Over-supplied lithium unlikely to happen to nickel

2019.11.13

An irrefutable truth right now is the global shift towards the electrification of the transportation system (cars, trucks, buses, trains) as governments, businesses and ordinary folk realize that reducing our carbon footprint is good for the planet, and us, involves moving from an oil-based economy to one grounded on electric vehicles and sources of energy that emit fewer to no greenhouse gas emissions.

At Ahead of the Herd we’re invested in commodities that ride this electrification trend. Among the metals we are most bullish on, are lithium, nickel and copper. All three are crucial to this global transportation shift, with lithium and nickel needed for the lithium-ion batteries found in electric vehicles, and copper utilized in other parts of an EV, like the electric motor and wiring. An electric vehicle contains four times as much copper as a fossil-fueled model.

We especially like battery metals and the companies that explore for them because they are expected to be in short supply, against increasingly higher demand, as the world moves away from fossil fuels towards clean energy and electrics.

During the first half of 2019 total plug-in vehicle deliveries reached 1.134 million units, 46% higher than the first half of 2018.

According to Bloomberg, EV sales are expected to increase 10-fold by 2025, 27X by 2030 and 50X by 2040. JP Morgan is forecasting electric cars to be 35% of the global auto market by 2025 and 48% by 2030.

Two of the tightest markets facing this wall of demand are lithium and nickel; lithium is obviously crucial due to its use in electric vehicle batteries, along with Li-ion batteries in small electronic devices, cell phones and power tools. There is no substitute for lithium and it is expected to remain the foundation of all lithium-ion EV battery chemistries for the foreseeable future.

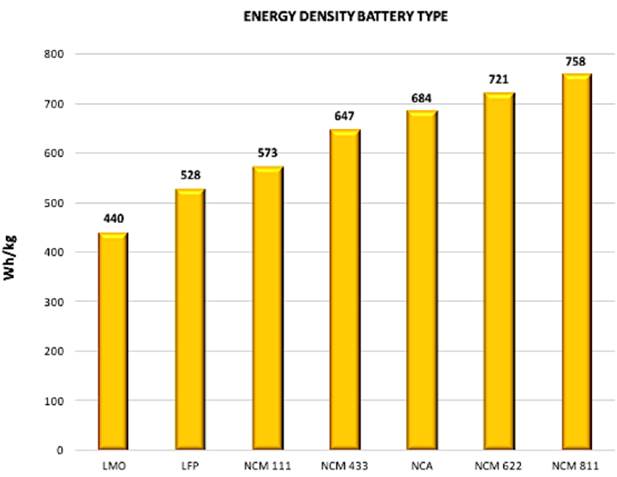

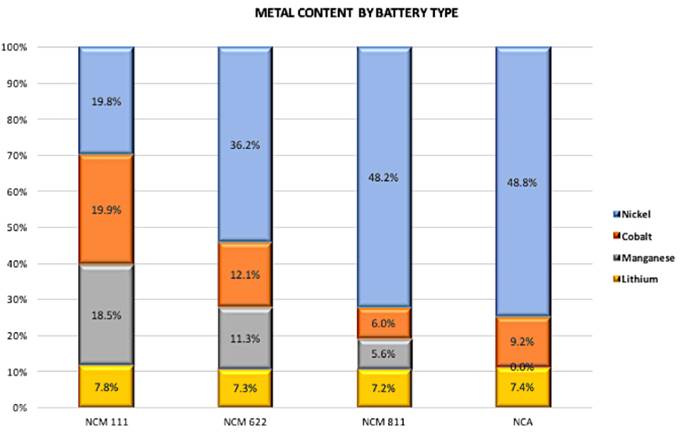

Nickel is becoming more and more important as a battery metal due to its use in nickel-cobalt-aluminum (NCA) and nickel-cobalt-manganese (NCM) Li-ion batteries. Battery companies and auto manufacturers are trying to develop batteries that contain more nickel and less cobalt, which is expensive and difficult to source, with nearly two-thirds mined in the DRC. NMC 811 battery cells (8 parts nickel, 1 part each lithium and cobalt) are being produced on a greater scale.

Lithium and nickel are interesting to watch because both face challenges in ramping up production to meet rising demand for them in EV batteries. Despite the lithium bull market of 2015-18, lithium brine producers failed to increase capacity by enough to meet demand.

The first responders to the lithium boom were in fact Australian hard-rock mines which had the capability to deliver the required tonnages.

These producers all started mining lithium like gangbusters to take advantage of bullish prices; the problem was, they over-delivered.

Currently the lithium market is over-supplied by Australian hard-rock lithium producers, most of whom sell their spodumene concentrate to China, for processing into lithium hydroxide; there is reduced Chinese demand for lithium, after Beijing cut EV subsidies that made electric vehicles more affordable.

Demand has also been dented by bottlenecks in Chinese chemical conversion facilities, that make lithium hydroxide from spodumene concentrate.

Benchmark says the price of spodumene concentrate containing 6% lithium fell 5% in October to between $480 and $550 a tonne, nearly half of the $900 per tonne it fetched in July, 2018. (Note however that South American lithium brine prices are still above US$10,000 per tonne for lithium carbonate).

Nickel faces no such glut. This past July LME nickel shot past $18,000 per tonne for the first time in five years, on account of nickel inventories in LME warehouses dropping to 150,000 tonnes. As we reported, this was a result of a massive drawdown in nickel inventories by China’s Tsingshan Group, the largest stainless-steel producer in the world. Tsingshan is heavily invested in Indonesian nickel and it appears to us that China is using Indonesia’s recently-imposed raw ore export ban to try and corner the nickel market.

Nickel prices are notoriously volatile, so we wanted to know, could the pendulum shift to over-supply just like happened in the lithium market when spodumene production overtook lithium brines and crashed lithium prices?

Spodumene ramp-up

To answer this question we first need an understanding of how the lithium market came to be oversupplied. Up until a few years ago there wasn’t much buyers’ competition for lithium, since it was a relatively small market that supplied lithium-ion batteries for electronics and power tools, mostly. At this time the world’s lithium was supplied by hard rock lithium mines.

Since the electric vehicle began to penetrate the internal combustion engine (ICE) car market, however, lithium has become the commodiy to stecure. Lithium brine operations in South America, mostly in Chile, along with a few in Argentina, vastly undercut prices and forced the hard rock mines (except the Greenbushes tantalum/tin/lithium mine in Australia) to close.

But there have been teething problems ramping up brine supplied lithium production to meet increased demand.

Between 2012 and 2016, major lithium brine miners planned to produce an extra 200,000 tonnes of new supply by 2016. But when 2016 rolled around, under 50,000 new tonnes came online, due to problems getting the lithium to market.

For various reasons, not least of which is the hesitancy of Chile, the top lithium producer, to allow foreign companies to increase quotas for what the country considers a strategic resource, South American brine producers couldn’t come up with the goods. Hard-rock pegmatite (spodumene) lithium miners, in Australia, thus seized the opportunity.

According to Benchmark Mineral Intelligence, by mid-2018, spodumene had overtaken brine as the leading source of chemical feedstock production. From just one spodumene mine in 2016 – Greenbushes in Australia – the number of active hard-rock mines grew to nine by 2018 year-end.

All the hard-rock lithium mines Down Under already know who their current and future customers will be. To know more read Aussie miners tapped out: who else is there?

In fact 100% of Australia’s lithium production is spoken for. Ganfeng Lithium – China’s top lithium producer – US-based Albemarle, the world’s largest lithium miner, and Tesla have grabbed Australian lithium supply, by signing offtake agreements with lithium mining companies producing in Australia.

In 2018 when spodumene prices hit $920/tonne, Australian lithium producers booked handsome profits, despite the higher capital and production costs of mining pegmatite rocks to produce a spodumene concentrate, versus brine operations. Many ramped up production to take advantage of high prices, creating a supply overhang.

Earlier this year, combined output at four new lithium operations in Australia totaled 175,000 tonnes, which is more than half the size of the ~300,000-tonne lithium market.

The resulting supply glut has turned some lithium bulls into bears. Click here to learn why they’re wrongConsider too, $10,000 per tonne is a heck of a lot better than $500/t. Lithium brine producers are receiving 20 times the price of a tonne of spodumene concentrate, for a tonne of lithium carbonate. Or $12,000/t if they can convert the carbonate to hydroxide.

Still, we all know the cure for low prices is low prices; as supply continues to hang over the market, we’ve seen the inevitable production cuts, unsurprisingly. It’s pretty tough to make a profit mining lithium @ $500 per tonne when your production costs are five times those of lithium brines.

Australia’s Mineral Resources (ASX:MIN) is pausing operations at its Wodgina lithium project, a joint venture with US-based Albemarle, due to “challenging lithium market conditions.” The prospect of a supply cut recently pushed battery materials equities higher, led by Pilbara Minerals which gained 23%.

Over the past four months about 200,000 tonnes of lithium carbonate equivalent (LCE) capacity has been yanked from the market.

An analyst at Canaccord Genuity says the lithium industry’s under-investment due to current market conditions may come back to bite them. Reg Spencer told Lithium Investing Newsthe industry needs to invest $30 billion in upstream capacity (mining) including funds from equities markets, to meet long-term demand. Last year the industry was valued at just $4 billion.

By 2025 Canaccord expects lithium demand to increase to almost 1 million tonnes per year which, in the absence of new supply, may indeed set the market up for another supply crunch, that last happened in 2017.

Nickel sulfate ramp-up

The nickel market is currently the opposite of lithium – under-supplied and likely to be so for the foreseeable future. That’s a problem because demand for nickel by battery manufacturers and EV auto-makers is not letting up despite some softness in Chinese auto sales.

Benchmark, May 2019

Tesla has expressed concernover whether there will be enough high-purity “Class 1” nickel needed for electric-vehicle batteries.

The reason is that nickel is being pulled from two completely different directions – stainless steel and battery-grade nickel sulfate.

Most of the world’s nickel production, about 70%, is used as an alloying agent in stainless steel. In 2007 when nickel prices ran past $50,000 a tonne, top stainless consumer China balked. Beijing discovered an alternative to pure nickel in the making of stainless steel, called nickel pig iron (NPI). The emergence of NPI revolutionized the nickel industry. The bulk of production shifted from the northern latitudes that host nickel sulfide deposits, to huge nickel laterite belts found around the equator – mostly in the Philippines and Indonesia.

As these countries cranked out NPI from nickel laterites, the price eventually toppled to $10,000 a tonne in 2016. That might have been an issue if the only demand for nickel was making nickel pig iron and ferronickel used in stainless steel. But the emergence of lithium-ion batteries containing nickel for EVs, took the industry in another direction.

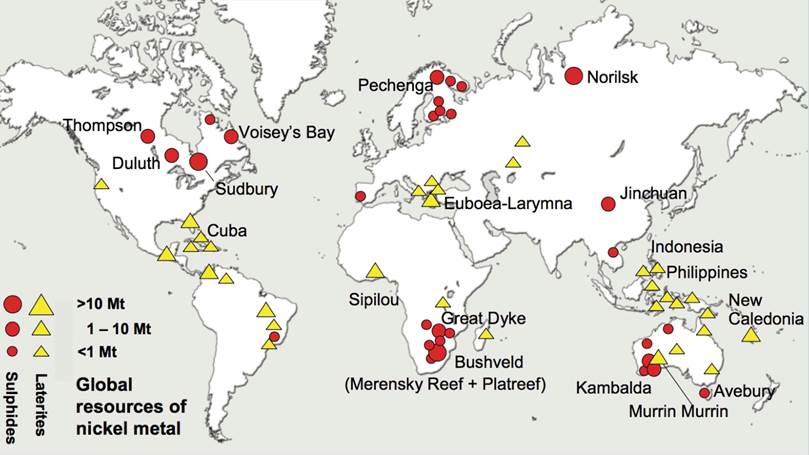

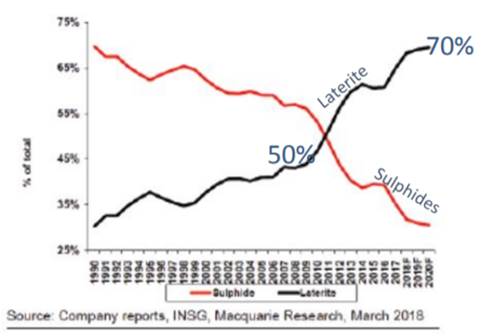

Nickel deposits come in two forms: sulfide or laterite. About 60% of the world’s known nickel resources are laterites. The remaining 40% are sulfide deposits.

Nickel Sulphide Deposits – the principal ore mineral is pentlandite (Fe,Ni)O(OH) – are formed from the precipitation of nickel minerals by hydrothermal fluids. These sulfide deposits are also called magmatic sulfide deposits. The main benefit to sulphide ores is that they can be concentrated using a simple physical separation technique called flotation. Most nickel sulfide deposits have traditionally been processed by concentration through a froth flotation process followed by pyrometallurgical extraction.

Nickel sulfide deposits provide ore for Class 1 nickel users which includes battery manufacturers.

Large-scale sulfide deposits are extremely rare. Historically, most nickel was produced from sulfide ores, including the giant (>10 million tonnes) Sudbury deposits in Ontario, Norilsk in Russia and the Bushveld Complex in South Africa, known for its platinum group elements (PGEs). However, existing sulfide mines are becoming depleted.

Nickel Laterite deposits – principal ore minerals are nickeliferous limonite (Fe,Ni)O(OH) and garnierite (a hydrous nickel silicate) – are formed from the weathering (nickel sulphides are converted to oxide ores) of ultramafic rocks and are usually operated as open pit mines. There is no simple separation technique for nickel laterites. The rock must be completely molten or dissolved to enable nickel extraction. As a result, laterite projects require large economies of scale at higher capital cost per unit of capacity to be viable. They are also generally much higher cash-cost producers than sulphide operations.

Roughly 60 percent of global available nickel is in laterite deposits – a deposit in which weathering of ultramafic rocks has taken place. The initial nickel content is strongly enriched in the course of lateritization – under tropical conditions fresh rock weathers very quickly. Some metals may be leached away by the weathering process but others, such as aluminum, iron and nickel can remain.

Typically nickel laterite deposits are very large tonnage, low-grade deposits located close to the surface. They tend to be tabular and flat covering many square kilometers. They are most often in the range of 20 million tonnes and upwards, with some examples approaching a billion tonnes of material.

Laterite deposits usually contain both an upper dark red limonite (higher in iron and lower in nickel, magnesium and silica) and lower bright green saprolite zone (higher nickel, magnesium and silica but lower iron content). Due to the different quantities of iron, magnesium and silica in each zone they must be processed differently to cost-effectively retrieve the nickel.

Laterite saprolite (higher nickel, magnesium and silica but lower iron content) orebodies are processed with standard pyrometallurgical technology.

However a laterite limonite zone is higher in iron and lower in nickel, magnesium and silica, which means using High Pressure Acid Leaching (HPAL) technology.

The trouble with HPAL

So, here’s the nickel industry’s dilemma: how to keep the traditional market intact, by producing enough NPI and ferronickel to satisfy existing stainless steel customers, in particular China, while at the same time mining enough nickel to surf the coming wave of EV battery demand?

The solution appears to be, mine the high-grade sulfide deposits (what’s left of them) and the laterites to produce nickel sulfate needed for EV batteries. That sounds good, but there’s another problem – the technology for producing battery-grade nickel from nickel laterite ores is – despite being available since the late 1950s – unreliable.

Laterite deposits usually contain both an upper dark red limonite (higher in iron and lower in nickel, magnesium and silica) and lower bright green saprolite zone (higher nickel, magnesium and silica but lower iron content). Due to the different quantities of iron, magnesium and silica in each zone, they must be processed differently to cost-effectively retrieve the nickel.

There is no simple separation technique for nickel laterites. As a result, laterite projects have high capital costs and therefore require large economies of scale to be viable.

Laterite saprolite (higher nickel, magnesium and silica but lower iron content) orebodies are processed with standard pyrometallurgical technology.

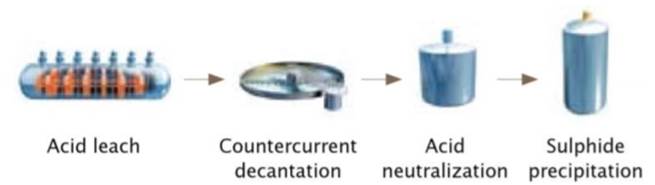

A laterite limonite zone that is higher in iron and lower in nickel, magnesium and silica, requires High Pressure Acid Leaching (HPAL) technology to extract the nickel, the Caron Process is no longer considered viable.

HPAL – whose performance record has been highly mixed – involves processing ore in a sulfuric acid leach at temperatures up to 270ºC and pressures up to 600 psi to extract the nickel and cobalt from the iron-rich ore; the pressure leaching is done in titanium-lined autoclaves.

Counter-current decantation is used to separate the solids and liquids. Separating and purifying the nickel/cobalt solution is done by solvent extraction and electrowinning.

The advantage of HPAL is its ability to process low-grade nickel laterite ores, to recover nickel and cobalt. However, HPAL is unable to process high-magnesium or saprolite ores, it has high maintenance costs due to the sulfuric acid (average 260-400 kg/t at existing operations), and it comes with the cost, environmental impact and hassle of disposing of the magnesium sulfate effluent waste.

Consider – High-grade nickel sulphide projects benefit from comparatively low costs while market prices are set by more expensive laterite producers.

Ni supply

Planned multi-billion-dollar investments by China in HPAL projects has left some industry players skeptical. Metal Bulletin quoteda panelist at Fastmarkets’ International Ferro-alloys Conference in Lisbon saying that projected timelines are likely to be pushed back and that costs will probably increase:

“[The Chinese are] looking to take advantage of the expected growth [in nickel demand for battery uses]. All of us are skeptical. It’s not impossible, but it’ll take a lot of work and a lot of money.”

However that hasn’t stopped a number of companies from planning new processing facilities in Indonesia to manufacture nickel sulfate; the government aims to make Indonesia a battery-manufacturing hub for the budding EV industry. It currently has 13 smelters and plans to build 25 more, having recently banned the export of raw nickel ores for processing in other countries.

Sumitomo says it will spend $1.7 billion to set up a nickel smelter designed for batteries, Tsingshan Group and partners have two battery nickel projects aimed to start production at the end of 2020, while Indonesia’s Harita Group of Indonesia and China’s Ningbo Lygend are planning another nickel battery plant.

Meanwhile in Western Australia, BHP is planning on producing nickel sulfate in the second quarter of 2020. The world’s biggest mining company currently produces around 75,000 tonnes of nickel metal at is Kwinana refinery near Perth, but these products, nickel powder and briquettes, are exported to chemical makers in Asia who refine them further into nickel sulfate.

The difference between BHP’s nickel sulfate refinery which would be the largest in the world (initially 100,000 tonnes a year), and HPAL projects planned for Indonesia, is BHP’s nickel concentrate is sourced from sulfide, not laterite ores, at BHP’s underground and open-pit nickel mines. The company currently sells about 75% of its nickel production to the battery industry. Let’s remember, this is not new battery material flooding into the market, just BHP cutting out the middlemen.

Ni demand

According to BloombergNEF, demand for Class 1 nickel is expected to out-run supply within five years, fueled by rising consumption by lithium-ion electric vehicle battery suppliers. But we don’t have to wait that long to see signs of tightening. This year, Sumitomo Metal Mining predicts the nickel market will be 51,000 tonnes in deficit. According to figures released by the World Bureau of Metal Statistics (WBMS) in early October apparent demand exceeded production by 77,100 tonnes.

It’s clear that nickel is facing some growing pains since the industrial metal was burnished by its new-found use in the transportation mode of the future.

According to Adamas Intelligence, which tracks battery metals, EV manufacturers deployed 57% more nickel in EV batteries this past May, versus May 2018. Nickel’s inroads are due mainly to an industry shift towards “NMC 811” batteries which require over 50 kg of nickel – eight times the other metals in the battery. (first-version NMC 111 batteries have one part each nickel, cobalt and manganese).

However, a lot of nickel will still need to be mined for stainless steel and other uses. Last year NPI represented almost half of global refined nickel output. It’s actually astounding to see how much, how quickly, nickel pig iron Indonesia was able to produce, launching it to the top of the nickel producers’ heap. According to Australia’s Macquarie Group, Indonesia’s NPI output climbed from near zero in 2014 to 261,000 tonnes in 2018. Most of that production has come from Chinese firms operating in Indonesia. Tsingshan, the biggest NPI producer in Indonesia, could add another 100,000 tonnes of NPI production next year, according to Reuters. By 2021, Indonesia’s NPI output is expected to surpass China’s, the number one producer.

Will annual world nickel production of around 2.3 million tonnes be enough to satisfy both stainless and battery demand? Less than half of total nickel output is Class 1, suitable for conversion into nickel sulfate used in battery manufacturing. Last year, only around 6% of nickel ended up in EV batteries; remember, 70% of supply goes into making stainless steel.

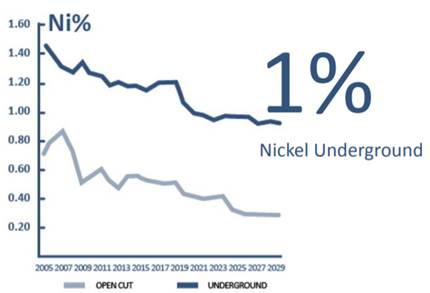

EXISTING NICKEL SULPHIDE MINE GRADES CONTINUE TO DECLINE

NICKEL SULPHIDE MINE PRODUCTION AS A % OF TOTAL NICKEL PRODUCTION WILL CONTINUE TO DECLINE

Class 1 nickel powder for sulfate production enjoys a large premium over LME prices ($2,000-$3,000/t) but for miners to switch to battery-grade material requires huge investments to upgrade refining and processing facilities. We’re talking in the hundreds of millions of dollars.

Conclusion

This article analyzed the current lithium and nickel markets to investigate the potential for a supply overhang developing in the nickel market, similar to what happened to lithium over the past year or so. The conclusion is that nickel is significantly less vulnerable to a price correction owing to over-supply than lithium. There are a couple of reasons for this. The first is that lithium only has one demand driver (the drug lithium is a small portion of the overall market): lithium-ion batteries. Any change to EV demand is going to have a large impact on prices. The long-term picture of lithium supply and demand is bullish, considering the exponential rise in electric vehicles, but short-term the market is vulnerable to being over-supplied. Both lithium brine and hard-rock lithium mining are well-established operations, meaning production can be easily scaled up in response to prices.

Nickel on the other hand used to be a one-demand-driver commodity (stainless steel), but the battery segment has emerged as a major new factor affecting demand. Most industry observers are expecting batteries to occupy a higher percentage of the nickel market. Research by Fastmarketsforecasts more than 500,000 tonnes of nickel to be used in lithium-ion batteries for electric vehicles by 2025, compared with 100,000 tonnes in 2018.

According to McKinsey, if there are 31 million EVs by 2025, demand for Class 1 high-purity nickel would increase 17X, from 33,000 tonnes in 2017 to 570,000t – “A shortfall in class 1 nickel production seems increasingly likely,” the consulting firm states.

Indeed at AOTH, we can’t think of a scenario that would result in a major nickel price correction, considering that stainless-steel demand is likely to continue apace, combined with ever-increasing requirements for nickel in NCA and NCM batteries, which are becoming the industry standard. And consider China is going to change all lithium battery production to these new high nickel use batteries.

It’s not easy to quickly ramp up Class 1 nickel production to get battery-grade nickel sulfate. High-grade nickel sulfide deposits are rare and nickel laterites are technically challenging to process. Also remember that Indonesia’s nickel ore export ban will keep a significant amount of nickel tonnage out of the global market and into China. Nickel prices should therefore remain supported for the foreseeable future.

Lithium and nickel are both commodities desperately needed for a North American sourced mine to battery to electric vehicle supply chain.

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.