NV Gold swinging for the fences in Nevada

2019.06.03

Nothing excites the gold market like a high-grade discovery.

And one of the best places to look for high-grade is in Nevada, with its 160-year-old history of gold mining that dates back to the Comstock Lode discovery in 1859.

The United States’ primary gold producer has an impressive geological endowment. According to the US Geological Survey, if Nevada were a country, it would be among the world’s top four producers.

Nearly every rock type known to geologists is found within its desert geography, though silver and gold have been the most prevalent. The state owes its unique geology to the northern Great Basin which features a number of mountain ranges and valleys where the rocks below have been smashed together and pulled apart through tectonic activity dating back millions of years.

Most of Nevada’s gold deposits are found within three northwest-trending belts. The most famous is the Carlin Trend, where sedimentary, disseminated gold appears near surface, often surrounded by smaller deposits of similar geology. Estimated to contain up to 180 million ounces, the Carlin Trend is the second largest gold endowment behind South Africa’s Witwatersrand Basin. The three major players operating mines in the Carlin Trend are Newmont Mining, Barrick Gold and Kinross Gold. Barrick’s Goldstrike mine is one of the world’s most prolific. Between the Betze-Post open-pit mine and the Meikle and Rodeo underground mines, the Goldstrike mines have produced over 1.1 million ounces and have 8.1 million ounces of reserves.

Newmont’s Carlin operations have produced 944,000 ounces out of 15 million ounces in reserves. Kinross’s Bald Mountain mine, purchased from Barrick in 2016, outputted 130,144 gold-equivalent ounces, with 2.1Moz in reserves.

The other two trends, Battle Mountain-Eureka-Cortez (or just Cortez) and Walker Lane, also host some of the world’s most important gold mines, including SSR Mining’s Marigold mine in Humboldt County and McEwen Mining’s Gold Bar operation – the latter producing 482,815 ounces of gold between 1986 and 1995.

The three major trends feature Carlin-style mineralization, but Nevada also has epithermal, low-sulfidation gold deposits. While generally smaller than the large Carlin-type deposits, epithermal vein-type deposits, which are not unique to Nevada, are often high grade, making them excellent targets for gold exploration companies.

Interest in Nevada has increased significantly since Barrick Gold and Newmont Mining started discussing their expansion strategy in Nevada, and their recent partnership has really heated up the market for all properties in Nevada, specifically interest in drill programs to discover and develop new ounces for the larger-cap producers.

Junior gold investors sometimes overlook Nevada, thinking that all the precious metal has been found, not so. While the western state certainly has been well-explored and mined, there is still huge exploration potential remaining for multi-million ounce gold deposit discoveries.

NV Gold

NV Gold (TSX-V:NVX) plans to capitalize on under-explored gold properties in Nevada – and hopefully hit the jackpot for it’s shareholders.

The Vancouver-based company has:

- Control of a sprawling portfolio of 15 gold projects that are all within the three above-mentioned major gold trends in Nevada

- An exceptional, world class exploration team

- Two extensive geological databases, which serve as an information bank for identifying prospective, drill-worthy projects

Compiled in the 1970s and 80s by USMX, which explored Nevada and built a wealth of information, and AngloGold in the 1990s and 2000s, the databases facilitate a “Nevada 2.0” thinking about the multiple layers of opportunity that remain buried in Nevada. The goal is to systematically evaluate and execute focused exploration programs with two to three drill programs per year.

Projects pipeline

A number of properties within NV Gold’s portfolio are either drill-ready or continue to become more interesting as they are reviewed. They include ATV, SW Pipe, Seven Devils, Painted Hills and Richmond Summit, to name a few. Additional properties such as Queens, Long Island and Larus/Gold Cloud are also on the radar with information NVX continues to discover with its high-caliber team digging deep into their geological database to unearth quality exploration targets.

Nevada expertise

NV Gold features a three-man powerhouse of Nevada-experienced geologists.

The trio of rock hounds includes Quinton Hennigh, a PhD in geology, and CEO of Novo Resources (CNS:NVO), which is developing a conglomerate gold play in Western Australia. Many remember Hennigh as the chief geologist at Evolving Gold where he is credited with discovering the Rattlesnake Hills deposit and a gold find three miles north of ATV – one of NVX’s 14 projects.

Odin Christensen, PhD, is another long-time geologist with over 35 years industry experience under his belt. He was with Newmont Mining for 21 years. Between 1985 and 89, Christensen was exploration manager for Newmont and Carlin Gold Mining in northeastern Nevada until he retired as their head geo.

Marcus Johnston, a PhD in economic geology, joined the company in January as VP Exploration. Dr. Johnston brings more than 20 years of experience in exploration and mining, with an emphasis on mineral systems in Nevada. Over the last four years he has consulted to a number of private groups, including NV Gold. Before that he worked with Renaissance Gold, Victoria Gold in the Yukon, and Newmont. Johnston began his research on Carlin-type deposits in 1997, which led to the discovery of the Helen Zone near the old Cove open pit in north-central Nevada. It has a current resource of 713,000 ozs gold and 237,000 ozs silver.

He also revitalized the entire McCoy mining district, now owned by Premier Gold Mines. Dr. Johnston has evaluated over 500 properties in Nevada and played a key role in advancing numerous exploration projects and active mines.

Productive exploration strategy

NV Gold’s exploration team is critical in advancing what I think is a smart, productive, cash-conscious exploration strategy. A lot gold juniors hone in on a prospect and then spend the summer poking holes in the ground. Then the wait starts for results.

NV Gold is changing things up, they are going to conduct their summer activities a little different. The objective, as mentioned, is to drill two or three projects per year – they are focused on drilling the best targets, on each project, one after the other…bang bang bang.

This way, the most promising targets get drilled. Time and money isn’t being wasted. The “drill to thrill” strategy being employed by a trio of geologists with 125 years combined of Nevada project evaluation experience will undoubtedly separate the wheat from the chaff, so to speak, bulk up the information bank, and reward shareholders who can get in on the news flow.

“Our goal is to manage our capital so that at the end of summer, we still have a strong cash balance in our treasury, but we’ve created enough opportunity for our shareholders to have a potential win,” explained President Peter Ball, in an interview this week with Ahead of the Herd.

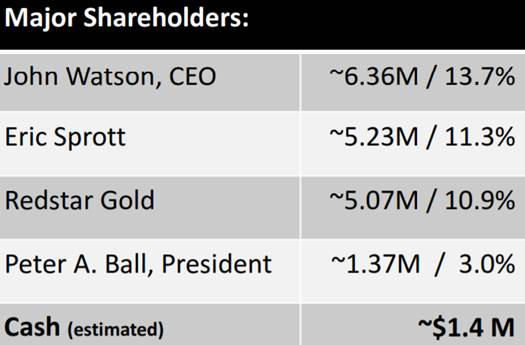

“It also giving us the strength to head into the fall with some capital to continue on,” Ball added. The company’s treasury is currently sitting at ~ Cdn$1.5 million. A $1 million plus oversubscribed private placement was completed at the end of March, whereby the board of directors and management purchased 27% of the shares.

In the next few weeks the NV Gold key trio of explorers/evaluators will be lacing up their cork boots, polishing their loupes and visiting two properties they anticipate being targets for drill programs, and one, Frazier Dome, they have already confirmed for drilling.

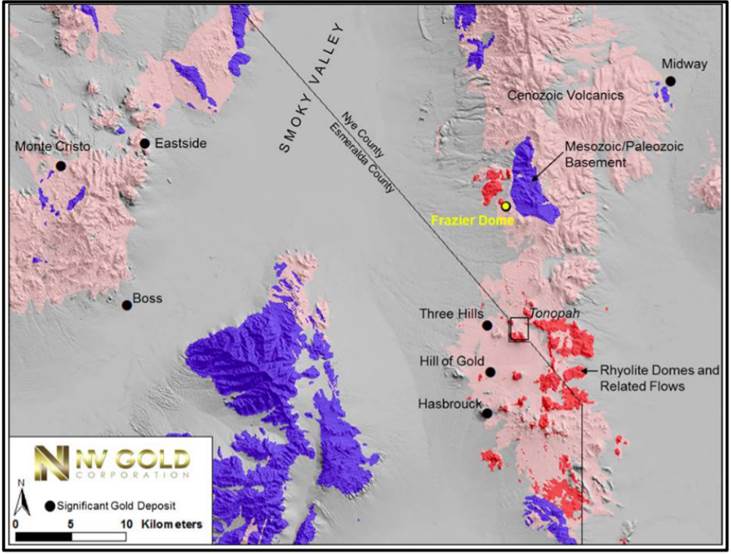

Frazier Dome

NV Gold has been evaluating the 1,195-hectare Frazier Dome property since it completed a relatively small drill program in the second half of 2018, which may have identified a potentially mineralized gold system at depth – something relatively unusual for Nevada, which has built a gold-mining reputation on a foundation of low-grade, high-tonnage mines, where disseminated (microscopic) gold is mined close to surface and heap-leached at reasonably low cost.

Frazier Dome is characterized as “a low-to intermediate-sulfidation, volcanic-hosted epithermal gold system with high-grade mineralization.”

That’s in line with two types of mineralization often seen around the Tonopah gold district:

- High-grade, intermediate-sulfidation silver-rich veins and

- Younger, low-sulfidation, gold-rich mineralization related to intrusive rhyolite domes, which have been the focus of West Kirkland Mining’s Hasbrouck, Hill of Gold and Three Hills mines to the south (total combined production of 1,063,000 ounces gold and 16,345,000 oz silver; and Allegiant Gold’s Eastside project 32 km to the west, which has shored up an inferred resource estimate of 654,000 ounces gold and 3.9 million ounces silver.

A rhyolite dome is a mound of rock containing rhyolite, a type of igneous rock formed when lava exudes from a volcano, creating a dome-like structure around the vent. The presence of a rhyolite dome at Frazier Dome is significant, because all of the other domes (cited above) around it have unearthed significant gold mineralization. Frazier is one of the last unexplored rhyolite domes in Tonopah.

In its 2019 exploration program, NV Gold plans to chase the anomalous gold found at surface, to depth. The idea is to try and find the source of the high-grade surface mineralization. The company will set up reverse-circulation drills and test the four targets it drilled last year, to a depth greater than 150 meters.

Here’s Peter Ball:

“There’s just too big of an alteration field, combined with multiple high grade samples sitting at surface that had to come from somewhere. We’re chasing high-grade mineralization not low-grade, and even though 0.4 to 0.6 g/t in Nevada is excellent, we’re looking for these 10+ grammers sitting beneath, which we test this summer to see what is beneath and feeding this intense alteration across Frazier.”

For more on Frazier Dome, read our NV Gold chasing high-grade Au in Nevada

Slumber

NV Gold published news on Thursday announcing a binding letter of intent to acquire a new gold property they are calling Slumber.

The project in the Jackson Mountains, located about 50 miles northwest of Winnemucca, Humboldt County, is approximately 21 miles west of the Sleeper bonanza epithermal vein gold deposit.

Slumber is one of several high-level epithermal gold systems on a trend that starts in the Jackson Mountains, runs through the Bilk Creek Mountains and continues north into Oregon. These deposits, along with the Sleeper, Sulphur-Hycroft, Goldbanks, Blue Mountain, Sandman, and other precious metals deposits located along fault-fracture zones of the Northern Nevada Rift, define an important epithermal province in northwestern Nevada.

The team is expected to be onsite within a couple of weeks to do preliminary exploration work and if all goes well, drills could wake up Slumber this summer.

Spoiler alert

We can’t say too much about the third target but Ball said the exploration team is doing their homework on another of NV Gold’s properties, that is expected to be readied for drilling this summer too.

“There’s a couple of really good targets, it’s got all the rocks, the right types of formation that our technical team (Quinton, Odin, Marcus, John) think there might be a chance. Its elephant country sitting out there at depth,” Ball said.

I’m sure the company will be happy to give us all the how, what, when, where of this latest drill target once their due diligence is concluded. Stay tuned.

Conclusion

At Ahead of the Herd, we love junior gold explorers and especially gold juniors that have a focused exploration strategy in place. We like the fact that NV Gold is being smart with how it sinks money into drilling, by hitting the best targets with drill holes that will act as a kind of smell test for going further.

We also love the exploration team that Ball and other NVX management have put in place. These guys have 125 years of combined experience in Nevada, and they have an incredible data set to help guide their claim-staking and exploration efforts. We feel very confident regarding this group and it’s upcoming Nevada efforts.

And we like NV Gold’s low share count – 46 million outstanding shares – of which management and insiders own >45%. NVX has quality shareholders like Eric Sprott, US Global Investors and Redstar Gold.

We have every reason to believe that NVX is going to have an excellent exploration season, with three projects in the drill pipeline including the very tantalizing Frazier Dome.

“We want people to know that news will be starting soon,” Peter Ball said. “We believe Frazier Dome has a high-grade epithermal target at depth. We are completing due diligence on two other projects for, and that the company is making the right decisions to manage their capital. Once news commences, and with good due diligence, luck may be on our side, and adding in a low share count and our technical teams reputation, I think we could have positive upside and good reaction in the market.”

That’s what I’m waiting for, and why I continue to have NVX on my radar screen.

NV Gold Corp

TSX-V:NVX, US:NVGLF

Cdn$0.16 May 31st

Shares Outstanding 46.4m

Market cap Cdn$7.42m

NVGold website

*****

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

NV Gold (TSX.V:NVX), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of NVX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.