Palladium One discovers massive sulphides during initial drilling at Tyko

2020.12.09

Following a lengthy delay in exploration activities due to Covid-19, Palladium One Mining (TSXV: PDM) (FRA: 7N11) (OTC: NKORF) has resumed work at its Tyko nickel-copper-PGE project in Ontario, Canada. The initial phase of diamond drilling is already underway, with discovery success achieved from the first two drill holes.

2020 Drill Program

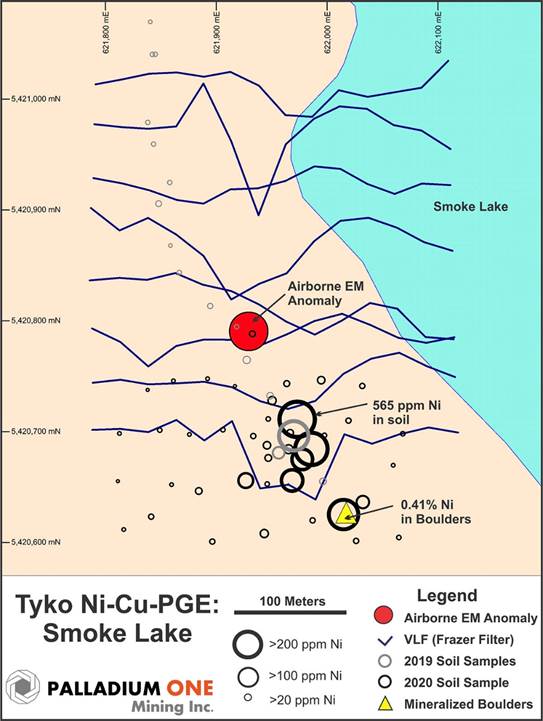

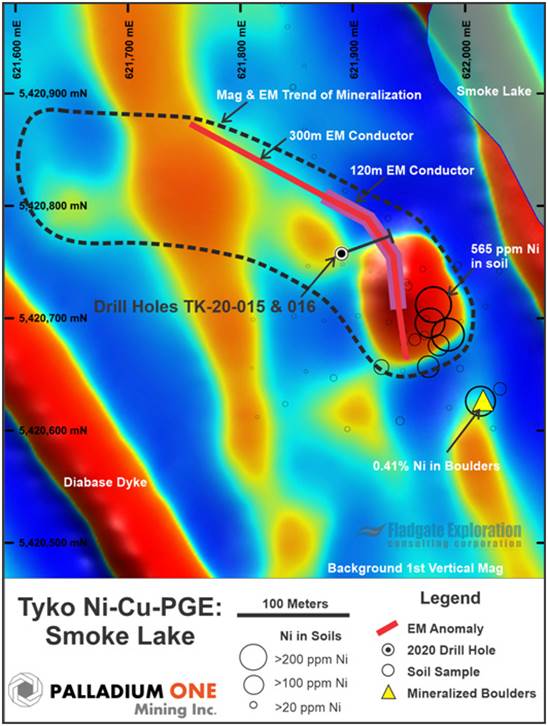

The 2020 drill program at Tyko is designed to test the Smoke Lake electromagnetic (EM) anomaly, where soil sampling returned up to 238 ppm Ni (over 20 times background levels).

During this year’s field exploration, EM surveys identified two near-surface, closely spaced conductors, the largest of which has a strike length of over 300 meters.

A drone-based magnetic survey also identified a strong bullseye associated with soil anomalies (up to 565 ppm nickel and greater than 40 times background levels), representing the surface expression of the EM anomaly.

Smoke Lake area showing VLF survey (dark blue lines), 2019 and 2020 soil sample, and Cu-Ni mineralized boulders

Mineralized boulders with high nickel (up to 0.41% Ni) and copper values were recently discovered ‘down ice’ of Smoke Lake, indicating potential for high-grade massive sulphide mineralization.

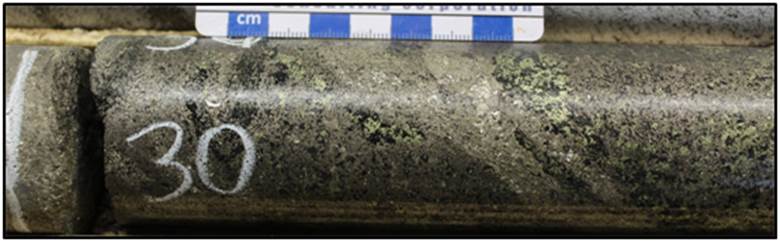

Discovery boulder located 180 m south of the Smoke Lake EM anomaly

This potential has now been validated by the first two diamond drill holes (see below), which intersected 4 m (Hole TK-20-016) and 2 m (Hole TK-20-015) of massive magmatic sulphides, respectively, both at less than 30 m true depth.

Massive magmatic sulphide intersection in hole TK-20-016

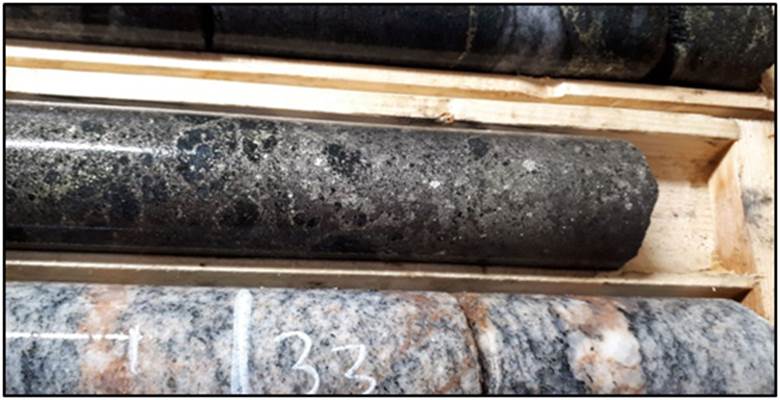

Closeup of massive magmatic sulphide in hole TK-20-016

Closeup of massive magmatic sulphide in hole TK-20-015

This was the first confirmed occurrence of massive sulphides on the Tyko project, according to Palladium One president and CEO Derrick Weyrauch.

“Given disseminated sulphides produced over 1% nickel in other zones on the project, we have high expectations for this new zone and are eagerly awaiting assay results,” Weyrauch said.

Cross section of the first two drill holes of the 2020 Smoke Lake drill program

According to Palladium One, lithologies in the two holes closely resemble those found at both the Tyko and RJ showings located 17 km to the west, where drilling on the property last occurred back in 2016.

Fourteen drill holes for a total of 1,780 m were completed in the 2016 winter drill program to expand the historic showings. That delivered the best nickel, copper and PGE grades to date, with notable results including 1.06% Ni and 0.35% Cu over 6.22 m (Hole TK-16-010).

Nickel Opportunity

Palladium One’s latest discovery cannot come at a better time.

Nickel prices recently surged to a year-high as demand gathered pace due to rising industrial activities in China. The base metal, mainly used in the production of stainless steel and electric vehicle batteries, has rallied more than 45% since the end of March.

Meanwhile, an export ban by Indonesia, the world’s top nickel producer, has led to an intensifying supply crunch, leaving nickel buyers looking elsewhere since January.

Copper, too, has been on the rise. In fact, it could be considered the “hottest metal” at the moment amid talks of a returning structural bull market, as recently predicted by Goldman Sachs analysts.

Like with nickel, there is also a looming copper shortage with global electrification right around the corner, especially in North America and Europe where there is virtually no production. This makes the red metal a “critical mineral” for the future.

This is where a project like Tyko could come into the fold; some of the largest mines in Canada have been developed from volcanogenic massive sulphide (VMS) deposits owing to their rich mixture of base metals and precious metals, though large-scale nickel sulphides are quite rare.

In a recent press release, Palladium One CEO Derrick Weyrauch commented:

“With President-elect Biden’s two-trillion-dollar green energy plan, discovering a high-grade sulfide nickel deposit in shipping distance to existing smelter infrastructure in Sudbury, Ontario, could be well timed. We are excited to drill test this anomaly at a time when nickel demand fundamentals are robust.”

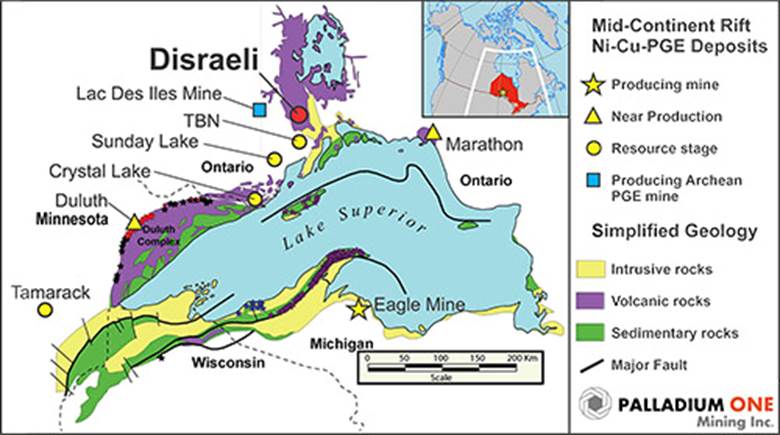

Tyko is an early-stage project with high nickel tenor potential located in Ontario’s highly prospective Mid-Continent Rift province.

The Archean-aged mafic-ultramafic intrusion at Tyko, formed during the Mesoproterozoic era, is rich in nickel; Tyko’s ore contains twice as much nickel as copper, and equal amounts of platinum and palladium.

The property is close to existing mining operations, with road and trail access and power and rail infrastructure close by. It is located 25 km north of the world-famous Hemlo mining complex, and 55 km from the Marathon deposit, which hosts a measured and indicated resource of 3 million ounces palladium and 618 million pounds of copper.

Survey Discovery at Disraeli

Tyko isn’t the only project that Palladium One is looking to advance in Ontario’s Mid-Continent Rift province. As the company name indicates, the miner is focused on palladium, another metal that is critical to the global auto industry.

A magnetic survey at the company’s Disraeli PGE project has outlined a significant magnetic signature, a key indicator of mineralization as demonstrated by nearby PGE-nickel-copper deposits and mines.

The project is located 40 km north of Clean Air Metals Inc.’s Thunder Bay North (TBN) project and 50 km east of Impala Platinum Holdings Ltd.’s Lac Des Iles palladium mine.

The producing Eagle mine operated by Lundin Mining, which hosts a measured and indicated resource of 4.6 million tonnes grading 3.7% Ni, 3.1% Cu, 0.9 g/t Pt and 0.7 g/t Pd, is also in the same geographic area (see map below).

Illustration of Proterozoic Mid-Continent Rift and select associated copper-nickel-palladium-platinum deposits

According to Palladium One, the magnetic target at Disraeli is high-grade PGE-rich nickel-copper mineralization located within magma conduits similar to Clean Air Metals’ TBN and Escape Lake deposits. Recent drilling at TBN returned 83.3m of 1.91 g/t Pd, 1.47g/t Pt, 0.73% Cu and 0.41% Ni.

“The presence of airborne EM conductors coincident with a reversely polarized magnetic body, something that does not occur at TBN, suggests the potential for semi or even massive sulphides,” company chief Weyrauch stated.

Rare massive sulphide intercepts at TBN have returned impressive grades such 98 g/t PGE (52.8 g/t Pd, 41.5 g/t Pd, 3.9 g/t Au), 3.3% Ni and 11.6% Cu over 2.6 m during prior drilling.

“These grades reflect the very high metal tenor of the sulphides, which is the hallmark of the PGE-rich mineralization in the Nipigon Plate portion of the Mid-Continent Rift.” Weyrauch added.

Illustration of the Nipigon Plate portion of the Proterozoic Mid-Continent Rift showing the West Nipigon Lineament which connects the Disraeli, Seagull and TBN intrusions

With exploration drill permits in hand, the company plans to begin Disraeli drilling in February 2021, pending weather conditions.

Exploration in Finland

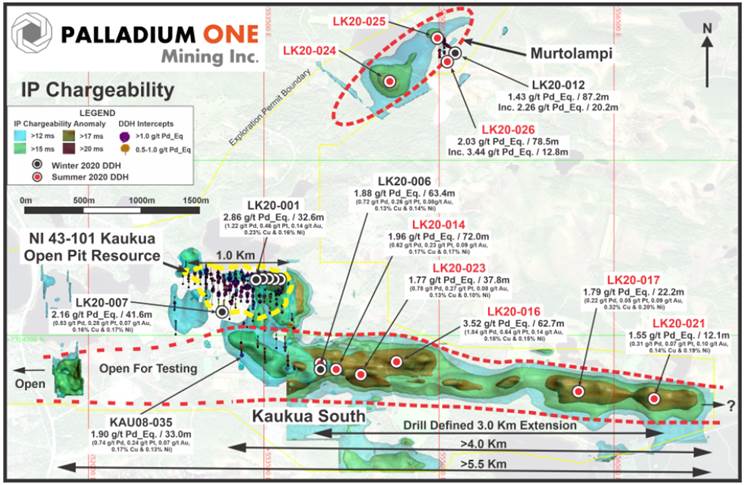

Elsewhere, Palladium One has also made progress at its flagship Läntinen Koillismaa (LK) project situated in north-central Finland.

Recent phase 2 drilling at the Murtolampi zone of the LK property intersected high-grade mineralization of 13 m at 3.4 g/t palladium equivalent (PdEq) within 79 m at 2.0 g/t PdEq (hole LK20-026), by far the best grade drilled in the area.

This figure shows the greater Kaukua area, the NI 43-101 compliant Kaukua open pit resource, Murtolampi and Kaukua South zones. Select resumed Phase I drill holes are labelled in red

This intersection is located 50 m southwest of hole LK20-012, which returned 20 m at 2.3 g/t PdEq within 87 m at 1.4 g/t PdEq during summer’s drilling. It is also located 550 m northeast of hole LK20-024, which returned a core interval of 3 m at 1.4 g/t PdEq within 21 m at 0.85 g/t PdEq.

Murtolampi Cross section showing hole LK20-012

The latest drill results suggest to the company that there is potential for a low-cost satellite open pit at Murtolampi, close to the existing Kaukua deposit located 2 km to the south.

The current 17,500 m diamond drill program also targets the Kaukua South zone. This is designed to support a future inferred resource estimate at Kaukua South, which possesses a drill defined, greater than 4 km mineralized strike length.

Approximately 2,500 m of drilling, targeting a 750 m long high-grade section, is scheduled to be completed by year-end.

With more results to follow, the company is moving closer and closer to adding open pit ounces and expanding the existing NI 43-101 resource.

Conclusion

With exploration drilling now progressing at multiple projects, Palladium One is bound to deliver more good news in the coming year.

Initial drill results from Tyko already look promising, and the growing shortage of the global nickel supply could only increase the project’s value. The Disraeli project has also shown potential for a major PGE discovery.

Investors have certainly taken notice of these projects’ upside. Shares of Palladium One have advanced nearly 50% over the past month as it began to resume work in Ontario.

The mining junior also received more than $5.6 million through the exercise of warrants held by shareholders including billionaire Eric Sprott, who upped his stake in the company from 13.3% to 20.7%.

This injection of cash will provide additional funds for Palladium One’s current exploration activities, and is a testament to the quality of those projects.

Palladium One

TSX.V:PDM, OTC:NKORF, Frankfurt:7N11

Cdn$0.20, 2020.12.08

Shares Outstanding 155,405,601m

Market cap Cdn$31.08m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of PDM and PDM is a paid advertiser on Richards site Ahead of the Herd

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.