Pampa Metals rounds off successful first year with at least two potential deep porphyry copper systems identified

2022.01.03

Global consumption of copper, an essential ingredient in modern society and one of the key metals anchoring the clean energy transition, is about to rise to levels we have never seen before.

Demand for the industrial metal used in our telecommunication and transportation systems currently stands at about 20 million tonnes (Mt) a year, which is more or less equal to last year’s mine production.

However, 2022 could mark the beginning of a decade-long market deficit, given demand is rising thanks to copper’s crucial role in electric vehicles and renewable energy technologies.

Copper Shortfall

In 20 years, BloombergNEF predicts that global copper production must double to meet the demand for a 30% penetration rate of electric vehicles — from the current 20Mt a year to 40 Mt.

The International Energy Agency (IEA) also suggested that world copper demand could double over the next 20 years as the pace of electrification grows, with clean energy applications potentially accounting for 45% of overall demand.

But at the current rate of mine production (up only 0.3% in 2020), a severe copper shortage looms. CRU Group is forecasting an annual supply deficit of 4.7Mt by 2030 as the clean power and transport sectors take off.

S&P Global Market Intelligence concurs that global copper supply will lag demand in the long term due to a shortage of copper projects.

While output from existing copper mines is expected to increase at a CAGR of 1.0% in 2021-25, it is expected to fall at a CAGR of 4.7% later in 2026-30, driven by declining ore grades and mine closures, according to S&P estimates.

By the end of the decade, the copper mining industry will be unable to meet a growing demand for concentrate, even when including uncommitted development-stage projects that could potentially move forward and start up during this period, S&P Global warns.

Energy research and consultancy Wood Mackenzie believes that a shortage of projects has actually been threatening supply since mid-decade.

Just prior to the global financial crisis in 2008 there were around 4.8Mt of probable projects available to be developed. That equated to 30% of the existing market at the time, or approximately 10 years of growth. By comparison, there are currently just 1.7Mt of probable projects, only enough to meet less than three years of demand growth.

So, the supply concerns haven’t just suddenly appeared out of nowhere.

Dwindling copper reserves and lower ore grades at some of the world’s largest mines also mean that a new deposit would just be replacing the existing output, thus not contributing to supply growth at all.

CRU estimates that over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

After years of underinvestment, we’re just starting to face the repercussions. Remember, at least 20Mt of copper supply must be developed in the next two decades, the equivalent of one large million-tonne mine (i.e. an Escondida) every year from now on.

The solution, as simple as it sounds, is to have more copper projects that can be developed into producing mines.

Focus on Chile

Chances are, the next major copper mine(s) are most likely to be in Chile, by far the world’s top producer with 5.7Mt a year, more than a quarter of the global total.

For years, the Latin American nation has been the ideal “elephant” copper deposit hunting ground for the big-name mining companies. Boasting the largest copper reserves worldwide, at 200 million tonnes, Chile’s dominance isn’t waning anytime soon.

Around 80% of its copper production comes from copper-gold porphyry deposits, with most situated in the northern desert areas. These porphyries, which are also rich in molybdenum with silver by-products, provide ore for some of the world’s most prolific copper mines.

Porphyry deposits are usually low-grade but large and bulk-mineable, making them attractive targets for mineral explorers. Since 1970 over 95% of US copper production has come from porphyry deposits, and more than 60% of world annual copper production.

Northern Chile has some of the largest copper and gold deposits in the world, formed from a combination of factors, but generally associated with intrusive-extrusive magmatism and tectonic activity on the western boundary of the South American plate.

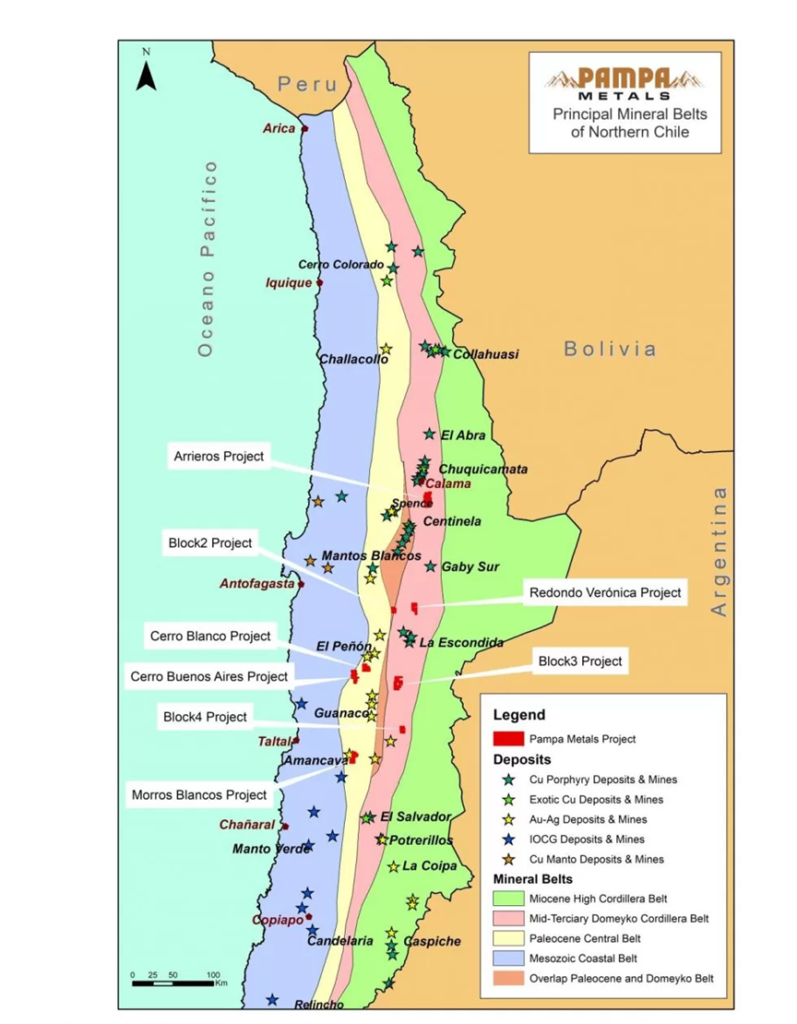

Several metallogenic belts developed, reflecting changes in the tectonic setting and igneous activity. These include the Miocene High Cordillera Belt, the Mid-Terciary Domeyko Cordillera Belt, the Paleocene Central Belt, the Mesozoic Coastal Belt and the Overlap Paleocene and Domeyko Belt.

Naturally, given northern Chile’s copper riches, some of the mining industry’s largest red-metal producers have flocked to the region. Chilean state-owned Codelco operates El Teniente, the world’s largest underground copper mine, along with Chuquicamata, the second deepest copper mine on Earth and one of the largest open-pit mines.

Other major copper miners, who have undertaken significant exploration and production, include BHP, Freeport McMoran, Rio Tinto and Antofagasta Minerals. The latter has four operating mines in Chile including its flagship Los Pelambres in the Coquimbo region.

Escondida, owned by BHP, Rio Tinto and a Japanese consortium headed by Mitsubishi, is the largest copper mine by capacity at 1.4Mtpa (and the largest producer of copper cathodes and concentrates). Collahuasi, another top Chilean copper mine, is jointly owned by Anglo American, Glencore and Mitsui.

Still, many areas along the copper-rich mineral belts of northern Chile remain underexplored, offering growth opportunities to those holding competitive greenfield land positions in this premier copper-producing region.

In recent years, there has also been an influx of mid-tier and junior mining companies looking for the next big copper discovery in northern Chile.

Dominant Landholder

One of the most promising landholders in this prolific part of Chile is Pampa Metals (CSE:PM) (FSE: FIRA). The company controls 100% interest in as many as eight exploration projects that are prospective for copper and gold, covering a total area of 62,000 hectares.

These projects (Arrieros, Block 2, Redondo-Veronica, Block 3, Block 4, Cerro Buenos Aires, Cerro Blanco and Morros Blancos) are all located along the proven mineral belts of the Atacama region, including the Central Paleocene and Domeyko, that have long dominated the world’s copper production.

Pampa Metals’ properties, all located within Chile’s productive mineral belts.

As shown on the map above, five are situated along the mid-Tertiary porphyry copper belt of northern Chile — the Domeyko Cordillera — that is host to three of the world’s top five copper mining districts: Collahuasi, Chuquicamata and Escondida.

The remaining three projects are located in the heart of the Paleocene mineral belt, which hosts a series of important copper porphyry deposits and mines such as Cerro Colorado (BHP), Spence (BHP), Sierra Gorda (KGHM & Sumitomo) and Relincho (part of Nueva Union – Teck-Goldcorp).

The Chilean Atacama Desert is characterized by mountain ranges separated by relatively flat, piedmont-gravel-filled “pampas” that conceal the underlying geology.

These areas remain underexplored because they contain a layer of gravel, 30-50m thick, that was deposited after the formation of the porphyries. A rough estimate suggests at least 50% of northern Chile is covered by pampas, meaning that half of the region’s undiscovered mineral deposits may be concealed by a thick gravel cap.

Notwithstanding the important discoveries noted above, there are still very large areas of untested pampas in northern Chile that have the potential to conceal significant mineral deposits.

Outcrops in the pampas are rare, however if found, they can display similar characteristics, in terms of geology and hydrological alteration, as copper porphyry deposits. Pampa Metals’ game plan is to first conduct surveys to find the outcrops, and then sample and drill them.

Redondo-Veronica and Cerro Buenos Aires are the focus of a 4,000m reverse circulation (RC) drill program that began in June. (RC drilling is different from diamond drilling in that it uses compressed air to produce small rock chips at the bottom of the hole which get flushed up to surface for sampling, versus diamond drilling where a diamond drill bit pierces the rock and produces drill core for assaying.)

Surface signatures at both projects have turned up evidence of a potential copper porphyry system at depth. If more drilling can verify this theory, it would instantly boost Pampa Metals’ stock price and trigger a flurry of interest from potential acquirers, given its proximity to some of the world’s largest copper mines and deposits.

Drilling Breakthrough

In its latest exploration update, Pampa Metals gave us a first glimpse of what the company is sitting on with positive results from drilling at Cerro Buenos Aires.

Cerro Buenos Aires is a copper-gold exploration project located approximately 130 km southeast of the port city of Antofagasta, covering a total area of 7,600 hectares.

The property is in a similar geological setting to, and approximately 200 km south-southwest of, the Spence (BHP) and Sierra Gorda (KGHM & Sumitomo) copper mines, and close to and along trend from both the El Peñon and Guanaco gold-silver mines.

Drilling at Cerro Buenos Aires this year has focused on the Cerro Chiquitin area to the north, which is representative of a porphyry-type level of exposure. Nine RC holes totaling 2,738m were completed during this summer’s program.

Assays from this drilling were received by Pampa earlier this month, confirming the company’s previous geological observations and interpretation of a porphyry-related hydrothermal system.

Specifically, all holes drilled around the small Cerro Chiquitin outcrop, in the northern third of the Cerro Buenos Aires project area, have returned a variety of anomalous precious metals and multi-element intersections, indicative of a fertile porphyry-type hydrothermal system in the vicinity, Pampa stated in the Dec. 7 news release.

The holes drilled in the immediate vicinity of the outcrop and those to the south and southwest returned gold and silver intercepts and significant anomalies in copper up to 0.07%, molybdenum (0.01%), zinc (0.06%) and lead (0.05%).

The three holes with the most anomalous geochemistry intersected multiple minerals including gold, silver, copper, molybdenum, zinc, lead, arsenic and antimony, which, according to Pampa, point to the inner periphery of a fertile hydrothermal system, with the target copper-rich core likely at depth.

Although drill holes to the north appear less mineralized, they are consistent with the propylitic exterior of a porphyry system, Pampa says. Drill holes to the south are on the inner periphery of the system but appear to be transitioning to propylitic alteration further to the southwest and west.

Could the outcrop at Cerro Buenos Aires be the tip of the iceberg of a large porphyry underneath? That would require further exploration to validate, but the results so far are very encouraging.

Geological and geochemical results to date from wide-spaced drilling at Cerro Buenos Aires have clearly vectored towards a fertile porphyry-type hydrothermal system to the south and southeast of the Cerro Chiquitín tourmaline breccia.

The nine holes extend over a north-south-oriented prospective corridor some 4.5 km x 1 km, largely obscured by 40m to 80m of post-mineral gravel cover, and results have narrowed the target area to a 1 km x 1 km core area of interest.

In view of this, Pampa is planning additional follow-up work comprising detailed induced polarization (IP) profiles and deeper diamond drilling for the area.

Conclusion

Remember, Cerro Buenos Aires is only one of the eight projects that Pampa is looking to develop in northern Chile, where many of the world’s major copper mines are found. In fact, the company’s land position is almost unrivaled by any other junior miner.

Drilling at the Redondo-Veronica project has also indicated deep porphyry potential with vectors derived from hydrothermal alteration and geochemical anomalies. Fieldwork at two other projects, Block 3 and Block 4, also revealed magnetic features of potential interest.

These represent significant progress for a copper miner that just went public about a year ago.

Backed by a seasoned management team with a track record of producing shareholder value, the company is also in good hands.

President and CEO Julian Bavin is a former exploration director at Rio Tinto, and is conveniently based in Chile. Company chairman Adrian Manger has 20 years of experience in executive roles with BHP, playing a part in the $1 billion development of the Spence copper mine in Chile.

Pampa’s other directors, including Paul Gill (executive chair of graphite miner Lomiko Metals) and Ioannis Tsitos (former business development manager with BHP, now president of Goldsource Mines), are also established figures in the industry.

AT AOTH, we are already impressed by what the Pampa team has accomplished in its first year. We look forward to what is shaping up to be an exciting flow of news as the company continues to advance its northern Chile portfolio heading into 2022.

Pampa Metals Corp.

CSE:PM, FSE:FIRA

Cdn$0.30, 2021.12.28

Shares Outstanding 43.4m

Market cap Cdn$13.2m

PM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Pampa Metals Corp. (CSE:PM). PM is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.