Mexico-focused Brigadier Gold discovers new vein system

2020.10.07

Brigadier Gold (TSX-V:BRG) has moved one step closer to proving that Picachos hosts a district-scale mineralized system similar to its neighbors.

On Tuesday, the company announced results from recent sampling of the El Placer vein system at Picachos, its gold and silver project in Sinaloa State, Mexico. The new discovery, consisting of multiple parallel veins, comes at an interesting time. Brigadier Gold has just inaugurated a maiden drill program at Picachos, targeting high-grade gold-silver veins.

Before we get to El Placer, a run-down of the drill program is helpful, thanks to head geo Michelle Robinson, who spoke to AOTH on Tuesday morning from the field.

Interestingly, Robinson is both the vendor of the project, having optioned it to Brigadier Gold, and was brought on as chief geologist, handling exploration and drill planning.

Robinson, P.Eng, has detailed knowledge of the property, having assembled it herself years ago. A geologist with an extensive resume to her name, Robinson is a member of working groups organized by the Mexican Mining Chamber (CAMIMEX), speaks fluent Spanish, and is a Qualified Person as defined by NI 43-101. There is arguably no-one better acquainted with these rocks than Robinson.

Value proposition

Picachos is equidistant between Vizsla Resources’ Panuco project to the north, and GR Silver’s Plomosas silver project to the south.

All three properties are on the same mineralized trend.

The highlights from 16 holes recently returned from the Napoleon Vein Corridor at Panuco, were 1,541 grams per tonne silver-equivalent (AgEq) (includes silver, gold, lead and zinc) over a 2m intersection, and 261 g/t AgEq over a lengthy 22.6m.

At Plomosas, near-surface gold and silver mineralization was recently reported at 716 g/t AgEq over 6.8m, 1,687 g/t AgEq over 0.4m, and 12.6m at 1.7 g/t Au, 17 g/t Ag and 0.7% Zn.

Brigadier Gold is aiming to replicate, or better, the successes of Vizsla Resources and GR Silver, which currently, from an investment point of view, in our opinion, are less attractive.

From the chart below it’s easy to see that newly minted Brigadier Gold stands out like a sore thumb among its Canadian junior exploration company peers operating in Mexico.

Its $13 million market capitalization is a pale ghost compared to neighboring GR Silver and Vizsla, at a respective $65 million and $137 million, much less the towering bars on the right.

Picachos

The 3,954-hectare, drill-ready property is centered over the historic “Viva Zapata” National Mineral Reserve due east of Mazatlán, in the municipality of El Rosario.

The project features over 150 historic mines and underground workings, high-grade veins open at depth, and it is road accessible, with drill permits and agreements with the local community already in place.

Primary targets include under-explored gold veins at the past-producing San Agustín mine, and La Gloria, a historic mine with rock samples containing 21.1 grams per tonne gold and 6 g/t silver across 0.8m.

Comprising four mining concessions, Picachos hosts two precious metal vein systems and a large porphyry copper prospect. It overlaps part of the western foothills of the Sierra Madre Occidental, one of the world’s largest silicic igneous provinces. Regional geochemical work at the turn of the millennium highlighted the reserve as one of the largest contiguous anomalies for gold and base metals.

It sits on one of the largest, most contiguous and highest amplitude anomalies for gold, silver and base metals in regional fine-fraction stream sediment samples in the Western Sierra Madre, with values up to 6,841 parts per billion (ppb) gold in fine-fraction, active channel stream sediments, according to the Mexican Geological Service (SGS), which staked and explored it in the 1980s.

Drill program

The company’s 5,000-meter, 40-hole drill campaign is targeting 4 high-grade gold-silver veins. The focus is on proving the potential for multiple veins; the depth, strike length and continuity of the veins; and understanding the source of the vein-hosted mineralization, along with its potential relationship to copper porphyry mineralization identified on the property.

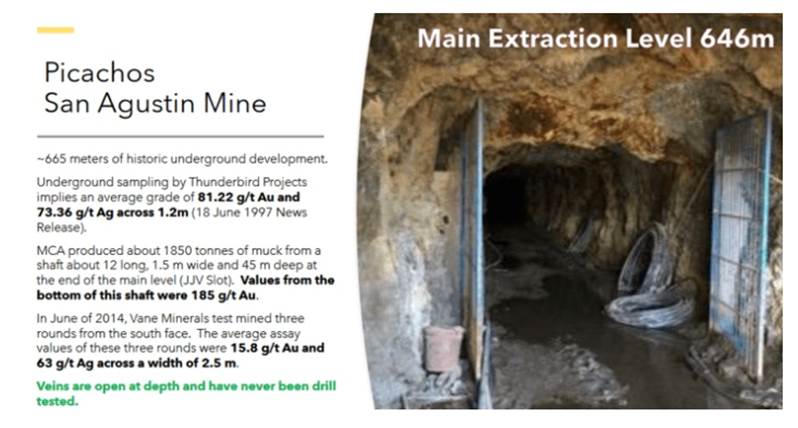

At the San Agustín mine, about 665 meters of underground development has been completed. Historic workings range from shallow pits, a few meters across, to tunnels hundreds of meters long, driven at several levels on some of the larger vein systems.

Underground channel sampling by a previous operator returned an average 81.22 g/t Au and 73.36 Ag across 1.2m. Values from the bottom of a 45-meter-deep production shaft were 185 g/t Au. In 2014, Vane Minerals test-mined three rounds from the south face. Average assay values were 15.8 g/t Au and 63 g/t Ag across a width of 2.5 m.

The veins are open at depth and have never been drill-tested – making San Agustín the primary focus of the current drill program. The first diamond drill will be aimed under the old mine workings.

“We think that by drilling there we’ll get a better sense of how wide the San Agustin vein really is and get a better understanding of the grade profile of both the gold and silver,” says Robinson.

Along with San Agustín, the first-ever drill program at Picachos will zero in on the Mochomos vein, where a historic rock chip channel sample yielded 18.5 g/t Au and 570 g/t Ag over half a meter; the Los Tejones vein with values of 28.6 g/t Au and 114 g/t Ag across a meter; and the Fermin vein, which sampled 268 parts per million (ppm) Ag and 0.3 g/t Au over 1m.

“It’s got some interesting pyrite-silver-rich mineralization hosted down hole so that’s another vein that could be parallel to San Agustín with similar strike,” Robinson said, referring to Mochomos.

She said the plan is to pierce the main structure at San Agustín, then drill offsets from it.

“We’ll step out to as we progress on this target. The decision as to when to step out is a field decision, based on how that core looks, if we’re hitting what we expect to hit.”

The campaign will also include 3 line-kilometers of trenching, across a number of historical sample sites where anomalies have been identified, and drill targets can be formalized. Most of the holes – ranging in length from 90m to 300m – are expected to be at San Agustín and Los Tejones, with a few at Mochomos and other prospects.

El Placer discovery

Guided by historical work, Brigadier’s geological team completed six weeks of mapping/ sampling around the San Agustin mine site, resulting in the discovery of the El Placer vein system mentioned at the top.

Derived from good old boots-on-the-ground prospecting, the team found up to 12 samples containing over 1 gram per tonne gold.

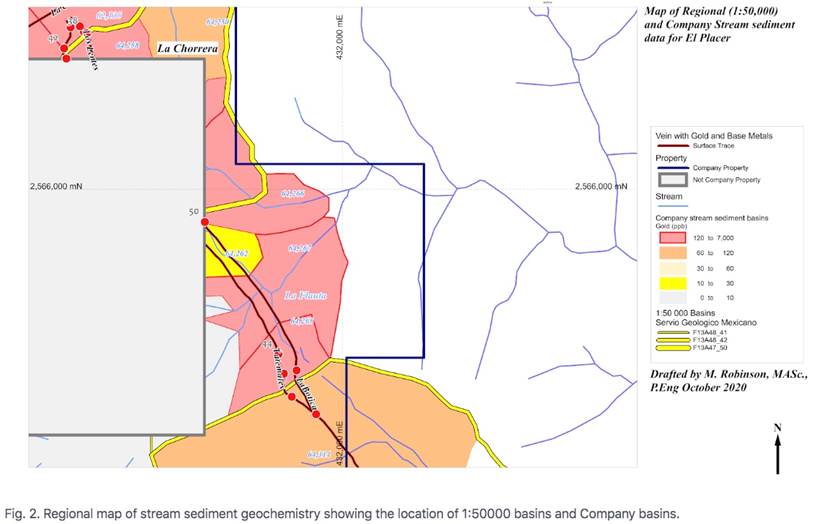

“The stream sediment results are really anomalous and that’s what drew us into the area in the first place,” Robinson commented.

The El Placer vein system has been mapped on surface over a strike length of 4 kilometres. There are several near-parallel veins within the system over a trend width, ranging from 60 to 160 meters.

“The natural exposure of the El Placer vein you can actually see the Tatemales vein on the right and the other vein, La Botic, on the left, between them is all mineralized,” she said. “The stronger mineralization is in the actual vein structures but there’s a lot of stockwork and disseminated mineralization between the veins so it’s really quite a spectacular showing.”

Sample assay results include 7.4 g/t over 3.2 meters; 12.8 g/t gold, 54 g/t silver, 0.1% copper, 7.7% lead and 6.73% zinc over 0.5m; and 101 g/t silver, 0.3% copper, 2% lead, 11.6% zinc over 1m.

Government stream sediment samples taken downstream from El Placer, define a 1,259-hectare area that includes ground east of the property. A maximum value of 2.6 parts per million (ppm) gold is reported. Government and company data sets both indicate very anomalous gold, strong base metals and subdued silver.

“The significance of these results cannot be overstated,” Robinson states, noting the Amalia discovery made by Radius Gold and optioned by Pan-American Silver, had values of just 0.06 ppm gold and silver.

Ranjeet Sundher, CEO, comments “We’re highly encouraged as Michelle and her team, driven by their intimate knowledge of Picachos, continue to bolster their understanding of the extensive vein systems surrounding the historic high grade San Agustin gold-silver mine. Our current 5,000 meter drill program is targeting several high priority veins under and around San Agustin for the first time in the project’s history. This latest round of sampling underscores our thesis that Picachos may host a district scale mineralized system not unlike those discovered approximately 15 miles to the north and south of us.”

The company has the mineral rights to two portions of the El Placer vein system – a 1,400-meter long strike named La Flauta because the historical workings look like the keys of a flute; and a 300-meter-long strike northwest of Fresñillo’s property called La Chorrera. The news release states, Structural fault damage between Tatemales and La Botica is extensive and stockwork zones are developed between these major veins.

Conclusion

Brigadier Gold (TSX-V:BRG) is an example of how quickly a company can form, start trading, and initiate a drill program, in a red-hot junior mining market.

In 60 days, the Mexico-focused company found Picachos, arranged $4.2 million in financing, and started an aggressive drill program.

Brigadier Gold isn’t re-inventing the wheel. Far from it. They are simply following the success that its neighbors to the north and south are having, in an established gold and silver district.

Here is CEO Ranjeet Sundher:

“We’re not talking anything grass roots, we feel there’s lots of gold there, lots of silver. We know it’s an economic grade, so all we need to do now is be the first company to systematically drill it, to prove out what we believe will be a resource, and a commercial opportunity.”

As the old mining adage goes, the best place to find a mine is to look in the shadows of previous headframes. What better target to start with than the past-producing San Agustín mine, where 665 meters of underground development has been completed. A previous operator found 185 g/t gold at the bottom of a 45-meter-deep production shaft. Well guess what? Brigadier Gold is drilling directly under that shaft, in a vein system that has never been drilled. Talk about upside.

The numerous oxidized gold expressions at surface are a good indication of what might lie beneath. Vizsla and GR Silver have been cutting high-grade intersections at depths up to 150m. Could Brigadier’s drills find similar mineralization?

Depending what is found in and under the old mine workings, there are three more targets waiting to be drill-tested. And a new vein system at El Placer that, while early stage, appears to show promise and if nothing else, hints that Brigadier Gold might only be scratching the surface of what is actually available for discovery at Picachos.

Brigadier Gold

TSX.V:BRG

Cdn$0.235, 2020.10.07

Shares Outstanding 56,303,865m

Market cap Cdn$13.5m

BRG website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Brigadier Gold (TSX.V:BRG). BRG is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.