Momentum builds for US soft landing with no recession – Richard Mills

2023.09.08

A while ago, we insinuated that the Federal Reserve may just be able to pull off its fabled “soft landing”, and that prediction is looking pretty shrewd right now with the way the US economy is going.

Corporate profit-taking is greasing the runway for a “soft landing”

The clues, as we just detailed here, have always been there: The big American corporations, drivers of a substantial share of economic activity, are booking massive profits, and that equals higher employment and more disposable income for consumers.

Simply by raising prices to fit the inflation theme, the rising interest rates have done nothing but boost their bottom lines. In fact, interest payments as a percentage of post-tax profits are actually sitting at their lowest in 60 years! It’s therefore no surprise that the S&P 500 regained more than half of the bear market losses suffered in 2022, and now, as Wall Street claims, is in a bull market.

As we also discussed many times before, the central bank can’t just keep raising rates, simply because it can no longer afford to (Note that the annual payment on US federal debt, which currently sits at $32.6 trillion, is about to hit $1 trillion).

Eventually, interest rates just have to come down due to the “inability of the economy to sustain higher rates due to mounting debt issuance and rising deficits, as Lance Roberts of RIA Advisors predicted here. The RIA chief portfolio strategist/economist also pointed to the idea that interest rates are relative globally, so higher yields in US debt would attract flows of capital from countries with low to negative yields, which then forces US rates down.

Furthermore, it’s actually possible for the Fed to suppress interest rates and to sustain weak economic growth, Roberts says, as non-productive debt (i.e. military spending, welfare programs) does not create economic growth.

And with inflation nearing the Fed’s 2% target and the US economy growing at a rate in line with the pre-pandemic years, a “soft landing” is well within sight.

Of course, nothing is 100% set in stone until it happens, but it’s always nice to be on the right side of a bold call.

Soft Landing ‘Not Easy’

Make no mistake, for the Fed to achieve a “soft landing” — referring to a moderate economic slowdown following a period of growth that manages to avoid a recession — is not easy. Strictly speaking, this only happened once over the past 60 years. This was when the Fed, under the guidance of Alan Greenspan, doubled interest rates to 6% between February 1994 and February 1995.

On the other hand, a “hard landing” (the opposite of “soft landing”) is much more common. A recession followed the last five instances when inflation peaked above 5% — in 1970, 1974, 1980, 1990 and 2008.

The reason a “soft landing” is hard is because when the US central bank embarks on a monetary tightening cycle to control inflation, the rise in interest rates makes the cost of borrowing more expensive, which stifles investments and puts a strain on the overall economy.

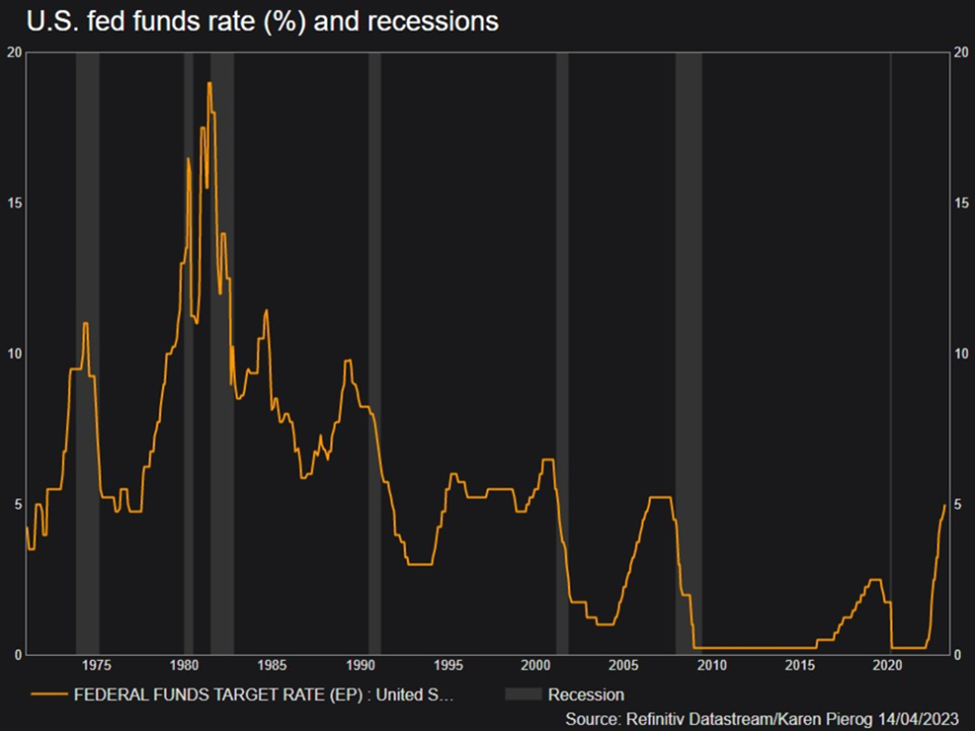

Since March 2022, the Fed has been doing exactly that, and at its most aggressive pace in 40 years, to combat inflation levels that have hit their peak over the same period. As of July 27, 2023, a total of 11 rate hikes were implemented, with the federal funds rate now sitting within a range of 5.25-5.50% (was 0.25-0.50% when the rate hikes first started).

So, within a span of 15 months, the US interest rates essentially went up by 5%, which understandably had many concerned about a recession scenario as early as the end of this year. Those concerns are valid, that is, if they’re based solely on historical precedents (as illustrated below).

But 2023 could spell another rare triumph by the Fed. There are multiple signs already pointing to a successful “soft landing”, none bigger than indications from the bank itself.

Fed Turns Optimistic

In late July, Federal Reserve chair Jerome Powell said in a news conference that the central bank’s economists no longer foresee a recession, which represents a reversal of the “mild recession” prediction given after its March meeting.

The Fed’s more optimistic outlook was recently reaffirmed by the minutes from the July 25-26 meeting, which stated that: “The staff no longer judged that the economy would enter a mild recession toward the end of the year,” though it still felt the economy would slow to a growth rate below its long-run potential in 2024 and 2025.

Even before Powell’s comments, the Fed had appeared to confirm a “soft landing” outlook by raising their median 2023 growth projection to 1.0%, which is more than double the previous forecast of 0.4%. This essentially revised their implicit recession call in the process, and importantly, changed their stance on whether a soft landing is realistic.

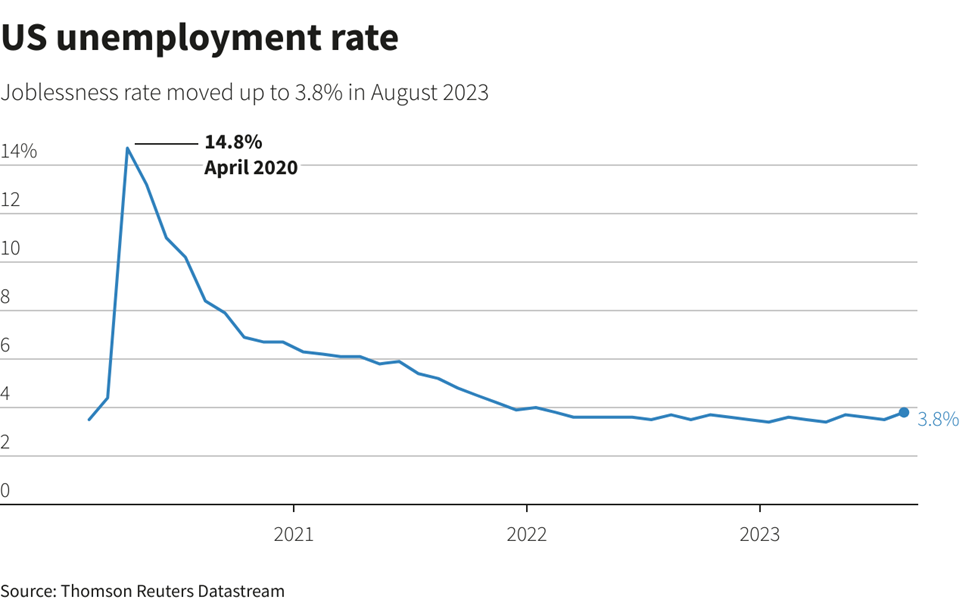

It also lowered their 2023 unemployment rate forecast and trimmed the outlook for the next two years, while slightly raising their 2023 inflation outlook but keeping their 2024 view unchanged.

Previously, Fed officials were predicting that unemployment would rise to 4.6% from 3.5%. In the eyes of some economists, a rise in the unemployment rate of more than 1% was seen as the Fed essentially trying to engineer a recession to bring down inflation.

The same officials are now predicting that the unemployment rate will rise to only 4.1% (from the current 3.7%) by the end of the year, and 4.5% for the next two years.

Meanwhile, the median projection for overall inflation (as measured by the personal consumption expenditure index) has fallen to 3.2% from the 4.4% set in April of this year, mirroring the Fed’s optimism in bringing price levels down.

Despite easing inflation, the Fed has maintained that another interest rate hike of 50 basis points will be needed sometime in the future. However, that would likely spell the end of its current tightening cycle for good.

In this year’s Jackson Hole economic summit, Powell reiterated the need to “proceed carefully” and the Fed’s commitment to the 2% inflation target, acknowledging that the US economy is at a point where inflation has by some readings slowed a lot without much cost to the economy.

But, as we know, the Fed chair can be all diplomatic he wants, but in reality, the bank doesn’t need to wait until it gets to its target. “The idea that we would keep hiking until inflation gets to 2%, it would be a prescription of going way past the target. That’s clearly not the appropriate way to think about it,” Powell previously said.

Backtracking on Recession Calls

Also backtracking on their “mild recession” calls are some of the most reputable economists.

At the beginning of the Fed’s rate hike cycle, many were absolutely convinced that a recession was bound to happen like it had in the past. Bear in mind, the US economy was already entering a downturn at the time; through the first two quarters of 2022, its GDP contracted at a 1.6% annual rate from January through March and at a 0.6% annual rate from April to June.

“A number of forces have coincided to slow economic momentum more rapidly than we previously expected,” Michael Gapen, chief US economist at Bank of America, said back in July 2022, adding that:

“We now forecast a mild recession in the US economy this year … In addition to fading of prior fiscal support … inflation shocks have eaten into real spending power of households more forcefully than we forecasted previously and financial conditions have tightened noticeably as the Fed shifted its tone toward more rapid increases in its policy rate.”

Fast forward a year later, Gapen and many others are now forced to “eat their words” and retract their previous forecasts, simply because the economic readings this year have been surprisingly good.

The US labor market, for one, continues to defy interest rates, with healthy numbers all around. Consumer spending has also accelerated, hitting an all-time high of $14.2 trillion in the second quarter.

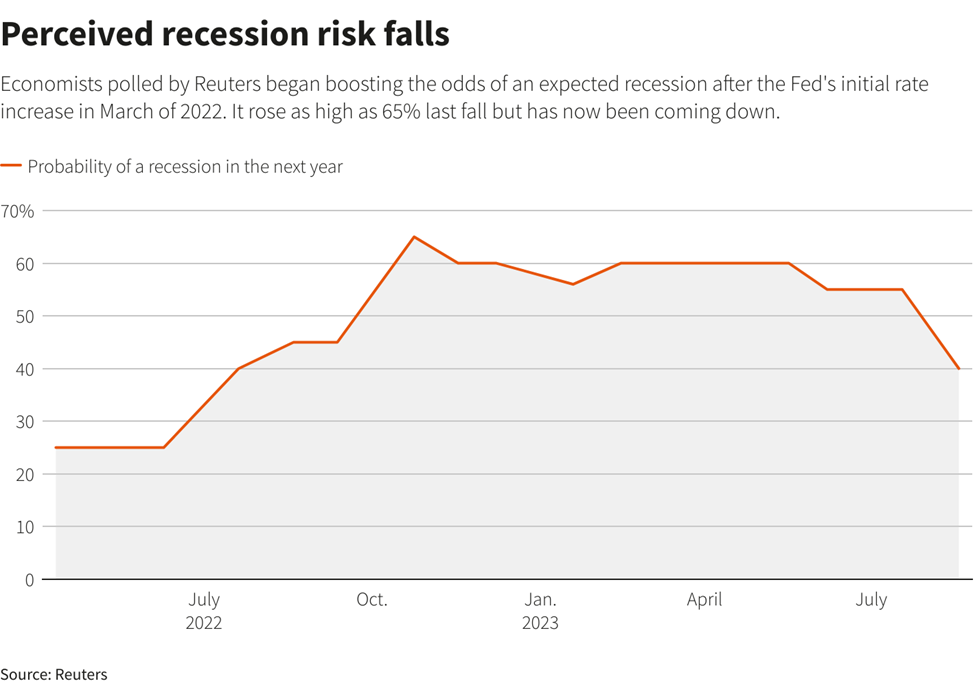

A recent Reuters poll of economists over the past year showed the risk of a recession one year out rising from 25% in April 2022, the month after the first rate hike of the Fed’s current tightening cycle, to 65% in October. The most recent read is 55%.

“Incoming data has made us reassess our prior view” of a coming recession that had already been pushed into 2024, Gapen wrote earlier this month. “We revise our outlook in favor of a ‘soft landing’ where growth falls below trend in 2024, but remains positive throughout.”

Bank of America isn’t the only financial institution to essentially admit their mistakes in public.

In mid-July, Goldman Sachs revised down the odds of a US recession happening in the next 12 months, cutting the probability down to 20% from 25% on the back of positive economic figures being pegged.

JPMorgan’s economists followed that up with a more buoyant outlook, stating that the bank is no longer forecasting a US recession this year and has raised its economic growth estimate as the economy expands at a “healthy pace.”

What really threw economists off, according to Omair Sharif, president of Inflation Insights, is the staying power of consumers.

Spending has shifted from the goods-gorging purchases seen at the start of the coronavirus pandemic to the hot services economy that exploded this summer in billion-dollar movie runs and music concerts, Sharif said.

But regardless of what’s in the basket, the amount being spent and circulated around the economy just kept on growing. This left many to steadily push back the date when the “excess savings” of the pandemic era will run dry, or puzzle over whether low unemployment, ongoing strong hiring and labor “hoarding” by companies, along with rising earnings, have trumped any anxiety over the outlook.

As this Reuters article points out, it could be that rising interest rates just don’t have as large of an impact on an economy that spends more on less rate-sensitive services, and where businesses have continued to borrow and invest more than many economists anticipated.

The surge in government spending also gave an unexpected boost to growth.

Of course, it’s still possible for inflation to resurface alongside a tighter-than-expected economy, and Fed policy would need to become even stricter and induce the inflation-killing downturn that officials still hope to avoid. But the odds of that may be falling.

“We’ve been wavering for a while on whether to shift to the ‘soft-landing’ camp, but no longer,” noted Sal Guatieri, a senior economist at BMO Capital Markets told Reuters, in reference to the Fed’s hopes of lowering inflation without provoking a recession.

“Broad strength” in the US economy, he said, “convinced us that the economy is more durable than expected … Not only is it not slowing further, it might be picking up.”

The Signs Are There

Clearly, there are signs pointing to the Federal Reserve being able to successfully engineer a “soft landing”; and the most recent US economic data might have shushed more doubters.

Gross domestic product, the broadest measure of economic output, rose at an annualized rate of 2.1% in the second quarter, according to the Commerce Department’s most recent estimate. While this is slightly lower than its first estimate of 2.4%, it still portrays an economy being steered further away from the doom scenario.

The new estimate factored in greater consumer spending, government outlays and exports, compared with the initial estimate, with lower business investment and inventories. The economic growth for the quarter was mostly broad-based.

Looking ahead, the Atlanta Fed is predicting GDP growth to accelerate sharply to an annualized 5.9% rate in the third quarter, though that will likely be revised lower as the third quarter comes to a close.

“The economy is slowing to a pace that will help bring demand in line with the US’s productive capacity and tame inflation,” wrote Bill Adams, chief economist at Comerica Bank, in an analyst note Wednesday. “The GDP revisions are good news on two levels: Growth still looks good, and the downward revisions reduce the risk of the economy running too hot and exacerbating inflation.”

Speaking of inflation, the Fed’s preferred measure of underlying inflation posted the smallest back-to-back increases since late 2020, which was likely the driving force behind the burst of consumer spending.

The core personal consumption expenditures price index, which removes the volatile food and energy components, rose 0.2% in July for a second month. The overall PCE price index also increased 0.2%, the most up-to-date Bureau of Economic Analysis data showed

Inflation-adjusted consumer spending increased 0.6% last month on the heels of a solid gain in June. That was the strongest advance since the start of the year.

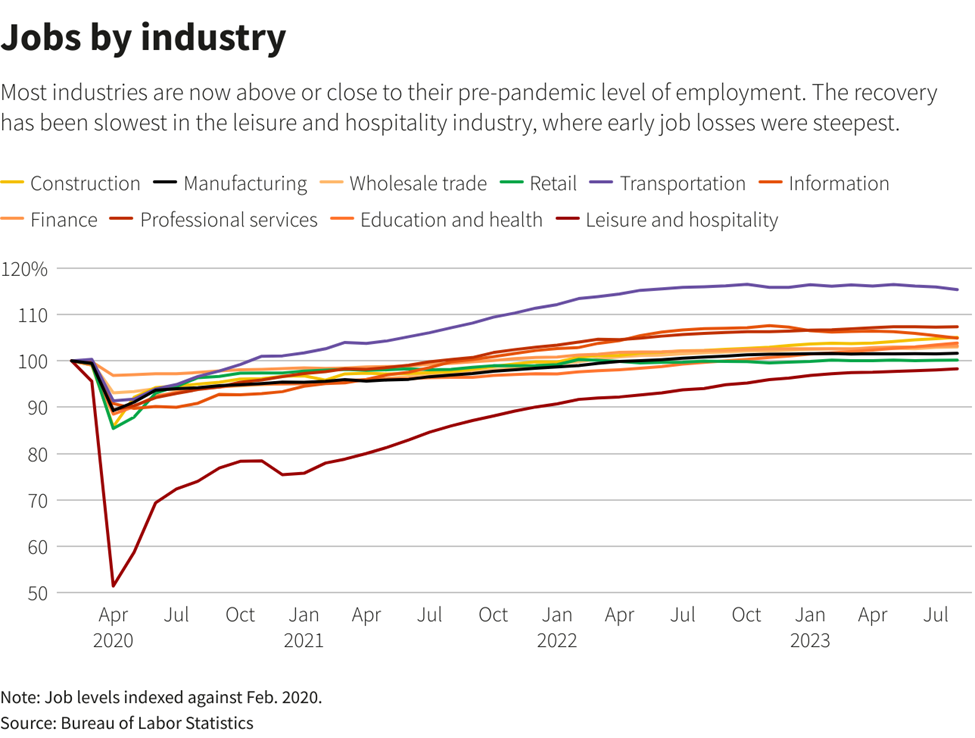

Job growth also picked up in August, while the unemployment rate rose to 3.8% and wage gains moderated, suggesting that labor market conditions were easing after hitting their peak.

Nonfarm payrolls increased by 187,000 jobs last month, after rising by 157,000 in July. This surpassed an analyst estimate of 170,000 for August. Job growth averaged 150,000 per month over the past three months, sharply down from 238,000 in the prior three-month period.

“This is still not the picture of the labor market we would expect to see if the economy were in danger of decelerating dramatically in the short term, although without question there are signs of moderation,” said Rick Rieder, chief investment officer of global fixed income at BlackRock, in a Reuters note.

This slowdown, as some suggest, could put the nail in the coffin for the chances of another rate hike by the Fed this month. Goldman Sachs told CNBC that the payroll numbers help confirm the firm’s forecast that the Fed is finished hiking rates during this cycle.

“The broad message here seems to be that we are nearing full employment, with supply and demand coming more into balance,” Bank of America’s US economist Stephen Juneau said in a client note. “The gains are concentrated in the laggard sectors. The rest of the labor market probably is at full employment.”

Conclusion

Momentum is surely building for a soft landing with no recession, which at this time last year would’ve been laughed off at.

The latest US jobs report portrayed a dream scenario for policymakers: more jobs created than expected and a rise in weekly working hours, reflecting the robustness of the economy, paired with an uptick in unemployment levels and slowing wage growth, which removes the need for further rate hikes.

This, according to former Treasury Secretary Larry Summers, improves the chances of a soft landing. “These numbers are consistent with very optimistic scenarios,” he said in a Bloomberg TV interview this week.

The better economic data also favors the US dollar, and in turn, raises the likelihood of a soft landing, as noted by those at wealth management firm Julius Baer. With a stronger dollar, higher US interest rates would stimulate other economies’ exports, making the kind of global recession that so many predicted even less likely.

Central bankers outside the US are already preparing for the endgame when it comes to monetary tightening. In Canada, there’s a very good chance of interest rates heading lower next year, following the Bank of Canada’s decision this week to hold rates steady as the economy shows signs of overall cooling.

Also this week, RBC’s chief executive Dave McKay told reporters that rates will need to come down to allow for the lender’s customers to “avoid major pain when the majority of its mortgage book reprices in 2025 and 2026.”

“We should be fine,” he said Sept. 6 at the Scotiabank Financials Summit. “We have lots of room to manage a soft landing here and we expect that to happen.” The difference between Canada and the US, according to McKay, is that the former has a more conservative consumer base, and so growth is slowing faster.

“The Bank of Canada is likely to leave interest rates where they are, let the economy sort of stall, maybe not an outright recession, but struggle a bit, and then bring relief in the spring once inflation is a little lower,” said Avery Shenfeld, chief economist at CIBC Capital Markets, via Bloomberg.

Also recently, the Bank of England governor Andrew Bailey said UK interest rates are probably “near the top of the cycle”, seeing that a further “marked” drop in inflation is likely this year. This signals another major economy bringing its tightening cycle to an end.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.