Peak silver – Richard Mills

2022.11.30

Like gold, we can study the supply-demand picture for silver to get a sense of whether we’ve reached peak mine supply.

At AOTH we differentiate between the total silver supply, which lumps in recycled silver with mined silver, versus mine supply on its own. (most recycled silver is industrial grade)

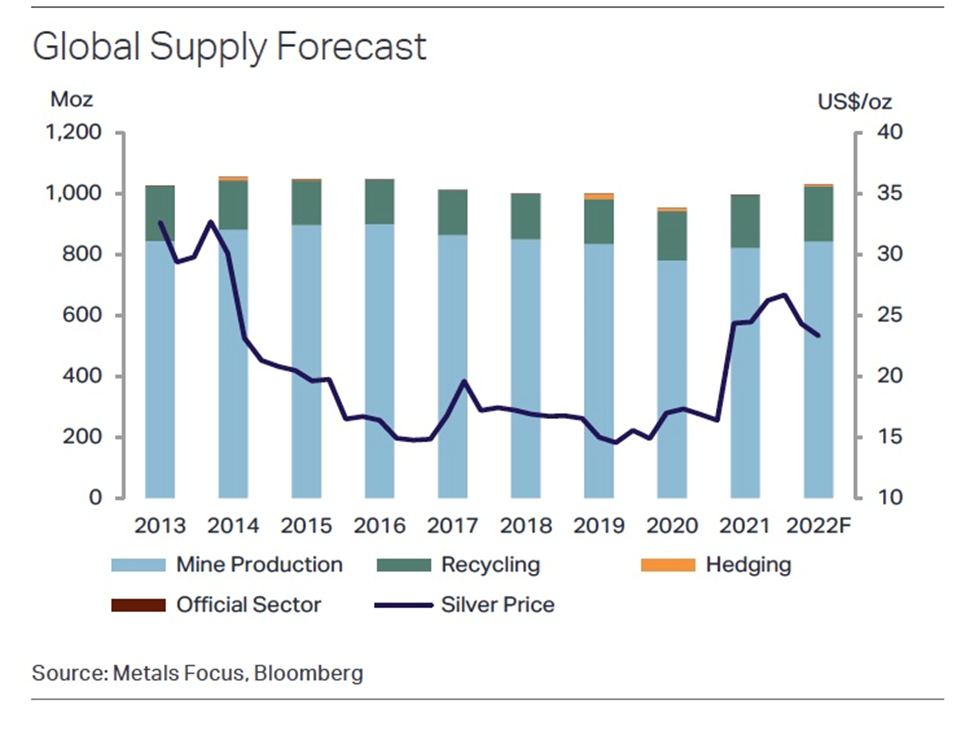

According to the 2022 World Silver Survey, in 2021 global mine production increased 5.3% yoy to 822.6 million ounces, or 25,587 tonnes. It was the biggest rise in production since 2013, largely due to economic recovery following a down year in 2020, when a lot of silver mines were disrupted due to the pandemic.

Helped by higher prices, silver recycling rose for a second year in a row, up 7% in 2021 to an 8-year high of 173Moz, or 5,382 tonnes.

Combined, therefore, we have total silver supply reaching 997.2Moz in 2021.

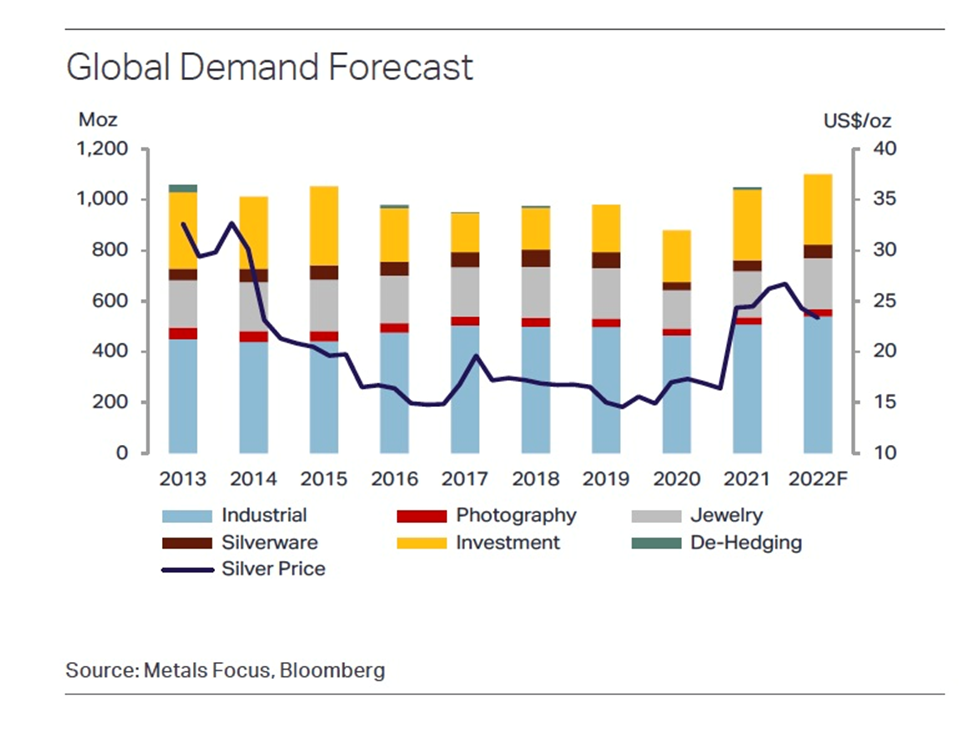

How about demand? According to the World Silver Survey, after a slump in 2020, global silver demand climbed by 19% last year to 1.05 billion ounces, surpassing pre-pandemic volumes and reaching its highest level since 2015.

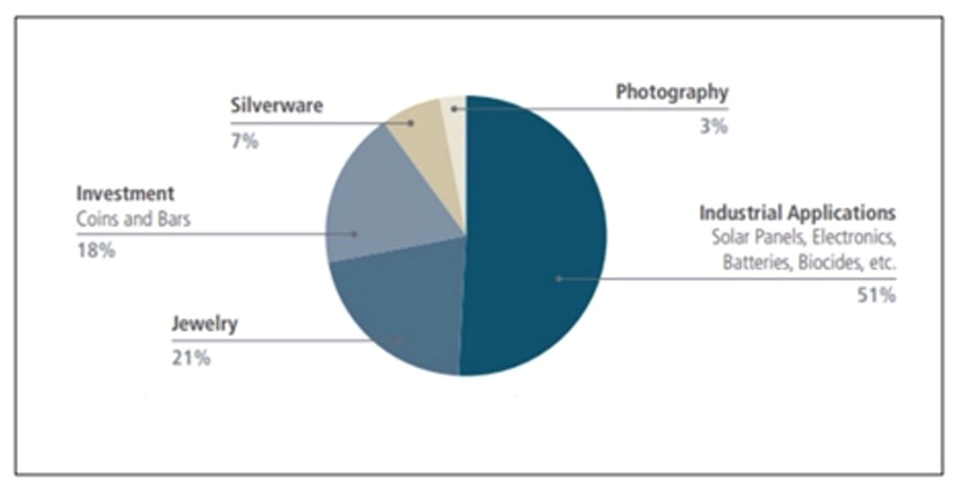

(Remember: While most of the mined gold is still around, either cast as jewelry, or smelted into bullion and stored for investment purposes, the same cannot be said for silver. It’s estimated around 60% of silver is utilized in industrial applications, like solar panels and electronics, leaving only 40% for investing.)

All the demand categories saw gains, the largest being bar and coin purchases, followed by industrial demand. Physical investment (bars and coins) demand skyrocketed by 35% to 278.7Moz, the highest level since 2015’s record, as investors hoovered up the white metal in response to inflation uncertainty and negative real interest rates. Sales of silver bars and coins in India more than tripled.

2021 demand of 1.049 billion ounces outstripped supply of 997.2Moz, by 51.8Moz. But remember, recycling is included in the total supply. When we take recycling out, 173Moz, we get an even greater deficit of 224.8Moz. (1,049,000,000 minus 824,200,000 = 224,800,000)

This is significant, because it’s saying even though mined silver supply last year rebounded from 2020, to 822.2Moz, the highest since 2013, it was unable to meet total demand, industrial plus investment, of 1.05 billion ounces, which was the highest demand for silver since 2015. It fell short by 51.8Moz, and that was including recycling.

This is our definition of peak mined silver. Will the silver mining industry be able to produce, or discover, enough silver that it’s able to meet demand without having to recycle? If the numbers reflect that, peak mined silver would be debunked.

It didn’t happen in 2021, (or 2020) and according to the Silver Institute, it won’t happen in 2022 either.

Again, let’s look at the numbers.

The Silver Institute expects silver output in 2022 to exceed last year’s total by 2.5%, yoy, hitting 843.2Moz, or 26,226t. The biggest increases will be from Mexico and Chile, with the La Coipa Mine in Chile commissioned this past February and reaching full capacity mid-2023.

But again, this includes recycling; it’s set to increase for a third straight year, with a 4% gain forecast, or 180,500,000 oz.

Taking 180,500,000 oz of forecasted recycling out of the equation, we have mined supply of 662,700,000 oz, against the Silver Institute’s 2022 demand forecast of 1,101,800,000 oz (1.101Boz), leaving another forecasted deficit, and one that is nearly twice as larger as 2021’s, when recycling is excluded, of 439.1Moz.

Despite this year’s price weakness alongside gold, there are multiple reasons to believe that longer term, silver will rebound.

The potential forces behind silver’s next rally include: monetary demand, industrial demand, above-ground stocks, gold-silver ratio, silver-copper correlation, net short positions reduced, physical market tightness, and low inventory.

Moribund silver may soon have liftoff

Much of the bullish story is told on the demand side.

According to the Silver Institute’s 2022 Interim Silver Market Review, released on Nov. 17, global demand for silver this year is forecast to hit a record 1.21 billion ounces, a 16% increase from 2021 demand. New highs are predicted for physical investment, industrial demand, jewelry and silverware production.

While institutional demand for silver has faced headwinds, due to rising interest rates leading to a decrease in silver ETF holdings, this has been countered by a surge in physical investment, which is on pace to jump by 18% to 329Moz this year.

According to the Silver Institute, “Support has come from investor fears of high inflation, the Russia-Ukraine war, recessionary concerns, mistrust in government, and buying on price dips. The rise was boosted further by a (near-doubling) of Indian demand, a recovery from a slump last year, with investors often taking advantage of lower rupee prices.”

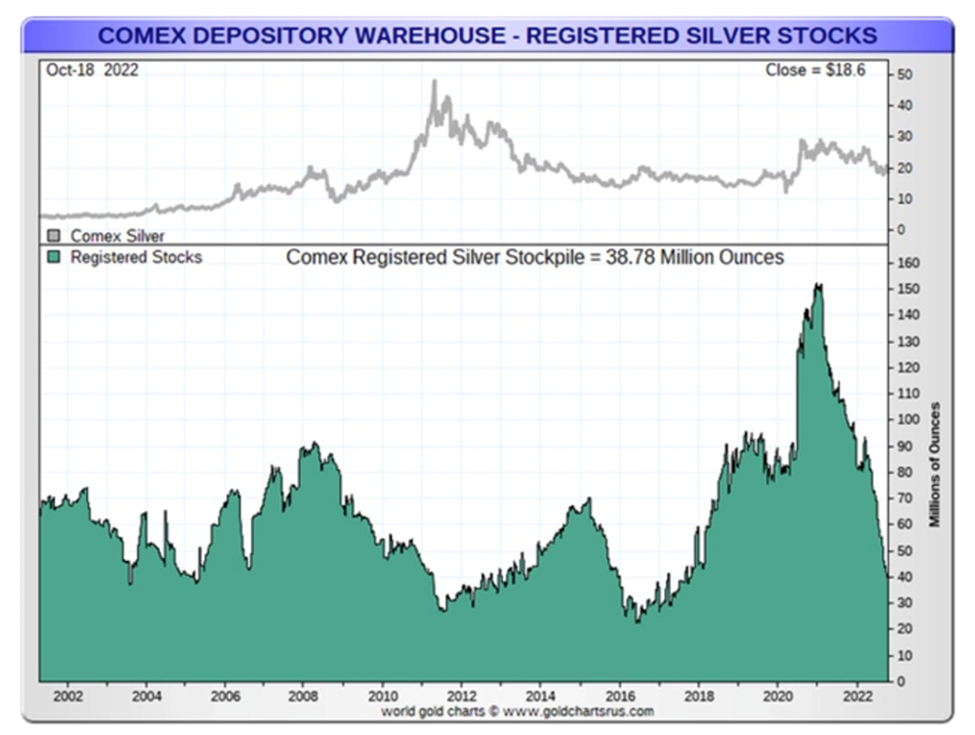

Evidence of high demand for silver is apparent from the decreasing amounts of silver in Comex vaults.

Earlier this month we reported that Comex silver inventories were at their lowest level since June of 2016.

Silver joining copper in upcoming supply crunch

Total registered silver stocks on the Comex have dropped nearly 70% over the past 18 months, to 35,527,659 oz.

Industrial demand for silver, which makes up 60% of total usage, is expected to reach a new record in 2022, of 539Moz.

More and more silver is being demanded for use in solar photovoltaic (PV) cells, as countries adopt renewable energy sources. One projection has annual silver consumption by the solar industry growing 85% to about 185 million ounces within a decade, according to a report by BMO Capital Markets.

5G technology is set to become another big new driver of silver demand. Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled devices.

The Silver Institute expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

A third major industrial demand driver for silver is the automotive industry. Silver is found in many car components throughout vehicles’ electronic systems.

A recent Silver Institute report says battery electric vehicles contain up to twice as much silver as ICE-powered vehicles. Charging points and charging stations are also expected to demand a lot more silver. It estimates the sector’s demand for silver will rise to 88Moz in five years as the transition from traditional cars and trucks to EVs accelerates. Others estimate that by 2040, electric vehicles could demand nearly half of annual silver supply.

Additionally, demand for silver jewelry and silverware is projected to surge by 29% and 72% respectively.

These unprecedented demand pressures are not being met with substantially higher silver supply, either through mining or recycling. According to the 2022 Interim Silver Market Review, silver mine output will only chart a 1% increase in 2022, resulting in a second consecutive deficit this year: At 194 Moz, this will be a multi-decade high and four times the level seen in 2021. (Silver Institute news release, Nov. 17, 2022)

We use the gold-silver ratio to find out how silver prices compare to gold. The ratio is the amount of silver one can buy with an ounce of gold. Simply divide the current gold price by the price of silver.

Current indications show that silver is significantly undervalued. Right now the gold-silver ratio is 81:1, meaning it takes 81 oz of silver to buy one ounce of gold. The average is between 40:1 and 50:1, and historically, the ratio has always returned to the mean.

See the chart below, and linked commentary by Schiffgold.com, showing that Historically, when the spread gets this wide, silver doesn’t just outperform gold, it goes on a massive run in a short period of time. Since January 2000, this has happened four times. As this chart shows, the snapback is swift and strong.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.