Orestone planning to drill Francisca in Q3/Q4, Captain in Q1 2026 – Richard Mills

2025.07.31

Orestone Mining Corp (TSXV:ORS) has two of its three projects at the drill-ready stage: Captain in north-central British Columbia and Francisca in Salta province, Argentina.

Orestone’s property portfolio includes exposure to gold, silver and copper in Canada and Argentina. Its near-term objective on the Francisca property is to define an oxide gold deposit mineable by open-pit methods using low-cost heap leach gold recovery. The company’s 100%-owned Captain gold-copper project hosts a large, gold-dominant porphyry system that is permitted and ready to drill.

During the second quarter of 2025 Oresone completed a $600,000 capital raise through a non-brokered private placement and issued shares for debt in the amount of $180,000. The company welcomed a new strategic shareowner, Crescat Capital, which took down $400,000 of the $600K financing.

CEO David Hottman and his team are experienced mine developers. The bottom line for me is Orestone management has put numerous heap leach projects into production, and those companies went on to do very well. Their Francisca project is an effort to replicate that.

Team

In a recent interview, Hottman told me that management is aligned with shareholders in that they “have skin in the game”, i.e. shares. Orestone has low overhead, including drawing minimal salaries, and most of the money they raise goes into the ground — something I like to see in an exploration-stage junior. As Hottman says, and I agree, “wealth is created at the end of the drill bit.”

The team has deep mining experience.

Chairman and CEO David Hottman has 30+ years in corporate finance and management of resource companies. He was a founder of Nevada Pacific Gold, serving as chairman, CEO or president from 1997 to 2007. Nevada Pacific Gold proved to be a great success as an aggressive gold and silver production/exploration company focused on Nevada and Mexico prior to a $150 million takeover by McEwen Mining in 2007. Before starting Nevada Pacific, Hottman was a founding member of Eldorado Gold, focused on gold production/exploration assets in Mexico, Brazil, Argentina and Turkey. Prior to Eldorado Gold he worked with Bema Gold. Hottman has been actively involved in financing mining companies for several decades, securing over $300 million for acquisition, exploration, development and production companies.

Director and President Bruce Winfield has more than 40 years of experience in the industry as a geologist, corporate executive and consultant. Following 14 years with major mining companies Texasgulf and Boliden, he focused on exploration in Central America and Mexico as vice president, exploration for Greenstone Resources and Eldorado Gold, leading to the exploration and development of five gold deposits.

Gary Nordin, Director and Senior Consulting Geologist has a proven track record of identifying and developing mining projects. As a co-founding director and vice president of Bema Gold from 1982 to 1990, he successfully identified significant open-pit-type heap leach gold reserves in the United States and Chile, including the Refugio deposit (6-8 million oz). Subsequently, as a founding director, executive vice president and chief consulting geologist of Eldorado Gold from 1990 to 2000, Nordin participated in the discovery and development of several important gold deposits, including the La Colorada Mine in Mexico (1.0 million oz) and the Kisladag deposit (12.0 million oz) in Turkey. Nordin has served on the boards of several publicly listed exploration and mining companies, such as Nevada Pacific Gold before its takeover by US Gold.

Hottman notes that he and Nordin with Bema Gold were involved in putting a 100,000-ounce deposit into production at 20,000 oz a year. In Eldorado Gold they put a 200,000-oz deposit into production, also at 20,000 oz a year. Both Bema and Eldorado went on to attain great success, and multi billion-dollar market caps. Regarding Francisca, he said at 1-2 grams of gold per tonne, even at 30-40,000 oz a year, it could throw off a lot of cash at today’s gold prices.

Francisca

Orestone signed an option agreement covering the Francisca property during the first quarter of 2025. ORS is preparing to initiate a Phase I exploration program in the third quarter. The program will consist of detailed mapping and up to 600 rock and trench samples to better define the surface extent of widespread oxide gold-silver mineralization prior to drilling.

Orestone describes the geology and mineralization as follows:

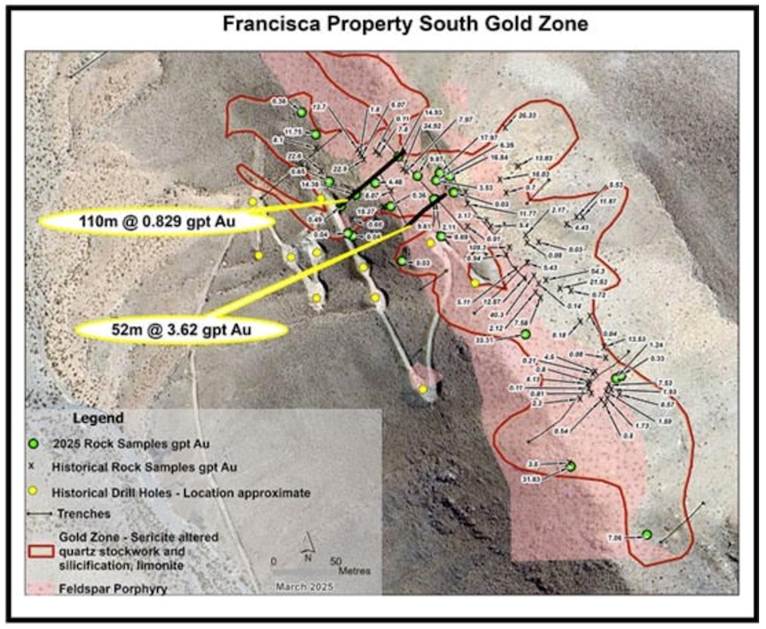

Geologic mapping has outlined an oxide gold stock-work mineralized trend along a northwest strike length of 1100 metres outcropping on the crest of a moderate relief hill. Two gold zones have been outlined to date within the trend. The surface expression of the North and South zones each measures 400 to 500 metres in strike length with widths varying from 50-100 metres. The zones are surrounded by a 500 to 1000 metre wide, area of strongly hornfels altered sediments and underlain by a large IP changeability anomaly indicating potential for a larger mineralized intrusive body at depth. The oxide gold quartz limonite stockwork trend is associated with quartz feldspar porphyry intrusive dykes and intense sericite alteration along NW trending faults.

Eighteen surface trenches at 50 to 100 metre spacings have initially outlined the zones with 11 trenches encountering significant gold and silver values.

My take on Francisca is its gold with a silver kicker. This is a pure precious metals play, and it is surface oxide, so the metallurgy is well known.

I took part in a small financing, bought shares on the open market, and the reason I like Francisca is because it looks like it could have some serious size to it. The management has been involved in the development of 10 or 12 of these oxide heap leach deposits, so I’m looking at this as a unicorn, which is basically a junior run by management that has built companies into cash flow; I think this is a project they can do that with.

Recently I had the chance to ask Quinton Hennigh, geologic and technical advisor to Crescat Capital, his opinion on Francisca.

Hennigh began by saying that Argentina is a country heading in the right direction for mining. While Salta province was previously off-limits to exploration, he believes it’s going to open up in a big way, noting that areas that have been locked up for awhile are the best places to go looking for the next great discoveries.

Hennigh says Francisca is a sizeable gold anomaly that is outcropping (positive relief), making it attractive for mining. There are trenches across the property that demonstrate decent grades, 1+ gram, even 3+ gram in one trench. Although there was some historical drilling it was misoriented and largely off-trend. He therefore thinks Francisca is an untested gold anomaly.

When I talked to David Hottman about Francisca, he said it represents a multi-million-ounce opportunity for an open-pit gold project.

The option agreement entitles Orestone to earn up to 85% ownership by incurring USD$4.2 million in exploration expenses over seven years.

He said they have porphyry dikes that are exposed to surface and there is a big IP anomaly that indicates that there is a larger target deeper, but basically, they are looking at open-pit gold and a heavy silver kicker.

Orestone’s near-term plans are to do more mapping and some resampling of the trenches. A recent check assay program revealed a lot of 4-6-gram material on surface, and they’ve planned where the first drill holes are going to be, but Hottman says they need to do a bit more confirmation before they start drilling.

The potential depth of the project is intriguing. Hottman told me that the region has high oxidation levels that run deep. Over at Taca Taca, a multi-billion-tonne copper-gold-molybdenum deposit, the oxidation runs down to 200-300 meters. Could the same thing occur at Francisca?

Hottman said if they drill 100 or 200-meter-long holes and encounter mineralization, it could indicate a large deposit that becomes a substantial driver of the market cap and share price.

Captain

Orestone has filed an amended Notice of Work (NOW) permit for an additional 23 drill locations at the Captain gold-copper porphyry property located in north-central British Columbia. The drill locations are on existing logging roads focused on the T2 target area which is a large target lying to the south of the primary T1 target along the same structural corridor. Drilling is anticipated in the first quarter of 2026.

Captain is sited 150 km north of Prince George in the prolific Quesnel Trough terrane, which hosts a number of copper-gold and copper-molybdenum porphyry deposits including the Mt. Milligan gold-copper deposit, 30 km north of Captain. The company currently controls 105 square kilometers in the politically safe jurisdiction of British Columbia. The area boasts year-round road access and excellent infrastructure.

Orestone says:

Exploration since 2019 has focused on locating the source of a high grade calc-alkaline potassium feldspar kspar-sericite monzonite porphyry inclusion in a post mineral dyke in drill hole C13-03. This intersection and re-logging of previous drill holes C12-03 and C19-03 confirmed the presence, to the east of a central magnetic high, of a large potassium feldspar kspar-sericite altered calc-alkaline porphyry system that is coincident with a magnetic low measuring 600m by 1300m.

Hottman said the main target does not get exposed at surface, it’s below the sand and gravel moraine left from the last Ice Age, so geophysics and drilling are the primary exploration methods.

Orestone has encountered porphyry dikes that are well-mineralized, in some cases over 100 to 200 meters.

But porphyries are difficult in the fact that there is such a halo of alteration. You do your surveys and your drilling but it’s a bit much to expect a center hit the first drill program. You really have to work at it to vector into those centers.

In Orestone’s case, Hottman said they have mineralization on three different sides and the 2022 MT survey indicated that the target is right in the center of them.

Over the winter, first quarter of 2026, the company plans to sink a couple of holes into the main target and a hole into the southern target down the center of them and see if they can make two significant discoveries at the same time, Hottman said.

Conclusion

At just 8 cents a share, and a 6.3 million market capitalization, as of Thursday’s close, Orestone is, in my opinion, undervalued.

I like both Captain and Francisca but Francisca in my view has the better short-term potential; the anomaly is exposed at surface making it much easier to explore and drill than if it was buried. Orestone is working with an oxide gold deposit mineable by open-pit methods using low-cost heap leach gold recovery. Its management team has been involved in the development of up to 12 of these heap-leach deposits

In exploration and mining, past success is usually an indicator of future success. This team has already had several wins for investors.

Francisca could be a company-maker for Orestone, and I can’t wait to see the drills start turning in Salta province, Argentina, which Hottman describes as one of the best provinces, if not the best in Argentina to work, with a good financial regime, good suppliers, permitting and government support, and positive social interaction.

Orestone Mining Corp.

TSXV:ORS

Cdn$0.08 2025.07.31

Shares Outstanding 61.6m

Market Cap Cdn$6.3m

ORS website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Orestone Mining Corp. (TSXV:ORS). ORS is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of ORS.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.