Pampa Metals lands deal with AI tech company to explore more copper-gold prospects in Chile

2022.02.10

For a technology to have a transformative effect on the mining industry, it must be able to significantly improve the speed of execution and process efficiency, from exploration all the way through production and reclamation.

According to Deloitte, Artificial Intelligence (AI) is an emerging suite of advanced and practical technologies that enables mining companies to become insight‑driven enterprises that utilize data to derive key benefits.

Systems powered by AI use different algorithms to organize and understand vast amounts of data, with the purpose of helping miners make optimal decisions. One immediate application of AI in mining is during the prospecting phase, especially for discovering deposits.

The traditional practice of finding the world’s next copper or gold deposit is more of an art than a science, revolving around legacy technologies that give incomplete or even conflicting data. This produces the exact inefficiencies that go against the ethos of mining and creates unnecessary inconveniences for the global supply chain.

AI systems, though, are capable of ingesting and analyzing different data to help miners better understand the environment and the terrain, bringing them closer to potential discoveries.

AI technology can pinpoint the exact locations of concealed mineral deposits, especially in underexplored areas of the world, all at a fraction of the time and with much greater accuracy.

Pampa Metals’ AI Partnership

Looking to leverage the power of AI in locating new exciting discoveries, Chile-focused explorer Pampa Metals Corp. (CSE: PM) (FSE: FIRA) (OTCQX: PMMCF) recently signed a definitive agreement with VerAI Discoveries Inc., a Boston-based AI technology company, that would allow Pampa to evaluate and explore a series of copper and precious metals targets that have been generated by VerAI’s proprietary AI methodologies.

The targets are distributed within eight property blocks wholly owned by VerAI, covering about 18,700 hectares located in parts of central-northern Chile. The eight property blocks all lie within similar geographic and geologic areas to Pampa’s portfolio of projects that totals an additional 62,000 hectares.

“This is an exceptional opportunity for Pampa Metals to leverage cutting-edge technologies in the exploration for porphyry copper, iron-oxide-copper-gold (IOCG), and other related mineral deposit types in a highly prospective part of northern Chile,” Paul Gill, Pampa’s CEO, commented in the Feb. 1 news release.

Gill added the agreement with VerAI “not only gives the company access to the predictive results of the latest in AI technology applied to mineral exploration, but VerAI’s property portfolio is highly complementary to that of Pampa Metals.”

“The company has manageable commitments that will allow it to evaluate VerAI’s portfolio, and potentially add quality projects for more detailed exploration to complement its already highly prospective portfolio. We look forward to working with VerAI’s experienced team and seeing the results of the exploration work on the ground,” he said.

About VerAI

VerAI Discoveries is committed to accelerating the global zero-carbon transformation by discovering the minerals essential for our sustainable future.

VerAI deploys an innovative AI targeting platform that detects concealed mineral deposits in covered terrain, while systematically improving the probabilities of success and shortening the time to discovery.

Based in Boston and operating in both North and South America, VerAI generates multiple high-probability target portfolios in select jurisdictions, and partners with leading exploration players to create long-term value from discovering new mineral deposits.

Its board of directors, advisors and technical team have decades of experience in the mineral exploration and AI sectors.

VerAI is backed by two venture capital funds: Chrysalix Venture Capital, which incorporates strategic investors such as Teck Resources, South32, Caterpillar and Shell, and specializes in mining transformation innovation; and Blumberg Capital, experienced in applying AI solutions to the disruption of various traditional industries.

VerAI Methodology

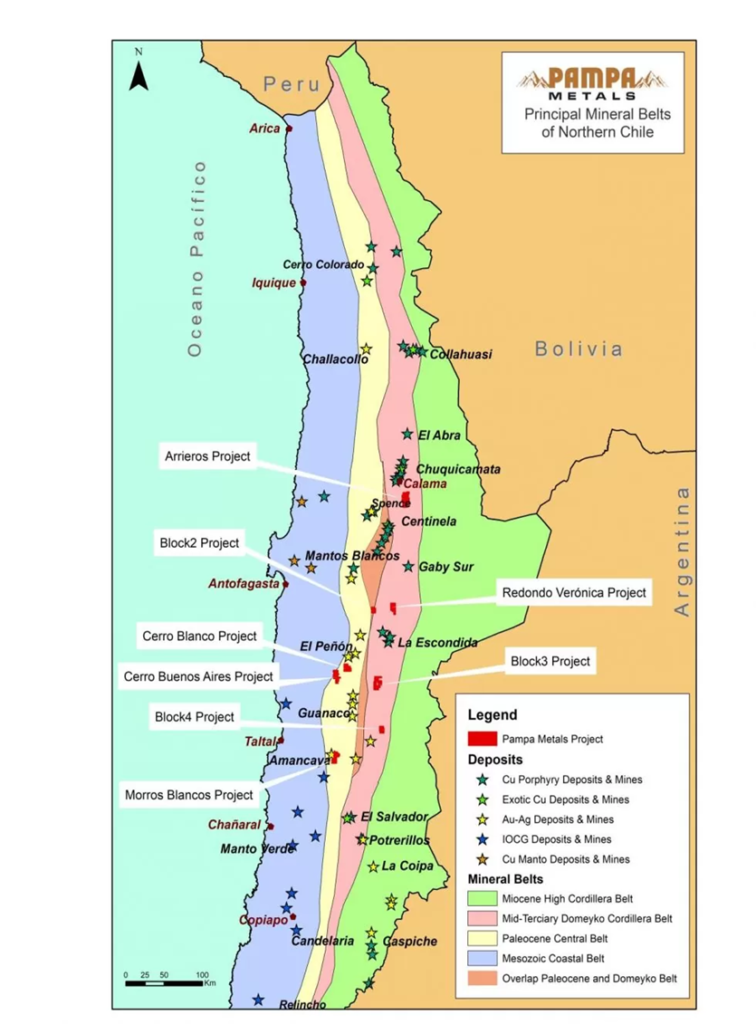

VerAI uses high-resolution geophysics data as the principal data source to generate its targets. The data covers an area of approximately 170 km north-south by 60 km east-west, mostly located over the Paleocene (or Central) mineral belt in northern Chile, but also partially encompassing portions of the Coastal mineral belt.

The study block extends from just south of the multi-million ounce El Peñon gold-silver mining district (Yamana Gold) in the north, to the Franke copper mine (KGHM) in the south. It also includes several historic mines and exploration projects, as well as the operating Guanaco and Amancaya mines (Austral Gold).

The AI targeting process is multi-faceted and iterative, improving the confidence that targets generated are reduced to the very best matches to be staked and claimed in northern Chile.

The targets are mostly obscured by post-mineral, gravel-filled basins, or “pampas” where the underlying geology of interest is largely not visible or available for geologic mapping, resulting in targets that have eluded previous exploration campaigns.

Agreement Details

VerAI has used its proprietary AI technology and high-resolution geophysics data to generate a series of exploration targets distributed between eight property blocks totalling about 18,700 hectares.

As part of the agreement, Pampa will have an exclusive option over 12 months to define one or more designated projects (DP) from the eight property blocks owned by VerAI. During that period, Pampa must spend $500,000 in total exploration activities.

Five of the eight projects must either be “designated” or returned to VerAI within six months; the remaining three projects must be “designated” or returned to VerAI over the remaining six months.

For each DP, Pampa must spend a minimum of $1 million over the following two years in order to earn a 51% interest in the project. If the company fails to meet this spending requirement, the project will be returned to VerAI.

Should Pampa earn 51% on any DP, a joint venture company will then be established for this particular project, and the JV will be governed by a shareholders’ agreement, whose terms have already been agreed.

At 51% on any DP, Pampa can opt to earn a further 24% (to 75%) by completing an NI-43-101-compliant Preliminary Economic Assessment (PEA) on the DP over the next two years.

Should Pampa decide not to proceed towards completion of a PEA, VerAI will take over management of the project, and both parties will be liable for their respective pro-rata expenditures on the project (51/49), with standard dilution clauses applicable.

If Pampa earns 75% of a DP by completing a PEA, both parties will then be liable for their respective pro-rata contributions for the continuing development of the project (75/25).

Initial Exploration Program

With the agreement signed and targets already generated by VerAI , Pampa will immediately carry out field inspections of the eight property blocks, including geological mapping of all available outcrops, as well as areas around the periphery of the properties.

Small-scale geophysical surveys will test for hydrothermal systems beneath post-mineral cover, together with the possible use of shallow, reconnaissance reverse circulation drilling.

VerAI will support Pampa’s activities by continuously revising and refining the AI models as new data is gathered and recorded.

Dominant Landholder in Chile

This agreement with VerAI could potentially expand Pampa’s already-dominant land position along the prolific mineral belts of northern Chile.

The company currently controls 100% interest in as many as eight exploration projects that are prospective for copper and gold, covering a total area of 62,000 hectares.

These projects (Arrieros, Block 2, Redondo-Veronica, Block 3, Block 4, Cerro Buenos Aires, Cerro Blanco and Morros Blancos) are all located along the proven mineral belts of the Atacama region, including the Central Paleocene and Domeyko, that have long dominated the world’s copper production.

As shown on the map above, five of these projects are situated along the mid-Tertiary porphyry copper belt of northern Chile — the Domeyko Cordillera — that is host to three of the world’s top five copper mining districts: Collahuasi, Chuquicamata and Escondida.

The remaining three are located in the heart of the Paleocene mineral belt, which hosts a series of important porphyry copper deposits and mines such as Cerro Colorado (BHP), Spence (BHP), Sierra Gorda (KGHM & Sumitomo) and Relincho (part of Nueva Union – Teck-Goldcorp).

The Chilean Atacama Desert is characterized by elevated ranges of mountains, separated by relatively flat, piedmont-gravel-filled “pampas” that conceal the underlying geology.

These areas remain underexplored because they contain a layer of gravel, 30-50m thick, that was deposited after the formation of the porphyries. A rough estimate suggests at least 50% of northern Chile is covered by pampas, meaning that half of the region’s undiscovered mineral deposits may be concealed by a thick gravel cap.

Notwithstanding the important discoveries noted above, there are still very large areas of untested pampas in northern Chile that have the potential to conceal significant mineral deposits.

Outcrops in the pampas are rare, however if found, they can display similar characteristics, in terms of geology and hydrological alteration, as copper porphyry deposits. The game plan is to first conduct surveys to find the outcrops, and then sample and drill them.

Pampa’s Exploration Progress

Pampa Metals is coming off a successful year during which it made significant exploration progress on multiple properties.

The two most advanced projects to date are Redondo-Veronica and Cerro Buenos Aires, which were the focus of a 4,000m reverse circulation (RC) drill program last summer.

(RC drilling is different from diamond drilling in that it uses compressed air to produce small rock chips at the bottom of the hole which get flushed up to surface for sampling, versus diamond drilling where a diamond drill bit pierces the rock and produces drill core for assaying.)

Redondo-Veronica is approximately 40 km north-northeast of the giant La Escondida-Zaldivar copper mining district, which is the world’s largest copper mining district centered on a series of porphyry copper deposits, with annual production of well over 1 million tonnes.

In 2021, assays from widely spaced RC drilling pointed to potentially deep porphyry copper mineralization at two of the three target areas tested at Redondo-Veronica, which the company plans to follow up with further drilling.

Cerro Buenos Aires is a copper-gold exploration project about 130 km southeast of Antofagasta. The property is in a similar geological setting to, and approximately 200 km south-southwest of, the Spence (BHP) and Sierra Gorda (KGHM & Sumitomo) copper mines, and along trend with both the El Peñon and Guanaco gold-silver mines.

Widely spaced RC drilling completed last year around the porphyry and tourmaline breccia outcrops at Cerro Chiquitin in the north of the 7,400-hectare project, resulted in geological, hydrothermal alteration, along with geochemical anomalies and zonation patterns indicating a potential porphyry copper target to the southeast of the Cerro Chiquitin outcrops.

A detailed IP survey totaling 20 line km is currently underway over this post-mineral gravel covered target area, with results expected next month. Follow-up diamond drill testing is under consideration.

Austral Gold, which the company has partnered with on the Morros Blancos project, commenced drilling earlier this year. The 7,300-hectare property is within the Paleocene Mineral Belt in northern Chile, close to Austral’s operating Guanaco/Amancaya mining complex.

The first phase of drilling at Morros Blancos involves approximately 2,000m of diamond drilling in five holes at the Rosario del Alto gold-silver target to the north, where key elements of a high-sulfidation system have been field-validated. Results are expected to be available by early second quarter.

Highlights to date include:

- Three prospective areas have been identified along a 15 x 3-km NE-oriented hydrothermal alteration corridor.

- Four structures and a number of breccias extending over about a 2 x 1-km area. Shallowly preserved volcanic features together with high-level hydrothermal alteration have been identified.

- Surface geochemical sampling revealed a high-sulfidation anomaly at the target’s central zone.

Austral has also completed geological mapping, geochemical rock sampling, and ground magnetometry at Pampa’s Cerro Blanco project, as part of the JV agreement, that allows Austral Gold to earn in to Morros Blancos and Cerro Blanco.

At its Block 4 project, Pampa Metals recently completed a trenching program over the quartz veinlet stockwork and porphyry zone. Six trenches totaling 2.3 km were excavated, over a 1 km-diameter area, with 202 samples collected. Follow-up IP surveying and/ or drill testing are being evaluated pending the release of assay results, expected shortly.

Geological field work and geophysical surveying at the 10,100-hectare Block 3 project has revealed multiple magnetic features of potential interest in post-mineral covered areas. Further IP surveying is being considered to define possible drill targets.

“After completing extensive geological mapping and geophysical campaigns, Pampa Metals has drill tested four porphyry copper targets distributed between two separate projects in its first year of existence, with three of those targets slated for possible further drill follow-up. The Company is currently acquiring detailed geophysical data over one of those drill targets at the Cerro Buenos Aires project, and is progressing well on the delineation of a potentially new porphyry drill target with a trenching program at its Block 4 project,” President and CEO Paul Gill stated in a recent update.

Copper Market Update

Pampa’s quest to hunt for the world’s next porphyry discovery comes at a time when the world is literally “running out of copper.”

Goldman Sachs’ head of commodities research Jeff Currie recently said that he’s “never seen commodity markets pricing in the shortages they are right now.”

“We’re out of everything, I don’t care if it’s oil, gas, coal, copper, aluminum, you name it we’re out of it,” Currie asserted in a Bloomberg TV interview this week.

And while copper prices have underwhelmed to start the year, the industry remains mostly upbeat on copper, given the multitude of positive long-term forces that will be increasingly felt towards the end of the decade. Supply shortages and consumption growth are still expected to push the metal higher for at least the next three to five years.

“At the heart of all this is the energy transition, it’s going to impact commodities for the foreseeable future,” Daniel Hynes, a senior strategist at Australia & New Zealand Banking Group, pointed out in the Bloomberg report.

Back in January, BlackRock’s global head of thematic and sector-based investing Evy Hambro also told Bloomberg TV that “commodity prices may stay high for decades” as mining companies struggle to keep up with demand from the energy transition.

“What we’re likely to see is strong demand that will keep prices at very very good levels for the producers for many years into the future, and that could be decades,” Hambro stated.

Compounding the issue is the depletion of copper reserves and lower ore grades at some of the world’s largest mines, reflecting years of underinvestment within the mining industry dating back to the 2000s.

Without new capital investments, CRU predicts global copper mined production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt.

Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place, CRU estimates.

A study by New York-based research firm Goehring & Rozencwajg found that both greenfield and brownfield reserve additions are expected to disappoint through the decade.

“The number of new world-class discoveries coming online this decade will decline substantially and depletion problems at existing mines will accelerate,” Goehring & Rozencwajg said in its report.

Conclusion

After years of underinvestment, we’re finally starting to face the reality of having less than enough copper for our future needs.

It’s estimated that at least 20Mt of copper supply must be developed in the next two decades, the equivalent of one large million-tonne mine (i.e. an Escondida) every year from now on.

The solution, as simple as it sounds, is to have more copper projects that can be developed into producing mines.

Chances are, the next major copper mine(s) are most likely to be discovered in Chile, by far the world’s top producer, which is why we have been monitoring the progress of Pampa Metals each step of the way over the past year.

Holding one of the largest prospective property packages along the mineral belts of northern Chile, the company stands to capitalize on some of the areas that major miners may have missed while conducting brownfield exploration on the peripheries of existing mines.

Drilling so far has already shown signs of a fertile porphyry system, which will surely be followed up by more drilling and positive results.

And the latest deal with VerAI, supported by a technology that has proven success in locating mineral deposits, could make Pampa’s dominant land position even bigger.

Pampa Metals Corp.

CSE:PM, FSE:FIRA

Cdn$0.27, 2022.02.09

Shares Outstanding 43.4m

Market cap Cdn$11.9m

PM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Pampa Metals Corp. (CSE:PM). PM is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.