Palladium One hunting PGEs, copper and nickel in mining-friendly Finland

2020.08.26

In 2017 Finland claimed the number one spot on the Fraser Institute’s ranking of investment attractiveness for mining jurisdictions, up from fifth place in 2016.

Among the factors that set Finland apart from its country peers, according to the annual Canadian survey, are its mineral endowments, relatively low corporate income tax rate, and clear rules surrounding mining and exploration.

Mining companies in Finland pay 20% corporate tax, compared to 21% in the United States and 28.5% in Australia, in addition to 24% VAT spent on goods and services. Exploration permits and mining permits are granted by the Mining Authority, which supervises and enforces compliance with applicable legislation. Exploration permit holders have four years to conduct geological surveying and other work, with three-year extensions for up to 15 years. Finnish authorities are generally considered to be supportive of mining. Property rights and the rule of law are entrenched.

World-class infrastructure is another selling point to mining companies. Electricity is reliable and inexpensive, and there are paved roads even in remote areas, along with a comprehensive network of railways, canals and sea lanes. Finland boasts one of the highest living standards in the world, which attracts a strong pool of skilled and well-educated workers.

Lastly, compared to its jurisdictional competitors, Finland has one of the better geological databases available to junior explorers. The icing on the cake: nearly everyone speaks English.

Mining in Finland dates back as early as 1540, with the production of iron ore. Since then, some 270 metals mines have been in operation, outputting 250 million tons of ores – two-thirds sulfide and one-third oxide ores.

Geologically, Finland sits on the Fennoscandian Shield, a segment of the Earth’s crust that shares similarities with Canada and Australia. Much of the area remains unexplored.

Finland has an established cache of industrial metals, including copper, nickel, cobalt, zinc and lead ores, as well as deposits of chromium, vanadium and iron ore.

Historically, Finnish companies Outokumpu Oy and Rautaruukki Oy were the top miners, producing copper, zinc, nickel, cobalt, lead, gold and iron, but after Outokumpu Oy exited the business in the 1990s, mining in Finland stagnated.

Recent years though have seen a revival. Despite the closure of some base metals mines, Finland’s production has doubled over the past 10 years.

Mineral exploration has also jumped, with a number of important discoveries made, including Anglo American’s Sakatti copper-nickel-platinum group elements project, 150 km north of the Arctic Circle, and the Rajapolot-Rompas gold-cobalt discovery being developed by Mawson Resources.

The Nordic nation sharing a border with Sweden and its eastern boundary with Russia, has quietly advanced, over the past decade, to become Europe’s largest gold producer. There are thought to be about 100 gold-producing sites, between southern Finland and Lapland. Currently, four mines produce gold.

Palladium One (TSX-V:PDM)

One company in an excellent position to benefit from Finland’s “open for business” mentality, is Palladium One Mining (TSX-V:PDM). The Vancouver-based junior, formerly called Nickel One, is exploring for platinum group elements (PGEs) in north-central Finland, and for nickel, copper and PGEs on the shores of Lake Superior, in Eastern Canada.

LK project

Palladium One is currently focused on its LK (Läntinen Koillissmaa) project.

The geology dates back to the early Palaeoproterozoic era, ~2.4 billion years ago, during which igneous activity produced mafic-ultramafic rocks containing palladium-rich copper-nickel-platinum group elements (Cu-Ni-PGE) sulfide minerals, chromium, as well as iron-titanium-vanadium.

Geologists think the deposit is a “basal Cu-Ni-PGE bearing sulphide accumulation within the larger Koillismaa Layered Mafic Intrusion” that is part of an intrusion belt that runs east-west across Finland and into neighboring Russia.

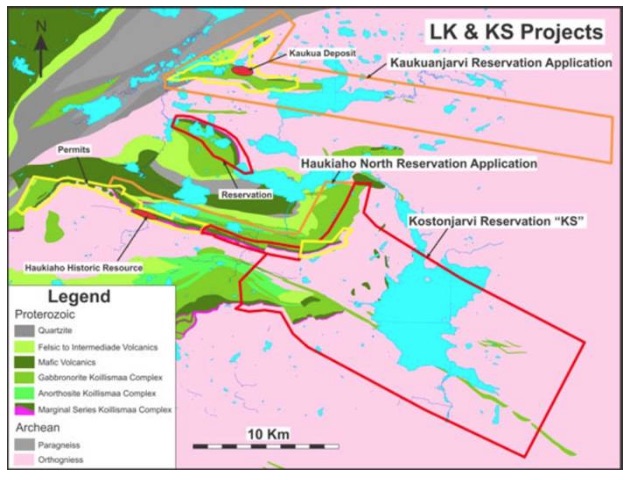

Nine exploration permits cover four mineralized zones: Kaukua, Lipeavaara, Murtolampi and Haukiaho.

Surface sampling and previous drilling have shown evidence of palladium, platinum, gold, copper, cobalt and nickel.

Last year Palladium One published the first (maiden) NI 43-101-compliant resource at the Kaukua target, putting the company on track for developing an open-pit PGE-nickel-copper mine in Finland.

Using a 0.3 g/t Pd cutoff grade, the optimized pit-constrained mineral resource at Kaukua includes:

- 635,600 Pd_Eq ounces of Indicated resources grading 1.80 g/t Pd_Eq (“palladium equivalent”) contained in 11 million tonnes, and

- 525,800 Pd_Eq ounces of Inferred resources grading 1.50 g/t Pd_Eq contained in 11 million tonnes.

Palladium One wishes to add multiples of the existing Kaukua resource in the Kaukua South area, which adjoins Kaukua.

Contained Pd-Eq ounces in the ground can currently be valued at between US$30-US$70/oz, according to a recent report by Paradigm Capital.

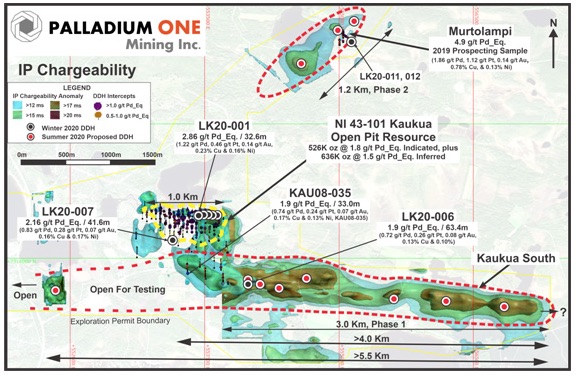

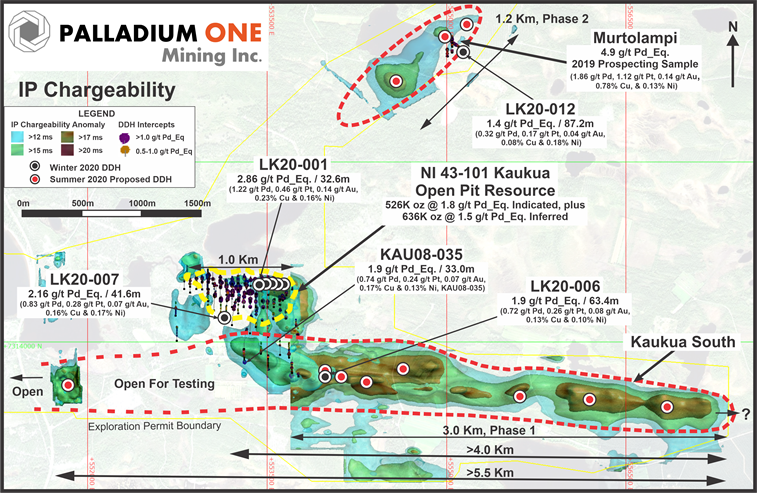

In January 2020, PDM commenced an induced polarization (IP) survey, designed to zero in on shallow zones of conductivity, containing higher sulfide concentrations. These zones are being drill-tested with up to 5,000 meters of diamond drilling.

In its Feb. 25 news release, Palladium One says initial IP results from the first grid, Kaukua East, discovered a large chargeability anomaly, which is indicative of underground mineralization.

“Significantly, the chargeability anomaly on the new Kaukua East survey appears to be more intense and wider than the one on the 2008 survey, making it a very high priority drill target,” President and CEO Derrick Weyrauch stated.

KS addition

Palladium One has significantly increased the exploration potential at its LK platinum-group element (PGE) and base-metal project.

In April, Vancouver-based PDM announced the acquisition of the 20,000-hectare Kostonjarvi (KS), which is adjacent to the company’s flagship Läntinen Koillismaa (LK) project in north-central Finland.

At LK, and now KS, Palladium One is pursuing PGEs, copper and nickel. The LK project’s nine exploration permits all feature mineralized zones. The focus at LK is to vector into thicker embayment-like structures using geophysics to de-risk drilling. Management describes LK as more of a farming exercise given the extent of known mineralization; their plan is to harvest resource tonnage via a conventional, systematic drilling process, given the nature of the LK system.

The addition of KS brings the company’s total land package in Finland to 32,226 hectares. Permission has been granted for exploration to be conducted on all permits and exploration reservations.

According to the April 2 news release, while the two properties are contiguous, KS differs from LK in that KS is an underground target, with high-grade massive sulfide potentially similar to the giant Voisey’s Bay nickel deposit in Labrador, Canada and the Norilsk-Talnakh in Russia; whereas LK is an open-pit-style deposit, featuring disseminated sulfide mineralization along the prospective basal unit of the Koillismaa complex, with similarities to Platreef in South Africa. Platreef and Norilsk are the largest known nickel-copper-palladium deposits in the world.

Obtaining KS is of interest to PDM shareholders, because it covers a large gravity and magnetic anomaly that is thought to represent a “feeder dyke” to the Koillismaa Complex, which hosts the palladium-dominant LK project.

Feeder dyke is a geological term that describes a conduit for magma to flow, carrying minerals that become deposits.

Palladium One describes the exploration targets at KS as “traps” in the buried feeder dyke, that potentially host massive sulfide mineralization. As for how KS connects to LK, the news release explains:

The Feeder Dyke begins at the ultramafic Narankavaaara intrusion and then dives to a depth of 3-5km before coming near surface again where it’s interpreted to connect to the Koillismaa Complex.

While magnetic, gravity and seismic surveys have been conducted to try and model the feeder dyke, little on-the-ground exploration has been done.

2020 exploration

As a result of the covid-19 outbreak, in March the company suspended its H1 2020 exploration program at the LK project. In total the company drilled 2,000 meters, and 12 holes, of the 5,000-meter planned program.

Drilling resumed in August, with a focus on expanding known mineralization to the east of existing drill intercepts in the Kaukua South zone.

On August 10 Palladium revealed that data from this past winter’s Induced Polarization (“IP”) geophysical program, suggests the Kaukua South anomaly now extends for over 5.5 kilometers (Figure 1).

In the news release, President and CEO, Derrick Weyrauch commented, “Kaukua South has become a key focus for the Company. The existing Kaukua Deposit is robust and contained within 1 kilometer of strike length, while Kaukua South may now have a strike length of over 5.5 kilometers. This suggests the potential to add significant, near surface, tonnage to existing NI 43-101 open pit resources and could materially increase conceptual mine throughput and/or a conceptual life-of-mine plan. We are eagerly awaiting results from the now resumed drill program.”

They didn’t have to wait long. The next day the company press-released the results of the first hole to test the eastern section of the above-mentioned >5.5-km-long IP charageability anomaly.

Hole LK20-006 intersected 166.7m @ 1.16 g/t palladium equivalent, including 63.4m @ 1.88 g/t Pd_Eq.

Weyrauch was pleased with the assays, stating, “To date, Hole LK20-006 bears the most significant results of the Phase 1 drill program. It is hard to understate the importance of this hole, as it has not only confirmed the eastern extension of the Kaukua South Zone, but intersected a core zone twice as thick as the next best intersection in Kaukua South. Significantly, the mineralization begins only 43m down hole, making it highly amenable to open pit mining. This confirms our belief that Kaukua South has the potential to quickly add tonnes to the 2019 NI43-101 open pit constrained Kaukua resource estimate.”

On August 25th Palladium One released the first drill results from the Murtilampi zone, 2.5 kilometers north of the Kaukua deposit at the open-pit Lantinen Koillismaa (LK) PGE-Cu-Ni (platinum-group-element-copper-nickel) project.

Starting at 5.8 metres downhole, hole LK20-012 intersected 87.2 m at 1.43 grams per tonne PdEq* including 20.2 m at 2.26 g/t PdEq. President and chief executive officer Derrick Weyrauch commented: “Murtolampi is a short distance north of the Kaukua open-pit deposit. We have now shown that both Murtolampi and Kaukua South have the potential to significantly add to the existing NI 43-101 open-pit resource at Kaukua. Similar to Kaukua South, Murtolampi is associated with a strong induced polarization (IP) chargeability anomaly that is not fully tested. IP has proven to be an invaluable tool for outlining palladium-rich sulphide mineralization on the LK project, as evidenced by the success of hole LK20-006 at Kaukua South. The current drill program will continue to test both the Murtolampi and the Kaukua South IP chargeability anomalies discovered earlier this year. We look forward to sharing further drill results with our shareholders in the near term.”

Palladium market

Palladium (Pd) is one of six platinum group elements (PGE) found in the Periodic Table of the Elements. The others are iridium (Ir), osmium (Os), platinum (Pt), rhodium (Rh) and ruthenium (Ru).

Palladium is also considered a precious metal, meaning it attracts a certain amount of investment demand, like gold, silver and platinum.

Catalytic converters are supplied for diesel- and gasoline-powered engines, to meet increasingly stringent government standards to reduce vehicle tailpipe emissions.

Both contain a mix of PGEs and other metals including platinum and palladium. A higher percentage of platinum is used in diesel autocatalysts, whereas gasoline autocatalysts employ more palladium.

Autocatalyst demand accounts for 83% of overall palladium demand, while also accounting for 140% of global mine supply. The balance of supply comes from depletion of ETF and Central Bank holdings and from recycling.

Concerns over air pollution led the EU to set a target of cutting emissions by at least 40% by 2030, from 1990 levels. According to Euractiv, the mayors of 10 European capitals are urging a switch to zero-emissions vehicles within the next 20 years.

Diesel engines are therefore being phased out in favor of gas-powered cars that meet stricter emission regs. The move away from diesel has hurt not only diesel-car manufacturers but platinum prices. Whereas palladium used to be platinum’s ugly sister, the roles are now reversed, with Pt worth less than half of Pd.

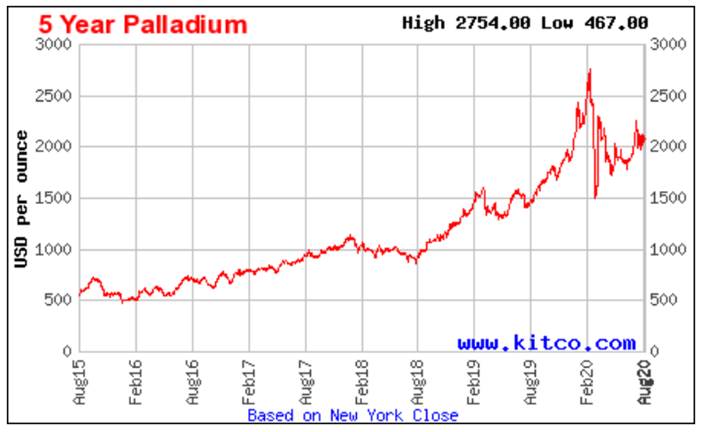

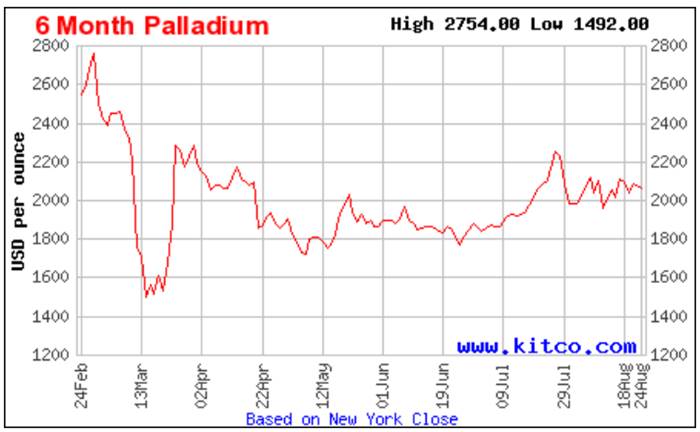

In contrast, palladium prices have surged over the past four years. From $479 an ounce in Feb, 2016, spot palladium has more than tripled, currently trading higher than gold at +$2,000 an ounce.

On Feb. 28 the precious and platinum-group metal hit an all-time high of $2,800/oz.

Currently and for the foreseeable future, palladium is facing constricted supply.

The palladium market has been in deficit for eight straight years, mostly to do with structural supply problems in South Africa, where 80% of mine supply is a by-product of other metal production, thus inhibiting producers from increasing production. South Africa supplies roughly 38% of global production and here platinum companies are under constant pressure to contain costs, because their mines are very deep, hot and labor-intensive. They also face frequent strikes as seen in 2014where most of South African supply was taken off-line.

In April, South African mining output fell as restrictions to curb the spread of covid-19 ground most of industry to a halt.

According to Statistics South Africa, production of platinum group elements (including palladium) dropped 62%, from a year earlier.

In May, the country’s biggest platinum miner, Sibanye-Stillwater, suspended production guidance, while Anglo American Platinum (Amplats) and Impala Platinum Holdings (Implats) both cut their output forecasts. (85% of global PGE production comes from only 5 producers)

The country produces three-quarters of the world’s platinum and about 40% of its palladium.

Norilsk Nickel, one of the world’s largest palladium producers with mines on the Taimyr and Kola Peninsulas in Siberia, has said it is planning to ease market tightness by shifting more production to investment-grade palladium ingots, from the powdered form required by industrial end users. We are not certain of the logic behind reducing industrial supply and increasing investment bar inventory and how such an action will help alleviate the supply shortfall that the industry is trying to cope with.

BNN Bloomberg reported Norilsk’s operations have “barely missed a beat” compared to producers in South Africa, who are struggling to ramp up production following the national virus lockdown.

Palladium prices have slipped back a bit since the pre-pandemic record high, but the platinum group element/ precious metal appears to have the wind at its back as the auto industry begins to recover from a severe slowdown, owing to coronavirus-related plant closures and slack consumer demand for new vehicle purchases.

Analysts say the palladium market is likely to remain in deficit for the foreseeable future. The median result from a recent poll of 32 analysts and traders found that palladium will average $2,050 an ounce this year and $2,138 in 2021.

Conclusion

Palladium One now has two significant projects in Finland with the potential for large mineralized systems, similarities to Platreef and Norilsk/ Voisey’s Bay-type deposits. Having such deposits in a top-tier mining jurisdiction ought to attract much fanfare.

Palladium prices, like gold prices, have held up well despite widespread market convulsions due to the coronavirus pandemic.

As palladium continues its multi-year run, amid supply constraints, new sources of palladium are needed to meet demand for gas-powered auto-catalysts, in conventional and hybrid vehicles and thereby help achieve stricter air quality standards.

This bodes well for explorers like PDM whose deposits contain significant amounts of palladium, as well as nickel and copper, which are also required by electric vehicles, lithium-ion batteries and charging infrastructure.

Cashed up and fully funded with Cdn$3 million in the bank, we look forward to more exploration and news flow regarding its flagship LK project, and are curious to see what Palladium One is planning to do with KS.

Palladium One

TSX.V:PDM, OTC:NKORF, Frankfurt:7N11

Cdn$0.11, 2020.08.25

Shares Outstanding 125,548,599m

Market cap Cdn$13.8m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Palladium One (TSX.V:PDM). PDM is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.