Nickel goes parabolic on historic LME short squeeze

2022.03.09

The war in Ukraine has lit a fire under commodities and none is hotter than nickel. As Russian forces continued to pummel Ukrainian cities, Tuesday, nickel trading was suspended in London after prices more than doubled.

Activity on the London Metal Exchange (LME) was so frenzied, the 145-year-old bourse had to cancel trading after an unprecedented price spike saw brokers struggling to pay margin calls against unprofitable short positions.

The base metal used in stainless steel and electric-vehicle batteries surged more than 250% in two days, briefly hitting $100,000 a ton, as investors and industrial users who had sold nickel scrambled to buy the contracts back after prices rallied.

The largest-ever price move on the LME began shortly after the US considered banning Russian crude oil imports. This sparked a massive squeeze in commodity markets, including oil, gas, nickel, aluminum and palladium. All hit multi-year highs or new record highs, according to Bloomberg.

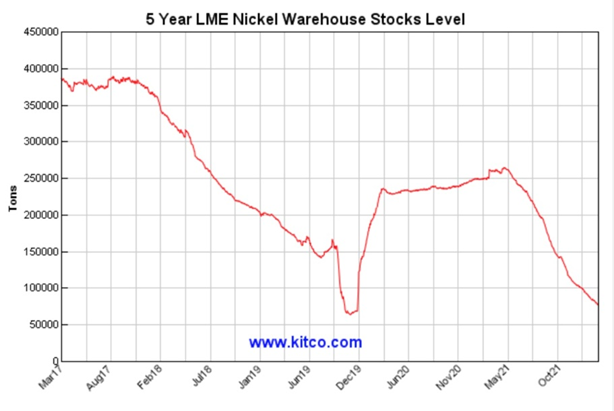

Nickel’s vertical price spike is seen in Kitco’s graph below. Note: while nickel has risen by about $11,000 a ton over the last five years, this week alone, it has jumped as much as $72,000.

The key driver behind the “short squeeze” was market participants with short positions, who were forced to close them out because they couldn’t meet margin calls.

Traders, miners and processors will often short metals as a hedge for their physical stocks, thinking that any volatility in the exchange position and physical stocks should cancel each other out. The risk is when prices rise sharply, anyone holding a short position will need greater collateral to pay margin calls.

On Monday, following a near doubling of the nickel price, the LME announced rule changes allowing traders to defer their contract obligations. The unusual move evoked memories of the 1985 “tin crisis”, when the exchange suspended tin trading for four years, pushing many brokers out of business.

Chinese entrepreneur Xiang Guangda was among the most hurt by the nickel short squeeze. Xiang, nicknamed “Big Shot”, is the chairman of Tsingshan Holding Group, the world’s largest nickel and stainless steel producer. Bloomberg said Xiang held a large short position on the LME through Tsingshan, which has been under growing pressure from its brokers to meet margin calls.

One of these brokers, a unit of China Construction Bank, was given more time by the LME to pay the hundreds of millions of dollars worth of margin calls it missed Monday. The payments were made Tuesday.

The LME said Tuesday’s cancelation of the nickel contract at $80,000 per tonne, and the deferred delivery of all physically settled contracts, followed a close monitoring of the ongoing impacts of Russia’s invasion of Ukraine. The bourse is also taking into account the recent “low-stock environment and high pricing volatility environment observed in various LME base metals, and in particular nickel.”

Russia is the third largest nickel producer in the world, in 2021 mining 250,000 tonnes, including 193,006 from Nornickel, the globe’s top producer of refined nickel. Nornickel’s output amounts to around 7% of global mine production, which in 2021 was 2.7 million tonnes, according to the US Geological Survey.

Note that Nornickel mines sulfide nickel, the kind best suited to lithium-ion batteries. (Sulfide nickel deposits are relatively rare, they comprise only 40% of nickel deposits found worldwide. The other 60% are nickel laterites. We can therefore say that Russia’s Nornickel mines 7% of the 40% of nickel sulfide deposits). This nickel can be processed at relatively low cost, and with minimal waste, using simple flotation, compared to the more expensive, and highly polluting techniques used to refine nickel from nickel laterites found in the world’s top nickel producer — Indonesia — the Philippines and New Caledonia.

Nickel prices were already pushing higher before the crisis began in late February — the market’s tight fundamentals reflected in low warehouse inventories and strong demand for nickel to be processed into EV battery cathode material.

A disruption to nickel supplies would not only harm nickel end users, but the entire lithium-ion battery supply chain because Nornickel mines sulfide nickel.

A report by UBS indicates that a deficit in nickel will come into play as soon as this year. By the end of the decade, UBS forecasts a large deficit of 2.2 million tonnes for the battery metal.

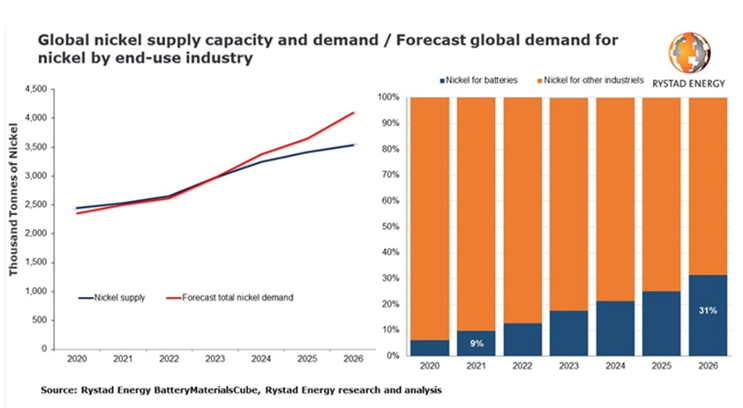

A more conservative estimate from Rystad Energy shows that demand for high-grade nickel used in EV batteries will outstrip supply by 2024. By then, global demand will climb to 3.4Mt, compared to 2.5Mt this year, while supply will grow to 3.2Mt.

The gap will then widen quickly to a deficit of 0.56Mt by 2026, driven by surging demand from the battery sector.

While batteries are not the dominant usage for nickel, that being stainless steel, electric vehicles’ share of nickel demand has been growing at a faster rate and is expected to trend up.

Wood Mackenzie estimates that of the 2.8 million tonnes demanded last year, 69% was used to make stainless steel and 11% to make batteries, up from 71% and 7% respectively in 2020. Batteries’ share of demand is expected to rise to 13% in 2022.

According to Rystad’s latest report, nickel demand from the stainless steel industry should grow at about 5% per year, while the market for batteries is poised to explode. “In an unconstrained supply scenario, batteries could require more than 1Mt of nickel metal by 2030, quadrupling from the current demand of 0.25Mt,” the energy research firm said.

Renforth Resources

As one of the few junior miners racing towards the next nickel discovery in Canada, Renforth Resources (CSE:RFR, OTCQB:RFHR, FSE:9RR) has the right metals at the right time, embodied in its Surimeau polymetallic project in Quebec.

The 330 square-kilometer property (it was recently expanded to include Malartic West, prospective for copper-silver at the Beaupre discovery) hosts several target areas for gold and industrial metals (nickel, copper, zinc, cobalt, silver) located south of the Cadillac Break, a major regional gold structure.

Exploration focus is currently placed on the sulfide-nickel-rich targets, in particular the Victoria West prospect, which has been the site of drilling by the company.

According to Renforth, information gleaned from drilling and trenching the Victoria West target, along with surface sampling, creates an area of interest that includes about 6 km of strike on the western end of a 20-km magnetic anomaly.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside and is intermingled with VMS-style copper-zinc mineralization.

Renforth considers this rare style of mineralization to be an “Outokumpu-like” occurrence, referring to a district in eastern Finland known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold.

About 50 million tonnes of ore averaging 2.8% copper, 1% zinc and 0.2% cobalt, along with traces of nickel and gold, were mined from three deposits between 1913-88.

Drilling completed by Renforth to date has affirmed the presence of a large polymetallic camp richly endowed with nickel, copper, cobalt and zinc, along with some PGEs (platinum group elements).

Sulfide nickel importance

Producing nickel-rich battery cathodes requires high-purity nickel, in the form of nickel sulfate, derived from ‘Class 1’ nickel sulfide deposits. This nickel can be processed at relatively low cost, and with minimal waste, using a simple flotation technique.

The problem is they are rare. Existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

A brief digression: nickel deposits come in two forms: sulfide or laterite. About 60% of the world’s known nickel resources are laterites, which tend to be in the southern hemisphere. The remaining 40% are sulfide deposits.

In Indonesia, nickel is produced from laterite ores using the environmentally damaging HPAL technique. The advantage of HPAL is its ability to process low-grade nickel laterite ores, to recover nickel and cobalt. However, HPAL employs sulfuric acid, and it comes with the cost, environmental impact and hassle of disposing the magnesium sulfate effluent waste. The Indonesian government only recently banned the practice of dumping tailings into the ocean (DST) for new smelting operations, and it isn’t yet a permanent ban.

Chinese nickel pig iron producers in Indonesia now are looking to make nickel matte, from which to turn laterite nickel into battery-grade nickel for EVs. The process however is highly energy-intensive and polluting, as well as far more costly than a nickel sulfide operation (up to $5,000 per tonne more). Read more

The presence of sulfide nickel at Renforth’s Surimeau therefore cannot be underestimated, especially in the current geopolitical environment where Nornickel’s 7% of 40% of the world’s sulfide nickel supply is endangered by sanctions.

As for Indonesian nickel, the Chinese may eventually get battery-grade nickel from the laterites but make no mistake about it, this is not green nickel. Its utility will be limited to China or other countries with low environmental standards, and where “ESG” (environmental, social and governmental) is not a concern for mining companies.

The world’s biggest automakers, on the other hand, are all over ESG. As they continue to build their supply chains for the new electrified economy, they are bringing their ESG requirements with them. For these car manufacturers, Indonesian nickel will be off limits — not only because of ocean tailings, but due to the way smelters get their power, from burning coal.

Renforth and its Surimeau project is in a much better position, environmentally. The property is road accessible, it shares a border with Canada’s largest open-pit gold mine, Canadian Malartic, and to the south, there are hydroelectric power lines from the Rapide-2 and Rapide-7 power generating stations running across the property.

Additionally, Surimeau is only about an hour away from the Horne smelter, which is Canada’s only copper-nickel smelting operation. “We have a customer sitting on our doorstep, in that they’re already producing polymetallics at Horne with the recycling of electrical goods,” Renforth’s CEO Nicole Brewster told me in an interview this week.

2022 exploration

Assays for the 21 holes drilled at Victoria West were announced in November, with each hole hitting mineralization as expected, and the four deeper holes demonstrating an increase in grade.

Highlights of the 2020-21 drilling included:

- A 111.05m mineralized interval starting at 57m down hole, averaging 0.17% nickel and 139.58 ppm cobalt. A highest-grade 40-meter sub-interval assayed 0.22% nickel and 168.98 ppm cobalt.

- A 107.2m interval starting at 130.5m down hole, averaging 0.15% nickel and 112.64 ppm cobalt, within which the highest-grade sub-interval of 14.4m assayed 0.22% nickel and 196.4 ppm cobalt.

- A 119.7m interval starting at 81.3m down hole, averaging 0.13% nickel and 90.49 ppm cobalt. A highest-grade 0.55m sub-interval assayed 0.95% copper, 0.17% nickel and 217 ppm cobalt.

Since then, seven new holes (1,203m) have been completed within an approximate 275m strike length. The recently concluded stripping of this area encountered more copper and zinc on surface than was seen in the drilling.

According to Renforth, this is thought to be due to the presence of the ultramafic nickel/cobalt body and the magmatic copper/zinc body, consistent with the company’s Outokumpu-style model that suggests two different mineralized bodies juxtaposed in one location due to the circumstances of the mineralizing event.

In January, Renforth published the results of channel sampling across the 275m of stripped surface area at Victoria West. According to the company, these channel samples demonstrate elevated nickel, copper, cobalt and zinc values, the highlight being where the two mineralization types (nickel-cobalt and copper-zinc) mix.

Channel 49 featured a 12.9m section with assays of 0.121% nickel and 0.013% cobalt. Included within this section were 0.224% nickel over 1m, and 5.5m of 0.43% copper and 1.63% zinc. The latter intersection included a best-grade 0.8m of 2.05% copper.

In addition to the channels cut, there were several grab samples taken. Highlights included 0.163% nickel and 0.012% cobalt, along with 0.496% copper and 0.09% zinc.

Renforth says these sampling results demonstrate that its discovery of a polymetallic (nickel/cobalt and copper/zinc) mineralized system at Victoria West, stretching over 6 km, is in fact “a surface system hiding in plain sight.”

The company has validated the historic data at Victoria West, Colonie, Lalonde, Surimeau and Huston. Results of last summer’s prospecting from the southwestern part of Huston gave the first ever documented nickel occurrence at the target, with one grab sample returning 1.9% nickel, 1.38% copper, 1,170 ppm cobalt and 4 g/t silver.

Remember: Victoria West is only one of six polymetallic target areas on the Surimeau property historically documented as hosting mineralization.

Renforth also plans to investigate the 14 km of magnetic anomaly between Victoria West and Colonie to determine the continuation of the ultramafic mineralization.

About 3 km north of Victoria West, the Lalonde showing was historically drilled over a strike length of 2 km within a 30-km magnetic anomaly.

Over the next few weeks, quite a bit of deskwork will be undertaken, as Renforth collates and analyzes geophysical data in anticipation of working up drill targets.

The results of a recently completed airborne geophysical survey will be interpreted in conjunction with existing geological information, to identify the best drill locations; drilling at Surimeau is expected to resume in late April.

At Victoria West, Brewster says she wants to “move as quickly and as efficiently as possible to an initial inferred resource.”

She noted the geophysics have been useful in confirming existing data and updating it with newer instrumentation, lower and tighter flight lines. “We can clearly see the magnetic trend we already knew we had. We can see a little bit more information what’s happening between the Victoria West Colonie trend and the Lalonde trend, over that 3 or 4 km,” Brewster told me over the phone.

“We definitely see the anomaly, we’ve got lots of detail and right now we’re just incorporating our own and the historic data with the geophysical data.”

Lithium kicker

Renforth already has nickel, copper and cobalt at Surimeau — three metals essential to electric transportation. One mineral that has received minimal attention so far is lithium, despite Renforth’s finding that the property hosts pegmatites, a type of igneous rock that often contains the chemical element.

According to Brewster, it’s no secret that Surimeau has lithium — the pegmatites have been historically logged and Renforth’s geologists have seen them too — it’s just a matter of how much is there.

“In the southern part of the property, the batholith is where there’s a lot of documented pegmatites, it is very prospective ground, it’s where they would typically occur in Quebec, in the margins of batholiths, so once we have the snow off the ground we can go down there and prospect those pegmatites and look at other areas where nobody’s bothered to look,” she said.

“Our own geologists walked over pegmatites and didn’t sample them because they weren’t there for lithium. So we will be visiting that area as well as some documented pegmatites in the north and we’ll be revisiting the core when we can access it, that we’ve already drilled at Surimeau because we’re getting lithium numbers in our own drilling, and the guys have noted magnetic occurrences and such, they really haven’t looked at the lithium in our own drill core so we’ll go back and see if there’s any substance to that as well, or if it vectors us elsewhere.”

Conclusion

I’ve often said that Renforth has the right rocks at the right time, and this is truer now than ever before, with nickel prices soaring to record heights on war between Russia and Ukraine.

Nickel was already doing well before the war but we now have an extremely tight market particularly for sulfide nickel, the kind of nickel best suited to battery-making. Western sanctions have put sulfide nickel from Russia’s largest nickel producer, Nornickel, in jeopardy. And while some may sniff at the fact that Russia is only the third-largest nickel producer, behind Indonesia and the Philippines, Nornickel mines 7% of the world’s sulfide nickel, of which less than half (40%) is in sulfide nickel deposits. The potential certainly is there for a shortage of sulfide nickel to filter down the supply chain to electric vehicles.

Goldman Sachs has forecast the nickel market to be in a 30,000-tonne deficit in 2022, more than double the 13,000-tonne deficit it predicted last August.

Tesla’s Elon Musk identified the shortage of nickel as one of the biggest hurdles to increasing production of EV batteries, in 2020 promising large contracts to mining companies able to supply the EV maker with sustainable nickel.

At the time, Musk wanted nickel because it was cheaper than cobalt; if elevated prices continue, nickel threatens to ratchet up costs for electric-vehicle batteries and complicate the gasoline to electric-vehicle transition.

However we must also keep in mind, that even though battery chemistries could change, the metals essential to lithum-ion technology will still be required. It’s also interesting to see the reversal of globalization, a phenomenon that started with former President Trump.

The United States has put zinc and nickel on their updated critical minerals list (also lithium, cobalt, graphite, palladium and platinum), and policymakers are finally starting to realize that relying on China and Russia for the raw materials needed for the new green economy isn’t such a wise idea.

We need to look inward to protect our interests closer to home and Renforth’s Surimeau polymetallic project is a great way to put that vision into practice. The company has over a million dollars in its treasury, enough to pay for this year’s exploration without having to go to the market for more funds.

I’m anticipating a busy field season at Surimeau and at Renforth’s other main project, Parbec, where the company is developing an open-pit high-grade gold deposit in the vicinity of Canada’s largest open-pit gold mine, Canadian Malartic.

With gold and nickel two of the hottest metals right now, Renforth is perfectly positioned to capitalize.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.07; 2022.03.08

Shares Outstanding 262.3m

Market cap Cdn$18.3m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.