NV Gold delivers 2 summer drill programs, planning a 3rd

2019.09.28

One of the worst things that can happen to a junior resource company is a failure to deliver. On drill results, grades, a financing, a technical report, getting the permits, meeting a production deadline, you name it. All of these are steps in the long walk towards the development of a mineral deposit into a mine that will churn cash for many years to come. Meeting or even better, surpassing objectives is the way junior resource companies de-risk their projects, providing a level of trust between company management and shareholders, that will hopefully attract the big boys – large institutional investors, financiers that will lend the junior the (usually) hundreds of millions of dollars required for mine-building, or major mining companies that, hungry for more metal to add to their coffers, are eager to purchase the property or the company, resulting in a big payday for stockholders.

Companies with greenfield projects are at the beginning eager for exposure. They want to stand out among the large crowd of juniors all competing for a limited pool of retail- and qualified-investor funds. And resource investors are fickle – many skip from one to another, buying on the dips, taking profits on a few cents gain, rarely sticking around to see the project advance beyond the first discovery hole.

Yet over-pumping a stock to gain the market’s attention can easily backfire. It’s important to keep expectations low, at least until the drills provide enough evidence to back up a geological theory. “Under-promise and over-deliver” is a good rule of thumb for early-stage exploration companies.

One of AOTH’s top gold picks this year is doing just that – setting goals and then hitting them, one by one, just like bowling pins knocked flying.

NV Gold (TSX-V:NVX, US:NVGLF) plans to capitalize on under-explored gold properties in Nevada, with:

- Control of a large portfolio of gold projects that are all within Nevada’s three major gold trends: Carlin, Cortez and Walker Lane.

- A world-class exploration team.

- Two extensive geological databases, which serve as an information bank for identifying prospective, drill-worthy projects.

Compiled in the 1970s and 80s by USMX, which explored Nevada and built a wealth of information, and AngloGold Ashanti in the 1990s and 2000s, the two databases facilitate a “Nevada 2.0” thinking about the multiple layers of opportunity that remain buried in Nevada. The goal is to systematically evaluate and execute focused exploration programs with two to three drill programs per year.

A number of properties within NV Gold’s portfolio are either drill-ready or continue to become more interesting as they are reviewed. They include SW Pipe, Seven Devils, Painted Hills and Richmond Summit, to name a few. Additional properties such as Queens, Long Island and Larus/Gold Cloud are also on the radar with information NVX continues to discover with its high-caliber team, digging deep into their geological databases to unearth quality exploration targets.

The trio of rock hounds includes Quinton Hennigh, a PhD in geology, and CEO of Novo Resources (CNS:NVO), which is developing a conglomerate gold play in Western Australia. Many remember Dr. Hennigh as the chief geologist at Evolving Gold where he is credited with discovering the Rattlesnake Hills deposit.

Odin Christensen, PhD, is another long-time geologist with over 35 years industry experience under his belt. He was with Newmont Mining for 21 years.

Marcus Johnston, a PhD in economic geology, joined the company in January as VP Exploration. Dr. Johnston brings more than 20 years of experience in exploration and mining, with an emphasis on mineral systems in Nevada.

NV Gold’s exploration team is critical in advancing what I think is a smart, productive, cash-conscious exploration strategy. A lot of gold juniors hone in on a prospect and then spend the summer poking holes in the ground. Then the wait starts for results.

NV Gold is changing things up. The objective, as mentioned, is to drill two or three projects per year – they are focused on drilling the best targets, on each project, one after the other…bang bang bang.

This way, the most promising targets get drilled. Time and money isn’t being wasted. The “drill to thrill” strategy being employed by the trio of geologists with 125 years combined of Nevada project evaluation experience will undoubtedly separate the wheat from the chaff, so to speak, bulk up the information bank, and reward shareholders who can get in on the news flow.

Before NV Gold could fire up the drills, they needed to put some money in the bank. In March 2019 the company announced the closure of a non-brokered, oversubscribed private placement totaling just over a million dollars ($1.06 million). About 27% of the units (one share plus half a warrant @ $0.12/sh) were purchased by management and board directors. It’s always good to know the management has skin in the game. Warrants can be exercised any time until Sept. 21, 2021, at $0.20/sh. NVX currently trades at 19.5 cents a share.

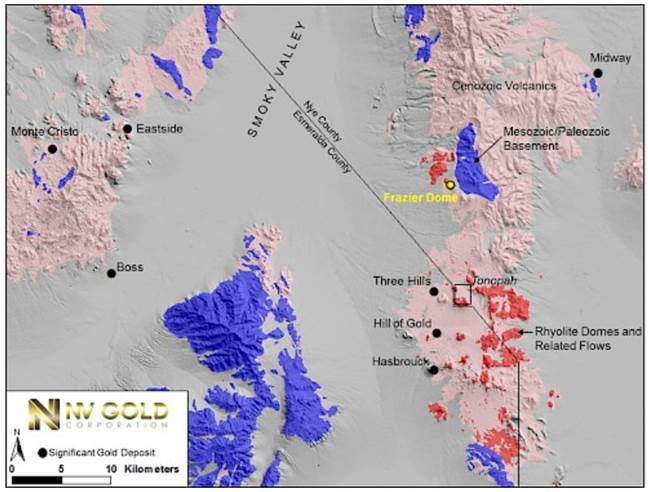

Frazier Dome

Next up, a doubling of the hectares at Frazier Dome, NV Gold’s flagship property, characterized as “a low-to intermediate-sulfidation, volcanic-hosted epithermal gold system with high-grade mineralization.”

That’s in line with two types of mineralization often seen around the Tonopah gold district, which contains multiple styles of volcanic-hosted epithermal gold mineralization similar to that at Frazier Dome, including:

- High-grade, intermediate-sulfidation silver-rich veins and

- Younger, low-sulfidation, gold-rich mineralization related to intrusive rhyolite domes, which have been the focus of West Kirkland Mining’s Hasbrouck, Hill of Gold and Three Hills mines to the south (total combined production of 1,063,000 ounces gold and 16,345,000 oz silver); and Allegiant Gold’s Eastside project 32 km to the west, which has shored up an inferred resource estimate of 654,000 ounces gold and 3.9 million ounces silver.

The question for President Peter Ball and NV Gold’s geologists is, what is the relationship between the high-grade, gold-silver anomalies found throughout the property, and the rhyolite dome that started off as a sort of slurry pipe, carrying mineralized fluids through the (extinct) volcano to surface, where the lava cooled to form a dome-like protrusion.

To gather more information about the project, a short 8-hole drill program (1,408m) was set up for three weeks in the fall of 2018. Nine targets were identified.

The most interesting thing about the 2018 drill program, which left five target areas left to test, is the possibility of “an interpreted model of a potential robust gold system at depth”. A strong indication is that 5 of the 9 widely-spaced holes delivered gold intersections greater than 0.10 g/t, and up to 1.035 g/t. In three of the holes, anomalous gold was found in every 1.5m section, all the way from surface to the bottom of the hole, to a depth of 150m.

“Our model is leading us to believe there may be a potential a high-grade system sitting at the base of the volcano, sub-150 meters, that developed into this halo of anomalous gold above. In layman’s terms, the anomalous gold made its way through the fractures all the way up from below where our holes ended in 2018,” Ball told Ahead of the Herd.

VP Exploration Marcus Johnston remarked on how the similarities between the Frazier rhyolite dome, to the rhyolite domes at the Eastside, Hasbrouck and Three Hills gold deposits, make the project highly prospective:

“The 8 reverse- circulation holes NVX drilled in 2018 all encountered significant runs of alteration and gold and silver mineralization. The lengths and widths of the mapped fracture/vein sets, combined with the long-runs of alteration and mineralization in drilling, and the shallow nature of the exposed system all point toward a potentially bonanza-grade deeper deposit(s), and the possibility of bulk-tonnage ore to be found on the property.”

Summer exploration at Frazier Dome was focused on one over-riding objective: go deep. The drill program started on Aug. 14, with assays pending. The idea is to try and find the source of the high-grade mineralization at surface. Here’s Peter Ball:

“There’s just too big of an alteration field, combined with multiple high grade samples sitting at surface that had to come from somewhere. We’re chasing high-grade mineralization not low-grade, and even though 0.4 to 0.6 g/t in Nevada is excellent, we’re looking for these 10+ grammers sitting beneath, which we test this summer to see what is beneath and feeding this intense alteration across Frazier.”

Slumber

If anyone knows how to multi-task, it’s NV Gold. As management was drawing up plans to drill Frazier Dome, they were also scanning their databases for something new to explore. On May 30 NVX announced the acquisition of a new property called Slumber.

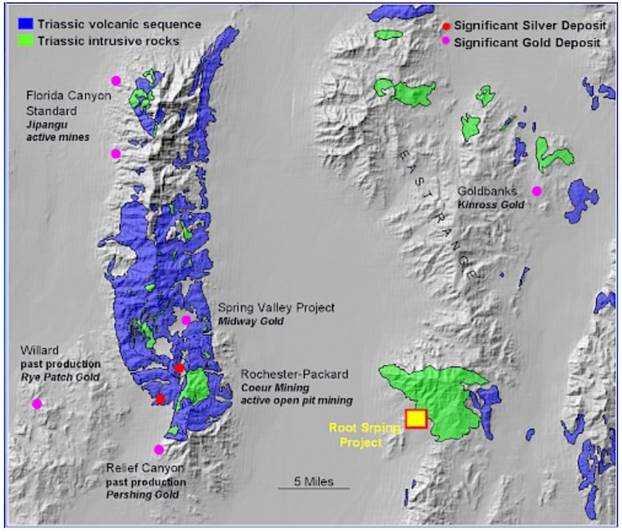

The Slumber project in the Jackson Mountains, about 80 km northwest of Winnemucca, Humboldt County, is approximately 33 km west of the Sleeper bonanza epithermal vein gold deposit.

Slumber is one of several high-level epithermal gold systems on a trend that starts in the Jackson Mountains, runs through the Bilk Creek Mountains and continues north into Oregon. These deposits, along with the Sleeper, Sulphur-Hycroft, Goldbanks, Blue Mountain, Sandman, and other precious metals deposits located along fault-fracture zones of the Northern Nevada Rift, define an important epithermal province in northwestern Nevada.

Of interest to the management team is a number of observed geological features, including:

- Hydrothermal alteration, principally in the form of silicification (imbued with the mineral silica), associated with widespread gold mineralization.

- Mineralized pieces of quartz vein float occurring in an alluvial-filled valley.

- Two or more gold-bearing zones exhibiting cross-cutting quartz veining, hydrothermal brecciation, and oxidized pyrite exposed through and surrounded by alluvium (gravel creek-bed).

Previous exploration at Slumber consisted of 15 shallow, reverse-circulation holes, drilled on and near silicified outcrops. Seven of the holes returned anomalous gold intercepts over thicknesses ranging from 1.5 to 32m. Rock chip samples collected from the outcrops held gold values up to a gram per tonne, plus elevated concentrations of silver, antimony and other gold pathfinder elements.

Seeing the potential for a drill program, NV Gold set about gravity and ground magnetics to assess structure and alteration that is obscured by widespread alluvial cover up to 100 meters thick.

The upshot of those surveys, released on July 18, was the discovery of a large, hidden gold structure, to be the target of NV Gold’s first drill program of 2019.

Two ground-based geophysical surveys covering a 4 sq. kilometer area “paint complementary images of the structure and nature of bedrock geology hidden at depth beneath the Slumber project area,” NV Gold stated in its news release.

According to NV Gold, the geophysical surveys identified a lens-shaped zone at the center of the target – further investigation will help to pinpoint areas likely to contain high-grade gold or silver mineralization. Also of interest are “hidden structural continuities, possible conduits for hydrothermal fluids, and a significant area of interpreted hydrothermal alteration.”

Between Aug. 22 and Sept. 24, NVX drilled seven holes at Slumber totaling 1,091 meters. Assay results are expected in October, but already we know that five of the holes hit “moderate to intense silification.” From the news release:

Quartz veining, locally accompanied by fine pyrite, was observed within some intervals of silicification. Holes were angled to test a prominent, NE-trending, silicified ridge. Alteration halos around zones of silicification include proximal white hydrothermal-clay alteration and distal green propylitic chlorite alteration, a characteristic of other low-sulfidation epithermal deposits in the region.

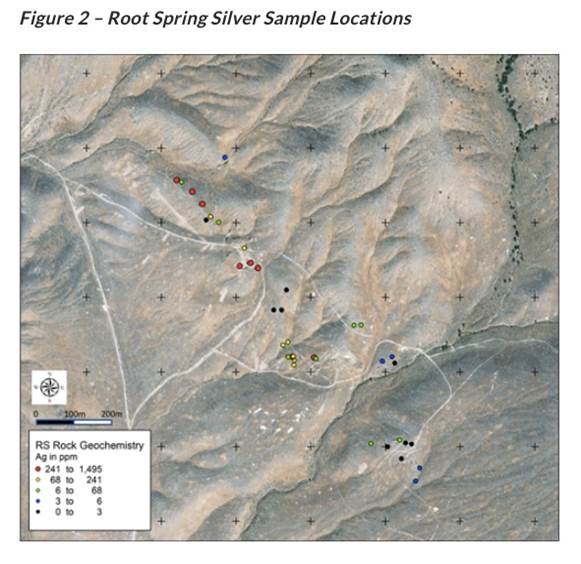

Root Spring

NV Gold’s Root Spring property lies 128 km south of Winnemuca, and 41 km east of Coeur Mining’s Rochester silver-gold mine. Gently dipping quartz veins and quartz-vein stockwork are exposed at surface along a northwest-trending strike, for at least 1.2 km.

Limited drilling in 2012 intersected down-dipping mineralized veins. The results included a 12.1m section of 14 grams per tonne silver and 0.1 g/t gold, 10.7m of 17.23 g/t silver and 0.15 g/t gold, and 9.4m of 16.4 g/t silver and 0.53 g/t gold.

NV Gold’s technical team conducted a mapping, sampling and drill targeting campaign to determine the geometry of the veins and whether there is any structure to the higher-grade gold and silver concentrations. Thirty-nine rock chip samples that were collected and sent for assay and geochemical analysis, returned a number of high-grade results:

- 28% of the samples contained silver assays of >150 g/t, and up to an eye-popping 1,495 g/t silver.

- 23% of samples contained between 1 g/t gold and 8 g/t gold.

- 41% of samples showed >0.5 g/t gold.

- Base metal appeared in concentrations up to 0.51% copper, 0.68% lead and 0.89% zinc.

As a result of its successful chip sampling program, NV Gold recently doubled its land position at Root Spring, and is in the final stages of permitting a drill program slated for October.

Sandy

If the summer wasn’t busy enough for NVX, the company had one more item on its to-do list – staking and acquiring the Sandy gold project. The first of many prospects contained in the USMX database, Sandy, located in Lyon County, shows alteration closely associated with iron oxides.

Originally explored in 1993-94, Sandy has seen geological mapping, chip and soil sampling, and 17 holes were drilled in the altered zones and vein systems.

According to Dr. Marcus Johnston, VP Exploration, the mineralization is consistent with other low-to-intermediate sulfidation deposits and historic mines, including the nearby Como gold-silver mine (1900-1940), the Hercules deposit which has a resource, and most exciting, the Comstock Lode – site of the first major silver discovery in the United States.

“These types of deposits are ideal for structural targeting, and we look forward to initiating our own mapping and sampling campaign this fall,” Dr. Johnston said in the news release, adding: “We are currently planning on building a better understanding of mineral deposits for the Sandy vicinity, and will look to assess additional information from our databases regarding the project and local area.”

Conclusion

If there’s one thing I love about a junior, it’s news flow. A steady stream of good news is what’s needed to set a precious metals exploration company apart from its peers, and to generate excitement in the market. As you can see from this article, NV Gold has it in spades.

An investor who bought NV Gold in early July at 12 cents and held on through some volatility to Aug. 23, would have doubled his/her money. The stock ran from $0.12 to $0.25, before retreating to its current Cdn$.20 cents. But it’s my opinion that NV Gold isn’t done yet. The assay results from Frazier Dome and Slumber are coming soon, and we still have Root Spring to drill and get assays from. Likely, with their portfolio of current properties, and their vast Nevada database, NVG will be able to JV several properties as well.

I must say I’m impressed with what has been highly systematic, well-executed summer exploration programs. AND the amount of news flow yet to come. For me NVX is a HOLD.

NV Gold Corp

TSX-V:NVX, Cdn$0.20 2019.09.26

US:NVGLF

Shares Outstanding 46,420,000m

Market cap Cdn$9.28m

NVX website

*****

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of NV Gold and NVX is an advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.