments.

When could they stop raising?

The Fed’s preferred inflation measure is currently running at a four-decade high of 6%, roughly triple its 2% target. If the Fed raises its expected 75 basis-points Wednesday, that would take its benchmark overnight interest rate to a target range of 2.25% to 2.5%, lifting rates to a level officials see as “neutral”, i.e., no longer supporting the economy over the long run.

A Reuters story quoted Luke Tilley, chief economist at Wilmington Trust, saying that “As long as inflation is as high as it is, and no sign of abating, you are going to have a united front,” referring to the Fed’s decision-makers who must make the call on interest rates. He noted that it may take as little as two months of slowing inflation for “the hawks and the doves … to make themselves known pretty quickly.”

The article goes on to say that, While financial markets have priced in higher rates – exemplified by rises in the cost of a 30-year fixed mortgage – they also see an increased risk of recession and, as a result, potential Fed rate cuts as soon as next year.

It notes consumers are already pulling back on spending due to prices rising faster than wages, with retail sales growth on an inflation-adjusted basis slowing to a crawl. The latest Conference Board survey shows consumer confidence slipping for a third straight month — something economists pay close attention to, given that consumer spending makes up about 70% of US Gross Domestic Product.

And finally, the observation that the last time the federal funds rate was in the 2.25-2.5% range, it was late 2018 following a string of rate hikes, but signs of economic weakness (like now) put a stop to further tightening and within eight months, the Fed was back to cutting rates.

According to the Reuters poll mentioned above with respect to the chances of a recession, a strong majority expects the Fed will slow its rate increases to 50 basis points in September, and then raise by only 25 bps at the November and December meetings.

The poll found a slowdown in economic growth would force the Fed to cut back on the size of rate hikes at future meetings. After contracting in the first quarter of this year, growth for the second quarter was penciled in at a seasonally adjusted, annualized 0.7%, down significantly from the 3% predicted last month. Over one in five respondents predicted another contraction. GDP growth this year was slashed to 2% from 2.6% forecast in June, and nearly halved to 1.2% for 2023, when the full effect of the Fed’s rate hikes are felt in the economy, Reuters reported.

Over 80% of poll respondents saw the federal funds rate at 3.25-3.5% or higher by the end of this year. As for when the Fed will stop raising rates, the median forecast is 3.5-3.75% in the first quarter of 2023.

Gold and the dollar

Back to gold, one of the most powerful forces dragging the gold price down is the US dollar, currently strong due to rising interest rates and safe-haven demand. Over the past year, the US dollar index has climbed 16%. Gold, meanwhile, has fallen 19% since hitting $2,078 in early March.

The Federal Reserve approved a June interest-rate hike June of 0.75%, which is the largest rate increase since 1994. Investors have been buying greenbacks as a source of relative stability amid weak economic conditions. When foreign investors buy US equities and bonds, they typically use dollars, which boosts the value of the currency.

But market observers including Goldman Sachs say the dollar is “highly overvalued,” and due for a correction. They also say it’s unclear whether the buck’s strength will hold in a recession. The Big Mac Index comparing the price of the hamburger around the world, shows that the greenback is overvalued against all but a handful of currencies.

One encouraging sign for gold investors is the European Central Bank’s recent decision to raise interest rates, to fight inflation. The hawkish move will likely help ease the soaring dollar which earlier this month reached parity with the euro.

Gold & silver close to bottoming

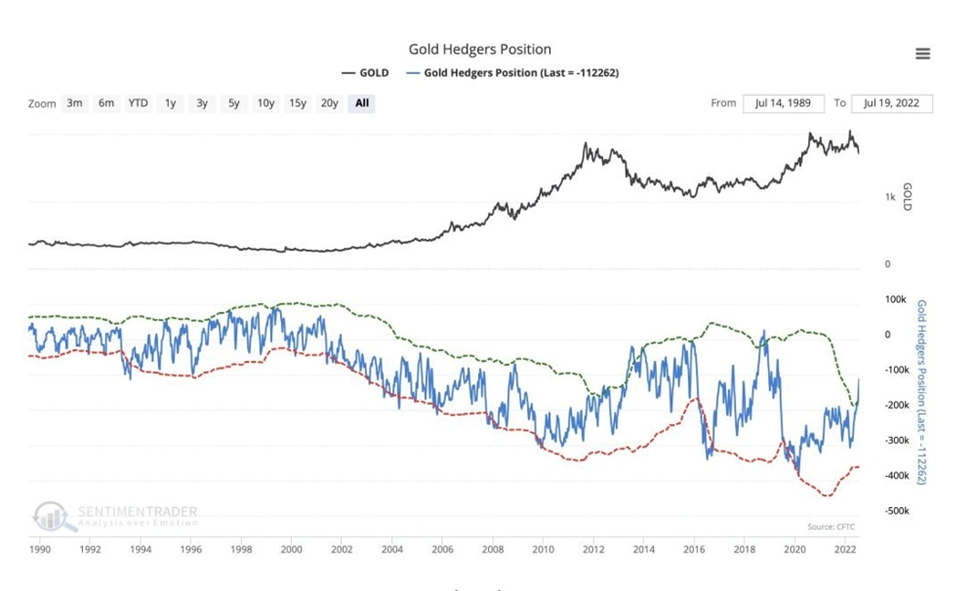

Another is the reduction in gold short positioning among bullion banks and commercial traders, indicating that gold has been “oversold”. Shorts are bets that the metal will lose value.

King World News ran a 10-year chart showing commercials covering their short positions, with accompanying commentary noting that It is possible the gold market may bottom here, but commercial traders typically have short positions of less than 100k at major bottoms and we are not quite there yet.

As shown in the chart, gold hedgers’ last position was -112,262.

Kitco gold columnist David Erfle writes that, While the commercial banks can continue to cut their shorts, pushing the price lower, their current positioning is bullish. It is also important to note that once the small specs became net short in May 2019, the GDXJ moved up over 55% in just a few months from similar deeply oversold conditions that we are currently experiencing.

Erfle also presents data indicating that gold stocks are deeply oversold and that they could move forcefully to the upside. For example:

- [When] comparing the now 14-week sharp move down in gold stocks with the previous high-velocity decline in the sector in 2020, the capitulation phase of this 2-year correction is close to reaching its conclusion.

- When GDXJ sold down briefly just below the $29 level last Thursday, the junior miner ETF entered its most oversold condition in seven years. This high-risk junior gold stock fund has also held its long-term weekly support level at $30, showing relative strength to both gold and the GDX heading into Fed Week.

- More importantly, the Gold Miners Bullish Percent Index ($BPGDM) has moved below 11, which is the lowest reading since the March 2020 spike low below 8. If this closely watched index goes down even further from here, it will likely sling-shot in the same way it did in early 2016 and March of 2020 climbing 202% and 189% in just a few months.

- [E]ither the already deeply oversold junior mining complex is in the process of carving out a bottom here, or we have just a bit more downside to the $26-$27 support level in GDXJ which could result in a sling-shot reversal to the upside.

The pain in the silver market could also soon see some relief. While the monetary and industrial metal is down substantially from a year ago (-36%), King World News points to the latest Silver Hedgers Position report as showing “The setup in the silver market has turned extremely bullish.”

The chart below shows commercial traders “are now in one of the most bullish positions in the last decade.” The second chart offers a multi-decade view of how bullion banks and commercial traders have been positioned in the silver market. “There is no question the setup in the silver market is extremely bullish at this point from a historic perspective,” King World News writes, adding that “right now and on any further weakness it is a good idea to be extremely aggressive in accumulating physical silver.”

Conclusion

I couldn’t agree more, which is why we at AOTH have been busily accumulating a basket of quality gold and silver juniors to buy and hold before the next up-leg in the secular gold bull market begins.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.