Mountain Boy Minerals hunting high-grade silver and gold targets in BC’s Golden Triangle

2020.07.17

With a rich gold mining history that spans over 100 years, the Golden Triangle, just inland from the Alaska panhandle in northwestern British Columbia, has been the site of three gold rushes and some of Canada’s greatest mines, including Premier, Snip and Eskay Creek.

Other significant and well known deposits include Brucejack, Galore Creek, Copper Canyon, Schaft Creek, KSM, Granduc, and Red Chris.

Premier Gold Mine, which started operations in 1918, returned 200% on the stock market between 1921 and 1923. The Snip Gold Mine produced a million ounces in the 1990s at an average grade of 27.5 grams per tonne (g/t). Eskay Creek was Canada’s highest grade gold mine and the world’s fifth largest silver producer, with production well over 3 million ounces of gold and 160 million ounces of silver.

But after this amazing rush of discoveries, the Golden Triangle, at least news and investor interest-wise, went dormant; isolated from major infrastructure, the area was expensive to conduct sampling, surveys and drill programs, and due to its harsh winter climate, only accessible for half a year.

Lately, however, there has been a resurgence of interest in the Golden Triangle, with the excitement driven mostly by new road and power infrastructure built by the BC government, receding glaciers revealing fresh mineralization, and the opening of Pretium’s Brucejack mine in the summer of 2017. With 14.1 g/t gold in reserves, Brucejack, an underground gold and silver mine, was ranked the highest-grade new mine in the world in 2016.

American Creek

The story of Mountain Boy Minerals’ (TSX-V:MTB) involvement in the Golden Triangle, particularly the area east of the old Premier gold mine, about 20 km from Stewart, begins in the early 2000s when the company and predecessors began picking up claims around the historic Mountain Boy mine.

The claim situation in that region was complex. Prospectors that came into the district in the early 1900s found gold and silver veins at surface and staked them. At the time they were known as Crown Grants, equivalent to patented claims in the US, ie., privately owned.

When explorers returned to the Golden Triangle in the 1970s-80s, they were confronted by Crown Grants in the southern part of the region. Faced with tracking down the owners (in many cases second or third generation heirs of the original owners) and cutting deals on each small claim, the region was passed over, in favor of areas to the north where the ground was open. A flurry of exploration led to the discovery of some of BC’s biggest mines, including Eskay Creek, Snip, Red Chris and Brucejack.

In the late 1990s, the BC government started enforcing the requirement that taxes be paid on mineral claims. Unpaid taxes meant the claims reverted back to the government. Over time, Mountain Boy accumulated the ground around the old mine as well two large properties further east – BA and Surprise Creek. None of these areas had ever been properly explored. They had been looked at by multiple operators exploring on small plots but no one had ever taken a big picture view.

In 2006, Mountain Boy conducted a 19-hole drill campaign around the old Mountain Boy silver mine that lies at the center of American Creek. A small underground drill was used. The average hole length was 47 meters – barely scratching the surface. The focal point was the aptly named High Grade Vein, which was the heart of the historic mining. Six holes in that vein intercepted more than a kilogram of silver over at least a meter, with the highlight being hole 2006-10 which hit 5,258 g/t over 5.18 meters. (5 kg is 160 troy ounces)

In 2011, the company put in an access road to the lower workings of the mine and drilled some of the other veins around the mine, with highly encouraging results, including 396 g/t Ag over 4.5 meters in DDH-MB-2011-1. At that time, they didn’t have a comprehensive geological model and the property was limited in size.

“I was blown away by the geology. Really impressed, really intrigued”, Lawrence Roulston, the CEO of Mountain Boy Minerals, told Ahead of the Herd, in an interview about the company’s history, discoveries and exploration plans in the Golden Triangle. “They were getting amazing results on the Mountain Boy mine and their Red Cliff project and Surprise Creek. While working on my Resource Opportunities newsletter, I was watching the results and thinking ‘there is something really significant here.’”

Roulston had previously managed junior resource companies, after studying geology and business administration at UBC, and a stint at Canadian mining stalwart Cominco before it merged with Teck.

When a chance came a couple of years ago to get involved with Mountain Boy, Roulston, no longer managing the newsletter, grabbed the opportunity.

First appointed a director, then the CEO, Roulston’s first priority was to expand American Creek to the west and north. The northerly claims had been kept in good standing with surface exploration by a series of individual owners but had never been drilled. To the west, only airborne geophysics and limited surface work had been done. “You have these multiple ownerships over a highly prospective ground where nobody had ever looked at it from a big picture or geological model,” says Roulston.

The company has since consolidated a 26 square km land position, assembled a highly experienced geological team and compiled the wealth of historic information. The big game-changer came in the summer of 2018. Poring over the historical results, Roulston wondered how there came to be such high-grade mineralization so far from what had generally been seen as the source of the mineralization, the Premier district, immediately west. The Premier district, which produced 2.5 million ounces of gold and 60 million oz of silver, is about to go back into production.

The very high grades throughout the Mountain Boy mine area extends east of American Creek to the old Terminus and Ketchum mines. Furthermore, the rock textures and style of mineralization all pointed to a nearby mineralizing source.

“I’m thinking this is not the kind of mineralization that is peripheral to a mineralized system, this is right in the heart of it,” he recalled.

Lucia Theny, vp exploration, carried out the first systematic exploration along the American Creek valley. A soil grid was put in to follow up on some intrusive dykes that the team had mapped. Closer examination of some gossanous rocks found in the course of the soil grid resulted in finding an intrusion that had never previously been mentioned. Lucia noted the similarity to the Premier porphyry, the driving force for mineralization in the Premier district. Geochron analysis (dating) confirmed an Early Jurassic age, similar to the Premier porphyry and other major deposits in the Golden Triangle.

Further prospecting and mapping demonstrated that the intrusion runs along American Creek for several kilometers. Exactly how far remains to be seen, but the fact that Pretium, on their American Creek project, bordering MTB’s property to the north, has hit good results, has Roulston thinking this trend could extend all the way through to the Pretium property.

Outlining this intrusion has been a game-changer for MTB. It is the same age as the Early Jurassic intrusion at the heart of the Premier District, the same minerology, similar alteration and a similar scale.

“For the first time we’re looking at this on a comprehensive basis. We’re seeing compelling evidence that what we have on the ground is similar to the other gold-silver systems in the Golden Triangle. In particular, it looks very much like the geological setting at Premier, with its high-grade silver and gold values extending over kilometers. We know there is something there of real significance. The challenge now is to demonstrate that potential in the most effective manner.”

“For the first time we’re looking at this on a comprehensive basis, we’re seeing compelling evidence that what we have on the ground is exactly the same as the other systems in the Golden Triangle.”

Mineralization

According to MTB, the American Creek project has multiple styles of mineralization, which closely parallels the situation at Premier. The predominant style consists of epithermal silver-dominant polymetallic veins associated with a medium sulphidation hydrothermal system. That system appears to be directly related to the recently outlined Early Jurassic intrusion. This is the dominant style around the Mountain Boy mine. The high grades of silver, and the minerology and rock textures point to that area being high in a hydrothermal system. Such systems sometimes transition to more gold dominant at depth.

The Chris prospect, near the Mountain Boy mine, produced high grades of copper, introducing an intriguing element to the geological model and pointing to a multi-phase mineralization event.

The newly-found Wolfmoon zone is believed to be situated at a higher stratigraphic level than the veins around the old mine. Notably, the Wolfmoon mineralization is found at the transition between volcanic and sedimentary rocks. This stratigraphic position hosts volcanogenic massive sulphide deposits such as Eskay Creek elsewhere in the Golden Triangle. This style of mineralization is similar, and occurs in the same rock units as the Silver Hill target on the Premier property, where Ascot reported good results from drilling last year.

Just southeast of American Creek, Mountain Boy owns a 35% interest in Red Cliff, a past-producing copper-gold mine. More than 400 drill holes outline a mineralized zone that extends for 2.3 km, is several meters wide and open at depth. Highlights include 43.9 g/t gold over 7.5m.

The company has also re-activated exploration on the BA and Surprise Creek projects. The combined properties host an extensive silver-rich VHMS system. At the Barbara zone, 178 holes have outlined a replacement style VHMS silver-lead-zinc deposit with favorable grades. At least nine other zones have yet to be tested; the property is permitted for drilling. The property was drilled by Great Bear before that company turned their attention to the Dixie project in Ontario. In selling their 50% interest back to MTB, Great Bear has become a significant shareholder of MTB.

Finally, the recently acquired Southmore project is located just south of the completed part of the Galore access road and adjoins the Enduro Metals property. In 1990, the last recorded exploration, samples assayed up to 13.58% copper with lead, zinc, gold and silver values.

Receding glaciers have opened up unexplored areas. Initial grab samples in MTB’s 2019 first pass exploration program yielded multi-gram gold values.

According to Roulston, Mountain Boy sees these properties as candidates for joint ventures, after completing some more field work on them this exploration season.

Exploration

On May 27, Mountain Boy Minerals announced the kick-off to its 2020 exploration program at American Creek. The two-phase campaign will first involve a LiDar aerial survey of the property, as well as further prospecting and mapping to confirm the drill locations. Three targets will then be drilled in Phase 2, with the objective of confirming the geological model, ie., that the various mineralized occurrences are surface expressions of a large geological system, analogous to the Premier District.

The three targets are:

- The area around the historic Mountain Boy mine;

- The extension of those veins onto newly acquired property to the north;

- The new Wolfmoon zone.

At the mine, a key part of the drilling will target the High Grade Vein, testing down-dip from where the 2006 drilling hit more than 5 kg of silver.

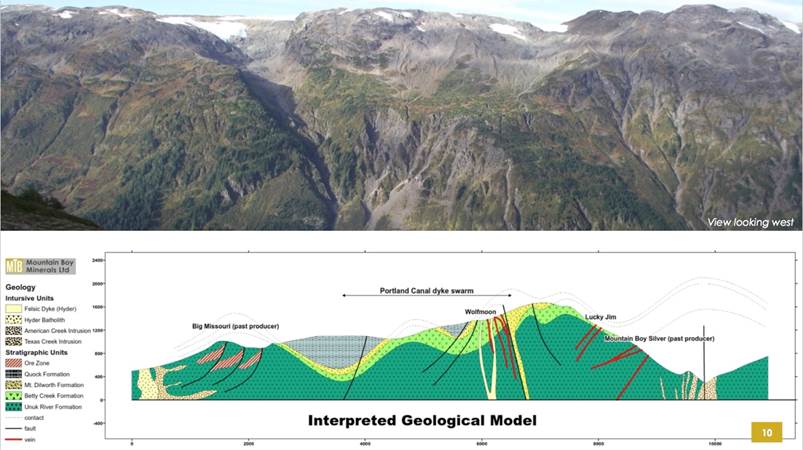

A helicopter-supported and more powerful drill rig will over-come the inability of the earlier drilling reaching down-dip on that vein. In the photo below, the mine area is just below the center of the photo. The cross section shows schematically the current understanding of the vein orientations.

This first drill program is budgeted at 4,000 meters and will involve 20-30 holes spread across the three target areas. Like all veins systems, the intensity of the mineralization varies along the vein.

“If that initial drilling demonstrates that the veins continue to depth and laterally, I think that’s enough that people are going to recognize the significance of this system,” he told me during our interview. “It’s a typical epithermal vein system, you get shoots, hot spots and areas not so hot. So the first few holes are going to give us an indication of structure, orientation and maybe a hit in the mineralization.”

“We’ll do a few holes near the old mine looking for extensions of the high-grade zone, and then we’re going to step out on these veins to the north. That property has been held for a couple of decades by individuals who did some great work and identified the veins at surface, but it has never been drilled.”

Regarding Wolfmoon, Roulston referenced Ascot Resources’ Silver Hill property, about 4 km away, where a surface sample returned an off-the-charts 15 kg/tonne silver assay. A 2019 induced polarization (IP) survey followed by drilling revealed plus 1 kg silver values in a drill hole.

That setting is very similar to Wolfmoon. Mountain Boy therefore plans to use IP to target vein orientation beneath the high grade surface samples.

According to Roulston, “Each one of these targets is potentially a company maker. If we start to see joy on multiple targets it’s going to provide a lot of support for our district model.”

Having twice extended the private placement financing in response to strong demand, MTB is now planning a larger program on the secondary projects, which may include further drilling at BA.

Conclusion

Mountain Boy Minerals is active in one of the best jurisdictions for base and precious metals exploration. Between past-producing gold mines and current compliant resources, British Columbia’s Golden Triangle has yielded a whopping 200 million gold ounces, putting it in the same league as the Carlin Trend in Nevada, the second-largest repository of gold on Earth.

The Triangle is also one of only a few billion-ounce silver districts in the world.

After several years – remember, Mountain Boy has been around since the early 2000s – the company is finally ready to get results on multiple targets, which hopefully will provide evidence of a district-scale opportunity that will create an enormous amount of interest, from the market and larger mining companies.

MTB has assembled a large land position centered around its flagship American Creek project and zeroed in on three targets for its summer drill program. Work this year on the other projects is intended to set them up for larger programs next year, perhaps funded by joint venture partners.

Roulston and his team are going for high-grade in the Golden Triangle. As he states, hitting a discovery hole on any of these targets could light this thing up. Expect a slow ramp-up in the first phase and growing interest once the drills start turning in late summer to fall.

Mountain Boy Minerals

TSX.V:MTB, Frankfurt:M9UA

Cdn$0.40, 2020.07.17

Shares Outstanding 36,710,382m

Market cap Cdn$14.68m

MTB website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Mountain Boy Minerals (TSX.V:MTB, Frankfurt:M9UA). MTB is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.