Norden Crown Metals: Summer exploration follows up on Broken Hill Type (BHT) discovery in Sweden

2021.08.27

Junior mining companies historically offer the best leverage to rising metals prices, meaning that juniors with quality deposits in mining-friendly jurisdictions are poised to benefit.

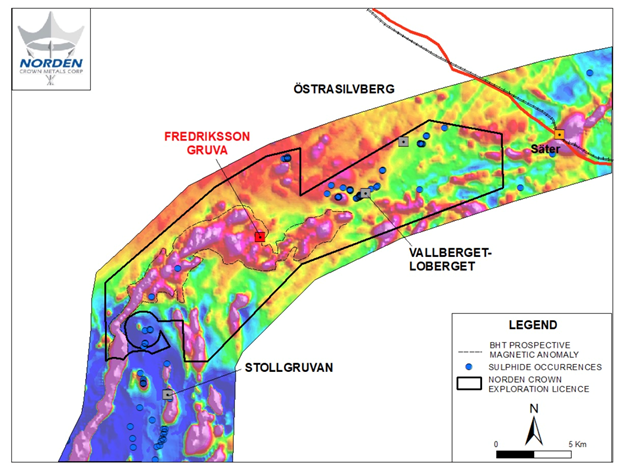

Norden Crown Metals (TSXV:NOCR, OTC:NOCRF, FSE:03E) is searching for high-grade silver and zinc deposits in Scandinavia. The Canadian firm earlier this year started drilling at Fredriksson Gruva, a past-producing zinc-lead-silver mine, as part of an 11-hole, 2,365-meter diamond drill program at its Gumsberg volcanogenic massive sulfide (VMS) property in southern Sweden.

The 18,300-hectare land package, with five exploration licenses, was mined from the 13th century through to the 1900s, with an astounding 30 historic mines on the property including Östra Silvberg — the largest silver mine in Sweden from 1250 to 1590.

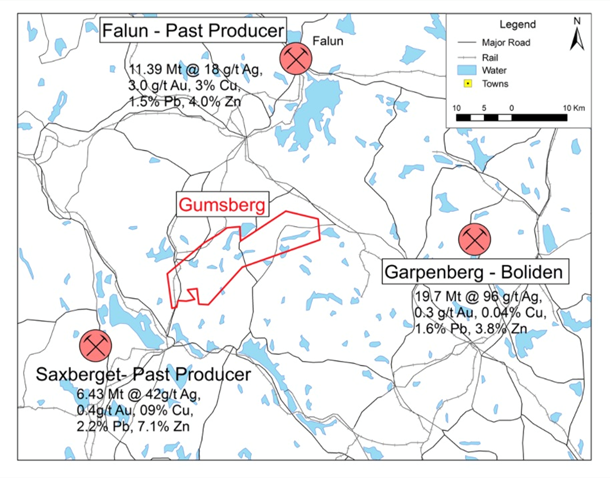

The project is located within the Bergslagen mining district, between the past-producing Falun and Saxberget mines, and the active Garpenberg (Boliden) and Zinkgruvan (Lundin) mines.

At the Fredriksson Gruva target, the idea behind 2021 drilling was to demonstrate that the mineralization continues below the old mine workings, which extend to 91m depth, and to confirm historical silver-zinc-lead grades, thicknesses and continuity. The evidence so far is proving this theory correct.

The three drill holes intersected wide and high-grade precious and base metals massive and semi-massive sulfide mineralization, in a geological setting unique to the Broken Hill Type (BHT) clan of silver-rich zinc-lead ore deposits.

BHT deposits

Broken Hill Types are some of the largest and highest-grade ore deposits in the world. They are distinguished from other silver-zinc-lead deposits by the chemistry of the sediment that hosts them, and they are usually associated spatially and temporally with volcanism.

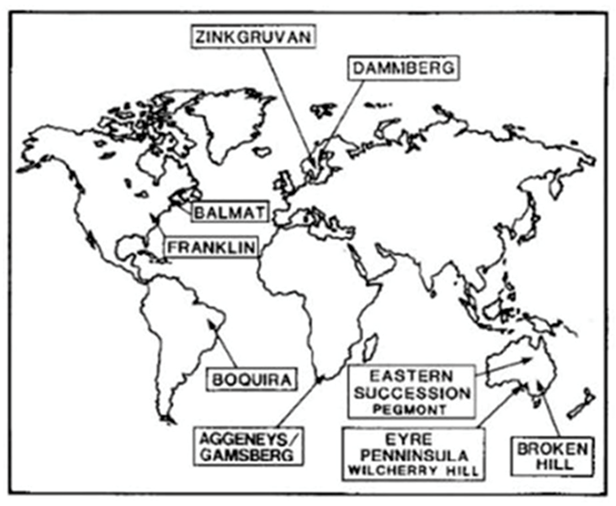

BHT deposits have been discovered in Australia — the Broken Hill mining property in New South Wales, a large silver-lead-zinc deposit from which BHT Billiton takes its name — South Africa, and parts of the Bergslagen mining district of southern Sweden, where Gumsberg is located.

There are two settings where mineralization in BHT deposits occurs: in calc-silicate rocks and in banded iron formations (BIF) (most Broken Hill Types contain both calc-silicates and BIF, but usually one is more prevalent than the other).

Examples of the calc-silicate type are the Broken Hill mine in Australia, Zinkgruvan in the Bergslagen mining district of Sweden, currently being mined by Lundin, and the Franklin zinc-iron-manganese deposit in New Jersey, USA.

Banded iron formations known to host Broken Hill Type mineralization include the Dammberg deposit in Sweden which is close to Norden Crown Metals’ Fredriksson Gruva target; Gamsberg and Aggeneys in South Africa, Pegmont at Mount Isa, Australia; and Boquira in Brazil.

In July, Norden Crown began surface exploration at Gumsberg, where the objective is to enhance existing drill targets through mapping, sampling and airborne geophysics.

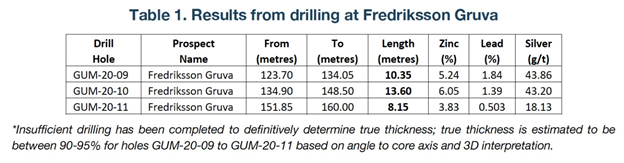

The three holes drilled earlier this year at Fredriksson Gruva delineated up to 13.60 meters of 6.05% zinc, 1.39% lead and 43.20 grams per tonne (g/t) silver, confirming the prospect’s potential for expansion.

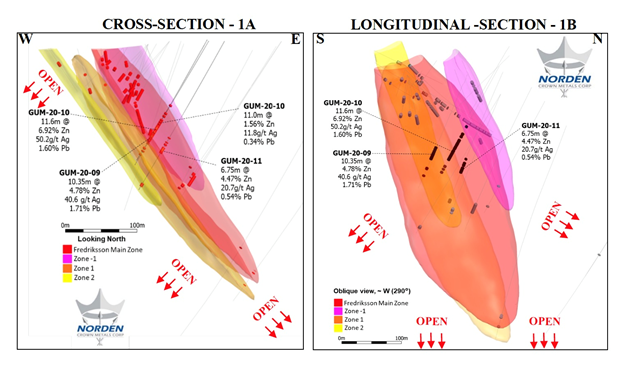

A cross-section (looking north 1A) and a longitudinal section (looking west 1B) showing the stacked silver-zinc-lead mineralization at Fredriksson Gruva and key intercepts from Norden Crown’s initial drilling in March (see NOCR news release dated March 1, 2021).

“Surface exploration work at Gumsberg will focus on expanding the current footprint of silver-rich base metals mineralization at Fredriksson Gruva,” said Norden Crown’s President and CEO Patricio Varas, in the July 26 news release. “Broken Hill Type deposits have the potential to yield large tonnages from comparatively small drill footprints due to the high density of the mineralization, so we are conducting detailed geological mapping and tightly spaced airborne magnetic geophysics to delineate mineralization in advance of additional diamond drilling.”

The high-resolution airborne (UAV) magnetic geophysical survey will be used to trace mineralization at subsurface, while surface and subsurface mapping efforts are expected to increase the confidence of drill targets, and provide insight into the size potential at Fredriksson Gruva.

According to the company, magnetic geophysical data sourced from the Geological Survey of Sweden suggests that the prospective magnetic anomaly (and coincident magnetite-bearing iron formation) extends over 21 kilometres across the Gumsberg West Licence (southwest of Fredriksson Gruva) greatly enhancing the exploration potential for additional BHT discoveries.

Metals update

Norden Crown is exploring its Gumsberg VMS property, and Fredriksson Gruva prospect within it, at a very good time for the metals contained within the deposit.

Many are pointing to the formation of a new super-cycle, driven not by fossil fuels and the rise of China, such as occurred in the 2000s, but by so-called “green” metals needed to electrify and decarbonize, to avoid the worst effects of climate change.

Zinc

Primarily used to coat and protect steel from corrosion, zinc is unquestionably a staple in a nation’s infrastructure buildout. What also makes zinc a critical commodity is the metal’s fundamental role in building a green energy future.

Like copper and nickel, zinc has clean energy applications. It can be used as anode material for batteries, making it a key part of energy storage systems as we move towards a world of renewables. Recent research also shows batteries built around zinc can be a cheaper, safer, and more effective alternative to the lithium-ion battery systems commonly used in electronics and electric vehicles today. This finding could potentially alter the landscape of the global energy storage market.

Given the current rate of consumption, it is projected that global zinc reserves — estimated by the US Geological Survey at 250 million tonnes — will only last another 17 years. The zinc market has reached a critical stage when more mines are needed. But even if all the development projects come online at full capacity, industry experts think that won’t be enough to outpace demand.

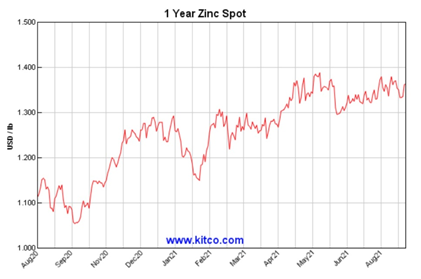

Zinc prices may have softened after hitting a 3-year high in May, but the outlook for the second half shows significant improvement, as demand outstrips supply, according to the International Lead and Zinc Study Group (ILZSG).

The ILZSG says zinc usage in Europe could rise 6.9%, and 15% in Japan, in line with the global economic recovery. Demand for the metal used to galvanize steel is also likely to increase in India, South Korea, Taiwan, Turkey and the US.

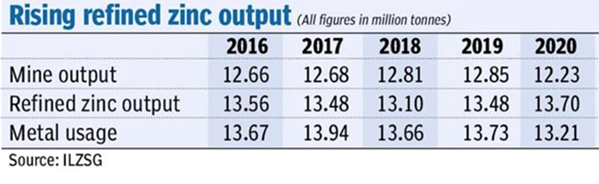

The ILZSG therefore forecasts demand for refined zinc to climb by 4.3% this year, against only a 3.1% increase in refined zinc output.

The greater penetration of solar power in global energy markets is expected to provide a tailwind for zinc demand going forward. A new report from commodities consultancy Wood Mackenzie predicts the usage of aluminum, copper and zinc in solar power systems is expected to double by 2040, prompting an increase in demand for all three metals.

In a typical solar panel installation, aluminum is required for the front frame and zinc-containing galvanized steel for structural parts. Copper is used in high and low voltage transmission cables and thermal solar collectors.

According to the Scotland-based firm, reductions in solar power installation costs due to falling production costs and efficiency gains are likely to prompt a rise in solar’s share of power, which may start to displace other forms of generation, presenting an opportunity for base metals.

Right now solar panel installations consume about 400,000 tonnes of zinc, but Wood Mackenzie projects a doubling to 800,000t in the base case climate change scenario, referring to an increase of 2.8 to 3 degrees C.

In 2020, refined zinc supply of 13.70 million tonnes exceeded metal usage of 13.21Mt, as the table below show.

This year, the zinc study group expects there will be another zinc surplus, but it will be smaller than last year, at 353,000 tonnes versus 488,000 tonnes.

The shrinking surplus is due to power shortages in China’s Yunnan province, where industries are being asked to cap their power loads or stagger power usage.

Cuts to power consumption in Inner Mongolia could lower mined zinc supply by 5,000 tonnes, and 6,500t of refined zinc.

China is by far the largest zinc producer, its mines outputting 4.2 million tonnes in 2020, out of a global total of 12Mt.

In sum, the group predicts global zinc prices will firmly remain over $2,750 per tonne ($1.24/pound) for the rest of the year, on the declining surplus, supply disruptions including smelting operations, and recovery in the world economy, particularly China, where the government is investing heavily in infrastructure programs requiring raw and finished metal products including galvanized steel containing zinc.

Silver

Analysts at Capital Economics think silver prices should gain momentum on the back of ongoing fiscal stimulus in China, and greater industrial activity which drives around half of annual silver consumption. They point out the latter will be helped by governments investing in green energy, including solar panels which contain silver paste.

The solar power industry currently accounts for 13% of silver’s industrial demand.

5G technology is set to become another big new driver of silver demand.

The Silver Institute (SI) expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

A third major industrial demand driver for silver is the automotive industry. While copper and battery metals are usually thought of as the main beneficiaries of electrification, it appears the white metal will get swept up in the EV growth story. SI anticipates that, due to the evolution of hybrid and battery electric vehicles, the auto industry is expected to absorb 90 million ounces of silver by 2025, rivaling silver consumption in photovoltaics, currently the largest application of global industrial silver demand.

According to the 2021 World Silver Survey, global demand for silver this year is expected to outpace supply by 7% (+ 8% supply vs +15% demand). Demand will be led by investments in industrial and investment-grade physical silver, as a result of economic recovery from the pandemic, as well as healthy coin and bar purchases building on 2020’s gains.

Conclusion

The presence of BHT mineralization hosted in banded iron formations could be an important characteristic at Fredriksson Gruva to trace and find deposits with the potential for scale — something a junior like Norden Crown Metals must be able to demonstrate to a prospective acquirer. It’s encouraging that another banded iron formation, the Dammberg Zn-Pb-Fe sulfide deposit, is in close proximity to Fredriksson.

I’m convinced that being part of the BHT pedigree will be of interest to a major or mid-tier miner, so it will be exciting to see them continue to characterize it and delineate it, hopefully to scale, as exploration there continues.

The team Norden Crown has put together speaks volumes regarding the company’s ability to drive the project forward.

CEO Pat Varas been working in mining for 30+ years. He was a founder of Western Potash, raising over $240 million, and was instrumental in the discovery of the Santo Domingo Sur copper-iron-gold deposit in Chile, now being developed by Capstone Mining. Varas was also the project manager during discovery at Diavik, a diamond mine operated by Rio Tinto in the Canadian Northwest Territories.

Director Eric Jensen has over 20 years experience as a mine-site and grassroots exploration geologist.

Dan MacNeil, Vice President of Exploration, is a precious and base metals specialist with over 19 years of experience with continental-scale project generation to in-mine resource expansion, in a wide variety of geological settings throughout the Americas and Eastern Europe.

Norden Crown has also brought in former Boliden Metals management which is very unique for an exploration company. Thomas Söderqvist, Director, and Rodney Allen, Technical Advisor, were both senior management at the largest mining company in the region.

Cashed up from a 30-cent financing that raised $2.5 million, Norden Crown has a healthy treasury with which to advance its Scandinavian properties. Along with field work at Gumsberg/ Fredriksson, NOCR has also deployed manpower to Burfjord, a copper-gold property in Norway it is developing in partnership with regional miner Boliden. Activities will include mapping, prospecting, sampling, airborne geophysics and a 2,500m drill program. Between the two projects, I’m looking forward to some very interesting results from Norden Crown this fall.

Norden Crown Metals

TSXV:NOCR, OTC:BORMF, Frankfurt:03E

Cdn$0.25 2021.08.26

Shares Outstanding 53m

Market cap Cdn$13.2m

NOCR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Norden Crown Metals (TSX.V:NOCR). NOCR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.