Opportunity knocking for North American lithium explorer – Richard Mills

2023.03.14

Global demand for lithium-ion batteries is expected to grow five-fold by 2030. In the United States, the demand is one magnitude higher, at 6X, and could translate to $55 billion by the end of the decade.

According to Benchmark Mineral Intelligence (BMI), to meet demand, the global lithium industry needs to invest up to $42 billion by the end of the decade. This works out to $7 billion each year from now until 2028, helping it to meet predicted demand of 2-4 million tonnes per annum by 2030, which is four times higher than the 600,000 tonnes of lithium that was expected to be produced in 2022.

Bloomberg notes the forecast, from a recent BMI report, comes as Europe and North America look to reduce their dependency on Chinese lithium imports and to try to develop their own lithium production.

The Biden administration has earmarked billions to help process key battery metals including lithium, while in Canada, 2022’s budget included CAD$3.8 billion to build a domestic critical metals supply chain.

Electric cars are expected to account for nearly 80% of EV market revenues and 83% of battery demand over the next two decades.

Annual spending on EVs reached $388 billion in 2022, up 53% from 2021, according to a new report published by BloombergNEF. The total value of electric vehicles sold to date in the passenger vehicle segment has now crossed $1 trillion. 2023 sales are likely to top $500 billion.

China’s lithium dominance

A graphic by Visual Capitalist used data from the International Energy Agency (IEA) to show that China is the largest producer of most of the world’s critical metals needed for the green revolution.

A mistake is often made in presuming that China mines a lot of these materials. In fact the country has relatively little, Lithium is one exception, more about that below, and instead, has developed sophisticated technology to process them. China’s share of refining is around 35% for nickel, 58% for lithium, 65% for cobalt and 85% for rare earths.

In 2022, China had had more battery production capacity than the rest of the world combined. The country’s well-established advantage is set to continue through 2027, with 69% of the world’s battery manufacturing capacity. (Visual Capitalist, Jan. 18, 2023)

China’s near-complete dominance of ‘green economy’ metals

US chemicals giant Albemarle recently said it expects China’s electric-vehicle market to grow 40% in 2023, or at least by 3 million vehicles, boosting lithium demand in the world’s largest automobile market.

Chinese lithium customers are not slowing orders, and the country’s stockpiles of battery parts and cathodes are decreasing.

EV sales in China have been driven by government subsidies, which ended on Jan. 1, but the deadline brought forward future demand.

A recent Bloomberg article reported that China’s efforts to ramp up lithium extraction could see it accounting for nearly a third of lithium supply by the middle of the decade. (China is the world’s second-largest producer of the battery metal behind Australia — USGS 2021 figures)

Swiss bank UBS AG expects Chinese-controlled mines, including projects in Africa, to raise output to 705,000 tons by 2025, from 194,000 tons in 2022. That would lift China’s share of the mineral critical to electric-vehicle batteries to 32% of global supply, from 24% last year, according to a note on Friday…

China’s needs are particularly acute because it’s home to the world’s biggest market for new energy vehicles.

The United States imports hundreds of millions of lithium-ion batteries each year, most of them from China. According to the UN Comtrade Database, via Statista, China accounted for the vast majority of U.S. battery imports last year, with a total trade value of $9.3 billion. South Korea and Japan are also popular sources with batteries worth $1.3 and $1.0 billion imported to the U.S. in 2022. The total import value of lithium-ion batteries nearly tripled since 2020, reaching $13.9 billion last year.

Running short

Despite the healthy trade in batteries, looming supply shortages of battery metals including lithium and graphite could derail the global transition to clean energy, according to Trafigura CEO Jeremy Weir.

Automakers could have problems increasing electric-vehicle output unless there is significant new investment in new supply, said Weir, head of the commodities trading house. He warns higher prices are needed to incentivize miners to bring new production online, and cautions that delayed permitting process could stymie new supply even if prices do move higher (Mining Weekly, March 9, 2023).

According to Bloomberg New Energy Finance, getting to “net zero” could require almost $10 trillion of metals between now and 2050.

Albemarle executives quoted by Reuters warned of the “potential for significant deficits” by the end of the decade without new mines and processing plants.

Fastmarkets previously forecast a small surplus in 2023 but this has been revised to a deficit because of increased battery demand and some expected supply disruptions. The introduction, in the United States, of the Investment Reduction Act, has resulted in Fastmarkets upgrading its forecast for battery electric vehicle (BEV) sales by 80% in 2023 and 107% in 2024.

Mine supply could increase by 35%, year on year, to 984,000 tonnes, mostly fueled by Australia and China, but Fastmarkets is predicting a 2023 deficit of about 14,000 tonnes lithium carbonate equivalent (LCE).

Reuters metals columnist Andy Home agrees that The world has been running short of lithium, with a surge of new supply failing to catch up with a still faster demand wave as the electric vehicle revolution accelerates.

Another problem with lithium supply, is that much of the supply growth comes from China’s lepidolite deposits. According to BMI, the resources at Jiangxi, the hub of China’s emerging lepidolite mining sector, “are lower grade than Australian spodumene and result in more carbon emissions and waste production.” One Chinese company was forced to suspend production last year after government testing of the Jinjiang River found it to be polluted.

Moving away from China

Supply problems in China present an opening for Canada and the United States to become leaders in the global battery metals supply chain.

The US mines and processes only 1% of the world’s lithium, according to the US Geological Survey. There is just one lithium mine in operation, Albemarle’s Silver Peak, which extracts lithium from brine outside of Tonopah, Nevada, outputting a paltry 5,000 tonnes of lithium carbonate a year.

However, we cannot rule out the United States as a major lithium producer; within its borders are 1 million tons of lithium reserves, ranking it among the top five countries in the world, according to the USGS. In the less certain resources category, the US has 12 million tons, including continental, geothermal and oilfield brines, claystones and pegmatites.

Canadian lithium

Canada doesn’t currently produce lithium, but hosts about 2.5% of the world’s lithium deposits. According to Natural Resources Canada, the country has an estimated 2.9 million tonnes of lithium resources, in the measured and indicated category. In a writeup on lithium, NrCan also notes the following, about two Canadian lithium operations:

- The North American Lithium mine in Québec, formerly the Québec Lithium mine, reached commercial production in early 2018 and shipped spodumene concentrate to refineries in China for processing into lithium carbonate. Prices of lithium products and spodumene concentrate fell sharply later that year when global spodumene capacity nearly doubled, primarily in Australia. North American Lithium suspended production in 2019, sought bankruptcy protection, and was acquired by Sayona Québec in 2021, a joint venture between Sayona Mining (Australia) and Piedmont Lithium (U.S.). The new owners plan to restart the North American Lithium mine, develop other mining projects in Quebec, and build a lithium hydroxide refinery.

- After several years of exploration and construction, Nemaska Lithium produced its first spodumene concentrate at the Whabouchi Mine in Quebec in early 2017. The company suspended production in 2019, and the mine was put on care and maintenance. After seeking bankruptcy protection, Nemaska was acquired by the Pallinghurst Group in partnership with the Government of Quebec and emerged from creditor protection in 2020. The company plans to restart the mine and build a lithium hydroxide refinery in Bécancour, Quebec.

With an abundance of battery metals and cheap hydroelectric power, particularly in British Columbia and Quebec, Canada is uniquely positioned to become an EV leader, from the mining and processing of metal ores, all the way down to the manufacture and assembly of electric and hybrid vehicles.

In December, 2022, the Canadian government and General Motors announced the opening of Canada’s first electric-vehicle manufacturing plant in Ingersoll, Ontario. The plant will make electrified delivery vans and is expected to manufacture 50,000 EVs by 2025.

The provincial and federal governments each invested CAD$259 million towards GM’s $2 billion plan for the Ingersoll plant and to overhaul its Oshawa, ON plant to make it EV-ready, Global news reported.

The next-door province of Quebec has also attracted EV investment. In March, 2021, Quebec-based Lion Electric announced it will build a battery pack manufacturing plant in its home province. The $185 million factory, funded by the Quebec and federal governments who each committed $50 million, will build lithium-ion battery packs capable of electrifying 14,000 medium and heavy-duty vehicles annually.

The latest EV investment into Canada is by Volkswagen. The German automaker has reportedly chosen Canada to build its first battery plant outside of Europe, with the site in St. Thomas, ON, to begin production in 2027.

According to Bloomberg, the decision is strategic:

VW is part of a wave of European companies looking to cash in on President Joe Biden’s climate law, which stipulates that 50% of the battery components of an EV must be made in North America to qualify for EV tax credits of as much as $7,500.

The carmaker in August signed an accord with Canada to cooperate on the supply chain for batteries with a focus on material such as lithium, nickel and cobalt.

Victory Battery Metals

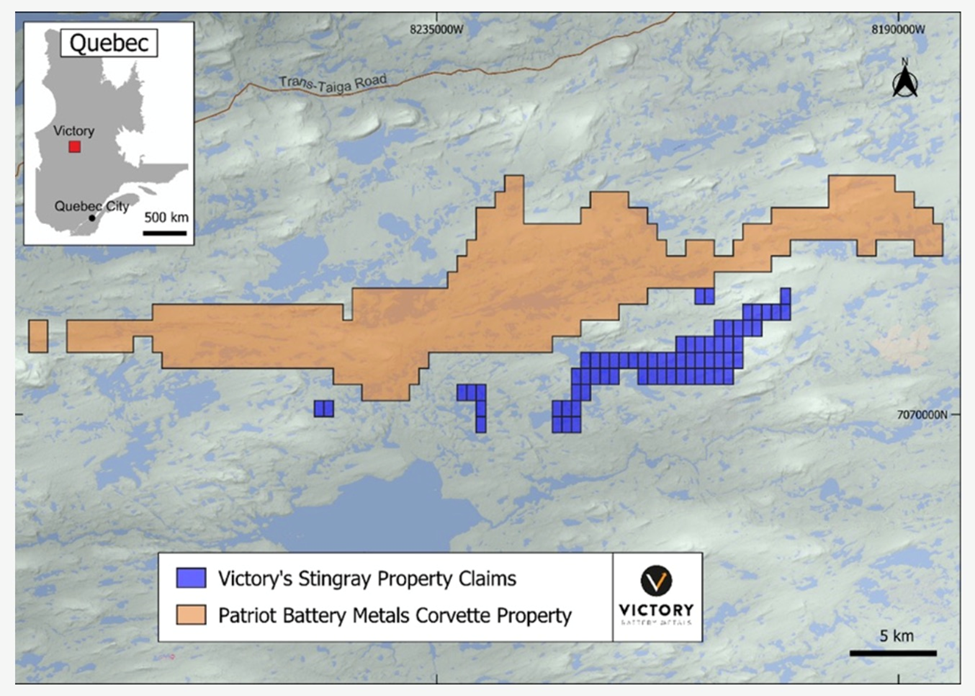

Canada- and Nevada-focused Victory Battery Metals (CSE:VR, FWB:VR61, OTC:VRCFF), formerly known as Victory Resources, in July, 2022, strengthened its lithium portfolio with the addition of two new properties in Quebec, that are adjacent to Patriot Battery Metals’ Corvette lithium discoveries.

The staked properties are known as Stingray I and II. Stingray I consists of four claims totaling 204 hectares extending directly from the south property line of the Corvette project, with Stingray II comprising 40 claims of 2,041 hectares situated south and southwest of Corvette.

The 44 claims were increased to 49, then to 66 last fall. In February, Victory announced a major expansion of the Stingray properties, acquiring 280 new claims and bringing its total claims in the area adjacent to Patriot’s Corvette to 347.

Victory says its holdings now represent a large ground position in an underexplored area within the emerging James Bay Lithium District.

Victory Battery Metals acquires 17,792 hectares in the James Bay Lithium District

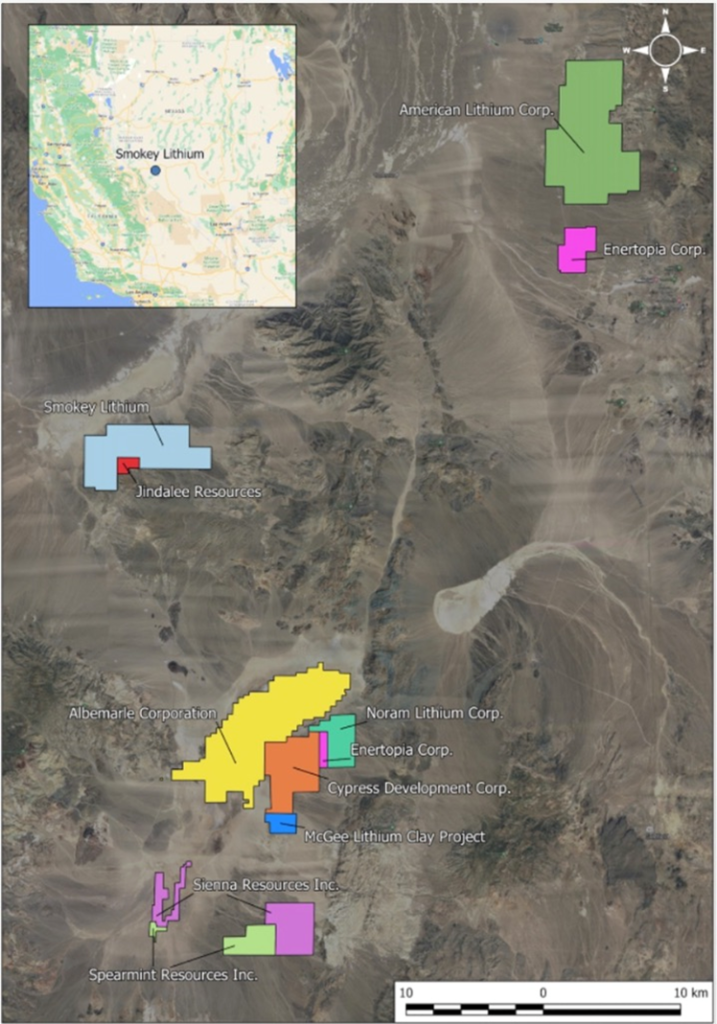

As Victory continues to advance Stingray in Quebec, its Smokey project in Nevada also holds tremendous potential.

The Smokey lithium property lies approximately 35 km north of Clayton Valley, NV, and 32 km west of American Lithium’s TLC project, within the Big Smokey Valley.

It is also in Esmeralda County, a prolific region for very large-tonnage lithium clay deposits, with grades up to and exceeding 900 ppm.

These include Noram Ventures (166Mt @ 900 ppm), Century Lithium (formerly Cypress Development, 593Mt @ 1,032 ppm), American Lithium (495Mt @ 1,000 ppm), Spearmint Resources, Enertopia and Jindalee Resources.

Victory completed a first round of drilling last year. In January, Victory announced it has filed a drill permit application, with newly identified hole locations in an area of interest contiguous with the southwestern part of the original claims block.

On Feb. 28, the companies announced the selection of drill hole locations, to extend strong lithium mineralization intersected previously in hole 9, which ended at 417 feet [127m].

This was followed on March 8 by the receipt of an amended drill permit. The company says The new drill targets are a perfect combination of step out drilling on previous a mineralized intersection along with grassroots targets of claystone sediments within the Weepah Detachment fault and underlying claystones of the Esmeralda Formation. The project area and surrounding lands show strong lithium mineralization with the Esmeralda Formation at surface. When combined with the highly encouraging results from Victory’s first round drilling (completed in 2022) the project area is highly prospective.

Conclusion

Flush with a $1.925 million private placement cash injection, Victory Battery Metals is in good shape to deliver on its 2023 field program.

Victory is exploring for lithium in two very prospective regions, the James Bay Lithium District of Quebec, and Nevada’s Esmeralda County.

The majority of the new Stingray claims lie along the same rock unit that was previously mapped by Patriot Battery Metals, containing lithium-bearing pegmatites up to 20 km in length with Li2O values as high as 1,280 ppm. The Stingray claim blocks range from adjacent to Corvette, to several kilometers away, and span over 65 km of east to west strike length.

The Smokey lithium property is in Esmeralda County, a prolific region for very large-tonnage lithium clay deposits, with grades up to and exceeding 900 ppm.

In this prolific lithium region, Victory’s Smokey project totals 350 claims covering 7,000 acres with excellent access and relatively flat ground.

The property shares similar geological settings to the Clayton Valley and the many exploration projects nearby. Outcropping clay on Jindalee’s property showed lithium grades as high as 930 ppm, possibly trending northwest onto Smokey.

Nascent battery supply chains in Canada and the United States will continue to grow. It was recently reported that global demand for lithium-ion batteries is expected to increase five-fold by 2030. In the United States, the demand is one magnitude higher, at 6X, and could translate to $55 billion by the end of the decade, Reuters said.

The electrification of the global transportation system doesn’t happen without lithium-ion batteries. Companies like Victory Battery Metals are well-placed to benefit from the global electrification and decarbonization trend.

Victory Battery Metals

(CSE:VR),FWB:VR61,OTC:VRCFF)

Cdn$0.08, 2023.03.13

Shares Outstanding 47.3m

Market cap Cdn$3.4m

VR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Victory Battery Metals (CSE:VR). VR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.