Palladium One doubles resource endowment at LK project, with new Kaukua estimates still to come

2021.09.09

Months of drilling success by Palladium One Mining Inc. (TSXV: PDM) (FRA: 7N11) (OTC: NKORF) on its Läntinen Koillismaa (LK) PGE-Cu-Ni property in Finland have culminated in a much-increased resource endowment, further confirming the flagship project’s potential to host a large, bulk-tonnage deposit.

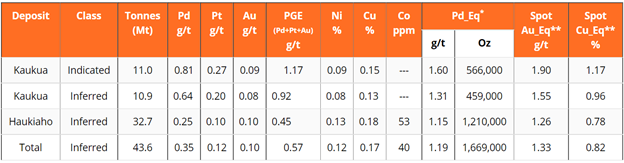

As announced in a September 7 news release, results from a 2,000m drill program at the Haukiaho zone were able to significantly increase this area’s resources (NI 43-101 compliant) to 32.7 million tonnes grading 1.15 g/t PdEq (palladium equivalent), for 1.21 million ounces of contained PdEq.

This resource update essentially doubles the resource endowment of the entire LK project, which now boasts 11 million tonnes of indicated resources grading 1.60 g/t PdEq (600,000 oz PdEq) and 44 million tonnes of inferred resources grading 1.19 g/t PdEq (1.7 million oz PdEq).

Haukiaho Zone

The Haukiaho zone was the original focus of drilling in 2020 until the discovery of Kaukua South led the company to first explore the greater Kaukua area. However, as Palladium One stated on several occasions, Haukiaho had always been a priority given the robust historical data set available.

Haukiaho is base metal-rich (nickel and copper) and hosts some of the highest nickel grades on the LK project. As such, the company considers this to be an important part of its strategy to grow a multi-million-ounce resource base.

At 17 km in length, the Haukiaho trend currently represents the largest continuous patch of blue-sky potential on the LK property.

The latest resource estimate comprises only 3 km of this strike length; 2 km of strike extent, immediately east of the Haukiaho resource estimate, contains two significant IP chargeability anomalies with sufficient historical drilling to potentially be upgraded to inferred resources with modest additional drilling.

The remaining 12 km of the Haukiaho trend has not been drill tested by the company, though widely spaced historic drilling has demonstrated that the trend is mineralized. This historic drilling provides a high level of confidence for potential additional nickel-copper resources to be delineated, Palladium One said.

The historic resource estimate was prepared in the 1980s by Outokumpu, a Finnish state-run mining company, using very widely spaced holes along a portion of the Haukiaho trend, which estimated 7 million tonnes grading 0.38% Cu and 0.24% Ni (however, no PGE assays were undertaken).

Then in 2013, Finore Mining Inc. completed a non-pit constrained NI 43-101 resource estimate over a much smaller strike length. Using a 0.1 g/t Pd cut-off grade, they estimated a resource of 1.13 million PdEq ounces within 23.2 million tonnes grading 1.51 g/t PdEq (0.31 g/t Pd, 0.12 g/t Pt, 0.10 g/t Au, 0.21% Cu, and 0.14% Ni). This resource estimate encompassed widely spaced drilling with a focus on maximizing tonnage, not grade.

The resource estimate prepared by Finore covers only less than 2 km of the 17 km Haukiaho trend.

According to Palladium One, this knowledge, coupled with the previous work by Outokumpu, points to the enormous potential to significantly add resources at Haukiaho with disciplined execution of exploration activities, which it has now accomplished.

Kaukua Area Update

In the same release, the company also updated shareholders on its drilling progress at the primary focus area of the LK project.

Resource definition drilling at Kaukua and the western half of Kaukua South (together known as the Kaukua area) has now been completed, with an NI 43-101 resource estimate scheduled for year-end.

While the Haukiahio trend is more copper-nickel rich, the Kaukua deposit is predominantly PGE (platinum group elements) rich, with two-thirds of the value in palladium and platinum.

The Kaukua mineralized system is also much larger than previously understood, as evidenced by last year’s major discovery about 500m away at Kaukua South, which hosts a >4km long IP chargeability anomaly, of which 3.5 km has never been tested prior to Palladium One’s drilling work.

Initial drilling last year, therefore, focused on expanding known mineralization to the east of existing drill intercepts in the Kaukua South zone, taking priority over the planned drilling to upgrade and convert the historical resource estimate at Haukiaho.

That drilling successfully confirmed the eastern extension and the over 4 km strike length, insinuating the presence of a large-scale, shallow mineralized system with significant continuity.

Phase 2 drilling by Palladium One this year continued to return significant PGE grades and widths, including 47m at 2.3 g/t PdEq and 53m at 2.1 g/t PdEq, and was successful in extending the strike length of the Upper Zone mineralization.

These results added to the company’s belief that it could add a significant amount of open-pit resources to the upcoming NI 43-101 resource estimate.

The question is not if, but by how much, the Kaukua drilling will add to the already doubled mineral resources at the LK property.

LK Project Overview

The geology at LK property dates back to the early Palaeoproterozoic era, some 2.4 billion years ago, during which igneous activity produced mafic-ultramafic rocks containing palladium-rich copper-nickel-PGE sulfide minerals, chromium, as well as iron-titanium-vanadium.

Geologists believe that the deposit is a “basal Cu-Ni-PGE bearing sulfide accumulation within the larger Koillismaa Layered Mafic Intrusion” that is part of an intrusion belt that runs east-west across Finland and into neighboring Russia.

The LK project area is covered by exploration permit renewals, new applications and exploration reservation applications.

The exploration permit applications — covering a grand total of 2,485.3 hectares — are divided into two groups: the Kaukua group consisting of the Kaukua and Murtolampi targets, and the Haukiaho group covering the Lipeävaara and Haukiaho targets as well as Salmivaara, which represents the eastern and western extension of Haukiaho.

This project draws comparison with the Platreef type deposits of the Bushveld Igneous Complex in South Africa, the largest layered igneous intrusion within the Earth’s crust. It is also where most of the world’s platinum is produced.

Surface sampling and previous drilling have shown evidence of palladium, platinum, gold, copper, cobalt and nickel.

In 2019, Palladium One published the first NI 43-101 resource for the Kaukua target, placing the company on track for developing an open-pit nickel-copper-PGE mine in this highly mineralized part of Northern Europe.

Now, with the conversion of historical resources at the Haukiaho zone to double the project’s endowment, plus a maiden resource expected in the coming months at Kaukua South, we could be looking at an even larger open-pittable resource than imagined.

It’s important to note that the LK project covers a 38 km stretch along favorable basal contact, where the intersection of mafic-ultrafmafic rocks occurs, and the company has so far only focused on the currently known higher-grade portions.

Given its recent exploration success, we can’t rule out another Kaukua South like discovery.

Conclusion

It’s exciting times ahead for Palladium One shareholders as the company continues to grow its wholly-owned LK project in Finland. The latest update shows that the resource endowment can be doubled in just two short years.

The next mineral resource update is due at year-end for the Kaukua area, which could see LK become an even bigger PGE asset that could benefit from a healthy palladium market.

As Palladium One’s president and CEO Derrick Weyrauch stated in the September 7 release: “LK is clearly shaping up to be a globally significant project in a best-in-class mining jurisdiction.

“With Finland’s exceptionally well-designed mining and development laws and our existing resources, we believe that LK is well on its way to demonstrating the critical mass needed for a robust mining scenario. Based on the significant number of drill targets still to be tested, we see a tremendous amount of resource expansion potential remaining to be defined.”

Don’t forget, LK isn’t the only project that Palladium One is advancing at the moment. In Ontario, Canada, the company continues to outline a high-grade sulfide nickel system at its Tyko nickel-copper-PGE project, where drilling to date has returned some of the highest sulfide nickel grades in the world.

Palladium One Mining

TSX.V:PDM, OTC:NKORF, FSE:7N11

Cdn$0.225 2021.09.08

Shares Outstanding 241.2m

Market cap Cdn$55.5m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Palladium One (TSX.V:PDM). PDM is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.