Norden Crown advances former Fredriksson mine to drill testing

2020.11.14

Fresh off its recent name change to reflect the company’s mining focus on Scandinavia, Norden Crown Metals Corp. (TSXV: NOCR) (OTC: BORMF) (Frankfurt: 03E) has made further progress from ongoing exploration at the Gumsberg silver-zinc-lead-gold project in Sweden.

Based on historical drilling data and 3D modelling, the company has identified a series of drill targets on the Fredriksson Gruva prospect, which will now be the focus of an upcoming drill program.

Fredriksson Gruva — Background

The Fredriksson Gruva is a past-producing mine in southern Sweden originally discovered in 1976.

Exploration on the property was carried out in 1976-1977 including surface trenching, sampling and drilling of nine diamond drill holes, which identified precious metal enriched base metal mineralization.

Test mining conducted by AB Statsgruvor, a state-owned mining company and the project’s previous owner, in 1978 produced 21,000 tonnes grading 53 g/t Ag, 5.13% Zn and 1.7% Pb from an open pit. An additional 11 holes were drilled in 1979 to test the down-plunge extent of mineralization.

After a short pause, mining resumed in 1980-1981 with the installation of an underground tram, 45,000 tonnes grading 49 g/t Ag, 5.77% Zn and 1.84% Pb from underground workings.

Also during this period, four holes were drilled and a core re-logging program was completed. Surface trenching and a magnetic geophysical survey had also been completed.

Norden (operating under the name Boreal Metals Corp. at the time) acquired the Fredriksson prospect as part of a larger staking acquisition in March 2017. This licence is referred to as “Gumsberg West“ and forms the western half of the Gumsberg project.

Diamond Drilling History

According to data recently compiled by Norden, a total of 29 historical holes (3,935.8 metres) have been drilled to date at Fredriksson Gruva to an average depth of 135 metres.

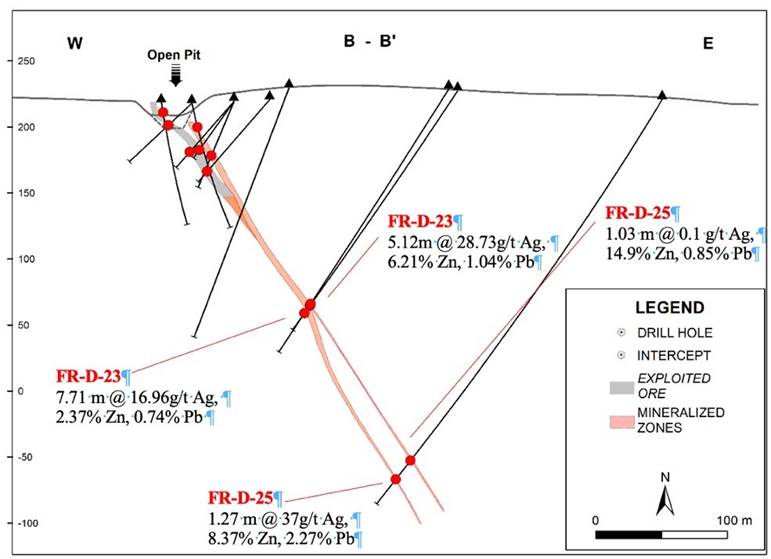

Drilling has penetrated to 300 metres below surface, though most of the holes are concentrated between surface and a 100-metre depth. Past drilling has defined significant silver-zinc-lead mineralization over an area measuring 300 metres (east-west), 200 metres (north-south) and 300 metres vertically (see figures below).

Longitudinal section Fredriksson Gruva

Cross section Fredriksson Gruva

Historical open-pit and underground mining has removed mineralization in the top 91 metres of the deposit. Mineralization at Fredriksson Gruva extends for a minimum of 200 metres below the historical workings and is open in all directions. True widths of the reported mineralized intervals have not been determined.

Norden said it will use these historical data as a guide for its future exploration programs.

Another Broken Hill Discovery?

Fredriksson Gruva is currently one of the four prospects located at Norden’s Gumsberg project and is the latest to reach the drill testing stage.

Apart from the past mining success at Fredriksson Gruva, a big reason why the company has committed to advancing this prospect is due to its resemblance to the famous Broken Hill ore deposit found in New South Wales, Australia.

Named after the town on which the deposit is situated, Broken Hill is widely considered the world’s richest and largest zinc-lead ore deposit.

The deposit is believed to be more than 1,800 million years old of the Proterozoic age. No other major sedimentary exhalative (SEDEX) lead-zinc deposits of this style are currently known from the Phanerozoic or Archean age.

The geology of the Broken Hill ore body is a series of boomerang-shaped, highly sheared and disrupted, ribbon-like and poddy (elongated, lens shaped) massive sulphide lenses that outcrop in the central section (hence the name “Broken Hill”) and then plunge steeply north and moderately south.

According to Norden CEO and chairman Patricio Varas, the silver-zinc mineralization found at Fredriksson reminds him of these Broken Hill-type Pb-Zn-Ag (BHT) deposits.

Gumsberg rock sample

The reported grade from mined ore is remarkably consistent, and past drilling rarely missed mineralization, which Varas says is very encouraging for further resource expansion when drilling begins.

Gumsberg Overview

In total, the entire Gumsberg project area consists of five exploration licenses totaling over 18,300 hectares within Sweden’s Bergslagen mining district, which has a rich mining history and is home to several world-class mining operations.

View of the Gumsberg project site

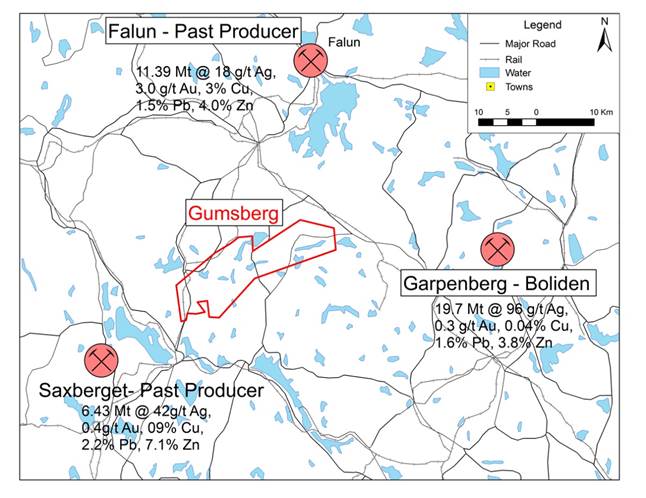

Surrounding the Gumsberg project are the past-producing Falun and Saxberget mines and what is currently considered the world’s most productive underground zinc mine in Garpenberg, owned by Swedish mining giant Boliden (see map below).

Gumsberg location map

Lundin’s Zincgruvan underground mine — which has been producing zinc, lead and silver since 1857 — is also in close proximity.

The volcanogenic massive sulfide (VMS) mineralization at Gumsberg was mined from the 13th century through the early 1900s.

There are over 30 historical mines present on the property, most notably Östrasilverberg, which was the largest silver mine in Europe between 1300 and 1590. This past-producing mine site is also one of Norden’s drill-stage prospects at Gumsberg, where drilling between 2017-2019 returned significant high-grade intercepts including:

- 10.94 m of 656.7 g/t Ag, 16.97% Zn, 8.52% Pb and 0.76 g/t Au; and

- 11.01 m of 275 g/t Ag, 7.45% Zn, 2.65% Pb and 0.77 g/t Au.

The four holes drilled along the 2 km long Vallberget-Loberget trend in 2016 also intersected significant intervals of:

- 2.8 m of 17.9% Zn, 6.9% Pb, 0.5% Cu and 68.9 g/t Ag a depth of 32 m below surface;

- 3.0 m of 9.2% Zn, 3.0% Pb and 12.8 g/t Ag at a depth of 22 m below surface.

These results demonstrated that multiple horizons of exhalative VMS style mineralization are present in the stratigraphy and contain interbedded zones of replacement style mineralization.

Exploration in Norway

Meanwhile, Norden is quietly advancing another highly prospective property in neighbouring Norway. This summer, the company began field exploration on its Burfjord copper-gold project, located 32 km west of the Kåfjord copper mines, the first major industrial enterprise north of the Arctic Circle.

View of the Burfjord project site

Mineralization at Burfjord belongs to the Iron Oxide Copper Gold (IOCG) deposit clan; these deposits are among the most valuable concentrations of copper, gold and uranium ores in the industry. High-profile examples include BHP’s Olympic Dam in Australia and the Candelaria copper-gold deposit in Chile.

Copper was mined in the Burfjord area during the 19th century. The property hosts more than 30 historic mines and prospects developed along the flanks of a prominent 4 by 6 km anticlinal structure consisting of interbedded metasedimentary and metavolcanic rocks.

Norden believes that many of the rocks in the anticline have been subjected to intense hydrothermal alteration. This potential has only recently been recognized in Norway.

Mineralization occurs as both high-grade Cu-Au lodes that were historically mined at high cut-off grades and lower-grade, bulk tonnage potential Cu-Au mineralization developed in stockwork vein arrays.

Samples from Burfjord

Only limited exploration has taken place at Burfjord in the modern era, however, paving the way for Norden to make this potentially large copper mineralization count. While current exploration by the company at Burfjord is still at an early stage, the project has not gone unnoticed by the big regional players.

In June, Swedish miner Boliden agreed to fund the entirety of the ongoing exploration program at Burfjord, which includes geological mapping, geochemical sampling and geophysics. Boliden also plans to spend $6 million over the next four years on the project, with a chance to earn an 80% stake if all goes well.

The long-term commitment by one of the leading mining firms in Europe goes to show how much it believes in the project’s copper-producing potential.

Resurgence of Scandinavian Mining

As with all mining projects, jurisdiction plays a vital role in their success, and Scandivania is easily considered one of the best in the industry for its favorable geology and political stability.

The Fennoscandian Shield, on which the Nordic nations are situated, is one of the most mineralized Paleoproterozoic areas in the world and has historically been one of Europe’s mining hotbeds. This has helped Sweden to become the #1 nation on the continent in terms of ore and metal production, with as many as 16 producing mines and counting.

Norway, which may now be seeking to resuscitate its mining industry given the state of the oil industry, could very well become another Sweden. Signs are pointing in that direction: the nation recently opened up its Arctic regions for copper mining.

Another plus for miners operating in these countries is the low corporate tax and energy costs compared to many of their Western rivals.

For companies like Norden, these early bets on Scandinavia and its vast mineral base are looking wise so far.

Norden Crown Metals

TSX-V:NOCR

Cdn$0.08 2020.11.03

Shares Outstanding 133,196,582m

Market cap Cdn$10.6m

NOCR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Norden Crown Metals Corp. (TSXV:NOCR) NOCR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.