Norden Crown kicks off 3-5,000m drill program at Burfjord, Norway

2022.07.08

Based in North Vancouver with an office in Sweden, Norden Crown Metals (TSXV:NOCR, OTC:BORMF, Frankfurt:03E) currently has two projects on the go: Gumsberg in Sweden and Burfjord (pronounced “burf yord”) in northern Norway.

The company in February announced a significant exploration initiative at Burfjord (budgeted @ $1.9 million) nearly two years after Norden Crown partnered with major Scandinavian mining company Boliden, to advance the Iron Oxide Copper Gold (IOCG) property.

Norden Crown followed that up in April with the results of 12 completed drill holes done at Burfjord during a 2021 winter program. Highlights included 12 meters of 1.26% Cu (more on that below).

This week, the company announced the start of an extensive (3,000 to 5,000m) drill program in partnership with Boliden Metals. A variety of anomalous geological, geochemical, and geophysical targets have been identified, that potentially host economic copper-gold mineralization. The primary objective of the drill program is to evaluate the copper-gold grades and test the continuity of newly established targets within an area of extensive historical mining and trenching. Stratigraphic drill holes are also planned to supplement targeting and expand prospectivity along the axis of the Burfjord anticline. Anticline is a geological term for an arch-shaped fold.

Norden Crown-Boliden JV

Under terms of the mid-2020 joint venture agreement, Boliden, a base and precious metals miner with six active mines in Europe and five smelters across Norway, Sweden and Finland, will have the opportunity to earn a 51% stake (Norden Crown would be the operator) in the project by spending US$6 million in exploration over four years.

If that happens, the companies will form a joint venture, and Boliden will get a crack at earning another 29% by funding and delivering an NI 43-101-compliant feasibility study, pushing its ownership to 80%; Norden Crown would retain a 20% stake.

Burfjord project

Burfjord is located 32 km west of the Kåfjord copper mines, the first major industrial enterprise north of the Arctic Circle. The road-accessible project is 40 km from Alta, where there is a regional airport, and 7.5 km from tidewater.

The property is comprised of six exploration licenses totaling 5,500 hectares. Mineralization at Burfjord belongs to the Iron Oxide Copper Gold (IOCG) deposit clan; this portion of northern Fennoscandia is a key IOCG province globally.

IOCG deposits are among the most valuable concentrations of copper, gold, and uranium ores. These orebodies, ranging from around 10 million tonnes of contained ore to 4 billion tonnes or more, have grades of 0.2 to 5% copper, and gold from 0.1 to >3 grams per tonne. Their tremendous size, relatively high grades and simple metallurgy give IOCG deposits the potential for making extremely profitable mines.

High-profile examples include BHP’s Olympic Dam complex in Australia, and the Candelaria undeveloped copper-gold deposit in Chile.

Copper was mined in the Burfjord area during the 19th century, with over 30 historical mines and prospects developed along the flanks of a prominent 4 x 6-kilometer anticline.

Many of the rocks in the anticline are intensely hydrothermally altered and contain sulfide mineralization. High-grade copper-gold veins that were historically mined at cut-off grades of 3-5% copper, are surrounded by envelopes of stockwork veins or disseminations of copper mineralization extending tens to hundreds of meters into the host rocks.

The company believes this mineralization has economic potential and represents an attractive bulk-tonnage drill target.

Copper-bearing veins are dominated by ferroan carbonate, sodium-rich minerals, and iron-oxide minerals (magnetite and hematite), but also contain the economically important minerals chalcopyrite, bornite and chalcocite, in addition to cobalt-rich pyrite as generally coarse-grained (often 0.5 centimeter to multi-cm scale) disseminations in the veins.

A key point: only limited exploration has taken place in the modern era. The best intercept from historical drilling was 7m of 3.6% Cu at the Cedarsgruvan prospect in the northern portion of the claim block.

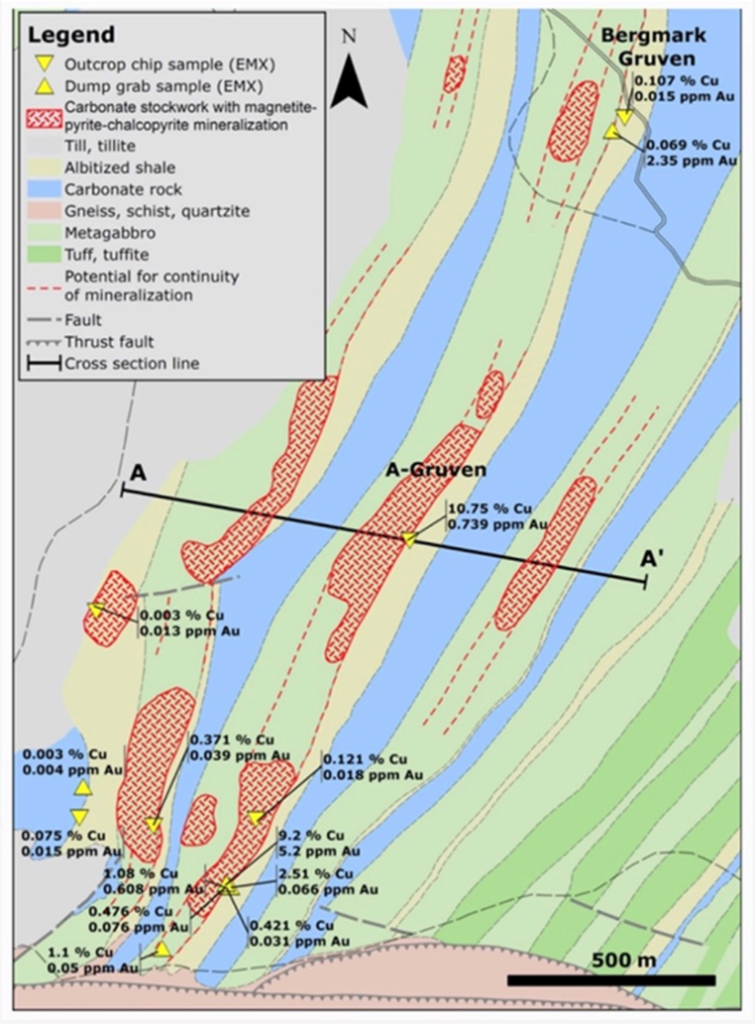

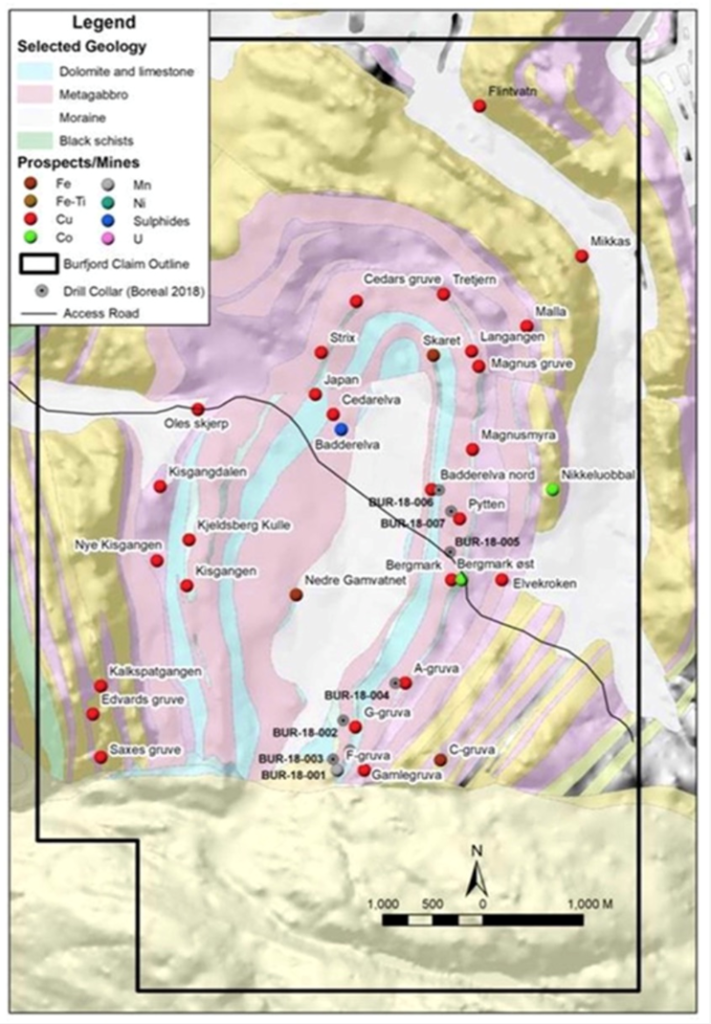

Taking a look at the map above, the property hosts a number of copper occurrences (the red dots) near surface, spread over a large area. These areas are best described as surface pits, mined up to 300 years ago by artisanal miners. It is quite incredible that, until now, no company has tried to consolidate all of these historical workings into a mineable resource. This is the challenge presented to Norden Crown and its earn-in partner, Boliden.

Norden Crown has gone into these shallow pits for samples, and mapped them.

In 2019 the company announced compelling drill results from Burfjord, including an intercept of 32m averaging 0.56% copper and 0.26 g/t gold (including 3.46m of 4.31% Cu and 2.22 g/t Au) at shallow depths below a group of historical mine workings.

A total of 3,179 meters was completed in 2021 through two reconnaissance drill programs. Among the highlights, hole 11 cut 12 meters of 1.27% Cu, hole 003 returned 30.1m of 0.28% Cu, and hole 004 delivered 17.2m of 0.34% Cu.

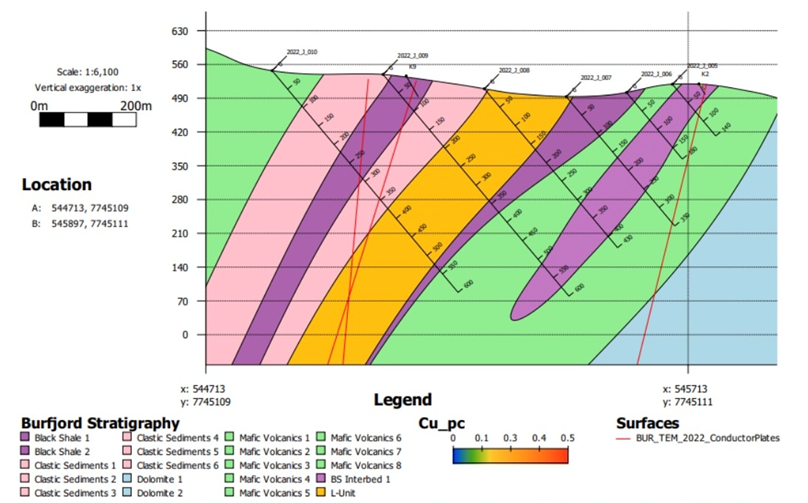

“The joint Norden-Boliden exploration team has leveraged results from last year’s drilling which combined with the recently completed TEM-geophysical survey, new geological mapping and geochemical sampling, have defined numerous high-potential drill targets on the West and East limbs and the Hinge of the Burfjord Anticline,” said Patricio Varas, Norden Crown’s Chairman and CEO, in the July 6 news release. “We are excited to test these new targets and feel confident that the summer 2022 drill program will advance the Burfjord Project substantially.”

2022 drill program

Norden Crown has contracted Arctic Drilling AS (Norway) to complete at least 3,000 meters of diamond drilling. The program is designed to test geological, geochemical and geophysical targets identified in the 2020 and 2021 field programs. The company reports that Arctic Drilling has mobilized to the first target site and drilling has started.

The drill bit will be pointed at several copper targets that are surrounded by historical adits, pits, trenches, and workings within the extensively iron-carbonate altered Burfjord anticline (Figure 1).

Targets have been identified and prioritized based on lithological and structural mapping, rock and soil geochemistry, airborne magnetic geophysics and ground-based electromagnetic geophysics.

West Limb (Kisgangen and Peninsula target areas)

Field programs in 2020 and 2021 delineated an intense magnetic anomaly, several conductive ground conductors (TEM), rock samples with elevated copper, a copper soil anomaly, and several faults thought to be possible fluid conduits. Extensive historical pits, trenches and adits are present along a strike length of at least 800m. The drill program will test both strike and depth continuity of mineralization along the western limb of the Burfjord anticline (Figure 2).

East Limb (Gamlegruva and A-Gruva target areas)

The East Limb of the Burfjord anticline constitutes about a 5 km-long trend of discontinuously outcropping copper occurrences and historical mine adits that contain disseminated copper sulfide mineralization. The drill program will follow up on 2021 hole BUR-21-005, which returned 1.35m averaging 8.67% Cu and 0.69 g/t Au (see April 11 news release). The objective of drilling is to intersect carbonate veins bearing high-grade copper within a gabbro unit which hosts a trend of historical pits, adits and trenches (Figure 1).

Hinge Zone (Cedarsgruvan and Cedarelva target areas)

The Hinge Zone is a structural target in the hinge of the Burfjord anticline. Several significant historical mines are present within the target area, which targeted massive chalcopyrite and strong chalcopyrite dissemination within albitite (Cedarsgruvan) as well as high-grade chalcopyrite veins (Cedarselva). Drilling aims to test strike continuity of mineralization at Cedarsgruvan (Figure 2).

Conclusion

The Burfjord IOCG project has tons of potential and I’m eager to see what the drill program comes up with. Those old mined pits are spread out over a large area, and there is a lot of them. To my way of thinking there must have been an incredibly powerful driving force from below to fill so many fractures and veins over such an extensive area.

Shareholders can expect to see quite a bit of news flow during the second half, as assay results trickle in.

Norden Crown Metals

TSXV:NOCR, OTC:NOCRF, Frankfurt:03E

Cdn$0.07 2022.07.06

Shares Outstanding 53m

Market cap Cdn$3.9m

NOCR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Norden Crown Metals (TSXV:NOCR). NOCR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.