New solar panels to use more silver, driving demand higher – Richard Mills

2023.07.05

Analysts have long been pointing to a severe shortage of silver due to the relentless growth in demand for the metal, which is used in many industrial applications such as automotive and electronics.

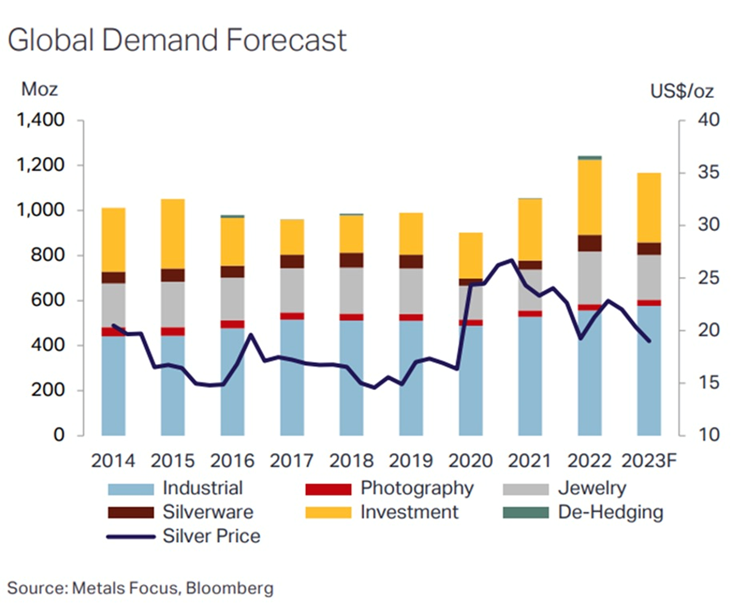

Data from the Silver Institute shows that global silver demand has increased by 38% since 2020 as economies continue to recover from the covid-19 pandemic.

Last year, demand for silver surged by 18% to a record-high 1.24 billion ounces against stagnant supply, stretching the market deficit to a second straight year, the Silver Institute said in its latest publication.

According to the 2023 World Silver Survey, the global silver market was undersupplied by 237.7 million ounces in 2022, which the institute says is “possibly the most significant deficit on record.”

It took just two years of undersupply — the 2022 deficit and the 51.1Moz shortfall from 2021 — to wipe out the cumulative surpluses from the previous decade, and this demand-supply gap is likely to remain for the foreseeable future.

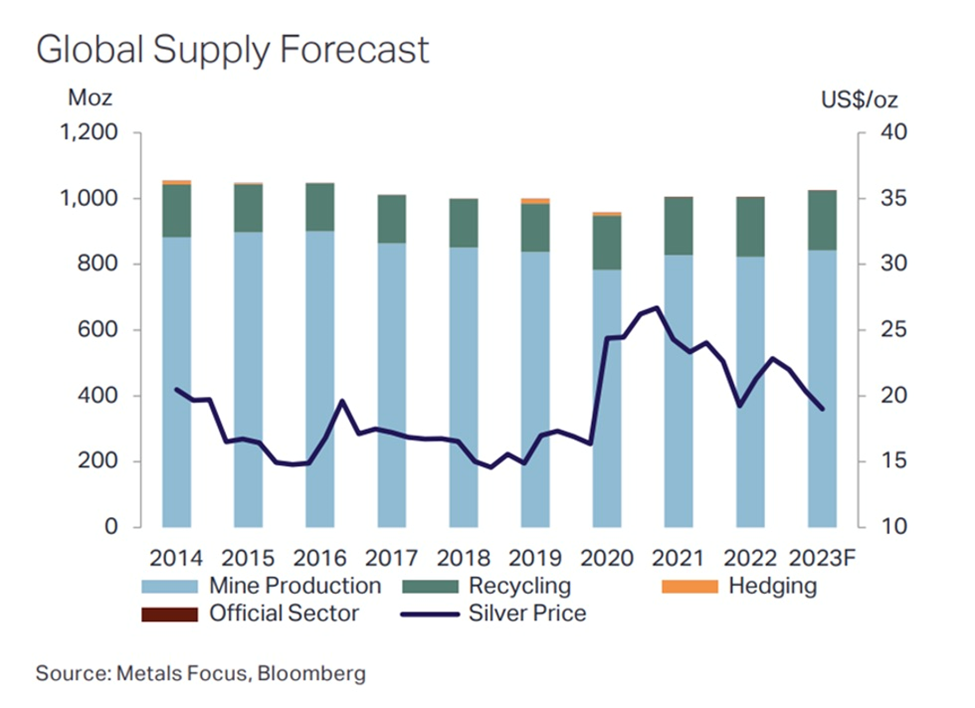

In 2023, we will most likely see a repeat of last year, with solid demand (+4%) and a slight increase (+2%) in mine production.

The Silver Institute is forecasting another 1.17 billion ounces demanded this year, against a projected supply of 1.02 billion ounces. While this would close the gap to 142.1 million ounces, it would still be the second-largest deficit in over two decades.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. A 2020 Saxo Bank report stated that “potential substitute metals cannot match silver in terms of energy output per solar panel.”

Using silver as conductive ink, photovoltaic cells transform sunlight into electricity. Silver paste within the solar cells ensures the electrons move into storage or towards consumption, depending on the need. It is estimated that approximately 100 million ounces of silver are consumed per year for this purpose alone.

Analysis by BMO Capital Markets has annual silver consumption by the solar industry growing by 85% to about 185 million ounces within a decade.

In the Silver Institute’s report, demand from photovoltaics climbed 15% last year to 140.3Moz, and is expected to surge another 28% to 161.1Moz in 2023.

Longer term, demand from the solar market is expected to keep up this pace. The institute, which references a World Bank projection for the energy technology segment as a basis for its predictions, forecasts that consumption could eventually hit 500 million ounces by 2050.

For context, total silver demand in 2022 was 1.242 billion ounces, meaning solar panels alone could by mid-century account for half of silver demand, compared to just 14% forecasted for 2023.

Changes to solar power technology

In fact, changes to solar power technology are accelerating demand for silver, and with little additional mine production on the horizon, this could widen the existing supply deficit.

According to Bloomberg New Energy Finance, the standard passivated emitter and rear contact cell will likely be overtaken in the next two to three years by tunnel oxide passivated contact and heterojunction structures. While PERC cells need about 10 milligrams of silver per watt, TOPCon cells require 13 milligrams and heterojunction 22 milligrams.

A recent Bloomberg story notes the difficulty in quickly cranking up silver supply, given that only 20% comes from primary silver mines. Rather, the vast majority, around 80%, of silver is mined as a byproduct of lead, zinc, copper and gold.

Newly approved projects could be a decade away from production, with the University of New South Wales forecasting the solar sector could exhaust up to 98% of global silver reserves by 2050.

Dolly Varden Silver

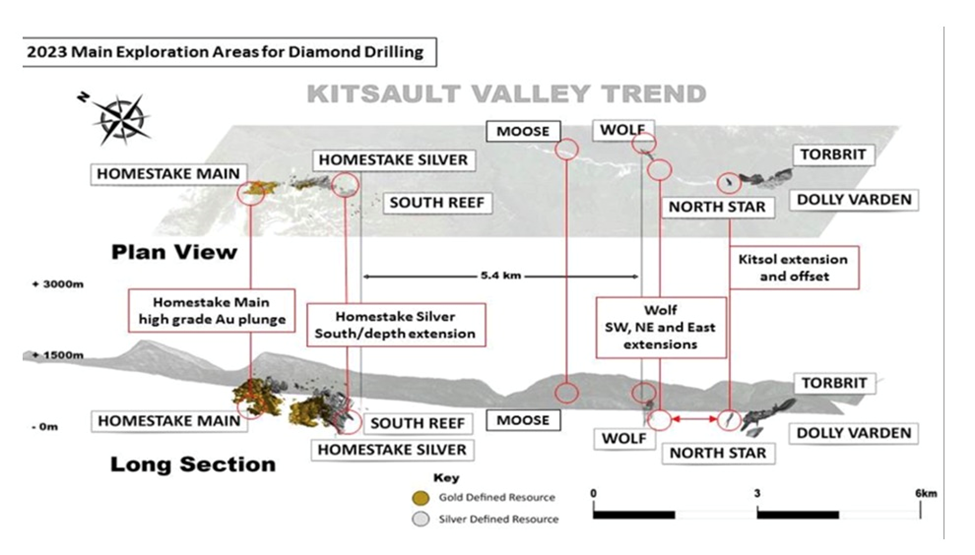

Hoping to capitalize on these extremely bullish silver market fundamentals, Dolly Varden Silver (TSXV:DV, OTC:DOLLF) recently kicked off a 45,000-meter drill program at its Kitsault Valley silver and gold project, located in the Golden Triangle region of northwestern British Columbia.

The land package, which includes the Dolly Varden silver property and the Homestake Ridge gold-silver property, hosts one of the largest undeveloped high-grade precious metals projects in Western Canada.

Last year, DV embarked on a comprehensive drill program at Kitsault Valley. The goal was to upgrade the inferred mineral resource to the measured and indicated classification, to expand the known deposits, and to discover new silver-gold mineralization along the Kitsault Valley trend.

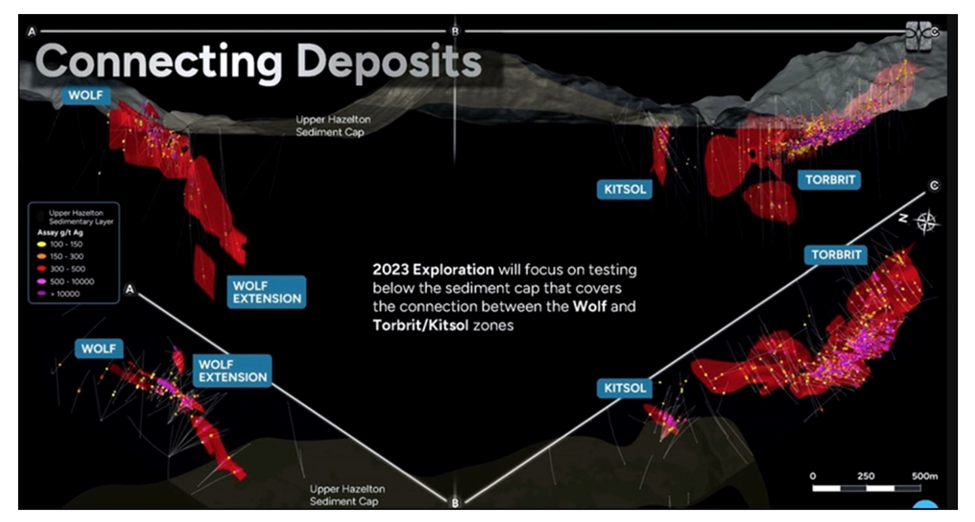

Specifically, the objective was to expand the wide, high-grade silver mineralization at the Wolf Vein, step out and infill at Torbrit and the nearby Kitsol Vein, and test several other nearby exploration targets.

Over 37,000 meters of drilling in 108 holes was completed.

In summary, the grade and consistency of silver mineralization from both the Kitsol and Wolf veins indicated the potential for an underground bulk-mineable deposit. The Wolf vein area has also emerged as a large system rivaling the Torbrit deposit.

Drilling from the newly acquired Homestake Ridge property demonstrated strong continuity of mineralization over wide intervals, similar to that of Kitsol and Wolf.

Two drill rigs are currently targeting the Wolf Vein, and two are at Kitsol, with a fifth rig available as the 45,000-meter program progresses.

“We have hit the ground running with four drills on our fully funded 2023 exploration drilling program. We have already completed several drill holes at Wolf and Kitsol, where aggressive step-outs in 2022 significantly expanded silver mineralization along strike to the north and south as well as down-dip,” Shawn Khunkhun, President and CEO of Dolly Varden Silver, said in the June 5 news release.

“The team is excited to test numerous new target areas beneath the sediment cap with the objective of connecting these two wide and high-silver-grade areas,” Khunkun added.

As disclosed previously, the priority of the 2023 exploration program is to connect the Wolf deposit with the Kitsol deposit, located 1,400 meters apart.

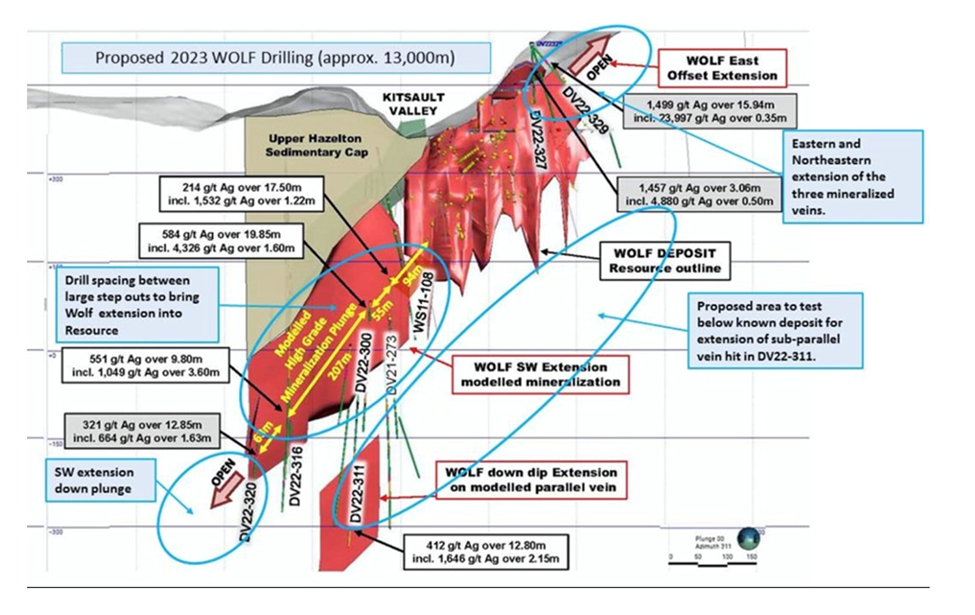

Drilling allocated to the Wolf deposit expansion (approx. 13,000 meters) will focus on both infill drilling of the wide-spaced intercepts from 2022, as well as further step-out holes in several directions where high-grade silver mineralization remains open. Similar step-out drilling will follow up on high-grade silver mineralization at the Kitsol Vein.

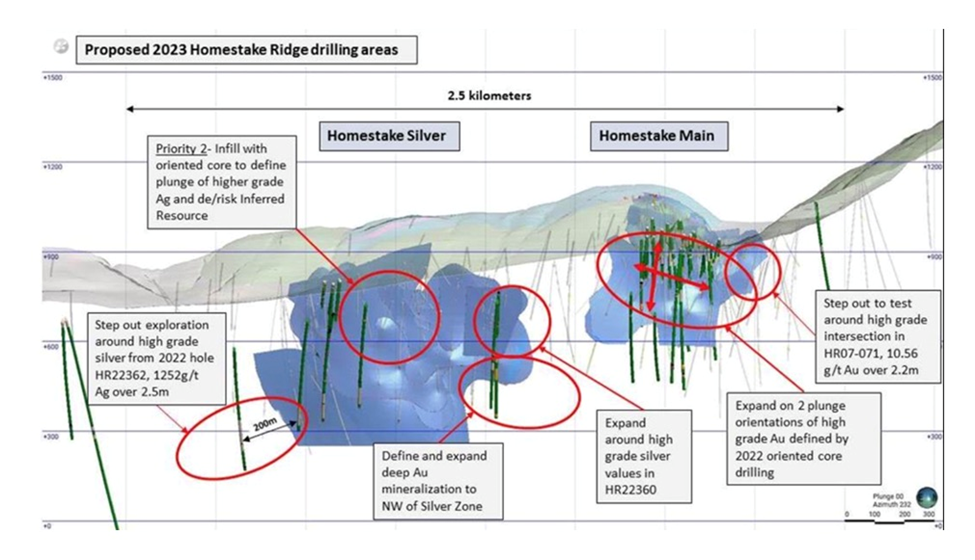

In a few weeks, the drills will be moved up the valley to the Homestake Ridge deposits. Here, 2023 drilling is influenced by structural information gained from infill drilling at the Main deposit, where two main plunge directions have been identified. The planned drilling will target the down plunge extensions of higher-grade and wider zones of gold mineralization. Drilling at the Silver deposit will prioritize step-out holes where 2022 expansion drilling had success at the southern extent.

Geology crews have been on site since early May, completing a program of additional sampling of core from 2022 Homestake Main drilling where assay results revealed an extensive low-grade gold (>0.1 g/t Au) envelope to high-grade mineralization.

Conclusion

Since the 2022 drill program, Dolly Varden has completed $22.6 million in financings, including a $1.9 million investment from Hecla Mining to keep its 10.21% ownership in the company.

This level of fundraising is almost unheard of in junior mining, and the continuous backing of Hecla, the top silver producer in the US, shows the level of confidence the market has in the Kitsault Valley project.

From just 36 cents a share at the end of September, 2022, DV’s stock price more than tripled to a five-year high of $1.23/sh on April 10, 2023. A pullback to around $0.75 presents a good entry point for shareholders wanting to capitalize on another strong set of drill results.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.74, 2023.07.04

Shares Outstanding 254.6m

Market cap Cdn$188.4m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.