Nickel prices on a rip, as Palladium One expands Tyko and completes geophysical survey

2021.07.30

Palladium One continues to outline a high-grade nickel system at its Tyko Ni-Cu-PGE project in Ontario, where a second-phase drill program started in April and a recently announced expansion increases the size of the property by over a fifth.

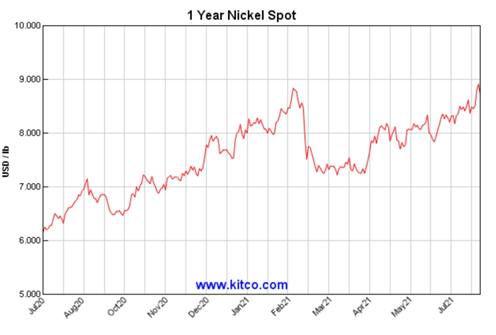

The company’s timing is good as far as attracting investor interest, with nickel prices currently at $8.82/lb and climbing due to healthy demand from stainless steel mills and electric vehicle battery makers.

Tyko

Notable for its high nickel tenor, Tyko is located in northwestern Ontario around 25 km north of the Hemlo mine (Barrick Gold) and 55 km from Generation Mining’s Marathon deposit, which hosts a measured and indicated resource of 3 million ounces palladium and 618 million pounds of copper.

The Archean-aged mafic-ultramafic intrusion is rich in nickel; Tyko’s ore contains twice as much nickel as copper, and equal amounts of platinum and palladium.

Tenors average 8.6% Ni, 4.6% Cu and 3.3 g/t PGE at the RJ zone, and 16.3% Ni, 8.7% Cu, and 12.8 g/t PGE at the Tyko zone, at 100% sulfides. According to Palladium One, the high tenor of the sulfide minerals suggests a valuable concentrate could be produced, and that even if the sulfides are disseminated, the deposit could still be economic.

Though previous operator Noranda did some historical exploration, the property remains under-explored, and un-mapped, even by the Geological Survey of Ontario.

The Tyko project covers over 24,000 hectares, including the 7,000-hectare mafic-ultramafic Bulldozer intrusion, which has seen virtually no geological mapping nor exploration.

A VTEM (Versatile Time Domain Electromagnetic) geophysical survey run by Noranda clipped the Smoke Lake target that is currently Palladium One’s focus at Tyko.

The 2020 drill program was designed to test the Smoke Lake electromagnetic (EM) anomaly.

A drone-based magnetic survey also pinpointed a strong bullseye associated with soil anomalies (up to 565 ppm nickel and greater than 40 times background levels), representing the surface expression of the EM anomaly.

Mineralized boulders with high nickel (up to 0.41% Ni) and copper values were discovered, indicating potential for high-grade massive sulfide mineralization.

This potential was validated by the first two diamond drill holes, which intersected massive magmatic sulfides grading 8.7% nickel equivalent (Ni_Eq) (193 pounds per tonne) over 3.8 meters, and 4.8% Ni_Eq over 2.3m, both at less than 30m true depth.

This was the first confirmed occurrence of massive sulfides at the Tyko project.

Subsequently the remaining 11 drill holes were announced; each was a resounding success and intersected massive magmatic copper-nickel sulfides, confirming the high-grade nature of the deposit.

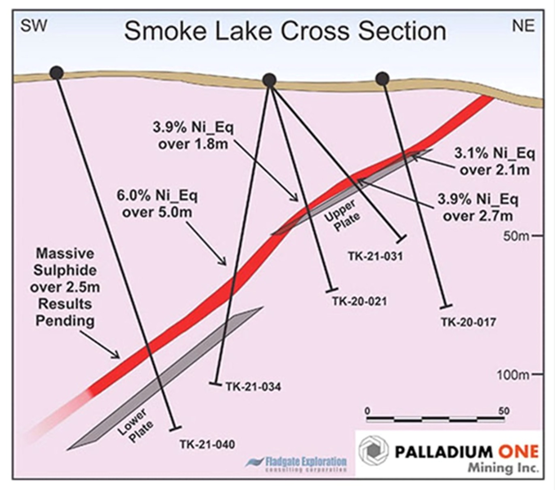

Additional EM surveys then identified two near-surface, closely spaced conductors (or plates, described and pictured below), the largest of which had a strike length over 300m.

A second-phase, 2,000m drill program started in April, following up on high-grade hits of 9.9% Ni_Eq (23% Cu_Eq) (30 g/t Au_Eq) over 3.8m – US$1,765.70 per tonne at a price of US$8.09/lb and 6.3% Ni_Eq (US$1,123/ tonne) over 0.9m, published on Jan. 19.

The objective of the phase 2 drill program was to test the down-dip continuity of the two EM “plates” (an upper plate and a lower plate) that Palladium One modeled after the first-phase drill program in the fourth quarter of 2020.

On April 28 PDM announced that 11 of 14 holes completed so far intersected massive sulfides, ranging from 1.3 to 5.0 meters in length.

Assay results from the first six holes (TK21-029 to TK21-034) were delivered in June. Final phase 2 results were released June 23; they continue to be spectacular.

A number of high-grade intersections were reported, all near surface, including:

- 1.7m @ 10.2% Ni_Eq (or 31g/t Au_Eq) within 4.5m @ 7.5% Ni_Eq (or 22 g/t Au_Eq)

- 1.7m @ 8.3% Ni_Eq (or 25vg/t Au_Eq)

- 1.7m @ 9.5% Ni_Eq (or 29g/t Au_Eq)

These are some of the highest sulfide nickel grades in the world.

According to Palladium One, the two most important results of the phase 2 program were, number one, to extend the strike length of the lower conductor to 350 meters, and number two, linking the high-grade massive sulfide mineralization between the upper and lower conductors.

“Smoke Lake continues to deliver exceptional nickel grades. These results, notably hole TK21-034 indicate that the upper and lower plates are in fact one continuous sulphide lens. Additionally, evidence exists that the high-grade mineralization has been remobilized, thus seeking the source of mineralization is our top priority,” Palladium One’s President and CEO Derrick Weyrauch stated in the June 17 news release.

Bringing readers up to date on the project, Palladium One has now completed a 2,000 square kilometer (3,100 line km) airborne geophysical survey (VTEMmax) — the first of its kind to be done across the whole Tyko property. According to PDM, the survey of closely spaced, 100m flight lines covered large areas for which no electromagnetic surveys had ever been flown, including the area around the Shabotik showing which has up to 1% Ni.

Mapping, prospecting and soil sampling is also underway, with 1,000 soil samples already submitted to the assay lab.

“Tyko continues to impress and warrants increased levels of expenditure and exploration. Results to date demonstrate robust mineralization spread over at least 18 kilometers, yet the area has seen virtually no government mapping or exploration,” said Palladium One’s President and CEO, Derrick Weyrauch, in the July 27 news release. “We believe that in addition to the high-grade Smoke Lake zone, there are new zones off nickel-copper mineralization yet to be discovered. We are awaiting result from the 3,100-kilometer airborne Electro Magnetic (VTEMmax) survey which will guide further exploration.”

Property expansion

Along with advancing exploration at the drill bit, Palladium One is also increasing its chances of hitting more high-grade massive sulfides by expanding its land position at Tyko.

Two earn-in agreements grow the nickel-copper project by 950 hectares and an additional 3,500 ha has been purchased from the original optioners of the project.

The upshot is an upsizing of the footprint from 20,100 hectares to 24,500 since phase 2 drilling was completed, an increase of 21% or 4,400 ha.

For the first option agreement, Palladium One can earn an 80% interest in the 700-ha Pickle Lake property, located on the west side of Tyko, by incurring exploration expenditures of at least $350,000 within three years and completing an NI 43-101-compliant technical report.

Pickle Lake is close to the historical RJ zone which returned up to 1.2% Ni_Eq (2.78% Cu_Eq and 3.6g/t Au_Eq) over 16.2 meters back in 2016, Palladium One reports.

The property comes with a 2% net smelter returns (NSR) royalty, which is subject to a 100% buy-back right, and wherein each 1% of the NSR royalty can bought back and extinguished for C$500,000, a fixed price.

The second option agreement, with a local prospector, involves the Cupa Lake property, which consists of 250 hectares and is located 8 km east of the Smoke Lake zone at Tyko. Under the terms, Palladium One can earn a 100% interest in Cupa Lake by incurring exploration expenditures of at least $180,000 within three years, plus a combination of $30,000 in cash and 30,000 PDM shares paid out to the prospector.

Palladium One retains the right at any time to purchase 50% of the 1% NSR royalty, via a one-time payment of $1,000,000.

Lastly, under a claims purchase agreement, the company has acquired 3,500 ha of new claims by re-imbursing staking costs to the original optioners of the Tyko project. These new claims are considered part of the original option agreement and thus are subject to a 3% NSR for which 50% can be purchased at any time for $1,500,000.

Nickel market update

Palladium One is exploring Tyko at a very interesting time in the nickel market. Consider the challenges nickel mining companies face in ramping up production to meet skyrocketing demand for high-purity nickel required in electric vehicle batteries.

In addition to its traditional role in stainless steelmaking, the base metal is becoming more and more important due to its use in nickel-cobalt-aluminum (NCA) and nickel-cobalt-manganese (NCM) lithium-ion batteries. NMC 811 battery cells (8 parts nickel, 1 part each lithium and cobalt) are being produced on a greater scale, because they deliver higher energy density and greater storage capacity, at lower cost.

However, the nickel market is currently under-supplied in relation to demand, a condition that is supporting higher prices. Spot nickel currently sits at $8.82/lb, the highest since February and a 20% increase since April. Nickel earlier this year reached a six-year pinnacle.

It is up amid rising demand expectations pertaining to the electric vehicle battery sector, and strengthening macroeconomic conditions (especially in Asia) as some economies lift coronavirus-related restrictions, leading to higher consumption of raw materials for making stainless steel.

Supply disruptions have exacerbated the market imbalance, particularly at nickel mines in New Caledonia, Russia and Canada, while covid-related restrictions raise the possibility of delays to new projects in top producer Indonesia this year, a Reuters article states.

The undersupply situation is easily seen in the graph below, showing stocks of nickel in London Metal Exchange warehouses dropping by more than 15% since April, while those monitored by the Shanghai Futures Exchange are near five-year lows.

Robust demand from stainless steel mills and EV manufacturers is expected to support higher prices over the coming months. Macquarie, an Australian bank, has re-calibrated its nickel demand forecast to an increase of 16%, versus its +10% prediction in March, although supply from lead producer Indonesia is expected to gather pace next year and possibly weigh on prices. For now, though, the nickel market will be undersupplied, with Macquarie’s forecasted demand of 2.8 million tonnes beating 2020 supply of 2.5Mt, as shown below in the table by the US Geological Survey.

The supply picture is clouded by the fact that not all nickel is created equal.

There are two kinds of nickel deposits in the world, sulfides and laterites, but only nickel sulfides can be easily (and inexpensively) processed to create battery-grade nickel used in lithium-ion batteries needed for electric vehicles.

While Indonesia has an abundance of nickel supply in laterite deposits, it is very expensive to produce, creates a lot of greenhouse gas emissions, and carries with it the added burden of tailings waste disposal, which in the archipelago nation has meant dumping it into the sea.

Any battery company or automaker in the least bit concerned about its green credentials which, when it comes to EVs, is the whole point, will have a hard time justifying a nickel laterite supply chain.

The main benefit of nickel sulfide ores is they can be concentrated using simple flotation.

Yet large-scale sulfide deposits are extremely rare. Existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting, nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically and technically feasible? The pickings are slim.

Limited nickel exploration in recent years has resulted in a very low pipeline of new projects.

That is regrettable, because the mining industry is going to need to find, develop and put into production more nickel mines, especially nickel sulfide deposits that can be mined cost-effectively and with a light environmental footprint.

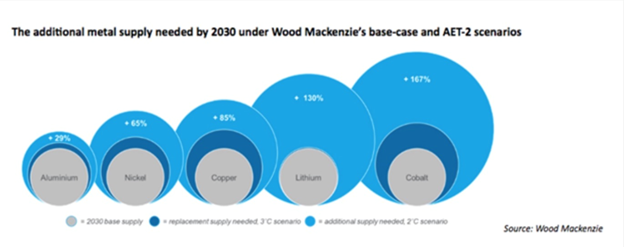

Nickel is among a handful of metals mentioned by Wood Mackenzie in a recent report wherein the Scotland-based consultancy says another commodities supercycle is on the horizon, but instead of being driven by fossil fuels, the vanguard will be industrial metals needed to electrify society, including nickel:

Under Wood Mackenzie’s Accelerated Energy Transition-2 (AET-2) scenario, which is consistent with limiting the rise in global temperatures since pre-industrial times to 2 °C, 360 million tonnes (Mt) of aluminium, 90 Mt of copper, and 30 Mt of nickel will feed the energy transition over the next 20 years. This level of additional metal presents obvious challenges for producers and consumers alike.

The report predicts by 2030, nickel producers will have to add 65% more supply, as the chart below shows.

Any junior resource company with a sulfide nickel project, like Palladium One’s Tyko, will therefore be extremely attractive to potential acquirers.

Palladium market update

Along with nickel, Palladium One is also keeping a close eye on palladium prices, as it develops its palladium-dominant LK (Läntinen Koillissmaa) copper-nickel-platinum group element (PGE) project in Finland.

Palladium is on track for a supply deficit for the 10th straight year. Driving palladium demand are higher sales of gasoline vs diesel vehicles and tighter pollution controls.

Palladium use in hybrids, seen as a bridge between gas-powered cars and pure electrics, is a growing source of demand. The lustrous metal is also used in electronics, surgical instruments, jewelry, watch making, aircraft spark plugs, hydrogen purification and groundwater treatment.

Supply, meanwhile, is being challenged by production disruptions, for example flooding at Arctic mines. In February Russia’s Nornickel partially suspended output at two of its mines — which account for 36% of ore mined by the company in Russia — due to a sudden inflow of water. The Oktyabrsky underground mine returned to production in May and the interconnected Taymirskiy operation was back at full strength in June.

On May 4 palladium hit a new record of $2,890/oz. Year to date, the autocatalyst ingredient is up close to 10%.

Conclusion

Palladium One has been getting some very high-grade hits at Tyko, including up to 9.9% nickel equivalent over 3.8 meters in TK21-023, a hole drilled earlier this year.

Moreover, the value of the nickel sulfides at Tyko is impressive.

At today’s metal prices, 9.9% NiEq over 3.8m is worth $1,931.58 per tonne (total gross metal value in $USD), calculated using Kitco’s “Rocks in the Box” tool. This is the dollar equivalent of a 20% copper deposit, a 77 ounce per tonne silver deposit (28.3 grams in an ounce), and a 33 grams per tonne gold deposit. Any gold, silver or copper junior would be escstatic with those kinds of grades.

Obviously the average grade will be lower, but even if it’s $1,300 rock, or $900, the project economics would almost certainly be favorable, especially considering it’s sulfide nickel which is fairly easily separated by flotation, driving the costs per tonne lower than if it was laterite nickel.

When you consider all that Palladium One has going for it — the right metals at the right time, ie., sulfide nickel for EV batteries, and palladium, used in gasoline-powered catalytic converters that will be needed for years during the transition from fossil fueled to electric vehicles — and deposits with top of the class grades in safe jurisdictions, Palladium One is a stealth company ripe for an acquisition.

Palladium One Mining

TSX.V:PDM, OTC:NKORF, FSE:7N11

Cdn$0.245 2021.07.29

Shares Outstanding 248m

Market cap Cdn$59m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Palladium One (TSX.V:PDM). PDM is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.