New Found Gold, Eric Sprott show confidence in Exploits with $8M upsized private placement

2021.05.15

Shareholders in Exploits Development Corp (CSE:NFLD, FSE:634-FF) were rewarded this week with an explosive move in the stock price following an announced $8 million financing.

Trading in the mid-$0.80s since Monday on the Canadian Stock Exchange, NFLD powered up Wednesday morning with an 18-cent gain, topping out at $1.02 a share.

Exploits is moving right along with its 2021 exploration program involving up to 13,500m of drilling at five targets — all of which are very prospective. Three of five host visible gold at surface with impressive grades up to 194 g/t Au.

The drilling contractor has been named and all five drill permits have been issued by the Newfoundland & Labrador government.

On May 12, Exploits published news that a previous financing involving billionaire resource investor Eric Sprott, has added New Found Gold (TSXV:NFG), whose exploration in 2019 yielded a stellar drill intersection of 92.86 g/t Au over 19 meters near surface, one of the highest ever seen in the province.

The 60-cent financing has Eric Sprott and New Found Gold each subscribing for $4 million, doubling Sprott’s investment and bringing his ownership stake in the company to 15.1% on a non-diluted basis. NFG increases its share to 13.6%, non-diluted.

“With Mr. Sprott doubling his investment in Exploits, and New Found Gold expanding on their existing cornerstone position, we are very pleased to have recognition of the exploration potential of our holdings in the Exploits Subzone in Newfoundland from these shareholders, and also their endorsement of the Company and its management team,” said Exploits’ President, CEO and Director Michael Collins. “With 5 drill permits in hand and a drill rig mobilizing shortly, Exploits is positioned for discovery and delivering value to our shareholders.”

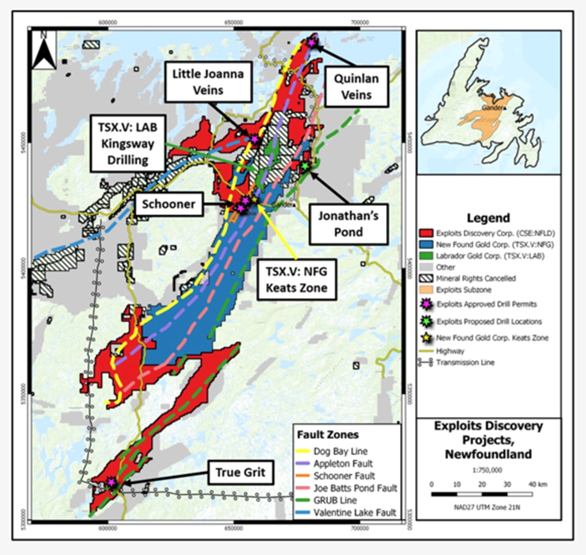

As the dominant landholder in Central Newfoundland exploring over 200 km of deep regional fault structures known to host significant gold discoveries, Exploits continues to generate buzz in what is one of the world’s most exciting gold area plays.

The company is fully funded for its spring/ summer drill programs and has received drill permits for True Grit, Schooner, Quinlan Vein, Little Joanna and Jonathan’s Pond.

The contract awarded to Newfoundland-based Majors Contracting is for 7,500 meters, with an option to extend to 13,500m.

Following is a summary of the five areas to be drilled:

- Schooner was the first high priority target identified by GoldSpot Discoveries. The Schooner Fault is parallel to the gold-bearing Appleton Fault which hosts NFG’s Keats Zone. Drilling will focus on a Schooner Fault splay, where the fault splits in two, and two secondary fault intersections.

- Little Joanna returned NFLD’s highest-grade visible gold in outcrop from quartz veins, averaging 30cm in width, uncovered up to 20m in strike, before disappearing under overburden. Sixteen samples from outcrop and subcrop at the Little Joanna Veins were taken with values ranging from 0.1 to 194 g/t Au. Five samples with visible gold returned assays of 194, 133, 123, 119 and 118 g/t Au.

- The Quinlan Vein prospect is located on a secondary structure splaying off the Appleton Fault. There are multiple 50-70cm-wide quartz veins over a 25m-wide zone, currently exposed 5-20m in strike before diving under overburden. Visible gold was discovered as fine grains in crack seal fractures and as fine to coarse grains in the quartz veins. Trace sulfide mineralization is also present in the quartz veins as pyrite, chalcopyrite, galena, and sphalerite. The veins are milky white with sections of vuggy and crack seal textures, which are typical of epizonal, orogenic gold deposits. Structurally, the veins are situated within secondary fault structures associated with the Appleton Fault zone, that were highlighted by GoldSpot’s geophysical analysis.

- True Grit is adjacent to the GRUB line fault and has seen some historical drilling (including 0.60 g/t Au over 117m from surface) plus new VTEM geophysics and an SGH soil survey completed within the past five months. The soil and geophysical results indicate that the historical drilling was in the wrong orientation and missed the best targets.

- About 30km southwest from Little Joanna is Jonathan’s Pond. Exploits consolidated its property here in late 2020 with land acquisition from New Found Gold, in exchange for 6.5 million shares, or 9.9% of the company at the time. This project has received the most historical work of any property in NFLD’s portfolio, with historical rock grab samples returning up to 29 g/t and 700 g/t Au. The property features a large, distinctive quartz vein exposed for over 200m, and is bound by the JBP and GRUB line faults. The company has also identified the JP Demagnetized Zone which stretches over 2 km, parallel to the structures known to host visible gold at the JP Veins.

Conclusion

Exploits is AOTH’s favorite gold junior in this exciting and evolving Canadian area play, for a number of reasons, but the main one is location.

Mining area plays, where a ground-breaking junior hits a discovery hole then begins staking prospective land around it while other companies rush in and do the same, are the very essence of junior resource markets.

Area plays like Eskay Creek, Hemlo and the 2010 White Gold Rush, can be company-makers, and they often produce the elusive 10-baggers (or more) all gold investors dream about.

Eric Sprott and New Found Gold have been quietly investing in companies surrounding the Queensway project, taking part in financings like the one just announced by NFLD, and hoping to secure future ounces.

It seems plain to me that the end game here for New Found Gold is to eventually own the whole area play; they have the market heft to do it. While most of the juniors surrounding it are trading under a buck, NFG has risen to over $8/sh and now has a market cap of $1.34B.

Too rich for my blood but that’s not the point.

Exploits’ projects all have comparable geological, geochemical and structural settings to the nearby Queensway discovery held by New Found Gold. That’s right, the same faults and sub-faults that served as perfect catch basins for gold mineralization as it bubbled up to surface.

It makes sense, therefore, for New Found Gold to want a piece of Exploits Discovery Corp. As mentioned the company is the largest landholder in the region and there is every reason to suspect that Exploits has an excellent chance of becoming another New Found Gold.

The value proposition here is compelling.

Two companies, each with beautiful gold projects in an underexplored region in a safe jurisdiction for mining. One trades for $8.00, the other can be purchased for 89 cents.

Exploits hasn’t even started drilling yet and it’s already more than doubled in less than a month — another AOTH winner for those who bought shares.

I have high hopes for NFLD, including a very good chance of a discovery hole, when the drills start turning.

Exploits Discovery Corp.

CSE:NFLD, FSE:634-FF

Cdn$0.91, 2021.05.14

Shares Outstanding 75.3m

Market cap Cdn$69.3m

NFLD website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Exploits Discovery Corp. (CSE:NFLD). Exploits is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.