Peak mined silver reached

2021.05.25

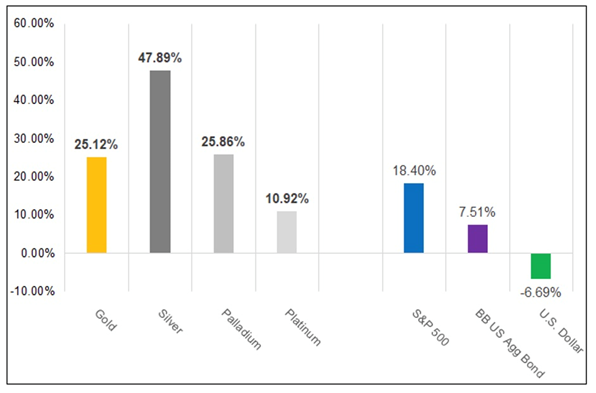

Spot silver jumped to $28.32 an ounce in August 2020, its best performance in seven years, and though the price retreated last fall, it finished the year up an impressive 47%, more than doubling gold’s 22% gain.

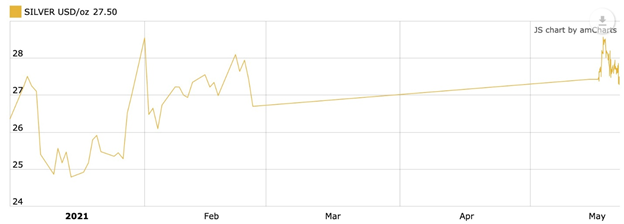

In late January silver kicked higher after a Reddit WallStreetBets subpost triggered a call to buy. A flurry of purchases saw silver blow past $28 and touch $31 briefly, before falling back. Since March, the white metal has been trading in a fairly tight range between $26 and $28.

However, the silver outlook is extremely positive due to a combination of strong monetary and industrial demand drivers.

According to the 2021 World Silver Survey, by The Silver Institute, global demand for silver this year is expected to outpace supply by 7% (+ 8% supply vs +15% demand).

Global demand will be led by investments in industrial and investment-grade physical silver, as a result of economic recovery from the pandemic, as well as healthy coin and bar purchases building on 2020’s gains.

The Silver Institute therefore expects the silver price to advance a whopping 33% in 2021.

In fact we can take the positive silver narrative further, by analyzing supply and demand. In doing so, we feel confident in calling peak mined silver.

Peak mined silver

The concept of a peak resource should be familiar to most readers and investors. It refers to the point when production is no longer growing, year after year. It reaches a peak, then declines.

Notice we didn’t say “peak silver”. At AOTH we differentiate between the total silver supply, which lumps in recycled silver with mined silver, versus mine supply on its own.

In calculating the true picture of silver demand versus supply, we don’t count silver recycling (most recycled silver is industrial grade). What we want to know, and all we really care about, is whether the annual supply of mined silver meets annual demand for silver. It doesn’t!

To illustrate:

In 2020 mined silver slumped the most in a decade, owing to a number of coronavirus-related mine closures in Latin America where the majority of silver is produced. It fell 5.9% to 784.4 million ounces, according to the 2021 World Silver Survey.

However, as a result of higher silver prices in the second half of the year, global silver recycling rose by 7%, hitting a 7-year high of 182.1Moz. Scrap generated from industrial end uses also climbed higher last year.

Combined, therefore, we have total silver supply reaching 966.5Moz in 2020.

How about demand? According to the World Silver Survey, after rising for two years, in 2020 silver demand weakened by 10%, with most of the losses attributed to a fall in industrial demand, resulting from the pandemic.

(Remember: While most of the mined gold is still around, either cast as jewelry, or smelted into bullion and stored for investment purposes, the same cannot be said for silver. It’s estimated around 60% of silver is utilized in industrial applications, like solar panels and electronics, leaving only 40% for investing.)

Industrial fabrication slumped to a five-year low in 2020, leaving total silver demand at 896.1Moz.

No peak silver here, right? Demand of 896.1Moz is more than satisfied by supply of 966.5Moz.

But when we strip recycling out of the equation, 182.1Moz, we get an entirely different result. ie. 896.1Moz of demand minus 784.4Moz mine supply leaves a deficit of 111.7Moz.

This is significant, because it’s saying even though industrial demand for silver, which makes up about 60% of usage, got slammed last year due to the pandemic, the total demand, industrial plus investment, was greater than mine supply (which admittedly had a bad year due to shutdowns) by about 100Moz.

Only by recycling 182.1Moz could silver demand be satisfied in 2020.

This is our definition of peak mined silver. Will the silver mining industry be able to produce, or discover, enough silver that it’s able to meet demand without having to recycle? If the numbers reflect that, peak mined silver would be debunked. It didn’t happen in 2020, and according to the Silver Institute, it won’t happen in 2021 either.

Again, let’s look at the numbers.

With silver mines returning to full capacity, the Silver Institute expects silver output to rebound from last year’s doldrums, rising 8.2% year on year to 848.5Moz. The biggest increase will be from countries most heavily impacted by the pandemic, such as Mexico, Peru and Bolivia.

The Silver Institute predicts total supply will increase 8% to 1,056.3Moz, but again, this includes recycling. Taking 196.2Moz of forecasted recycling out of the equation, we have mined supply of 848.5Moz against the Silver Institute’s 2021 demand forecast of 1,154.3Moz, leaving another forecasted deficit, and one that is larger than 2020’s, of 305.8Moz.

(total demand includes industrial fabrication rising to an 8-year high of 524Moz + jewelry fabrication of 184.4Moz + silverware 43.1Moz + bars and coins 252.8Moz + silver ETFs 150Moz = 1,154.3Moz)

Raucous demand

In fact the Silver Institute’s demand figure is quite conservative. We expect it to be much higher, given that the loose monetary policy of the US Federal Reserve and other central banks is likely to continue, keeping bond yields/ interest rates low, resulting in strong uptake for precious metals; and the numerous industrial applications for silver, stemming from silver’s high conductivity, which appear to be growing in leaps and bounds particularly those pertaining to “green” technologies and 5G.

As the US vaccine rollout continues and more sectors of the economy open up, the increased demand for manufactured goods including solar power cells and electronics is bound to be a boon for silver. Even more so considering that re-openings and inoculations are happening in most developed economies.

Solar

More and more silver is being demanded for use in solar photovoltaic (PV) cells, as countries move towards adopting renewable energy sources.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. Silver pastes within the solar cells ensure the electrons move into storage or towards consumption, depending on the need.

Around 20 grams of silver are required to build a solar panel. While there are innovations trying to reduce the amount of silver used in solar cells, as a cost-saving measure, this practice known as “thrifting” has its limits. Substitute materials such as copper and aluminum have trouble competing, and non-silver PVs tend to be less reliable and have shorter lifespans.

According to CRU, a metals consultancy, the rate of silver reduction substantially decelerated since 2016, as the price of silver fell.

BMO analysts quoted by the Northern Miner last year are modeling more than 500 gigawatts (GW) of new solar capacity will be added globally by 2025.

The PV sector has recovered well from a slow first half of 2020, and the momentum is expected to carry through 2021. SI forecasts 105Moz will be demanded this year, canceling out the losses in 2020.

In the United States, demand for solar is expected to surge if and when the Biden administration’s $2.3 trillion infrastructure plan (now trimmed to $1.7 trillion to try and get Republican support) including several clean energy spending components, is passed by Congress. President Biden wants to install 500 million solar panels over the next five years and Goldman Sachs estimates that solar installations will jump 50% from 2019 to 2023. Solar power penetration is also expected to increase overseas, especially in China, as governments commit further to decarbonization agendas and ever-tightening regulations on power plant and vehicle emissions.

5G

5G technology is set to become another big new driver of silver demand.

Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled devices.

The Silver Institute expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

The growing penetration of 5G technology in consumer electronics is expected to power a 7% increase above 2020 levels to 300Moz, which is more than double the silver offtake needed by the solar power industry.

While President Biden has yet to take any executive action on building out America’s 5G network, he mentioned it during the campaign and it is expected that any proposed infrastructure plan will include 5G, especially since doing so means staying competitive with China.

5G has numerous advantages over current 4G technology. According to a report, ‘Silver’s Role in a Future 5G Connected World’ quoted last year by Metal Tech News, “5G is not just an incremental improvement over 4G — it is the next major evolution of mobile communication technology with performance improvements of several orders of magnitude over today’s networks.”

Examples include significantly improved download speeds (a two-hour film takes under five seconds on 5G versus six minutes on 4G); faster latency, referring to response time to commands; and facilitation of current and future technologies such as robotics, autonomous driving and virtual reality.

“5G will be the glue in an ecosystem of improved connectivity between all sorts of devices, and as such, it is expected that connected devices, such as the IoT, will significantly increase over the next five years. Silver will benefit from this development over the forecast horizon. Everything 5G-related will be based on electronic devices, such as semiconductors, multi-layer ceramic capacitors, micro electro-mechanical systems, and many more, which to one degree or another consume various amounts of silver,” the report predicted.

Automotive

A third major industrial demand driver for silver is the automotive industry.

A recent Silver Institute report says battery electric vehicles contain up to twice as much silver as ICE-powered vehicles, with autonomous vehicles requiring even more due to their complexity. Charging points and charging stations are also expected to demand a lot more silver.

Like for solar power, the Biden administration’s focus on electric vehicles is expected to be a boon for silver. The president has set a goal of transitioning the government’s fleet of cars and trucks to EVs assembled in the US, including about a third used by the US Postal Service.

Also in his clean energy plan, is a pledge to build 500,000 charging stations by 2030, and allow rebates to replace old vehicles with American-made electric models. At least 15 countries have announced timelines to ban new sales of gasoline or diesel-powered vehicles.

According to SI, silver’s use in the automotive market will see a strong rebound in 2021, to just over 60Moz. It estimated the sector’s demand for silver will rise to 88Moz in five years as the transition from traditional cars and trucks to EVs accelerates. Others estimate that by 2040, electric vehicles could demand nearly half of annual silver supply.

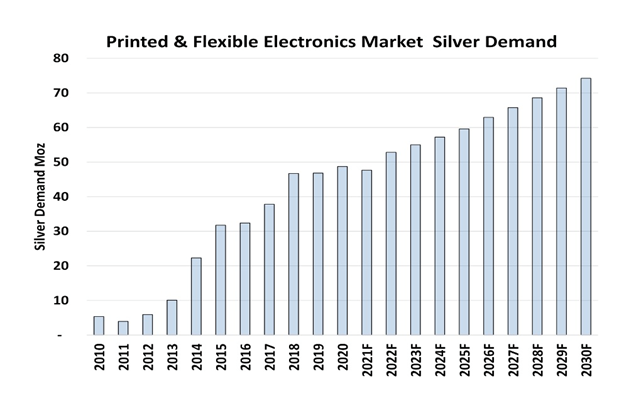

Printed and flexible electronics

Finally, silver demand for “printed and flexible electronics” is forecast to increase 54% over the next 9 years, rising from 48Moz in 2021 to 74Moz in 2030, meaning a consumption of 615Moz during this time frame.

A recent Silver Institute news release describes them as “mainstays” in a variety of electronic products, including sensors that measure everything from temperature, pressure and motion, to moisture, relative humidity and carbon monoxide. They are also used in medical devices, mobile phones, appliance displays and consumer electronics.

The sector generates about $57 billion a year in annual revenues and is expected to grow 11.1% through 2025.

The Silver Institute notes that Manufacturers are incorporating printed and flexible electronics into their devices and products because they are flexible, customizable, innovative, and portable. Since many of these electronics can be processed on a roll-to-roll or large area substrate, their cost and manufacturability make these technologies extremely attractive. For example, printed and flexible electronics are increasingly being used in labels and packaging for retail goods, and warehouse logistical operations. They are vital to smart buildings that rely on wholly integrated systems that share essential information using internet connected sensors to control HVAC, lighting, security, energy, access, and security monitoring, and other applications.

Source: Precious Metals Commodity Management LLC

Conclusion

All of the above taken into account, industrial demand for silver is projected to notch an 8-year high of 524Moz in 2021.

It seems clear to us, given this relatively brief analysis, that the role of silver is changing. Once considered the ugly stepsister of gold, either referred to as “poor man’s gold” for its affordability or “the devil’s metal” for its volatility, silver has been given a new make-over as a green metal.

The most conductive of all the metals, silver is ideal for use in solar panels, 5G, and automotive applications including EVs which use up to twice as much silver as regular vehicles.

The need for silver in all three applications is going up. Silver demand for “printed and flexible electronics” is forecast to increase 54% over the next 9 years.

According to Sprott Insights, silver plays a critical role in all “green revolution” discussions, even more fundamental than cobalt, lithium and nickel, battery metals that are more usually associated with electrification.

The United States, Canada and other countries that have committed to lowering carbon emissions, are going to need more silver, to go into electric vehicles, charging stations, 5G, and for the cables connecting new wind turbines and solar farms to the grid.

Sprott Insights recognizes the problem, and so do we: supply is limited. In the first part of the article we showed that we have already reached peak mined silver. Silver mines currently do not produce enough silver to meet demand without recycling. It’s the same situation with gold and copper.

For now, as long as prices remain where they are, the industry will be able to melt down enough silver to meet demand. But this isn’t a sustainable model. Because silver is more of an industrial metal than a monetary metal, there is a limited amount of above-ground silver available for recycling. Eventually the industry will reach a point where they have to either get more production from existing mines or find new silver deposits. The latter can’t be done in a hurry; it takes seven to 10 years at minimum to build a mine and often longer.

According to Sprott Insights, the three areas of growing demand — solar, 5G and automotive — potentially account for greater than 125 million ounces, annually, in 10 years. Where is this new silver supply going to come from?

Their conclusion? “We do not see enough supply growth to offset the demand growth,” with mine supply falling since 2016 and “we do not see enough projects in development to generate the kind of production levels in question, at least not at current silver prices.”

“Our view is that the ‘green revolution’ will be highly positive for silver.”

It’s hard to disagree with that, and the obvious conclusion to be drawn from it, which is that silver prices are heading higher.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.