Palladium One has the ‘decarbonization metals’ needed for future transportation

2021.10.09

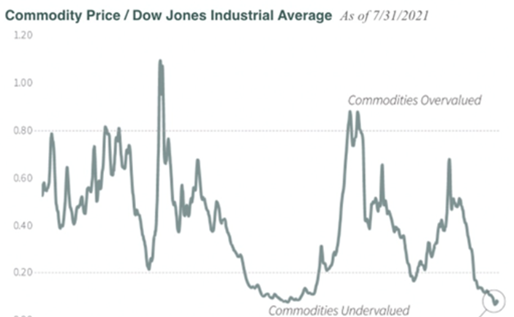

Commodities are considered one of the best places to park investment capital during periods of rising inflation.

The reason is simple. As inflation rises, commodity prices rise and miners have a leveraged advantage with their existing resources, let alone new discoveries. Investing in commodities is therefore considered a hedge against inflation.

The global economy is currently running hot, fiscal and monetary policies of governments and their Central Banks, and a waning coronavirus pandemic (even factoring in the recent surge in cases due to the Delta variant), has caused demand for goods and services to outstrip the ability of companies to supply them resulting in inflation.

Toss in virus-related supply chain bottlenecks, including a shortage of labor in some industries, rising freight rates, and companies having to frantically restock drawn-down inventories, amid high demand, and we have the biggest inflation increase in more than a decade. Consumer prices marched 5.4% higher in June, the biggest monthly gain since August 2008 (the July figure is also 5.4%).

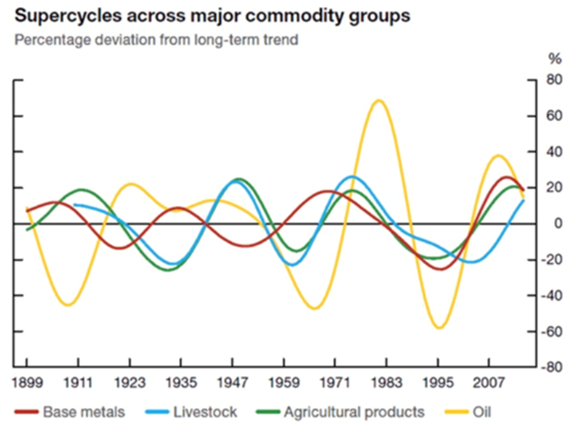

From the bottom of the last commodities “super-cycle” in 2003 to the peak in 2008, commodities rose over 300%.

The commodities super-cycle of the 2000s collapsed in the Great Recession of 2008, then resumed from 2009 to 2011. It ended in the bear market of 2011-15.

Many are pointing to the formation of a new super-cycle, driven not by fossil fuels and the rise of China, such as occurred in the 2000s, but by so-called “green” metals needed to electrify and decarbonize, to avoid the worst effects of climate change.

On top of surging demand for metals needed to feed so-called “green infrastructure” programs, we have current and emerging structural deficits for several metals, that will keep prices buoyant for the foreseeable future.

The new “green economy” rejects dirty sources of energy and transportation, namely coal, oil, and natural gas. Instead, it relies on carbon-friendly modes of transport and energy production, including electric vehicles, renewable power, and energy storage — the latter required for storing electricity when the wind doesn’t blow and the sun doesn’t shine.

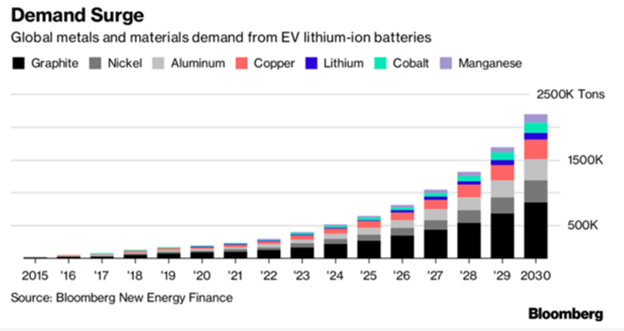

However, the transition to clean and green will not happen without a major boost in the production of so-called battery and energy metals.

According to Wood Mackenzie, mining companies will need to spend $1.7 trillion over the next 15 years, to supply enough lithium, graphite, cobalt, copper and nickel for the shift to a low-carbon world.

The commodities consultancy says meeting new emissions targets being set by countries like Canada, the US, Britain, China and Japan, will mean large-scale deployment of electric vehicles, renewable power and electrical transmission, all of which will require copious metal content. But where will the supply come from?

Copper

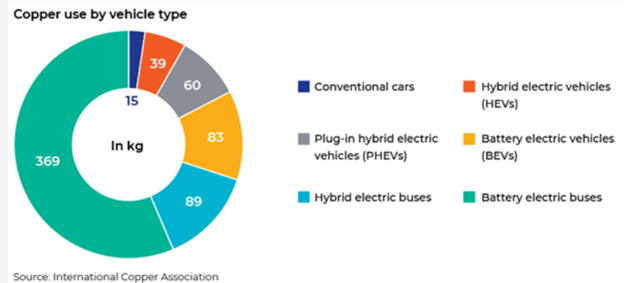

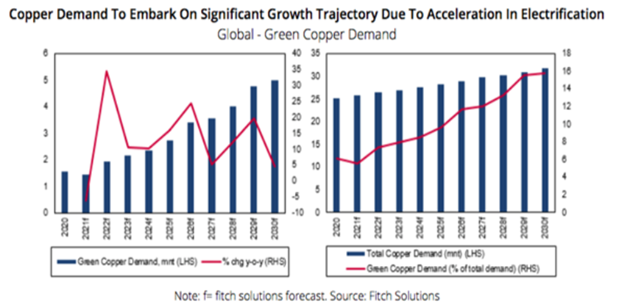

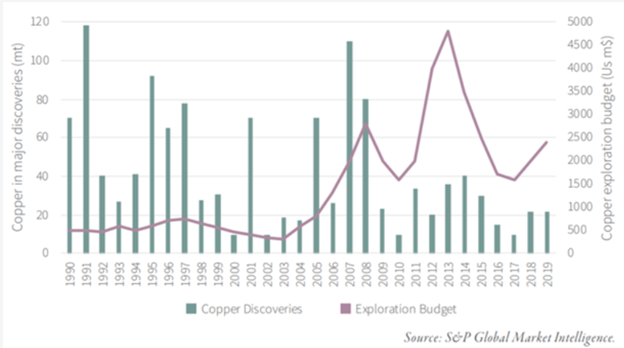

Curiously, copper is often overlooked when tallying up the metals required for the transition to clean energy and electrification. There is no shift from fossil fuels to green energy without copper, which has no substitutes for its uses in EVs, wind and solar energy, and 5G.

The big question is, will there be enough copper for future electrification targets, globally? And remember, in addition to electrification, copper will still be required for all the standard uses, including copper wiring used in construction and telecommunications, copper piping, and copper needed for the core components of airplanes, trains, cars, trucks, cell phones, homes and boats.

The short answer is no, not without a massive acceleration of copper production worldwide.

By 2040, Bloomberg New Energy Finance estimates around 30% of the world’s passenger cars will be electric. To me that’s a conservative and reasonable number. It means 500 million EVs will be on the road in 20 years, out of a total vehicle fleet of 1.6 billion. If each EV contains 85 kg of copper, that is 21.2 million tonnes of copper, meaning we’ll have to double the current volume of copper currently produced by all of the world’s copper mines – in just 19 years. Where is the list of mining projects to come on stream to achieve the theoretical demand? Remember, on average it takes well over 10 years for a new mine to be discovered and developed.

A report by Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand. Total world mine production in 2020 was only 20Mt.

You know it’s interesting. Politicians and “green economy” business leaders continue to promote electrification using lithium-ion batteries without understanding or caring about the limitations of this technology in terms of metals supply.

It’s going to be all but impossible for the mining industry to provide enough copper for even the most conservative of EV penetration aspirations.

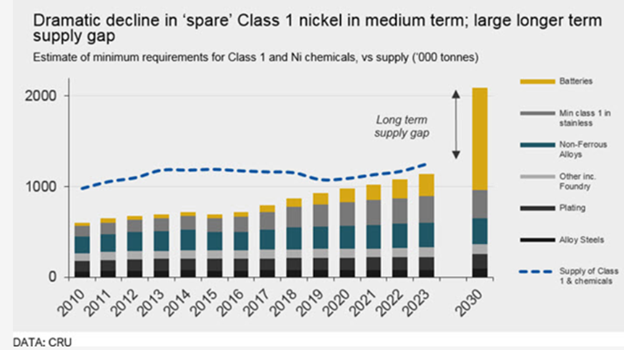

Nickel

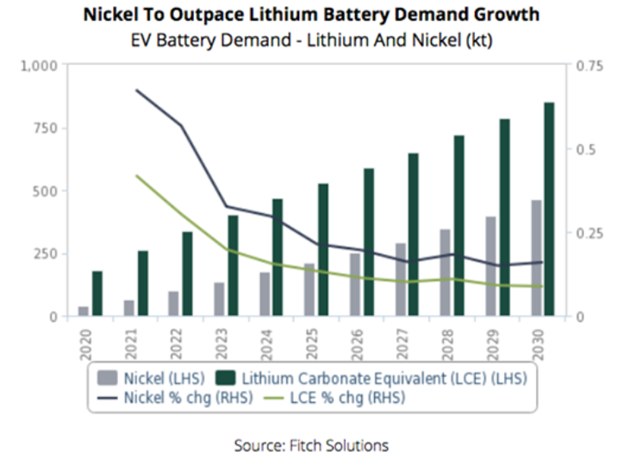

Other EV metals are facing similar fates. The Bank of America projects that 13.6 million EVs sold in 2025 would need 690,000 tonnes of nickel. That represents nearly the entire mined nickel supply of Indonesia, the world’s top nickel producer, which in 2020 outputted 760,000 tonnes, out of the 2.5Mt total. If we take that number out and apply it to EVs, the mining industry has to find another 690,000 tonnes to supply all of nickel’s other uses, the primary one being stainless steel.

Nickel sulfate powder made from nickel sulfide ore, is a crucial ingredient in cathode formulation for lithium-ion batteries needed to propel electric vehicles.

Nickel is popular with EV battery-makers because it provides the energy density that gives the battery its power and range. Increasing the amount of nickel in a battery cathode ups its power and range.

The rate of nickel consumption for EV battery manufacturing is set to outpace both lithium and cobalt over the next decade, with an average annual growth rate of 29%, according to Fitch Solutions.

Glencore CEO Ivan Glasenberg recently said nickel supplies need to grow by an additional 250,000 tonnes a year, and he projected annual nickel demand will rise from 2.5 million tonnes currently to 9.2Mt, over the next few decades. Mining companies can’t simply flip a switch and turn on that much new nickel. Where is the list of mining projects to come on stream to achieve the theoretical demand? Remember, on average it takes well over 10 years for a new mine to be discovered and developed.

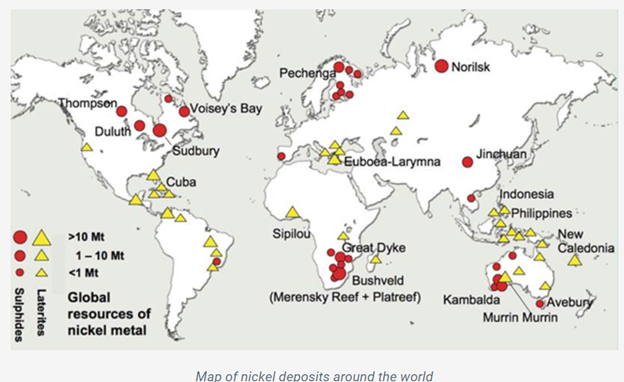

Historically, most nickel was produced from sulfide ores, including the giant (>10 million tonnes) Sudbury deposits in Ontario, Norilsk in Russia and the Bushveld Complex in South Africa, known for its platinum group elements (PGEs). However, existing sulfide mines are becoming depleted, and are not being replaced, which has changed the geographical weighting of nickel production.

With existing sulfide mines becoming depleted nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically, technically and environmentally feasible? The pickings are slim.

Decades of under-investment equals few new large-scale greenfield nickel sulfide discoveries.

Without a major acceleration of mining worldwide, including in the United States and Canada which have so far yielded to the NIMBY crowd, we are likely to fall short of battery metals supply in a reasonably short period of time, spurred by the dual trends of electrifying the global transportation system and decarbonizing electricity generation.

Palladium

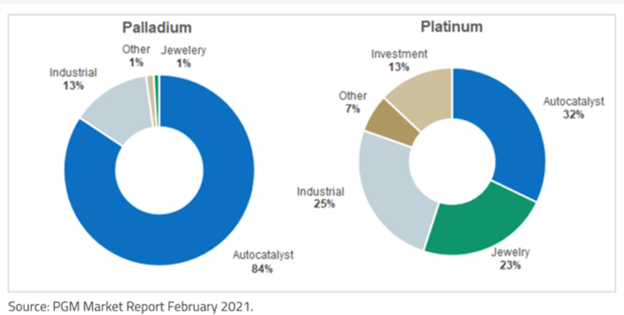

As the world transitions from fossil-fueled “ICEs” to battery-powered electric vehicles, the internal combustion engine is unlikely to be resigned to the scrap heap, just yet. Gasoline vehicles and gas-electric hybrids will gradually displace more-polluting diesels, the former equipped with catalytic converters to filter out pollutants like NoX and particulate matter.

This means growing demand for materials that go into gas-powered autocatalysts, including palladium.

The platinum group metal is set for a supply deficit for the 10th straight year. Driving palladium demand are higher sales of gasoline vs diesel units and ever increasing pollution control (GHS reduction) regulations.

Palladium use in hybrid vehicles, seen as a bridge between gas-powered cars and pure electrics, is a growing source of demand.

We’ve written much about the need for battery metals and their expected shortages in the drive to electrification and decarbonization, and the transition period when palladium will play an increasingly important role in reducing emissions as countries aim to mitigate the effects of global warming.

The hydrogen economy

However there is another solution to the problem of rising temperatures, that has so far received minimal attention in the mass media, and that is hydrogen.

Although hybrids and all-electrics are the modern vehicles of choice for the time being, many believe that lithium-ion batteries are a stop-gap technology that will eventually be replaced by hydrogen fuel cells.

The upside of hydrogen fuel cells is they produce zero emissions (just heat and water) but the downside is that to make hydrogen requires significant amounts of energy, currently being sourced, from highly polluting coal or natural gas. So-called “green hydrogen” would be produced from renewable sources such as wind, solar or nuclear. The process to produce ‘green hydrogen” is expensive and requires a large electrolyzer to power the electrolysis of water.

The utility of hydrogen as a fuel is also limited due to its low density, making it difficult to store, and its flammability. The relatively small number of hydrogen vehicles versus EVs, and extremely sparse hydrogen filling station infrastructure, has badly dented hydrogen’s consumer appeal.

According to Green Tech Media, in 2020 there were roughly 7,600 hydrogen fuel-cell cars on US roads compared to more than 326,400 EVs sold in the US in 2019.

For now, hydrogen’s use is mostly restricted to industrial applications.

Due to centralized fueling facilities where far less extensive fuel distribution networks are required, buses and utility vehicles like garbage trucks are good candidates for the incorporation of hydrogen fuel cells into the commercial vehicle market.

Remote power generation is another growing application. Caterpillar, for example, this month announced it will start offering Cat generator sets capable of operating on 100% hydrogen including fully renewable green hydrogen. More immediately, the company says it will launch gen-sets that can be configured to operate on natural gas blended with up to 25% hydrogen.

NASA has for years used hydrogen fuel cells to power its systems onboard and to provide drinking water for the crew.

How would a greater penetration of hydrogen fuel cells affect the supply of raw materials required to make them? According to the International Platinum Group Metals Association, developments in the hydrogen sector are a demand signal for platinum, chromium and nickel.

Fuel cells are devices that convert a chemical reaction into electricity with heat and water as by-products. Platinum and ruthenium play a large role in this technology, platinum being the catalyst which converts hydrogen and oxygen to heat, water and electricity. Palladium will likely also play a role in the fuel cell, but it is unknown yet how big.

An article in Argus Media last year states that In addition to using a catalyst — often made of platinum — proton exchange membrane fuel cells typically also use chromium steel, comprising 18pc chromium and 8pc nickel.

Looking further into the future, beyond battery-powered cars and trucks, companies that can supply raw materials for an expanding hydrogen economy, if the technology moves in that direction, will in our opinion do very well.

Palladium One Mining

Fortunately we don’t need a crystal ball to identify these companies. Palladium One Mining (TSXV:PDM) (FRA:7N11) (OTC:NKORF) has been working diligently to advance two projects with mineral deposits applicable to both the battery metals designation familiar to most readers, and future-facing metals like platinum and palladium that will find a market in hydrogen fuel cells. For the purpose of this article, we are merging them into one broad category, named “decarbonization metals”.

At Palladium One’s Tyko project in Ontario, its decarbonization metals are nickel and copper, while at the LK project in Finland, PDM is exploring for palladium, platinum, nickel, copper and cobalt.

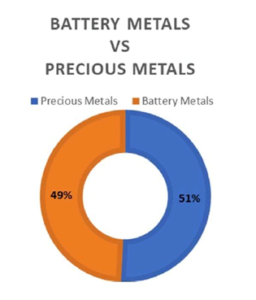

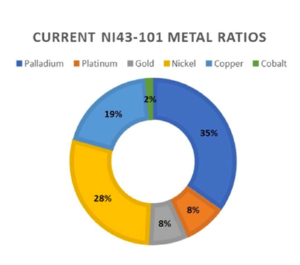

Combined, Tyko and LK offer investors nearly equal exposure to battery metals and precious metals — the latter in the form of platinum and palladium, as the graphic below shows. The current metal ratio conforming to NI 43-101 resource reporting standards shows palladium is the most prevalent at 35% followed by nickel, copper, platinum and gold. Note precious metals refers to palladium, platinum and gold.

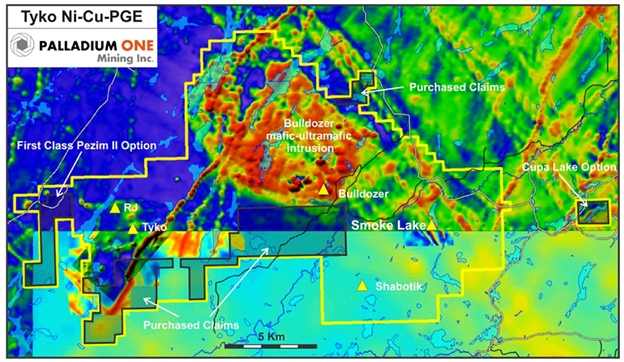

Tyko

Palladium One continues to outline a high-grade nickel-copper system at its Tyko Ni-Cu-PGE project in Ontario, where a second-phase drill program started in April and a recently announced expansion increases the size of the property by over a fifth.

Notable for its high nickel tenor, the project covers over 25,000 hectares, including the 7,000-hectare mafic-ultramafic Bulldozer intrusion, which has seen virtually no geological mapping nor exploration.

A VTEM (Versatile Time Domain Electromagnetic) geophysical survey run by Noranda clipped the Smoke Lake target, decades ago, and that is the location of a high-grade discovery. Palladium One’s focus at Tyko is twofold, firstly to expand the known mineralization at Smoke Lake and secondly to assess the entire property for additional high-grade drill targets.

All 13 holes drilled at Smoke Lake intersected magmatic sulfides, with widths ranging from 1 to 15 meters.

A second-phase, 2,000m drill program started in April, following up on high-grade hits of 9.9% nickel equivalent (NiEq) over 3.8m.

A number of high-grade intersections were reported, all near surface, including:

- 1.7m @ 10.2% NiEq (or 31g/t AuEq) within 4.5m @ 7.5% NiEq (or 22 g/t AuEq)

- 1.7m @ 8.3% NiEq (or 25g/t AuEq)

- 1.7m @ 9.5% NiEq (or 29g/t AuEq)

These are some of the highest nickel grades in the world.

Excited as Palladium One is about its nickel results, there are also notable copper and nickel occurrences, in particular the RJ and Tyko zones located about 18 km west of Smoke Lake. Drilling in 2015 returned several intercepts over 1% nickel + copper with a high of about 1.5% Ni + Cu. The above-mentioned Bulldozer intrusion also has significant historical copper showings.

Palladium One has now completed a 2,000-square-kilometer (3,100 line km) airborne geophysical survey (VTEMmax) — the first of its kind to be done across the whole Tyko property. According to PDM, the survey of closely spaced, 100m flight lines covered large areas for which no electromagnetic surveys had ever been flown, including the area around the Shabotik showing which has up to 1% Ni.

Mapping, prospecting and soil sampling is also underway, with 1,000 soil samples already submitted to the assay lab.

“Tyko continues to impress and warrants increased levels of expenditure and exploration. Results to date demonstrate robust mineralization spread over at least 18 kilometers, yet the area has seen virtually no government mapping or exploration,” said Palladium One’s President and CEO, Derrick Weyrauch, in the July 27 news release. “We believe that in addition to the high-grade Smoke Lake zone, there are new zones off nickel-copper mineralization yet to be discovered. We are awaiting result from the 3,100-kilometer airborne Electro Magnetic (VTEMmax) survey which will guide further exploration.”

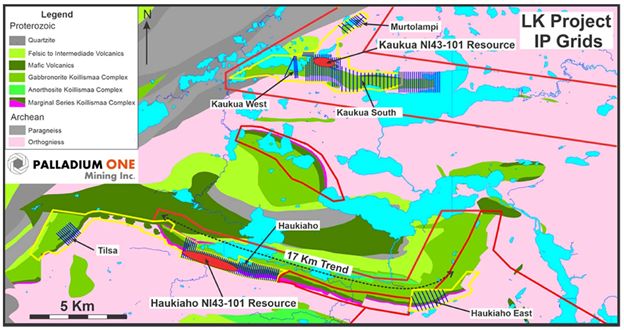

LK

Months of drilling success by Palladium One Mining Inc. on its Läntinen Koillismaa (LK) PGE-Cu-Ni property in Finland have culminated in a much-increased resource endowment, further confirming the project’s potential to host a large bulk-tonnage deposit.

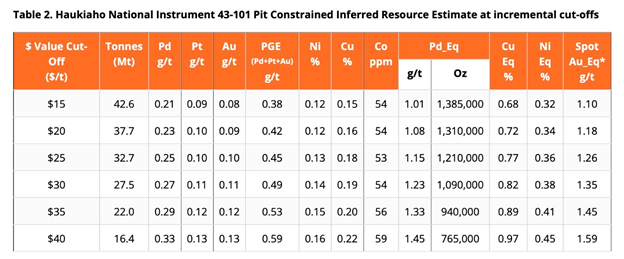

As announced in a Sept. 7 news release, results from a 2,000m drill program at the Haukiaho Zone significantly increased existing resources by 32.7 million tonnes grading 1.15 g/t PdEq (palladium equivalent), for 1.21 million ounces of contained PdEq.

This resource update essentially doubles the resource endowment of the entire LK project, which now boasts 11 million tonnes of indicated resources grading 1.60 g/t PdEq (600,000 oz PdEq) and 44 million tonnes of inferred resources grading 1.19 g/t PdEq (1.7 million oz PdEq).

The Kaukua Zone of LK is mostly a palladium-platinum-gold play, however it may surprise readers to learn there are significant base metal values particularly at Haukiaho, where two-thirds of the zone’s value is in nickel and copper compared to the Kaukua Zone where 66% of the value is in palladium and platinum.

Indeed Haukiaho hosts some of the highest nickel grades on the LK project. At 17 km in length, the Haukiaho trend currently represents the largest continuous patch of blue-sky potential.

The latest resource estimate of 1.2 million ounces PdEq grading 1.15% g/t, comprises only 3 km of strike length; 2 km of strike extent, immediately east of the Haukiaho resource estimate, contains two significant IP chargeability anomalies with sufficient historical drilling to potentially be upgraded to inferred resources with modest additional drilling.

The remaining 12 km of the Haukiaho trend has not been drill tested by the company, though widely spaced historic drilling has demonstrated that the trend is mineralized. This historical drilling provides a high level of confidence for potential additional nickel-copper resources to be delineated, Palladium One said.

Also worth noting is the fact that the Haukiaho Zone’s resource estimate shown tabulated below contains cobalt. There is a reasonable expectation that the next resource estimate update at the Kaukua Zone where PDM is concentrating its drill program, will also contain notable values of the crucial lithium-ion battery component.

Phase 2 drilling by Palladium One this year continued to return significant PGE grades and widths, including 47m at 2.3 g/t PdEq and 53m at 2.1 g/t PdEq, and was successful in extending the strike length of the Upper Zone mineralization.

Last month the company announced the highest-grade hole to date at LK, which intersected 4.07 g/t PdEq over 24m within 2.08 g/t Pd_Eq over 112m, starting at 171.5m depth.

On Oct. 5 Palladium One announced drill hole LK21-088 at Kaukua South cut 3.1 g/t PdEq over 21.3m within 2.4 g/t PdEq over 48.5m starting at 120m depth.

With hole LK-21-087 returning 1.0 g/t PdEq over 51.0 meters, the mineralized zone of Kaukua South has been extended 200 meters east from previous drilling, meaning that the Kaukua trend (including the Kaukua deposit and the Kaukua South Zone) now boasts a drill proved mineralized strike length of 4.4 km within a 7-km induced polarization (IP) chargeability anomaly.

These results bolster the company’s belief that it could add a significant amount of open-pit resources to the new NI 43-101 resource estimate expected in Q1 2022.

Conclusion

The excessive demand pressure on decarbonization metals including copper, nickel, cobalt, platinum and palladium as the world transitions from fossil fuels to electrification, is running up against looming supply shortages especially for copper and sulfide nickel. This bodes well not only for the prices of these commodities but companies like Palladium One that are exploring for and discovering them.

PDM is extremely well placed to supply the market for electrification metals — nickel, copper and cobalt — along with the longer-term hydrogen economy that will likely employ fuel cells en masse requiring platinum, palladium and nickel.

Palladium One is also fortunate to have a palladium focus at LK in Finland which, if it becomes a mine, can supply the PGE raw materials for gas-powered catalytic converters expected to serve as a bridge between fossil-fueled internal combustion engines and all-electrics.

Putting it all together, it appears to us at AOTH that Palladium One has the decarbonization metals at its two projects to help mitigate the expected supply shortfall, and is working hard to develop its nickel-copper rich Tyko deposit and mostly palladium LK property (with copper-nickel kickers) into producing mines.

Palladium One Mining

TSXV:PDM, OTC:NKORF, FSE:7N11

Cdn$0.19, 2021.10.08

Shares Outstanding 241m

Market cap Cdn$47m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Palladium One (TSX.V:PDM). PDM is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.