Mercado Minerals taking first steps towards securing two silver projects in Mexico – Richard Mills

2025.09.16

Mercado Minerals (CSE:MERC) is in the process of acquiring two high-grade silver projects in Sinaloa State, Mexico, through a Letter of Intent (LOI) to buy Concordia Silver.

The properties, named Copalito and Zamora, are both located along the western side of the Sierra Madre Occidental, a world-class mining district host to many silver and gold deposits.

Under the LOI, signed on June 6, 2025, Mercado intends to acquire 100% of Concordia and its Mexican properties. Mercado CEO Daniel Rodriguez provided an update on July 28:

“To have the opportunity to secure a district scale land position over such a large number of high-grade vein occurrences that have never been drilled at Zamora is exactly the type of prospective potential we want to provide our shareholders,” he stated. “We see an immense opportunity in both properties with existing drill results or the lack of them, indicating we have the potential to make further discoveries and create value for our shareholders. We continue to compile data and complete our due diligence on both properties and on Concordia in preparation for the signing of a definitive agreement and future exploration.”

Copalito project

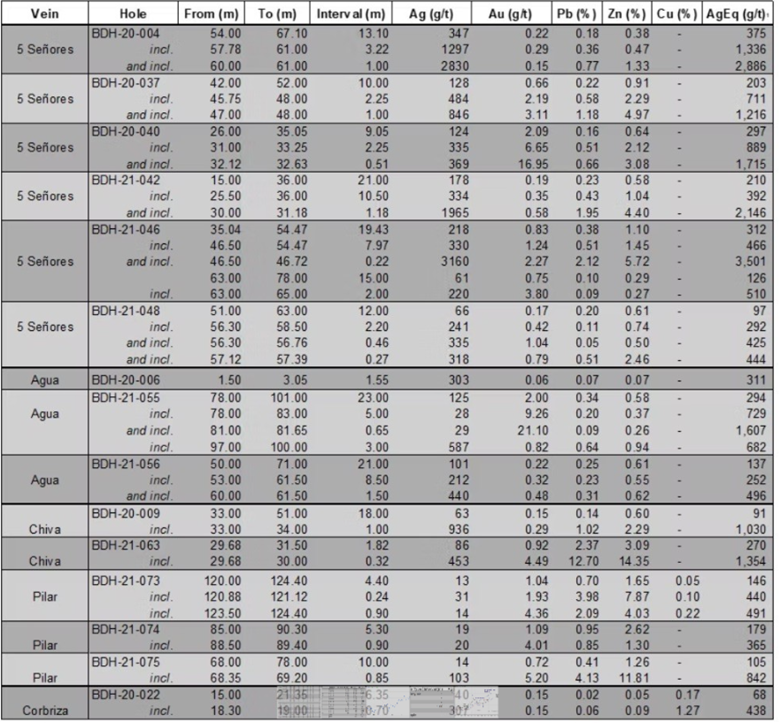

According to the company, the Copalito project presents a district-scale opportunity with known and drilled silver — gold low sulfidation vein mineralization that is open for expansion. Historical third-party high-grade silver and significant gold and base metal drill intercepts include 347 g/t silver, 0.22 g/t gold, 0.18% lead and 0.38% zinc over 13.10 meters in hole BDH-20-004, and 125 g/t silver, 2.00 g/t gold, 0.34% lead and 0.58% zinc over 23.00m in hole BDH-21-055.

Under the terms of the LOI, Mercado will acquire an option to purchase seven concessions covering 2,820 ha. Six known veins on the project have a cumulative strike length of over 8 km.

The Copalito project is located approximately 123 km northeast of Culiacan, Sinaloa. The property has good access, moderate topography and infrastructure nearby. The neighboring property to Copalito is McEwen Inc’s (NYSE:MUX) El Gallo mine complex, located 35 km to the west. Kootenay Silver was the most recent operator of the Copalito project. Kootenay successfully drilled 81 diamond drill holes over six veins. This historical drilling has only tested approximately 60% of strike of the veins and only to an average depth of 100m. Mercado has also acquired the existing drill data, which provides an excellent base for future exploration drill targeting of higher and thicker-grade portions of veins along strike and to depth.

Copalito property significant historical drill intersections

Investors are warned: the data for the Copalito property appears to be of a good standard. However, the Qualified Person (QP) has not conducted sufficient work to independently validate the assay drill core results. Therefore, the company is treating the Copalito results as historical in nature and are not to be relied on. The QP will independently verify results of the historical work during a site visit later this year.

Zamora project

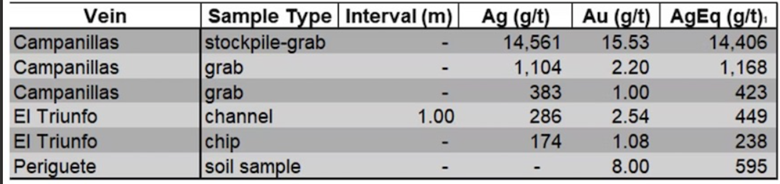

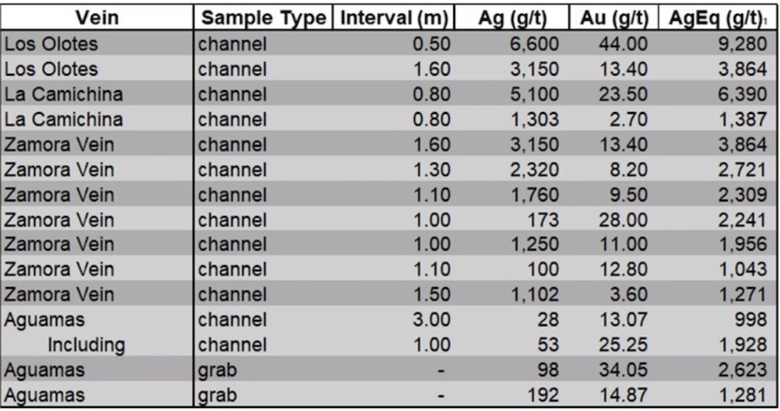

The Zamora project and surrounding area presents district-scale potential that, according to historical reports, has never been drilled. Under the terms of the LOI with Concordia, Mercado will acquire four concessions covering 378 ha, which covers small-scale historical underground production at Campanillas, and the right to potentially bring another 2,999 ha of concessions back into good standing with the government, thereby securing title. If successful, Mercado will own a total of 3,377 ha covering a cumulative strike length of over 8 km of structures with 14 historical high-grade silver gold mines on them.

Historic sampling by the previous operators on concessions currently under LOI and controlled by Concordia includes results from underground workings at Campanillas that returned 14,561 g/t silver and 15.53 g/t gold from a grab sample. Additional sampling at El Triunfo returned 286 g/t silver and 2.54 g/t gold over 1.00m, while a soil sample near the Periguete workings is reported to have returned 8.00 g/t gold.

Like at Copalito, the data for the Zamora property appears to be of a good standard. However, the QP has not conducted sufficient work to independently validate the assay rock sample results from Zamora. Therefore, the company is treating the Zamora results as historical in nature and are not to be relied on. The QP will independently verify results of the historical work during a site visit later this year.

Silver market

Silver is breaking out, up around 48% year to date, surpassing even gold. In January 2025, the Silver Institute forecasted another deficit in the silver market, with annual demand at 1.20 billion ounces and supply at 1.05 billion ounces. The 150-million-ounce shortfall would be the fifth consecutive year that silver demand outstrips supply.

Silver’s time to shine — Richard Mills

Influential investor and financial commentator Ray Dalio recently warned that the US dollar and other reserve currencies are waning in appeal due to high government debt burdens. The US government’s debt-service payments now equal about a trillion dollars a year in interest, with about $9 trillion needed to refinance the debt which will mature this year.

A top economist says the US is at the ‘Edge of the cliff’ and in a full-blown labor recession that risks spilling into the rest of the economy.

Moody’s economist Mark Zandi has been closely watching what he describes as a “labor recession” unfold, with revisions for June showing a contracting workforce for the first time since 2020. The most recent labor report did nothing to dissuade him of the notion, and now the Moody’s economist told Business Insider he’s looking ahead for signs that the job-market downturn could spill into the broader economy.

Could history repeat itself and lead to stagflation? The signs are worrying.

In 1979, then US Federal Reserve Chair Paul Volcker faced a serious challenge: how to quell inflation which had been wracking the economy for most of the decade.

Not only was inflation going through the roof, but economic growth had stalled, and unemployment was high, rising from 5.1% in January 1974 to 9% in May 1975. In this low-growth, hyperinflationary environment we had “stagflation”.

Volcker is widely credited with curbing inflation, but in doing so, he is also criticized for causing the 1980-82 recession. He did it by aggressively raising the federal funds rate. From an average 11.2% in 1979, Volcker and his board of governors through a series of rate hikes increased the FFR to 20% in June 1981. This led to a rise in the prime rate to 21.5%, which was the tipping point for the recession to follow.

If the employment situation worsens and inflation keeps climbing, look for economic growth to sputter as the US enters stagflation.

The resumption of the Fed’s cutting cycle means that gold and silver should outperform even a hot equity market, states Sameer Samana, head of Global Equities and Real Assets at Wells Fargo Investment Institute.

“It’s becoming harder and harder to make a bear case for really anything other than bonds, given this pivot by the Fed,” Sameer said via Kitco.

Goldmoney’s Alasdair Macleod said during the first week of September that “There’s growing appreciation that the gold and silver bull has returned,” noting the Sept. 2-5 price action was a turning point.

Among the background factors driving bullish silver and gold chart action were plans for a non-dollar currency area; a developing G7 bond crisis; and technical analysis pointing to higher gold and silver prices.

He notes the prospect of the gold-silver ratio declining from its current 86 to 50, pushed down by the falling dollar. “With gold at $4,000 and a ratio of 50, that makes silver $80. This is not a forecast, only an illustration of silver’s potential,” Macleod writes.

Precious metals analyst Hubert Moolman posted a Silver/ US Dollar chart dating from 1983. He says that based on the fractal in the chart (a fractal is a pattern of five consecutive price bars that signals a potential trend reversal or continuation), “it is expected that we are now likely in a sustained silver rally similar to 2010-2011, for example.” Silver hit an all-time high of $49.51 in April 2011.

Further, Moolman showed in a previous article that significant silver peaks occurred within 8.5 years after the Dow/gold ratio peak, with the Great Depression silver peak occurring the soonest (6 to 7 years after).

“Given that silver actually rallied on a sustained basis for at least 2 years before each of these peaks, we are likely to see silver rally for most of the coming 20 months,” he wrote.

FX Empire wrote that Silver climbed within striking distance of $42 an ounce on [Sept. 8- it’s now exceeded that — Rick], posting its strongest rally since 2011 as a deteriorating U.S labour market reinforced expectations of a September Fed rate cut.

If the Fed makes a “jumbo rate cut” of 50-bp, it “could send precious metal prices into the stratosphere,” FX Empire predicts.

The publication says momentum points to higher highs beyond the 48% gain silver has already made this year:

“Structural deficits are colliding with an unprecedented demand boom,” explains GSC Commodity Intelligence. “This is the kind of perfect storm that doesn’t come around often. Breakouts above the $40–$42 resistance zone unlock a direct path to $50 an ounce – and once that level gives way, the market will move faster than most traders can imagine.”

Conclusion

Mercado Minerals is an early-stage exploration company that is still in the process of acquiring two silver projects in Mexico. To be clear, Mercado does not yet own Copalito and Zamora.

There are six veins on the Copalito project. The historical drilling has only tested about 60% of strike of the veins and only to an average depth of 100m.

To me the bigger opportunity is at Zamora. Like Copalito, Zamora has a large number of high-grade vein occurrences. Unlike Copalito, they have never been drilled.

Mercado would get four concessions of 378 hectares, which covers some of the underground production at Campanillas, but the big thing at Zamora is the right to potentially bring another 3,000 ha of concessions back into good standing with the government and then secure title. If they’re successful, Mercado will own a total of 3,300 ha, a strike length of 8 kilometers of structures, with 14 historical high-grade silver-gold mines on them. Extraordinary.

The grades are bound to raise a few eyebrows. Results from underground workings at Campanillas returned 14,561 g/t silver and 15.53 g/t gold from a grab sample. Additional sampling at El Triunfo returned 286 g/t silver and 2.54 g/t gold over 1.00m, while a soil sample near the Periguete workings is reported to have returned 8.00 g/t gold.

The grades at Copalito are also decent; there’s definitely something there and it’s worthy checking into, especially in this market.

Between these two silver projects there’s enough to make a compelling story, imo, for Mercado: high-grade silver veins at Copalito, only 60% explored; and 14 high-grade historical gold-silver mines at Zamora, with a potential 3,377 ha covering a cumulative strike length of over 8 km. Also, high-grade silver veins. None of the Zamora project has been drilled, presenting possible huge upside.

Besides having potentially two great projects, Mercado has other characteristics I like to see in an early-stage junior: a low share price, a reasonable market cap and reasonable outstanding shares. This is one to watch for sure.

Mercado Minerals Ltd.

CSE:MERC

2025.09.15 Share Price: Cdn$0.16

Shares Outstanding: 35.6m

Market Cap: Cdn$5.7m

MERC website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Mercado Minerals Ltd. (CSE:MERC). MERC is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of MERC

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.